- English

- ePUB (mobile friendly)

- Available on iOS & Android

About this book

Big Money, Less Risk: Trade Options will put the income boosting power of strategies like writing covered calls, selling naked put options, and placing vertical spread trades or iron condors in your hands. Mark Larson has become one of the most sought after trading educators because of his ability to make once elusive investment approaches accessible to every trader.

Success in the stock market is determined by consistently making money every month, not closing your eyes and hoping you can afford to retire. With this book, Larson divulges the secrets to making your money work for you instead of having to work for your money.

Ever dream about making 30% in one month?

Big Money, Less Risk: Trade Options will put the income boosting power of strategies like writing covered calls, selling naked put options, and placing vertical spread trades or iron condors in your hands. Mark Larson has become one of the most sought after trading educators because of his ability to make once elusive investment approaches accessible to every trader.

Success in the stock market is determined by consistently making money every month, not closing your eyes and hoping you can afford to retire. With this book, Larson divulges the secrets to making your money work for you instead of having to work for your money.

Inside you'll learn:

- How to repeatedly make money when the market goes up or down.

- Investment strategies that allow for huge returns with the use of very little money.

- How to purchase good stocks at discount prices.

- How to make significant returns even if you are wrong on the trade.

Larson will alo cover the importance of option pricing, implied volatility, the Greeks such as delta, theta, and gamma, and the probability of your option expiring profitable. Most important, you will get, in plain English, some of his favorite technical indicators and the key to how they will form the basis of your options trading success.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

Chapter One

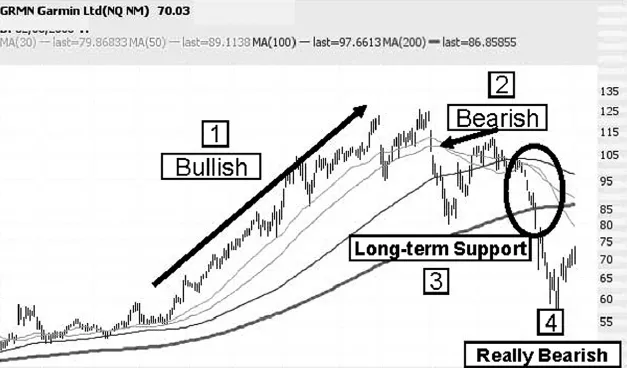

Pointing the Way with Technical Indicators

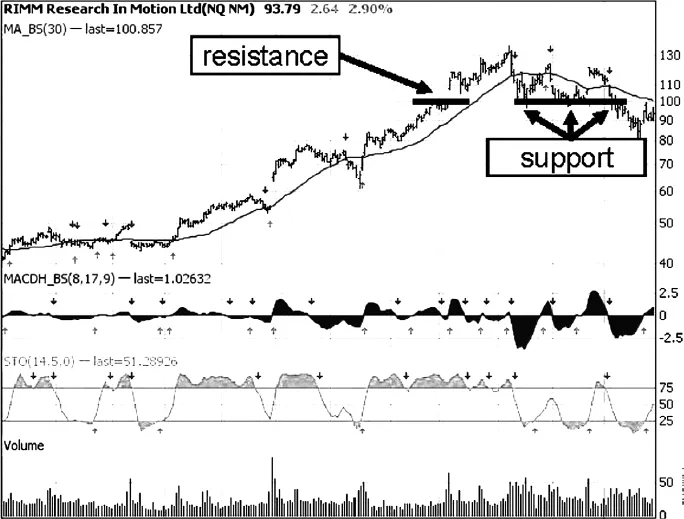

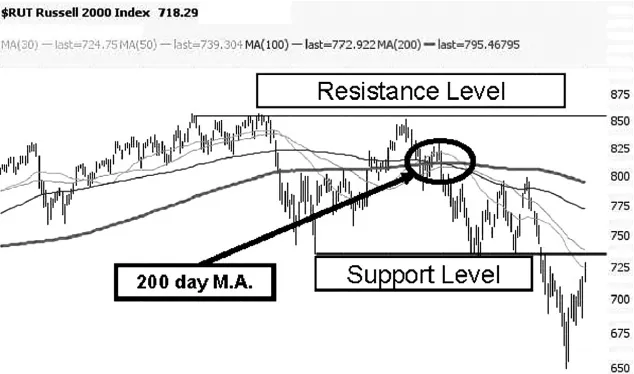

Support and Resistance Levels

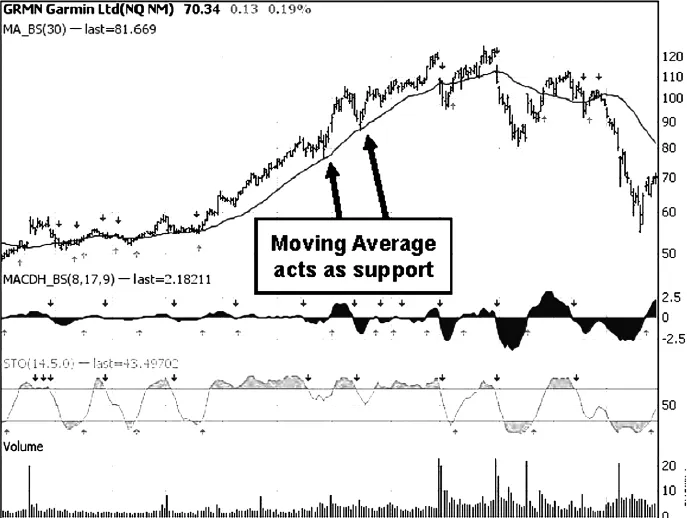

Moving Averages

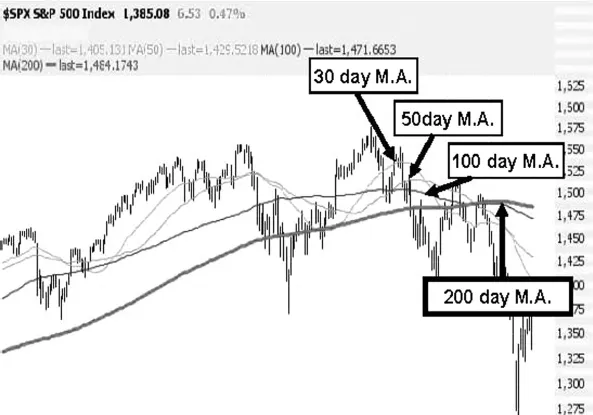

Multiple Moving Averages

Table of contents

- Cover

- Contents

- Title

- Copyright

- Foreword

- Preface

- Acknowledgement

- Introduction

- Chapter One: Pointing the Way with Technical Indicators

- Chapter Two: An Introduction to Options

- Chapter Three: It’s All Greek To You: Understanding Delta, Gamma, and Theta

- Chapter Four: Making the Call: Buying Call Options

- Chapter Five: You Have It Covered: Covered Calls

- Chapter Six: Put It Down: Buying Put Options

- Chapter Seven: Passing It On: Selling Puts

- Chapter Eight: Spreading the Wealth: Vertical Bull Put Spreads

- Chapter Nine: What’s the Spread: Vertical Bear Call Spreads

- Chapter Ten: Taking Flight with Iron Condors

- Conclusion

- Appendix A: Advanced Order Feature on thinkorswim.com

- Appendix B: Protect Your Assets

- Glossary

- Recommended Reading