![]()

Part 1

Performance Profiling

![]()

ONE

Boom or Bust?

Rich or poor? Boom or bust? The choice is often ours, but what really makes the difference to the result? In the financial markets the difference comes from money management. This can be learned, and it uses techniques mastered with simple spreadsheets and easy rules. The objective is to take a small amount of cash and, by trading the market, consistently turn it into a larger pile. In this book our focus is on better ways to turn cash into capital through better trading.

We delude ourselves with comforting lies if we think the difference between wealth and poverty is just about being born with money. This does not explain how money is used to make money.

We all start with some cash, and we need to keep it so that it can grow. The financial markets are the most effective way of putting money to work. They are also a very effective way of losing money very quickly if you place faith in blind luck, in selected blue chip companies such as Enron or WorldCom, or in investment funds which focus on fees and commissions just for matching the performance of the market.

By selecting this book, you have shown you are ready to move beyond the commonly accepted notions that prevent ordinary people from effectively participating in the growth of capital available from the financial markets.

Money management is the secret separating average traders from successful traders, and superstar traders from successful traders. There are many different ways to use money management techniques to increase profits and returns from trading. We look at just a few and show how these are modified so that they are suitable for small traders with limited accounts. The right money management helps your trading boom. Select the wrong, and often common, approaches, and your portfolio goes bust.

Money management is not just for the funds and institutions, but it requires some modification to work for us. Our portfolios are measured in thousands of dollars, rather than millions. Our survival is important to each of us, and money management of individual trades, and of portfolios, helps us reach this goal.

We work with five traders in this book. The first is Trader Average. You probably know him, or someone like him. He has lots of fun in the market, making a few dollars in good times, and struggling in weak and nervous markets. The second is Trader Success. She trades full-time, and trading is her primary source of income. You know of these people by reputation. This is where you want to be.

The third is Trader Superstar. There are not many traders who fit this category. They represent the pinnacle of trading achievement. We know them from their books and interviews in specialist publications. We use their methods to help improve our trading success. The fourth is Trader Lucky. He is a mythical trader who buys at the very bottom and sells at the very top. He is/the friend of a friend whose uncle knows the managing director. This financial media creation is an urban myth, but we can use his performance as a benchmark. Trader Novice also makes an appearance, but we do not work with her much in this book. The material we cover works best with more developed trading skills.

HOW CAN I IMPROVE MY TRADING?

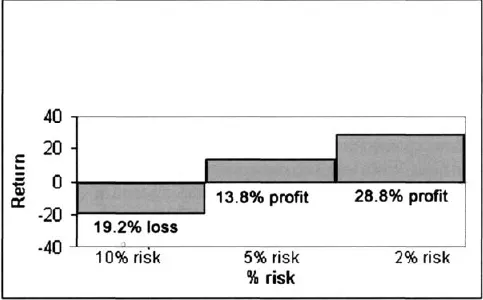

This chapter is designed to answer just one question: How can I improve my trading results most effectively? The chart displayed in Figure 1.1 summarizes the best answer. This is the path to success for Trader Average.

Trader Average latches onto a winner 62.5% of the time. Out of 16 trades he expects to win 10. His performance is terrible when he first starts. Each of his six losing trades sacrifices 10% of his trading capital. This does not sound a lot, and many new traders lose more than this. Over 16 trades this strategy results in a 19.2% loss of trading capital. Losses are cushioned by trading successes.

Apply just one money management technique and Trader Average turns the same win/loss ratio into a trading approach generating the 28.8% profit shown in the third column. He does this by reducing the loss in each losing trade to 2% of his total trading capital.

Sound too hard? Just by reducing the loss to 5% of total trading capital in each of the six losing trades, Trader Average turns a losing experience into a 13.8% profit.

This is one of the most important charts in this book. If you already completely understand and appreciate the impact of this on your trading success, then this book is not for you. If you want to find out more about how various money management strategies are used to achieve these results, then the rest of this book is written for you.

WORK SMARTER, NOT HARDER

When I first started trading I believed the best way to improve was to become more skilled. The more I could learn, the better I should perform. The result was a very large library of trading books, and a moderate increase in trading success. We all need to master the tools of technical analysis. Understanding how they work and when they are best applied is an important part of developing the skills of trading — in theory.

When it comes time to put this theory into action in the market, we discover many unexpected psychological barriers to our success. We do not have much money when we start trading, so we take a lot of time to decide on each trade. Often the first trades are easy and turn into effortless winners. This is poor preparation for the inevitable losses, because we do not know how to react. When losses do come, most times we just hold on and hope. The result is a trading portfolio littered with long-term investments in the vain hope that, given time, some of these fallen stocks may rise again.

The market provides the most expensive self-education course available. Standing knee deep in blood from losing trades, we are easily distracted by the promise of trading systems developed by other people. These approaches may work very well for others, but unless they match our growing and changing understanding of, and appetite for, risk, they work poorly for us.

Some people buy an expensive promise of trading success delivered by black box trading systems. Typically these are priced at an attractive $3,000 to $8,000. You might be told that there are only a few licensed copies left so you need to be fast. It is a sure way to a small fortune for the promoters of this software, but rarely a successful solution for the private trader.

HARD WORK

A less expensive method takes us back to the grindstone of hard work, of more study, and endless system testing and evaluation. It starts with reading about other trading approaches and testing them yourself. We do this for readers in our weekly newsletter.

At some stage we all question whether this is worthwhile. I believe the answer is “Yes,” but I also recognize that this is “grunt” work. It forces us to work harder for incremental rewards, instead of working smarter for much more significant improvements in our performance. The big danger is that while we work harder, we also chew up our trading capital. By the time we know enough to succeed consistently, we may not have enough trading capital to make success possible.

Working harder also fails to acknowledge the way the burden of work increases while the return diminishes. Once I had the opportunity to climb the rigging on a tall sailing ship. The climb to the first crow’s-nest at the lowest yard-arm was relatively easy. The climb to the second crow’s-nest was much more difficult, even though the distance was shorter. The climb to the top of the mast was nerve-wracking and seemed almost impossible, yet it was the shortest distance of all. The same applies with developing trading skills.

Armed with just a little knowledge, Trader Novice calls the direction of a trend successfully 50% of the time. With more knowledge and skill, Trader Average finds it relatively easy to boost the success rate to 60%. This means that for every 10 trades he enters, only four are losers, or unsuccessful. Notice that we say nothing about where the four losing trades occur, nor do we say how big the profits are in the winning trades. An up-front series of four losing trades in a row is demoralizing and reduces capital significantly. A series of small winning trades does not compensate for a single large loss.

Those considering trading as a regular way to improve their income are generally working at around the 60% success rate. There are many traders in this grouping.

Getting from 60% to 70% is much more difficult. For every 10 trades, only three are failures. This success rate is sufficiently high for Trader Success to realistically consider trading as a full-time occupation. To turn this sustainable trading into a major success, we shoot for an 80% success rate to become Trader Superstar. This is like the top of the mast. Very few people make it to this level. And once they have achieved this success rate, it is very difficult to maintain. Often success comes from the mastery of just one set of market conditions. When the conditions change, the success rate declines dramatically. Most commonly this is called “confusing a bull market with brains.”

There are traders who consistently achieve a success rate higher than 80%. Some of them are interviewed in Jack Schwager’s Market Wizards books. These books are an excellent place to research trading styles and to learn about the level of successful trading enjoyed by these trading superstars. Just a few of the traders interviewed lay claim to a success rate greater than 80% — and these are market wizards. If these global masters cannot move much beyond an 80% success rate, then what are our chances?

The real answer is that our chance of dramatic improvement in skills and techniques is not great. Sure, we move from Trader Novice to Trader Average status relatively easily. Reaching the first crow’s-nest, we find many others perched at the same level — around the 60%) success rate. Moving to the next level is difficult. It takes a lot of time, and a lot of experience. It means honing trading skills to the extent where you understand your trading edge.

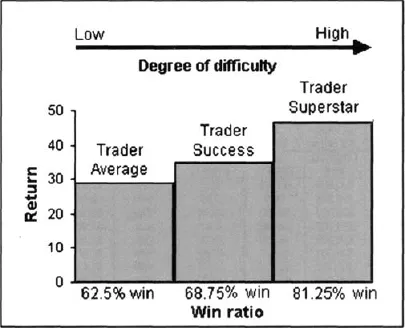

Let’s say we succeed in reaching the 80% success rate. How much better is our trading going to be? The answer is “Not all that much.” Figure 1.2 is based on the same set of trading results used in Figure 1.1. All losing trades lose 2% of total trading capital. The first column shows Trader Average with a 62.5%) win rate. This gives a 28.8%o return for the period.

The second column shows the result for Trader Success with the win rate increase...