![]()

1

The Credit Derivatives Market

1.1 INTRODUCTION

Without a doubt, credit derivatives have revolutionised the trading and management of credit risk. They have made it easier for banks, who have historically been the warehouses of credit risk, to hedge and diversify their credit risk. Credit derivatives have also enabled the creation of products which can be customised to the risk-return profile of specific investors. As a result, credit derivatives have provided something new to both hedgers and investors and this has been a major factor in the growth of the credit derivatives market.

From its beginning in the mid-1990s, the size of the credit derivatives market has grown at an astonishing rate and it now exceeds the size of the credit bond market. According to a recent ISDA survey,1 the notional amount outstanding of credit derivatives as of mid-year 2007 was estimated to be $45.46 trillion. This significantly exceeds the size of the US corporate bond market which is currently $5.7 trillion and the US Treasury market which is currently $4.3 trillion.2 It also exceeds the size of the equity derivatives market which ISDA also estimated in mid-2007 to have a total notional amount outstanding of $10.01 trillion.

In addition to its size, what is also astonishing about the credit derivatives market is the breadth and liquidity it has attained. This has been due largely to the efforts of the dealer community which has sought to structure products in a way that maximises tradabililty and standardisation and hence liquidity. The CDS indices, introduced in 2002 and discussed extensively in this book, are a prime example of this. They cover over 600 of the most important corporate and sovereign credits. They typically trade with a bid-offer spread of less than 1 basis point and frequently as low as a quarter of a basis point.3

To understand the success of the credit derivatives market, we need to understand what it can do. In its early days, the credit derivatives market was dominated by banks who found credit derivatives to be a very useful way to hedge the credit risk of a bond or loan that was held on their balance sheet. Credit derivatives could also be used by banks to manage their regulatory capital more efficiently. More recently, the credit derivatives market has become much more of an investor driven market, with a focus on developing products which present an attractive risk-return profile. However, to really understand the appeal of the credit derivatives market, it is worth listing the many uses which credit derivatives present:

• Credit derivatives make it easier to go short credit risk either as a way to hedge an existing credit exposure or as a way to express a negative view on the credit market.

• Most credit derivatives are unfunded. This means that unlike a bond, a credit derivative contract requires no initial payment. As a consequence, the investor in a credit derivative does not have to fund any initial payment. This means that credit derivatives may present a cheaper alternative to buying cash bonds for investors who fund above Libor. It also makes it easier to leverage a credit exposure.

• Credit derivatives increase liquidity by taking illiquid assets and repackaging them into a form which better matches the risk-reward profiles of investors.

• Credit derivatives enable better diversification of credit risk as the breadth and liquidity of the credit derivatives market is greater than that of the corporate bond market.

• Credit derivatives add transparency to the pricing of credit risk by broadening the range of traded credits and their liquidity. We estimate that there are over 600 corporate and sovereign names which have good liquidity across the credit derivatives market.4 The scope of the credits is global as it includes European, North American and Asian corporate credits plus Emerging Market sovereigns.

• Credit derivatives shift the credit risk which has historically resided on bank loan books into the capital markets and in doing so it has reduced the concentrations of credit risk in the banking sector. However, this does raise the concern of whether this credit risk is better managed in less regulated entities which sit outside the banking sector.

• Credit derivatives allow for the creation of new asset classes which are exposed to new risks such as credit volatility and credit correlation. These can be used to diversify investment portfolios.

The relatively short history of the credit derivatives market has not been uneventful. Even before the current credit crisis of 2007–2008, the credit derivative market has weathered the 1997 Asian Crisis, the 1998 Russian default, the events of 11 September 2001, the defaults of Conseco, Railtrack, Enron, WorldCom and others, and the downgrades of Ford and General Motors. What has been striking about all of these events is the ability of the credit derivatives market to work through these events and to emerge stronger. This has been largely due to the willingness of the market participants to resolve any problems which these events may have exposed in either the mechanics of the products or their legal documentation. Each of these events has also strengthened the market by demonstrating that it is often the only practical way to go short and therefore hedge these credit risks.

In this chapter, we discuss the growth in the credit derivatives market size. We present an overview of the different credit derivatives and discuss a market survey which shows how the importance of these products has evolved over time. We then discuss the structure of the credit derivatives market in terms of its participants.

1.2 MARKET GROWTH

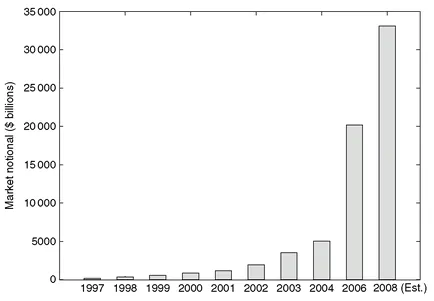

The growth of the credit derivatives market has been phenomenal. Although there are different ways to measure this growth, each with its own particular approach, when plotted as a function of time, they all show the same exponential growth shown in

Figure 1.1. Let us consider the three sources of market size data:

1. The British Bankers’ Association (BBA) surveys the credit derivatives market via a questionnaire every two or so years. Their questionnaire is sent to about 30 of the largest investment banks who act as dealers in the credit derivatives market. Their latest report was published in 2006 and estimated the total market notional at the end of 2006 to be $20.207 trillion.

2. The International Swaps and Derivatives Association (ISDA) conducts a twice-yearly survey of the market. In the most recent, they surveyed 88 of their member firms including the main credit derivatives dealers about the size of their credit derivatives positions. The collected numbers were adjusted to correct for double-counting.5 The mid-2007 survey estimated the size of the credit derivatives market to be $45.25 trillion, an increase of 32% in the first six months of 2007.

3. The US Office for the Comptroller of the Currency conducts a quarterly survey of the credit derivatives market size. The survey covers just the US commercial bank sector. The June 2007 survey found that the total notional amount of credit derivatives held by US commercial banks was $10.2 trillion, an increase of 86% on the first quarter of 2006. This number is lower than the others partly because it excludes trades done by many non-US commercial banks and investment banks.

Although these numbers all differ because of the differing methodologies and timings, what is beyond doubt is the rapid growth that has been experienced by the credit derivatives market.

Figure 1.1 Evolution of the credit derivatives market size using estimates calculated in the BBA Credit Derivatives Report 2006. Source: British Banker’s Association

Although the size of the credit derivatives market is significant, it is important to realise that credit derivatives do not increase the overall amount of credit risk in the financial system. This is because every credit derivative contract has a buyer and a seller of the credit risk and so the net increase of credit risk is zero. However, credit derivatives can in certain cases be used to increase the amount of credit risk in the capital markets. For example, suppose a bank has made a $10 million loan to a large corporate and this loan is sitting on their loan book portfolio. As we will see later, to hedge this risk, the bank can use a credit default swap (CDS) contract. The credit risk of the corporate is therefore transferred from the bank to the CDS counterparty who may then transfer this risk on to another counterparty using another CDS contract. At the end of this chain of transactions will be someone, typically an investor, who is happy to hold on to the risk of the corporate and views that the premium from the CDS is more than sufficient to compensate them for assuming this risk. The loan that was sitting on the bank’s loan book is still there. However, the risk has been transferred via the CDS contracts to this investor in the capital markets. Because the credit risk has been transferred without any actual sale of the loan, the credit risk produced by a CDS is ‘synthetic’. If a default of the corporate does occur, the loss compensation is paid from the investor to the counterparty and on down the chain of contracts to the bank which was the initial buyer of protection. The bank has successfully hedged its credit exposure to this loan.

The only way in which credit risk has increased is through the counterparty credit risk associated with each contract. This is the risk that the protection seller does not make good a payment of the default loss compensation to the protection buyer. In practice, this risk is usually mitigated through the use of collateral posting as explained in Section 8.8.

1.3 PRODUCTS

The simplest and most important credit derivative is the credit default swap (CDS). This is a bilateral contract which transfers the credit risk of a specific company or sovereign from one party to another for a specified period of time. It is designed to protect an investor against the loss from par on a bond or loan following the default of the issuing company or sovereign. In return for this protection the buyer of the CDS pays a premium.

We note that someone who is assuming the credit risk in a credit derivatives contract like a CDS is called a protection seller. The person taking the other side of this trade is insuring themselves against this credit risk and is called a protection buyer.

An important extension of the CDS is the CDS index. This is a product which allows the investor to enter into a portfolio consisting of 100 or more different CDS in one transaction. For example, one of the most liquid indices is the CDX NA IG index which consists of 125 investment grade corporate credits which are domiciled in North America. We call this a multi-name product because it exposes the issuer to the default risk of more than one credit or ‘name’. The considerable liquidity and diversified nature of the CDS index have meant that it has also become a building block for a range of other credit derivatives products.

There are also a number of option-based credit derivatives. These include single-name default swaptions in which the option buyer has the option to enter into a CDS contract on a future date. More recently we have seen growth in the market for portfolio swaptions. As the name suggests, these grant the option holder the option to enter into a CDS index.

Then there are the multi-name contracts such as default baskets and synthetic CDOs which are built on top of a portfolio of CDS. These contracts work by ‘tranching’ up the credit risk of the underlying portfolio. Tranching is a mechanism by which different securities or ‘tranches’ are structured so that any default losses in the portfolio are incurred in a specific order. The first default losses are incurred by the riskiest equity tranche. If the size of these losses exceeds the face value of the equity tranche then the remaining losses are incurred by the mezzanine tranche. If there are still remaining losses after this, then these are incurred by the senior tranches. The risk of this credit derivatives contract is sensitive to the tendency of the credits in the portfolio to default together. This is known as default correlation and, for this reason, these derivatives are known as correlation products.

Finally, we have the credit CPPI structure and the more recent CPDO structure. These structures exploit a rule-based dynamic trading strategy typically involving a CDS index. This trading strategy is designed to produce an attractive risk-return profile for the investor. In the case of CPPI, it is designed to provided a leveraged credit exposure while protecting the investor’s principal. In the case of CPDO, the strategy is designed to produce a high coupon with low default risk.

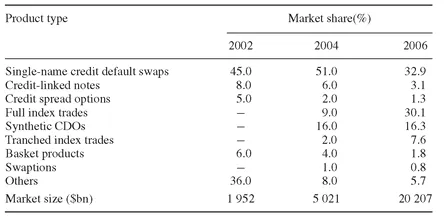

Table 1.1 Market share of different credit derivatives products measured by market outstanding notional. We compare the results of the BBA survey for 2002, 2004 and 2006. Source: BBA Credit Derivatives Report 2006

Table 1.1 shows a breakdown of the various credit derivatives by their market outstanding notional. The data is sourced from the BBA survey of 2006 mentioned earlier. Note that this survey does not consider the CPPI and CPDO products since these have only become important in the time since this survey was carried out. This table already enables us to make the following observations about the current state and also the trends of the credit derivatives market:

• Many of the products which appeared in the 2004 and 2006 surveys did not exist in 2002. The most notable examples of this are the full index trades, which refer to trades on the CDX and iTraxx indices which were launched after 2002. We also see the establishment of a number of synthetic CDO categories and a tranched index trade category.

• We see a relative decline in the importance of more traditional credit derivatives products such as credit-linked notes and spread o...