![]()

CHAPTER 1

Making Money in Small-Caps

By almost any benchmark, small-cap stocks are the new value on Wall Street—and, increasingly, on its counterpart in Canada, Toronto’s Bay Street, where some of the highest fliers of the low-priced stock world trade. What’s more, in the years to come, you’ll find these hidden gems, these proverbial diamonds in the rough, leading the indexes higher. I say this with barely concealed enthusiasm because, given the current beaten-down investment climate, it is inevitable that the cycle will change and the small-caps will explode higher.

Small-caps present a ground-floor opportunity—one that doesn’t present itself every day. We all know that expectations are the highest at market tops. But right now, because market expectations are less than stellar, the conditions are ripe for the astute investor to gobble up low-price shares in dozens of beaten-down companies whose stocks are selling significantly below their true value. Cheap stocks, depressed stocks, penny stocks, small-cap stocks—whatever you want to call them, they are the next new big thing. The question is: Will you get on at the ground floor, or would you prefer to wait until these shares sell at penthouse prices?

SMALL-CAPS: THE NEXT BULL MARKET

It’s a simple premise: With the indexes already climbing to new highs, it is not a matter of if the next bull market will see a surge in small-cap stock prices, but when. Looking back, one can see plenty of historical evidence for continued explosive growth among low-priced stocks. Small-caps, for instance, have traditionally enjoyed spectacular gains compared with their higher-priced cousins. Over one recent 10-year period, small-caps outperformed larger-cap stocks by a whopping ten-to-one margin. As for percentage gainers, the small-caps invariably lead the pack. The top ten low-priced gainers increased in value by more than 261 percent over a recent year. During an identical period, the top ten S&P listed stocks gained just under 15.5 percent.

When you consider the numbers involved, you can see why investors prefer low-priced stocks. From an investor’s standpoint, you can take $5,000 and buy 5,000 shares of a $1 stock (commissions excluded) or 100 shares of a $50 stock. A 50-cent gain in the $1 stock would generate $2,500 in profit. That’s a 50 percent gain. The same 50-cent gain on the $50 stock, however, would generate just $50 in profit. To double in value, a $1 stock has to rise to only $2. To generate the same percentage gain, a $50 stock has to trade at $100 a share. Now ask yourself which is more likely to happen: a $1 stock going to $2 or a $50 stock going to $100?

The reluctance of investors to jump on the bandwagon of a higher-priced stock explains why successful companies often have two-for-one splits. By offering twice as many shares to their investors, companies can enjoy greater investor participation by halving the share cost from, say, $60 a share to $30 via a stock split.

Investor enthusiasm for small-caps is likely to grow for many reasons beyond the price alone. Smaller companies are more likely to be start-ups or in the early stage of their development. This allows greater upside potential. A seasoned company, on the other hand, has far greater difficulty in achieving the same level of growth as a new, smaller company. Accordingly, low-priced stocks can often double and triple in value while their big brothers have trouble attaining even a double-digit gain. It is not uncommon to see the stock of smaller companies increase in value by many hundreds of percent.

During uncertain times, however, these lower-priced companies are often ignored. People prefer something tried-and-true, perhaps a blue chip that pays steady dividends. The result is a lot of hidden value in the lower-priced issues. These are the shares we want to go prospecting for, sort of like digging up gold that lies hidden in the mine. Not surprisingly, many small-caps are indeed mining companies, their resources literally lying in the ground.

I found just such a stock several years ago when a friend recommended a little-known company trading on the Toronto Stock Exchange. Though its corporate offices were headquartered in Vancouver, British Columbia, First Quantum Minerals (FM.TO) was really an undiscovered asset-rich little copper-mining company in Zambia (see Figure 1.1). Its hidden value lay in its vast reserves still underground. The shares were then changing hands for just 80 cents Canadian. Within three years, a bull market in copper pushed the stock to more than $48 a share!

Although this stock has already made its run, you can be certain that many similar opportunities are out there. Moreover, the opportunities are not limited to just one sector or another. You might seek your fortune in mining or biotech or technology or dozens of other industries. There truly are opportunities everywhere!

SEPARATING THE WHEAT FROM THE CHAFF

In the pages that follow, I spell out a number of concepts and theories on how best to identify value in small stocks. I cover in detail the two most popular approaches to traditional stock market interpretation: fundamental and technical analysis. My approach is to find bargains based on price, value, and market activity. Whether you call it buying low, buying cheap, or simply buying depressed stocks, you want to find the overlooked company that promises an impressive return. We are not looking to flip stocks. Your time horizon could be several weeks, months, or even years. It all depends on how you can best capitalize on a legitimate growth spurt. For investors who know where to look, the highest profits come from small companies with big prospects, so that is the area where we will concentrate our efforts. I hope you will find the guidelines easy to understand and implement.

FIGURE 1.1 First Quantum Minerals Courtesy of the Toronto Stock Exchange.

You will learn how to evaluate and interpret performance: the best time to purchase—or sell—a given stock. You will also learn why some stocks fail to live up to their promise. You will discover the hidden pitfalls of investing—the most common mistakes made by just about every investor.

Over the years, I have looked at literally thousands of stocks. There are many stocks that, while they may look promising at first glance, upon analysis, don’t measure up to our chosen criteria. We look at them from both a fundamental and a technical viewpoint. From a sample of more than 1,000 stocks, for example, you might select just 50 for additional analysis. This number then might be cut in half, and you’ll ultimately end up with 15 to 20 high-probability selections. This task can be daunting, but it is necessary if you are to capitalize on the best opportunities.

What are the key criteria? You want to find small companies trading at attractive prices. So you might limit your study to stocks trading under $10 a share. You want the company to enjoy some measure of participation from the investment community. So you will take trading volume into consideration.

I try to avoid initial public offerings (IPOs) because they lack the price history that is crucial in making intelligent decisions. This is not to say there aren’t wonderful opportunities in the IPO market. There are. But you must know what to look for and when to take the plunge. You’ll find additional information about getting started in the IPO market in Chapter 5.

Then there are the all-important fundamental factors. What exactly does the company do? Does its business plan allow it to grow exponentially in the months and years ahead? Is its management sound? Does management have the experience to get a relatively new start-up off the ground? If the company has been in existence for a period of time, are there reasons for it to take off in the future? And so on.

On a technical level, a whole host of technical indicators measure whether a stock is performing correctly. I don’t necessarily rule out an underperforming stock. But we’ll want to know why the stock cannot pass muster on these vital benchmarks.

Learning what to look for takes time. Once you understand the key guidelines to stock selection, however, you’ll be able to make both sound and quick decisions concerning a stock’s viability.

HIDDEN VALUE: THE SMALL STOCK’S SECRET WEAPON

If you want to make a small fortune, goes the old saying, start with a large fortune. In the world of small stocks, however, the key to making a small fortune is hidden value. What does the company have that could make its shares explode in value? In the case of First Quantum Minerals, the key was its vast copper reserves in a country set in the middle of political strife. Although the Zambian authorities have become increasingly pro-business in recent years, the same could not be said for some of its neighbors, notably the Democratic Republic of the Congo (DRC). Just the possibility of a political coup from a hostile neighbor can understandably scare off investors. No one wants to invest in a company that might one day be nationalized.

At times, the clues to a stock’s potential can be subtle. While researching First Quantum, I learned that despite the possibility of neighboring government intrusions, the company had a good record in dealing with its employees. It operated a small hospital, for example, to provide its workers with health care. Didn’t it make sense to conclude that a company that cared for its workers might also look out for the interests of shareholders? No fly-by-night operation would go to the trouble to construct a hospital. This company planned to be around for a while—truly, a positive sign.

At about the same time, an interesting article appeared in the New York Times that cited a surge in the growth of private golf courses in Southern Africa. What exactly is the connection between golf courses and mining? It seems that during the political turmoil of earlier times, private golf courses had been shut down as their members fled Africa. More often than not, these private clubs’ membership included the managerial class of Africa’s leading firms. These management professionals were precisely the people needed to generate business revenue, yet they had been driven out of the region because of political unrest. Now they were returning. According to the Times article, the new pro-business climate was generating renewed interest in leisure activities in the region, golf being just one of them. With the European managerial class returning, a new day had broken.

This change was subtle perhaps, but it didn’t take me long to draw the logical inference. One, here’s a company with vast undeveloped resources. Two, the company actually seems to take an interest in the welfare of its employees. Three, the influx of quality management professionals was on the upswing, as evidenced by the boom in local golf courses.

The fourth major point was as yet unknown. What was the potential for metal prices—specifically, the price of copper? If this company had what it promised, everything was in place for a phenomenal investment. The worldwide demand for the red metal soared. Share prices for the Zambian copper company went from under a buck to over $26!

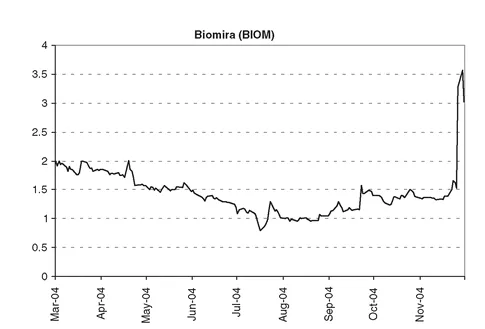

If you are looking for a similar bonanza, you have to sense the potential before it becomes evident. One place to look is at biotech start-up firms. Though obviously fraught with risk (almost all of these firms have no profits in the beginning), these companies often double or triple in price when a breakthrough drug or diagnostic cure is introduced or, better yet, approved by the regulatory authorities. Take the case of one such stock I owned last year. The biotech firm Biomira (BIOM) surged from 80 cents to close to $3 a share almost overnight following a favorable ruling on one of its drug studies (see Figure 1.2).

Another biotech Canadian firm, DiagnoCure (CUR.TO), specializing in the development of proprietary diagnostic tools, likewise had a meteoric rise, soaring from $1 to over $6 a share, when it introduced its proprietary prostate test kit (as shown in Figure 1.3). At the same time, the Quebec City-based Canadian firm partnered a deal with San Diego-based Gen-Probe, which specializes in distribution of medical diagnostic equipment. Just recently, Gen-Probe has become a darling of Wall Street, making new highs day after day. Can it be long before little DiagnoCure is likewise discovered?

These companies are examples of what an intelligent investor looks for in terms of value. Timing is critical if you are to participate in the lion’s share of the profits available in these and other stocks. But they illustrate the potential—if you are selective when you buy and sell. At the same time, remember that despite good intentions, even the best companies often encounter roadblocks and obstacles. Rare is the investor who hasn’t been knocked around and blindsided by an unexpected earnings report. Even the best companies underperform occasionally. So the road to profitability is not always a carefree course. If you concentrate on finding hidden value, however, you will find that what a company has often prevails in the end.

FIGURE 1.2 Biomira’s Surge

FIGURE ...