eBook - ePub

Modern Portfolio Management

Active Long/Short 130/30 Equity Strategies

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Modern Portfolio Management

Active Long/Short 130/30 Equity Strategies

About this book

Active 130/30 Extensions is the newest wave of disciplined investment strategies that involves asymmetric decision-making on long/short portfolio decisions, concentrated investment risk-taking in contrast to diversification, systematic portfolio risk management, and flexibility in portfolio design. This strategy is the building block for a number of 130/30 and 120/20 investment strategies offered to institutional and sophisticated high net worth individual investors who want to manage their portfolios actively and aggressively to outperform the market.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Modern Portfolio Management by Martin L. Leibowitz,Simon Emrich,Anthony Bova in PDF and/or ePUB format, as well as other popular books in Business & Investments & Securities. We have over one million books available in our catalogue for you to explore.

Information

PART One

Active 130/30 Extensions and Diversified Asset Allocations

CHAPTER 1

Active 130/30 Extensions and Diversified Asset Allocations

Anthony Bova

Vice President

Morgan Stanley, Research

Vice President

Morgan Stanley, Research

Martin Leibowitz

Managing Director

Morgan Stanley, Research

Managing Director

Morgan Stanley, Research

Virtually all asset allocations have risks that are dominated by a 90 percent or greater correlation with equities. This high correlation acts as an 800-pound equity gorilla lurking behind the multiasset façade of even the most diversified allocations. The dominance of equities as risk factors is generally known, but their many significant implications have yet to be fully incorporated into either the theory or the practice of investment management. One such implication relates to the opportunity for return enhancement from active extension (AE) 130/30 strategies.

Benchmark-centric equity strategies such as active 130/30 extensions aim to have tracking errors (TE) that are largely uncorrelated with equities. Within equity-dominated allocations, these uncorrelated TEs should have little impact on fund-level volatility risk. Positive alpha opportunities from these strategies can, therefore, be particularly valuable because they can significantly increase the fund’s total return with only minor increases in the overall volatility or other forms of beyond-model risk. Moreover, because such strategies relate to the basic equity assets, they help minimize any stress beta effects from short-term correlation tightening.

Active extension strategies can be designed to fit within a sponsor’s existing allocation space for active U.S. equity with TEs only moderately greater than that of a comparable long-only fund. The expanded footings can open the door to a fresh set of active underweight positions and provide a wider range of alpha-seeking opportunities for both traditional and quantitative management. AE mandates are often conversions of pre-existing relationships in which the sponsor has grown comfortable with a manager’s alpha-seeking skills, organization infrastructure, and risk-control procedures.

A growing body of studies has addressed the potential performance benefits that can be obtained by loosening the standard long-only constraint. The early work of Jacobs and Levy (1993, 1995, 1999, 2006) on risk-controlled, long/short equity portfolios created a body of literature that served as a foundation in this area. A further dimension was analytic framework for active management developed by Grinold (1989, 2005), Grinold and Eaton (1998), and Grinold and Kahn (2000a,b,c). In recent years, the 130/30 strategy has been the direct focus for an increasing number of theoretical studies, including key papers by Clarke, de Silva, and Thorley (2002, 2004, 2005) and Clarke (2005), with further contributions on this specific topic by Jacobs and Levy, Grinold and Kahn, as well as various studies by numerous other authors (Michaud, 1993; Arnott and Leinweber, 1994; Brush, 1997; Litterman, 2005; Markowitz, 2005; Bernstein, 2006; Emrich, 2006; Winston and Hewett, 2006). Two recent articles by Jacobs and Levy (2007a,b) provide a comprehensive review of how AE compares with traditional long-only and market-neutral strategies. The current authors have also published a series of papers from 2006 to 2007 on various topics related to AE (Leibowitz and Bova, 2006a, 2007f), including articles in the Journal of Portfolio Management (Leibowitz and Bova, 2007b) and Journal of Investment Management (Leibowitz and Bova, 2007d).

At the outset, it should be noted that there are important preconditions and cautionary points for achieving value-additive AE. First, the portfolio must be able to access positive long alphas. Second, it must have the risk discipline necessary to maintain the beta target and a reasonable level of TE. Third, the alpha productivity must be extendable into the short area. Shorting differs significantly from long-only management in a number of important ways, including higher transaction and maintenance costs, the available level and continuity of liquidity, the need for more intensive monitoring and risk control, and so on. To realize the potential benefits from AE, the management organization must also have the ability to establish short positions in a risk-controlled, operationally secure, and cost-efficient fashion.

The first section of this part describes the key features of AE strategies and highlights their ability to improve an equity portfolio’s alpha at the cost of increasing TE. There are a number of considerations, such as position size limits, use of generics versus active positions, and so on, that come into play when analyzing AE strategies and that can affect the results. The second section discusses AEs from the point of view of the asset owner as a way to add alpha to the overall fund return with only modest increases in overall fund risk. The higher TE from AE can be shown to be largely submerged within the beta risk that dominates the volatility of the overall fund. Moreover, AE strategies should be able to avoid the equity-correlated TEs and stress betas that could complicate the risk structure of other forms of active management.

ACTIVE MANAGEMENT WITH ALPHA RANKING MODELS

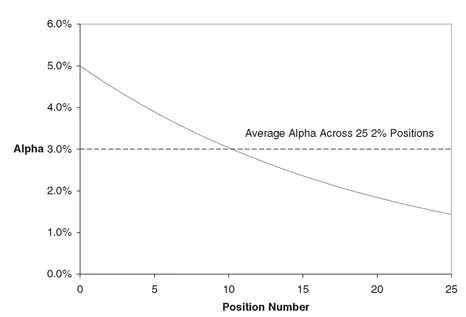

In a benchmark-centric management process, a portfolio is structured to maintain a targeted beta relative to the stated benchmark. An active position is then based on the expectation of a positive return in excess of the security’s beta-adjusted return. Portfolio managers generally have some formal or informal process for classifying these prospective active positions in a descending sequence based on their expected excess return. Alpha ranking models can be used to approximate such classifications. The base case ranking model in Exhibit 1.1 is based on an exponential alpha decay with a beginning alpha of 5 percent that declines to 1.5 percent by the 25th position.

An active position is established by assigning a differential weight to the security that is above (or below) its weight in the benchmark. Note that even in long-only portfolios, active positions can take the form of either overweights or underweights. However, the exposition is greatly simplified by treating the long-only active positions as if they were all overweights. The long-only portfolio, therefore, consists of 25 active positions, each having a 2 percent weight for a net activity level of 50 percent. The remaining nonproactive component of the portfolio is assumed to serve as a source of funds, as well as to help maintain the fund’s target beta.

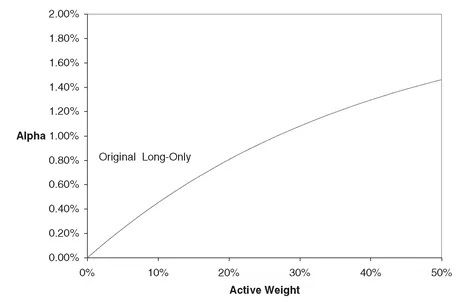

The alpha contribution of each active position is represented by the product of its alpha (from the alpha ranking model) and its 2 percent active weight. The sum of all such alpha contributions adds up to the expected portfolio alpha. As shown in Exhibit 1.2, for the 25 position long-only portfolio, the cumulative alpha attains a level of 1.5 percent.

The key for both fundamental and quantitative managers in moving from a long-only to an AE portfolio is to have some sort of alpha ranking system. For quantitative managers, this is quite easy because their models typically already rank all stocks in their universe. However, for fundamentals managers, the ranking system may be more implicitly expressed in terms of conviction tiers. The question for fundamental managers becomes whether they were actively avoiding certain stocks by underweighting them, or simply using these underweights as a source of funds.

EXHIBIT 1.1 Alpha Ranking Model

Source: Morgan Stanley Research

EXHIBIT 1.2 Portfolio Alpha

Source: Morgan Stanley Research

TRACKING ERROR MODELS

With the target beta pinned down by assumption, the remaining source of volatility risk is the portfolio’s TE. The three factors that determine the TE are the residual volatilities of each position, the portfolio weightings, and the correlations or factor effects that exist between the positions.

At the security level, the TE is simply the residual volatility of the excess return; that is, the standard deviation of the security’s return above or below its beta-adjusted market return. At the portfolio level, when the portfolio beta is tightly targeted at 1, the TE measures the deviation of portfolio returns around the benchmark.

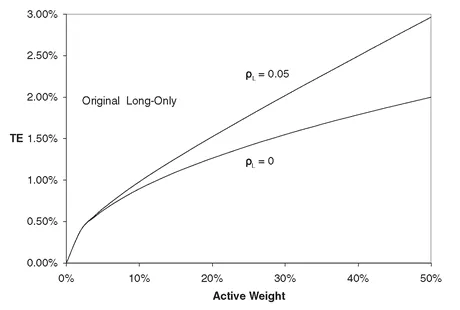

With uncorrelated positions in the long-only portfolios, projected TEs in the range of 1 to 2 percent will be well below the observed TEs of 4 percent or higher seen in most actively managed portfolios. This discrepancy between the observed TEs and the theoretical uncorrelated values implies that there is typically some degree of correlation among the various positions. These correlations, even at a minimal level, can have a significant effect on the TE and can, therefore, have a meaningful impact on portfolio performance.

Exhibit 1.3 shows how the TE grows as positions are added to the long-only portfolio under assumed pairwise correlations (ρL) of zero and +0.05. For the 25-position long portfolio, the TE ends up at 2 percent for the uncorrelated case, and at 3 percent for an assumed +0.05 pairwise correlation among all 25 active positions. Thus, it takes only a slight increase in pairwise correlation to generate significant increases in the TE.

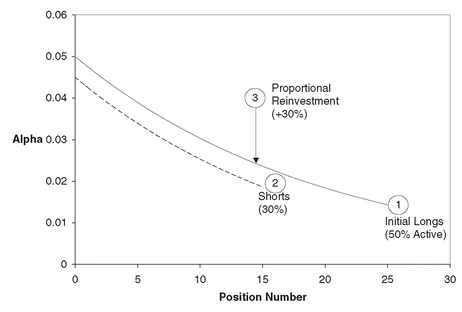

THE ACTIVE EXTENSION

The ability to take short positions provides access to a fresh set of underweights. These new underweights are assumed to have alphas that coincide with the corresponding long-only alpha ranking model, less some given shorting cost, taken to be 0.50 percent in the base case example. The shorter, dashed line that starts at a 4.50 percent alpha in Exhibit 1.4 schematically depicts a 30 percent AE. In essence, these new underweights are picking off the early cream of the alpha ranking curve. The gross short weight determines the number of 2 percent positions in the short portfolio while adding proportionally to the size of the 25 long positions.

EXHIBIT 1.3 Uncorrelated versus Correlated TE

Source: Morgan Stanley Research

EXHIBIT 1.4 AE: Proportional Reinvestment

Source: Morgan Stanley Research

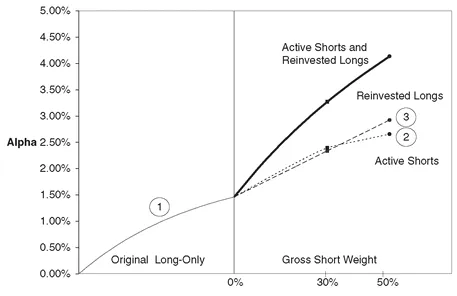

EXHIBIT 1.5 Alpha versus Gross Short Weight

Source: Morgan Stanley Research

Exhibit 1.5 displays the build of the cumulative alpha from the (1) initial long-only portfolio (25 position/50% active weight), (2) the new active shorts, and (3) the enhanced long position funded by the reinvested proceeds. With the combination of the added short alphas and proportional reinvestment into the long alphas, the portfolio alpha rises from 1.5 percent in the long-only case to 3.3 percent for the 30 percent extension, and 4.1 percent for the 50 percent extension.

The size of potential alpha improvement often seems disproportional given the modest 30...

Table of contents

- Praise

- Title Page

- Copyright Page

- Dedication

- Foreword

- Structure of the Book

- Acknowledgements

- Introduction

- PART One - Active 130/30 Extensions and Diversified Asset Allocations

- PART Two - The Role of Quantitative Strategies in Active 130/30 Extensions

- PART Three - Special Topics Relating to Active 130/30 Extensions

- PART Four - Key Journal Articles

- About the Authors

- Index