![]()

PART 1

BASIC BUNK TO MAKE YOU BROKE

There are myriad reasons investors fail, long term, to get the returns they want. Folks have a romantic notion about “beating the market.” A lofty goal—and possible, though difficult—but most investors not only fail to beat the market; they don’t match the market or come anywhere close.

You’d think with all of today’s technology and instant information, we’d have banked on all that past collective wisdom and do better at investing—overall and on average. Yet, overwhelmingly, investors don’t.

There’s no one reason, but a major reason—maybe the primary one—is our brains aren’t set up to do this stuff right. (I’ll talk about this more in future chapters.) Our brains evolved to keep us warm, dry, fed, and safe from charging beasts. That helps us in our quest to build taller, stronger, safer buildings and develop life-saving vaccines, but it does nothing in our quest to conquer capital markets. In fact, it can hurt us. Humans are intuitive creatures; markets are inherently counterintuitive.

Simply, the way our brains evolved can make us see the world completely wrong. We see heightened risk exactly when risk is actually least. (Bunks 7, 9.) We seek patterns where there are none (Bunk 10)—we want to see order in something that is inherently and beautifully chaotic. Then, despite our innate desire to assign meaning when there is none, we completely ignore obvious patterns—even mock them! (Bunks 1, 2.)

Part 1 deals with the most basic fundamental misunderstandings. These aren’t mere theoretical disagreements—these are misperceptions that can cause investors to make lasting, costly errors. For example, despite decades—centuries even—of historic evidence, investors overwhelmingly cannot get, in their bones, that stocks rise more than fall. (Bunks 1, 2, 6, 8.)

Investors are also compelled to think too short term. Humans are obsessed with near-term survival—have to be! That helped us survive the colder months and stay fed, but it makes humans think about the investing future all wrong—to their detriment. (Bunks 3, 4, 8.) And though most investors (those with long-term growth goals, i.e., almost everyone reading this book) know they should think long term—and even say so in cooler moments—all that can go out the window once volatility kicks up. (Bunks 1, 6, 7, 8.) And once you make one or a few strategy shifts driven not by rational, cool-headed, long-term goals but by greed, fear, anxiety, indigestion, insomnia, what-have-you, you can seriously erode the chances you get anything near equities’ long-term average growth. (Bunks 2, 5.)

And volatility! Drives folks crazy—because they can’t train themselves to think long term. But volatility is normal. Even the most grizzled old investor can forget: In capital markets, averages are just that—averages. Reality can be wildly extreme—and that’s normal. (Bunks 5, 7, 9.) Folks who fail to understand that may not only get unnerved and end up missing the likely superior long-term return of stocks—they can even get robbed blind! (Bunk 11.)

Ultimately, these are misperceptions that fade away if you can get, in your bones, the power of Capitalism—that human ingenuity is boundless, and that ingenuity eventually shows in future firm earnings, which goad stock prices higher over the long term. And that if you exchange the future uncertainty of likely higher returns from stocks for the nearer-term certainty of guaranteed returns—through a risk-free investment like a Treasury—finance theory and history both say you get a lower return. That’s the risk/reward trade-off. (Bunks 1, 2, 3, 4, 5, 6, etc., etc., etc., etc.)

And if you don’t believe in the power of Capitalism, that’s fine—you don’t have to—it believes in you. Still, if you think, as many perma-pessimists do, that Capitalism is broken, can’t work anymore, or is somehow morally wrong, I’m sorry for you, but also you shouldn’t be investing in stocks anyway and you probably wasted your money on this book. Many are prone to look at the current environment as I write in 2010 (or anytime, really) and fear Capitalism is unable to overcome the anti-capitalistic forces in our government and from other governments. But ultimately, Capitalism is a bigger force than any of those anti-forces. You may not believe that, but it’s true.

Investing, inherently, requires faith that Capitalism isn’t perfect in the near term but eventually gets darn close in the longer term—and is the best way (we currently know) to ensure capital flows to where it can be best used to create near-infinite future wealth. (Bunk 10.) Therefore, investing success requires grit, discipline, alligator skin, and the clearer vision you can get through debunkery. On with it!

![]()

BUNK 1

BONDS ARE SAFER THAN STOCKS

Bonds just feel safe. The very name even implies safety—as in, “My word is my bond.” Far too many investors with long-term growth goals load up on bonds, presuming they’re safer than scary stocks. But are they? Depends largely on how you define “safe.”

Does “safe” mean a high probability of lower long-term returns with less near-term volatility? Or is “safe” increasing the probability your portfolio grows enough to satisfy your long-term growth and/or cash flow needs? If you need a certain amount of growth to maintain your lifestyle in retirement, you might not feel so “safe” when you discover having too little volatility risk for too many years later means you must subsequently dial back your lifestyle. And you may not feel “safe” when you must explain that to your spouse—particularly if in that future there is any huge inflation spurt (always possible).

Bonds Can Be Negative, Too

Yes, stocks can be pretty darn volatile and scary—near term. But people forget: Bonds do sometimes lose value in the near term too. In 2009, bonds not only suffered relative to stocks (world stocks were up 30 percent)1 but also absolutely—10-year US Treasuries fell 9.5 percent.2 Not what you’d expect from über-safety.

Still, stocks can and do fall much more—in 2008, world stocks were down 40.7 percent!3 But remember, these are all short-term returns. Stocks are generally riskier short-term because the expectation is they’ll have better returns long-term. And they have! (See Bunk 2 for more on stocks’ long-term superiority.) Overwhelmingly, if you’ve got a long time to invest (and most investors do—see Bunk 3 on how investors usually underestimate their time horizon to their detriment), stocks are typically a better bet. And if you need portfolio growth and can give stocks a bit of time, they have even been the safer bet! It’s all about time horizons.

Given Just a Bit of Time

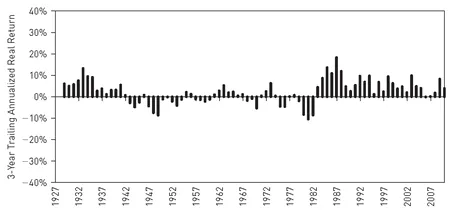

Buying stocks with money you need to pay the rent over the next year is always foolish. But the truth is: Given a bit of time, historically stocks have bigger and, surprisingly, more uniformly positive returns than bonds. Figure 1.1 shows three-year rolling real returns (adjusting for inflation) of 10-year Treasuries. Note: There are plenty of down periods—in some cases many of them right in a row. You aren’t protected from down periods with Treasuries.

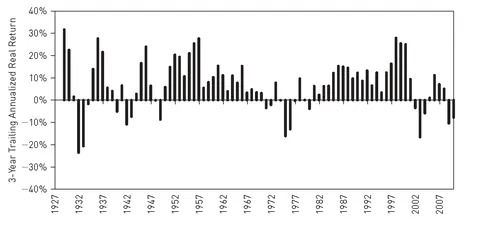

Now compare that to Figure 1.2, which shows the same thing but for the S&P 500. (I use US stocks here because they have longer, better data, and we can measure this over a longer period—but the story is generally the same using world stocks.) You actually have fewer negative three-year periods historically. Yes, the negative periods can be bigger, but the positive periods are more numerous and simply huger. Stock returns blow away bond returns, with fewer negative three-year periods!

Figure 1.1 US 10-Year Treasuries (Three-Year Rolling Real Returns)—“Safer” Than Stocks?

Source: Global Financial Data, Inc., USA 10-year Government Bond Total Return Index from 12/31/1925 to 12/31/2009.

Figure 1.2 US Stocks (Three-Year Rolling Real Returns)—Compare to Bonds

Source: Global Financial Data, Inc., S&P 500 total return from 12/31/1925 to 12/31/2009.

Inflation’s Bite

Folks also forget about inflation. If, over your long-term investment time horizon, we have a period (or two) of materially increasing inflation, two things can happen at once. First, long-term interest rates typically rise as inflation does. Bond yields and price have an inverse relationship—so when rates rise, the price and value of your long-term bonds fall proportionally.

Second, and as surely, your bonds get paid back in cheaper, inflated dollars—double whammy! With the amount of recent global money creation (as I write this in 2010) and the huge global deficits, it would be foolish indeed not to consider this a material possible risk. During such inflationary periods, stocks have tended to have lower returns relative to history but positive returns nonetheless (with short-term volatility, of course)—yet returns that generally have beaten inflation and maintained real purchasing power, and then some.

I’m frequently accused of being a perma-bull. I’m not—I’ve gotten bearish three times in my career thus far and I wrote about it publicly then. (For a history thereof and my other views over the long-term past, see Aaron Anderson’s The Making of a Market Guru: Forbes Presents 25 Years of Ken Fisher, John Wiley & Sons, 2010.)

But I do have a bias to being bullish if I can’t find any decent reasons to be bearish. Why? Look at those graphs! Capital markets are super complex. No one person or group of people can understand all the intricate inter-workings of the massive global market. As such, there are no certainties in investing, only probabilities. And history says you should want to be bullish way more than bearish. Bears can’t get that. They see the big down periods for stocks and say, “Eek!” But for some reason, they just can’t see the plain truth: Stocks are more consistently positive than bonds historically—given just a bit of time. Therefore, over the longer term, they have been less risky. Stocks are safer than bonds? Sure looks that way.

![]()

BUNK 2

WELL-RESTED INVESTORS ARE BETTER INVESTORS

Can you sleep at night? For some reason, many investing professionals and pundits have a creepy fascination with what happens in your bedroom. Cooked into their recommendations is often the elusive “sleep at night” factor (which, believe it or not, isn’t a primary benchmark determinant—see Bunk 4).

Many people just can’t stomach volatility—wild wiggles make ’em crazy! Give them ulcers and keep them up at night. For those folks, before we consider dooming them to what’s likely a lifetime of lackluster returns, I’d put a few hard questions to them.

Are You So Sure Stocks Are the Problem?

First, do you know bonds can and do have down years? (You do if you read Bunk 1!) Of course, everyone knows stocks had a dreadful 2008, but most folks (who haven’t read this book) don’t realize 10-year US Treasuries were hammered in 2009—down 9.5 percent.1

Second, are you so sure you hate wild wiggles? Folks think of downside volatility as bad and upside volatility as not volatility at all. But it’s all volatility. You like the wild wiggles when they’re up wiggles. It’s amazing how many folks claiming they hate stocks at the end of a bear market—don’t want to hold them ever again—change their tune radically after a couple or three or six years of a bull market and come back to stocks (sometimes just in time to get hammered again). Suddenly, they can’t get enough “risk”—want to load up on it. These folks aren’t risk-averse; they’re myopic—they’re heat chasers and crowd followers (and may need a court-appointed financial conservator to protect them from themselves). A certain amount of stock phobia can be offset by training yourself to ignore the near term and think long term. Of course, many folks can’t go there.

It’s not easy to do. It requires training. Folks naturally think about near-term survival (see Bunk 7). But if you can train yourself to think longer term, those sleep-at-night factors melt away. Why? Because if you’ve got a longer time horizon (and if you’re reading this book, you most likely do—see Bunk 3), stocks are just likelier to treat you better. And you can learn to sleep, even in difficult volatility (rather the same way as a child you learned to sleep on Christmas Eve, despite knowing all the excitement immediately ahead).

Investing Is a Probabilities Game

Past performance is never indicative of future results—simple fact. But history can tell you if something is reasonable to expect. Investing isn’t a certainties game. It is inste...