![]()

PART ONE

THE BUSINESS OF PIPES

![]()

CHAPTER 1

Overview An Emerging Market

RICHARD E. GORMLEYa

Cowen and Company, LLC

The emergence of PIPEs, or Private Investments in Public Equity, and RDs, or Registered Direct offerings, during the last five years has altered the capital markets and corporate finance landscape for small and midsize public companies. PIPEs and RDs have become the preferred financing source for many issuers seeking expeditious access to competitively priced capital from institutional investors. The growing participation of varied investors in this market likewise demonstrates the appeal of PIPEs and RDs as an attractive investment asset class. This chapter provides a brief overview of the emerging PIPE and RD markets.

A PIPE transaction is commonly considered to be the privately negotiated sale of a public issuer’s equity or equity-linked securities to investors, where the sale is conditioned upon a subsequent resale registration statement being filed with, and declared effective by, the Securities and Exchange Commission (SEC). This permits the immediate resale of the purchased securities upon effectiveness of the registration statement. Because PIPEs are private placements, they are governed by the guidelines found in Section 4(2) of the Securities Act of 1933, as amended, which provides an exemption from registration for an issuer’s transactions that do not involve any public offering. Furthermore, SEC Regulation D (Reg D) establishes a “safe harbor” exemption applicable to the private offers and sales of securities satisfying the specific requirements of this rule. PIPE offerings are generally conducted in accordance with Reg D.

In addition to the sale of unregistered securities, the PIPE market also includes the sale of registered securities to a limited number of investors. These placements are commonly referred to as registered direct offerings (RDs) and include equity or equity-linked placements by issuers utilizing a shelf (primary) registration statement that has been filed with and declared effective by the SEC.

PIPEs and RDs provide an alternative financing vehicle for public companies in circumstances in which a public follow-on equity or equity-linked offering is not desirable, advisable, or possible. PIPEs and RDs may be compelling for an issuer in one or more of the following circumstances:

• The issuer hopes to execute a small transaction ($5 million to $50 million) on an accelerated basis, many times in as quickly as one or two weeks

• The issuer’s market capitalization is too small for a successful, traditional underwritten public equity or equity-linked transaction

• Expansion of its shareholder base through targeted marketing is an important goal for the issuer

• The issuer’s industry sector is out of favor in the broader public equity markets

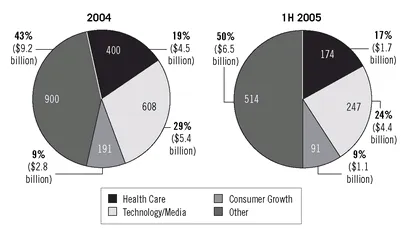

FIGURE 1.1 PIPE and RD Issuance by Industry Sector (Percentage Based on Number of Issuers)

• The issuer seeks flexibility for the purpose of tailoring a financing structure

• The issuer wants to avoid the up-front SEC registration process for timing-related reasons

• Confidentiality throughout the capital-raising transaction is an important consideration for the issuer

PIPEs and RDs are typically offered to a limited number of accredited investors and to qualified institutional buyers (QIBs). Typical investors include public crossover funds, mutual funds, private equity/sponsor funds, hedge funds, and financial institutions. Typical issuers are growth companies such as those in the technology, health care, media, and consumer sectors, although many other types of companies in sectors such as energy, mining, manufacturing, finance, and financial services utilize the PIPEs market as well (see FIGURE 1.1).

Some History

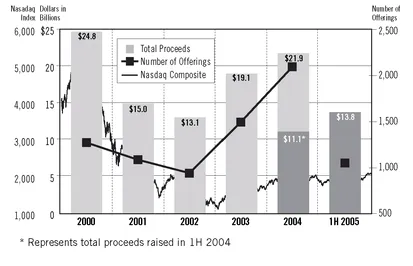

The combined PIPE and RD market has recently experienced dramatic growth. Since 2000, companies have raised more than $100 billion under a variety of structures. Although transaction volume peaked in 2000 in concert with the Nasdaq index appreciation and related technology financing activity, 2004 transaction volume was robust, approximating $22 billion (see FIGURE 1.2). Issuers at all stages of the business cycle, including cash-generating companies, are choosing to issue securities in this market.

The PIPE market as a vehicle for capital formation began more than two decades ago, when micro-cap companies facing uncertain financing prospects could secure capital from technical-oriented hedge fund investors as well as high-net-worth individual investors. With the advent of SEC Regulation S (Reg S) in 1990, PIPEs became more popular because public companies were thereafter allowed to sell unregistered securities to non-U.S. entities, and these securities could be resold into the public markets after a forty-one day holding period. These transactions were typically structured as convertible preferred equity or convertible debt with variable or reset pricing features that often resulted in a deterioration of the issuer’s share price. Transaction sizes ranged between $1 million and $5 million, and the aggregate size of the PIPE market was no more than a few billion dollars. Although Reg S was an effective financing platform for many companies, it was abused by some investors and issuers. In 1997, the SEC amended Reg S in order to curb this abuse. For a detailed discussion of Reg S and its associated amendments, please refer to Chapter 5, “The Law: Legal and Regulatory Framework.”

FIGURE 1.2 2000-First Half 2005 Nasdaq and PIPE/RD Market

Source: PlacementTracker.com, FactSet.

By the mid- to late 1990s, the PIPE market began to mature as larger companies took advantage of the ease and certainty of financing it provided. At that time, many biotechnology companies began to finance via PIPEs because the public equity markets remained closed to them. It was then that fundamental-oriented investors began to invest in PIPEs.

With the increased utilization of universal shelf registration filings by issuers desiring financing flexibility, RDs emerged as an adjunct to the PIPE market. Today, the combined PIPE/RD market is a well-recognized financing vehicle through which a variety of issuers successfully raise capital and in which both fundamental and technical investors actively participate. Evidence of the market’s legitimacy includes the growing participation of larger issuers (who possess many financing options) and blue chip institutional investors. According to PlacementTracker.com, a research company that tracks private placements, in the first six months of 2005, excluding issuers with market capitalizations of less than $25 million, the average transaction size was approximately $20 million and common stock transactions represented the largest percentage of PIPEs. The PIPE/RD market predominantly facilitates primary share issuance, but it can accommodate the sale of shares on a secondary basis as well. At the current pace, 2005 PIPE/RD volume and number of deals is expected to exceed that of 2004.

Structural Considerations

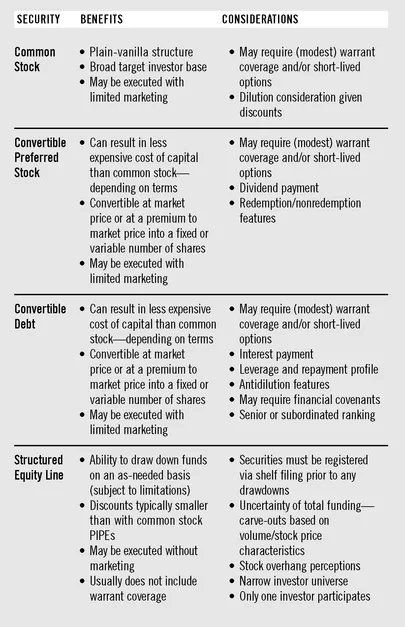

Although the PIPE market is becoming more standardized each year (the proliferation of plain-vanilla common stock structures is an example of this trend), it remains a highly negotiated marketplace. PIPEs can be structured in various ways depending upon an issuer’s objectives and profile:

• Common stock (may include warrants/options)

• Convertible preferred stock (convertible into a fixed or variable number of shares; may include warrants/options)

• Convertible debt (convertible into a fixed or variable number of shares; may include warrants/options)

• Structured equity line (SEL)

Common stock PIPEs, which are commonly referred to as plain-vanilla or straight equity PIPEs, are typically issued at a discount to the issuer’s current stock price. Convertible preferred stock and convertible debt structures are typically issued at an issuer’s current stock price or at a premium to an issuer’s current stock price. Structured equity lines are based on an issuer’s stock price, volume, and trading characteristics. Convertible preferred stock, convertible debt, and structured equity lines are each referred to by some market participants as “structured PIPEs.”

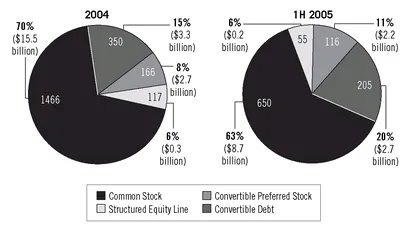

According to PlacementTracker.com, in terms of the number of issues, common stock transactions accounted for approximately 70 percent of the combined PIPE/RD market in 2004, whereas in prior years convertible preferred stock and convertible debt offerings were more prevalent. Common stock structures are expected to constitute the majority of such deals in the future.

The trend toward common stock issuance has been caused, in part, by higher quality, larger companies entering the PIPE market and by the widely publicized adverse effects of “death spiral” or “toxic” convertible PIPEs in several high-profile transactions. These complicated securities, issued primarily by companies in dire need of funding, had negative consequences for both investors and issuers in the wake of the stock market collapse in 2000. In many cases, the issuing companies were heading toward bankruptcy prior to the issuance of their securities, and the death spiral/toxic securities played a large part in sealing their fate. Death spiral/toxic transactions are typically structured as convertible securities with variable conversion pricing ratios, allowing investors to convert a fixed dollar amount into a floating share amount with no pricing floor. Downward movements in issuers’ stock prices are often exacerbated by the existence of these variable conversion features, allowing investors to purchase larger and larger portions of a company’s equity while severely diluting the holdings of existing shareholders. These types of transactions are not prevalent in the market today.

FIGURE 1.3 Summary of Structural Alternatives

Source : SG Cowen & Co, LLC

FIGURE 1.4 PIPE/RD Issuance by Type (Percentage Based on Number of Issues)

Source: PlacementTracker.com

In the current market, issuers primarily raise capital by using common stock structures, or by using convertible structures with a fixed share conversion price, often at a premium to the issuer’s current share price. The eventual structure used by an issuer largely depends on its financial and business profile prior to the transaction, and on its technical trading characteristics. The flexible nature of these deals affords many companies the ability to raise funds in a targeted, customized fashion; however, the terms of such financings can vary significantly, depending on the profile of the issuer and market conditions.

Sample terms for both common stock and convertible preferred stock/ convertible debt PIPE structures are outlined in FIGURE 1.5 below.

Recently, RDs have emerged as an important adjunct to the PIPEs market. RDs are equity or equity-linked placements by issuers who have, prior to the transaction, filed a shelf registration that has been declared effective by the SEC. These offerings usually refer to the sale on a “best efforts” basis of registered common stock (usually at a slight discount to the issuer’s current share price), generally to a limited number of institutional investors, whereupon the issuer files a prospectus supplement with the SEC prior to completing the offering. RDs are technically public offerings with all the related considerations and requirements; however, given the generally limited and discreet distribution and negotiated nature of the transaction, the offering resembles a PIPE. Increasingly in today’s market, RDs have a favorable profile when compared to public follow-on equity offerings. Most PIPE investors have an interest in purchasing RDs. Statistics indicate that such transactions account for approximately 10 percent of the overall PIPEs market.

FIGURE 1.5 Sample PIPE Terms

Source: SG COwen & Co , LLC

Documentation

Documentation for PIPEs typically consists of a Securities Purchase Agreement, a Registration Rights Agreement, a Warrant Agreement (if applicable), and a legal opinion.

Securities Purchase Agreement: Sets forth the agreement between the issuer and the investor pursuant to which the investor will purchase the securities of the issuer. Terms typically contained in the Securities Purchase Agreement include issuer representations and warranties, investor representations and warranties, covenants, closing conditions, and a schedule of purchasers. In addition, either the Securities Purchase Agreement or a separate Registration Rights Agreement will set forth an agreement between the issuer and the investor by which the issuer undertakes to have the securities that are being issued in the PIPE offering (or, if the securities issued in the PIPE transaction are convertible securities, the securities underlying such convertible securities) registered with the SEC. An issuer will typically commit to file a resale registration statement with the SEC within a reasonable amount of time after the closing of the transaction and agree to use its best efforts to have the registration statement declared effective after a defined period of time. (Although the amount of time in which an issuer agrees to have the shares registered can vary, the registration statement covering the securities underlying a PIPE offering would typically be required by the investor to be declared effective within sixty to 120 days following the closing.) In addition, if ...