![]()

PART ONE

WHERE ACCOUNTS PAYABLE FRAUD CAN HAPPEN IN YOUR ORGANIZATION

As you will see as you work your way through the first portion of this book, crooks looking to get money from your firm can be pretty darn creative. When most people think of accounts payable fraud, or payment fraud, their minds usually focus on check fraud. And that is with good reason. Check fraud is a huge issue in this country. In fact, it was referred to as one of the biggest growth industries in the early 1990s.

But we’ve come a long way, and there are now many deterrents that make check fraud more difficult. However, at the same time, advances in technology have put the tools to commit check fraud within the financial reach of virtually anyone who wants to commit it. It is a constant battle, with the crooks trying to get their grimy hands on your money and the banks and software developers introducing new products to thwart those fraudsters. The battle is interesting and continually changing.

At the same time, if we focus solely on check fraud, we are looking at only a portion of the fraud picture when it comes to accounts payable-related functions. Fraudsters know they can play a variety of other games taking advantage of payroll, petty cash, your master vendor file, your employees’ desktops, your credit cards, automated clearinghouse (ACH), and the invoices your legitimate and phony vendors send you.

So, as you can see, there is still a lot to cover even after we finish with the check stuff. While check fraud may be a big tip of the iceberg, there are still lots of other ways for crooks to get your money. In this Part, we’ll dissect them all.

![]()

1

PROFILES OF FRAUD IN THE BUSINESS WORLD

In responding to an Accounts Payable Now & Tomorrow Fraud Survey, one savvy professional wrote, “I hope to find out if fraud is generally internal or external to an organization. Can we trust our employees? Or is it someone from the outside that we need to be wary of?” She brings up a very good point. Where should executives focus their resources when it comes to protecting their organization from fraud? By the end of this chapter, you will have the answer to this question.

Without a doubt, everyone reading this is at some risk for employee fraud, also referred to as occupational fraud. When you think about it, the explanation is simple. Who better than your employees know where the weaknesses are in your processes? And even if your processes are iron tight, your employees will know how to get around the controls you’ve worked so hard to put in place. Now, some reading this may be scratching their heads, thinking I’m making a mountain out of a molehill. Before we dive into the statistics that demonstrate just how common fraud is in the corporate world, let’s look at some of the myths that surround fraud in the corporate world.

THREE BIG MYTHS

When it comes to fraud, there are a number of misconceptions. The three biggies are:

1. It could never happen here.

2. My employees would never steal from me.

3. We have good segregation of duties, except for a few long-time, trusted employees who would never steal from us.

As you will see after reading this chapter, all three are false. It could happen in your shop and, in fact, has in almost every organization; sadly, a few of your employees will steal from you given the opportunity; and saddest of all, if an employee does steal from you, the odds are high that it will be one of your long-term, trusted employees.

FRAUD STATISTICS

Generally speaking, reported fraud statistics understate the problem. The reason is twofold:

1. People can report only what has been discovered. Undetected fraud can never be included in the statistics.

2. People are sometimes embarrassed to admit they have been the victim of fraud, especially when it demonstrates a shortcoming on their part. However, given the numbers you are about to see, it is not clear that this is still as strong a factor as it once was.

Throughout this book, you’ll see reference to three sources of statistics. They all have different target audiences, yet they all tell a similar, chilling story. The sources are:

1. The Association of Certified Fraud Examiners’ (ACFE’s) Report to the Nation

2. PricewaterhouseCoopers (PwC) Global Economic Survey

3. Accounts Payable Now & Tomorrow’s (APN&T’s) Fraud Survey

We should also point out that the surveys do not ask the same questions, but, again, the conclusions that can be drawn from the numbers are similar. PwC asked its survey respondents about “significant” crime. It was left to the respondent to decide what was significant and what wasn’t. In this case, over 43 percent responded that their organization had suffered one or more significant economic crimes within the prior two years.

The APN&T respondents were asked if any organization the respondent had worked for in the past ten years had been a victim of any sort of fraud. In that instance, a whopping 86 percent responded affirmatively.

While the time frames are clearly different and the questions are not identical, the conclusion cannot be denied. Every organization must be concerned about fraud and take the necessary steps to guard against it.

In providing commentary to the APN&T survey, one of the respondents questioned whether the threat to her organization was internal or external. As the rest of the numbers will illustrate, the threat is dual. No organization can afford to let its guard down on either front.

OCCUPATIONAL FRAUD: IT’S A BIG PROBLEM

Occupational fraud is just as ugly as it sounds. Every two years, in a widely awaited “

Report to the Nation,” the ACFE provides an update on this topic. The 2006 report contains some fascinating information that is especially relevant to those concerned about accounts payable (AP). Why? Because it examines three of the most common frauds related to AP:

1. Check tampering

2. Billing schemes

3. Expense reimbursements

DEFINITIONS AND FREQUENCY

The ACFE describes occupational fraud as “the use of one’s occupation for personal enrichment through the deliberate misuse or misapplication of the employing organization’s resources or assets.” Of those cases reported, 91.5 percent involve asset misappropriations, with a median loss of $150,000.

Billing schemes, the most common, are described as “any scheme in which a person causes his or her employer to issue a payment by submitting invoices for fictitious goods or services, inflated invoices, or invoices for personal purchases.” This can be done by the employee’s creating a shell company and billing the employer for nonexistent services or the employee’s submitting invoices for personal items. A whopping 28.3 percent of the cases of misappropriated assets were of this type, and the median loss was a mind-boggling $130,000.

Check tampering is defined as “any scheme in which a person steals his or her employer’s funds by forging or altering a check on one of the organization’s bank accounts, or steals a check the organization has legitimately issued to another payee.” This can be done by the employee’s either stealing a blank company check or taking a check made out to a vendor and depositing it into his or her own bank account. A little over 17 percent of the asset misappropriation frauds were related to check tampering, with a median loss of $120,000 associated with this type of fraud.

And then there is expense reimbursement fraud, defined as “any scheme in which an employee makes a claim for reimbursement of fictitious or inflated business expenses.” Readers of this book have probably seen more than their share of this type of fraud, which accounts for 19.5 percent of asset misappropriations. The median loss related to expense reimbursement fraud is $25,000.

WHO GETS HIT THE HARDEST?

Regrettably, small businesses continue to suffer a disproportionate share of fraud losses. The median loss suffered by organizations with fewer than 100 employees was $190,000 per scheme. This was higher than the median loss in even the largest organizations. The most common occupational frauds in small businesses involve employees fraudulently writing company checks, skimming revenues, and processing fraudulent invoices.

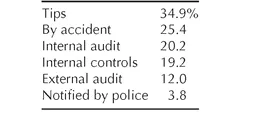

HOW FRAUD IS DETECTED

As much as I would like to report that internal processes uncover most fraud, that is just not the case. By far, the largest number of cases is discovered because of a tip, and the second-largest number comes to light by accident. Here is a rundown of how frauds are initially discovered:

(If you do the math, you will note that occasionally two methods are credited for the discovery.)

What this demonstrates is that organizations are not doing a good job at either preventing or detecting fraud. What is truly disheartening is the fact that over half the frauds are detected through methods that have nothing to do with the controls put in place by the organization. In fact, the tips often come about because the crook couldn’t keep his or her big mouth shut and bragged about their “accomplishments,” resulting in the tip. It is also why anonymous hotlines are such an important component in discovering fraud.

WHO COMMITS OCCUPATIONAL FRAUD?

According to the ACFE, long-term, trusted employees continue to have a stranglehold on this type of crime. Larger losses are associated with employees in higher positions as well as those who have been employed for a longer time. There is a direct correlation between the size of the loss and these two factors.

Men are over one-and-a-half times more likely than women to commit this type of fraud, and when they do, the losses are two-and-a-half times as large. Is this tied to the fact that in most organizations men tend to hold higher positions than women?

Since readers of this book are most apt to run into check tampering and expense reimbursement schemes, I thought I would take a look at the biggest perpetrators of each. If you are thinking sales and/or purchasing, think again.

While sales is the third-largest abuser on the expense reimbursement side, they fall far behind executive/upper management, who account for over one-third of all this type of crime, and accounting, who commit just under 32 percent of it. When it comes to check tampering, accounting (probably because of its familiarity with the issues) is responsible for a whopping 57.4 percent of the cases, with executive/upper management responsible for another 26.4 percent of the cases.

TO PROSECUTE OR NOT

While there is lingering reluctance to prosecute offenders, just over 70 percent of the cases included in this study were referred to law enforcement. The median loss in the referred cases was $200,000, about double that of the cases that were not referred. Fear of adverse publicity continues to be the primary reason for not prosecuting. Almost 44 percent indicated that this was their motivation for declining to take legal action.

Another third of the respondents said that they felt internal discipline was sufficient and a slightly lower number indicated that they had come to a private settlement with the perpetrator. A little over 21 percent believed that it would be too costly to take action. This probably accounts for the lower median loss on nonreported cases. The remaining reasons include:

• Lack of evidence

• Civil suit

• Disappearance of the perpetrator

The other reason that organizations may be reluctant to take legal action is that their chances of recovering a reasonable amount of the loss are not very good. Only 16.4 percent recovered 100 percent of their loss, while 42 percent received nothing.

However, it should be noted that a well-publicized prosecution can do wonders for stopping other potential internal thieves, and we are not necessarily talking about the media. Making sure that everyone within the company is aware that legal action was taken should do the trick.

This report is just one of the many resources available from the ACFE (www.acfe.com).

IS FRAUD AN EQUAL OPPORTUNITY CRIME?

Do you have a preconceived notion as to whether fraudsters are more likely to be male or female? This is one area where the numbers do not tell the same story.

According to the ACFE, 61 percent of the frauds were committed by men. However, the PwC data show that 85 percent of the perpetrators were male. This is a bit of a difference. The explanation probably lies in the makeup of the people interviewed. The PwC respondents tended to be very high-level executives who were asked about “significant” crime, while the ACFE respondents were fraud examiners and did not differentiate between frauds where the losses were big and those where it wasn’t.

FRAUD IN THE EYES OF THE BEHOLDER

As we sift through the mountains of data related to fraud, one of the issues is the way an organization views fraud, especially if committed by insiders. One organization might consider it a firing offense, another might only give an employee a warning, and still others might ignore it completely.

Thus, if an organization is serious about preventing fraud, it is crucial that the message is sent from the top. In reality, what we observe is that one organization will fire (and possibly even prosecute) an employee for a relatively minor infraction, while another will completely ignore it.

Take the example of two travelers putting in for the same meal, splitting the profit. In most organizations, if this deed were discovered, the employees would be given...