![]()

CHAPTER 1

Risk Management in Energy Markets

In most financial markets there are a fairly small number of fundamental price drivers which can be easily translated into pricing and risk-management models. In currency markets, for example, the commodity that has to be delivered is cash, a piece of paper which is easily stored, transferred and not sensitive to weather conditions.

But energy markets are concerned with bulky, dangerous commodities that have to be transported over vast distances, often through some of the most politically unstable regions of the world. This means that there are a large number of factors that can affect energy prices. A fairly short list of such factors might include the weather; the balance of supply and demand; political tensions; comments made by the leaders of certain countries; decisions taken by OPEC; analysts’ reports; shipping problems; and changes to tax and legal systems. All of these contribute to the high levels of volatility in energy markets, which often experience sudden price movements from one day to the next, or even from one minute to the next.

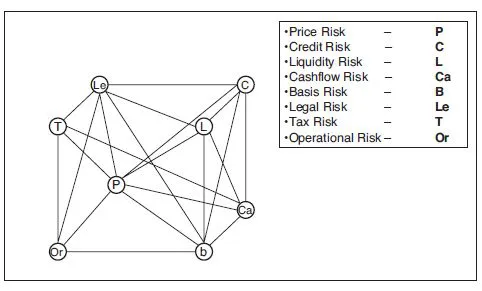

THE RISK MATRIX

One way of understanding how these factors combine to influence energy prices is to use the risk matrix shown in Figure 1.1. This illustrates how all the risks shown interrelate and affect one another, and makes clear that the relationships between them are never two-dimensional. It also makes the point that it is impossible to manage price risk effectively without reviewing all the other risks that an individual or a firm may face.

FIGURE 1.1 The Risk Matrix

As the matrix shows, the key additional risks to be managed in an organization when using derivatives for trading or price-risk management purposes are credit risk, liquidity risk, cash-flow risk, basis risk, legal risk, tax risk and operational risk. All these risks will have a direct bearing on which derivatives are employed and the choice of trading partner. They will also affect decisions on where trading takes place (which is dependent on jurisdiction and tax risk) and how much is traded (which will depend on operational risks).

FINANCIAL RISKS

Price risk

This is the risk of losing money as a result of price movements in the energy markets and is sometimes referred to as “market risk”. Typically, producers will lose money when prices fall, while users will find themselves out of pocket when prices increase.

Credit risk

Credit risk is the risk of financial losses arising when the counterparty to a contract defaults. It is often said that a hedge contract is only as reliable as the credit standing of the counterparty and credit-risk management has moved to the top of the priority list for the energy industry. The credit crunch felt in the U.S. energy sector in the aftermath of the Enron disaster has prompted energy traders to review credit policies and also to review effective methods to control and reduce credit risk wherever possible.

Liquidity risk

In the context of this book, this is the risk of losses caused by a derivatives market becoming illiquid. This happened during the Gulf War when there was so much volatility in the markets that many banks and oil traders would not give a bid or offer price. Companies who were exposed to those markets at the time were sometimes unable to close out their positions or could only do so at great cost to themselves.

Cash-flow risk

This is the risk that an organization will not be able to produce the cash to meet its derivatives obligations. In the late nineties, Korean Airlines found itself in this kind of situation and suffered heavy losses as a result. The company had been hedging against movements in the jet-fuel price by using derivatives which were denominated in dollars. When the Korean won suddenly fell in value against the dollar, the company found that the cost of the dollars needed to service its derivatives contracts had soared. The company lost out because it had not hedged against the risk of a negative movement in the currency differential between the won and the U.S. dollar.

The perils of liquidity and cash-flow risk: Metallgessellschaft AG

In 1993 the German conglomerate Metallgessellschaft AG announced that its Refining and Marketing Group (MGRM) had been responsible for huge losses of around US$1.5 billion, which it had incurred by writing oil futures contracts on the New York Mercantile Exchange (NYMEX). The great irony of the situation was that its position had been perfectly sound from an economic point of view. The company’s difficulties stemmed from the fact that it had ignored the perils of liquidity and cash-flow risk.

In the early 1990s, MGRM agreed to sell 160 million barrels of oil at a fixed price at regular intervals over a 10-year period. At the time this kind of forward contract looked like a lucrative strategy: as long as the spot price for oil remained lower than the price that MGRM had fixed, the company was sure to make a profit. However, the company was vulnerable to a rising oil price, so it hedged this risk using futures contracts. Thus, if the oil price rose it would lose on its fixed-price forward contracts, but gain on its futures. If the price fell, it would gain on the forward contracts, but lose on the futures. This appeared to hedge MGRM’s price risk adequately, but unfortunately failed to take account of its liquidity and cash-flow risk.

One of MGRM’s problems was the sheer size of the position it had taken. The 160 million barrels of oil that it had committed to sell was equivalent to Kuwait’s entire production over an 83-day period. It has been estimated that the number of futures contracts needed to hedge the position would have been around 55,000. NYMEX was known to be a large and liquid market, but its trade in contracts relevant to MGRM’s position averaged somewhere between 15,000 and 30,000 per day. There was thus a clear theoretical risk that MGRM could have problems liquidating its futures position. This risk created an imbalance in the market as many other players realized the size of MGRM’s position, which became in itself a factor in market pricing. Prices inevitably began to move against the company.

This liquidity risk was compounded by the cash-flow risk which resulted from the way that MGRM’s hedge had been structured. As was noted earlier, when oil prices went down, the value of the company’s fixed-rate forward contracts rose and the value of the futures fell. The problem arose because although the forward contracts increased in value, they did not generate the cash flow which was needed to fund the regular margin calls that were due on the futures contracts. The structure of the hedge had succeeded in dealing with price risk over the life of the hedge but had failed to deal with cash-flow risk in the short term. This was probably the major factor in the staggering losses that the company suffered.

BASIS RISK

What is basis risk?

Basis risk is the risk of loss due to an adverse move or the breakdown of expected differentials between two prices (usually different products). In the context of price-risk management, it describes the risk that the value of a hedge (using a derivative contract or structure) may not move up or down in sync with the value of the price exposure that is being managed.

In the energy market, these market movements may be triggered by factors such as poor weather conditions, political developments, physical events or changes in regulation. These can lead to basis risk occurring in circumstances such as the following:

- Physical material in one location cannot be delivered to relieve a shortage in another location.

- A different quality of product cannot be substituted for an energy product in severe shortage. This often happens in the pipeline gas and power markets if there are any problems with transmission networks.

- There is not enough time to transport or produce an energy product to alleviate a shortage in the market.

When conducting price-risk management, the ideal derivatives contract is one that has a zero risk or the lowest basis risk with the energy price from which protection is needed. The larger the basis risk, the less useful the derivative is for risk-management purposes.

The attraction of over-the-counter (OTC) swaps and options is that basis risk can at times be zero, as OTC contracts can often price against the same price reference as the physical oil. However, futures contracts (sometimes referred to as “on-exchange” derivatives) traded on exchanges such as the Intercontinental Exchange, the New York Mercantile Exchange and the Tokyo Commodity Exchange all have their pricing references and terms fixed in the exchange’s regulations. This means that if their pricing reference does not match the underlying physical exposure, the basis risk must either be accepted or an OTC alternative needs to be sought. (There will be more on the differences, and respective advantages and disadvantages of on-exchange and OTC contracts in later chapters.)

Components of basis risk

Locational Basis

FIGURE 1.2 Locational basis

Time Basis

FIGURE 1.3 Time basis

Brent Crude futures and the Cushing Cushion

The success of the Brent Crude oil futures contract is an interesting example of the importance of basis risk in the energy markets. This contract was first traded on London’s International Petroleum Exchange (IPE) in 1983, two years after the West Texas Intermediate (WTI) crude futures contract had been launched on the NYMEX. On the surface, both contracts do similar jobs, for hedging purposes, at least. So, over the years, why have international companies chosen to hedge with the IPE Brent futures contract rather than its betterestablished and more liquid American rival?

The answer is a particular kind of basis risk, known in the industry as the “Cushing Cushion” (after the Cushing refinery in Oklahoma, the destination of several of the major oil pipelines in the southeast United States). The Cushing Cushion enables the WTI’s crude price in the U.S. to act totally independently of international market prices. This can be because pipeline bottlenecks at the Gulf coast are preventing additional foreign crude from reaching the midcontinent refineries or it can be because bad weather has closed the Louisiana Offshore Offloading Point (LOOP), halting the offloading of foreign crude from carriers into the pipeline system.

In situations like these, the first reaction of speculators and refineries which depend on oil in the pipeline system is to buy WTI NYMEX Futures. Sometimes WTI premiums of US$3 a barrel over the IPE Brent price have resulted from LOOP problems, pipeline problems or both.

So for anyone hedging international crudes such as West African, Brent, Mid East crude oils, Dubai or Tapis, the WTI NYMEX contract carries a significant basis risk. The IPE* Brent future, on the other hand, is exempt from this basis risk, which is almost certainly one of the keys to its success.

Mixed basis risk

Mixed basis risk occurs when an underlying position is hedged with more than one type of mismatch between the energy that is the subject of the price-risk management and the pricing index reference of the derivatives instrument that is being used. For example, if a January gasoil (heating oil) cargo is hedged with a March jet kerosene swap, it would leave both time and product basis exposures.

LEGAL, OPERATIONAL AND TAX RISKS

Legal risk

This is the risk that derivatives contracts may be not be enforceable in certain circumstances. The most common concerns in this area surround clauses on netting of settlements, netting of trade, bankruptcy and the concern that the liquidation of contracts may be unenforceable. Opinions on many jurisdictions around the world can be obtained from the International Swaps Dealers Association (ISDA).

Operational risk

The risk that may occur through the errors or omissions in the processing and settlement of derivatives is known as operational risk. Internal controls alongside an appropriate back-office system (whether manual or computerized) should be employed to reduce this risk.

Tax risk

Tax risk can occur when there are changes to taxation regulations that affect either the derivatives market directly or the physical underlying energy market in some way. This can create additional costs to the trade. For derivatives contracts, the issue of imposed withholding taxes on any settlement payments is normally an issue covered by ISDA contracts.

SUMMARY

When designing an energy-price risk management or trading program, it is essential to be aware of all the risks that are involved in the energy market and the ways in which they interrelate. But it is important to remember that any hedging strategy which focuses narrowly on any one of the risks outlined in this chapter and ignores the others may be worse than having no hedging strategy at all.

![]()

CHAPTER 2

The Energy Derivatives Markets

ON EXCHANGE AND OFF EXCHANGE

Derivatives normally make the headlines for all the wrong reasons. In the public mind, they are often associated with the activities of greedy speculators or with highly publicized corporate financial disasters. This is ironic because derivatives are essentially instruments to manage and reduce risk. They were created to provide opportunities to minimize price risk and to lock in profits, while reducing balancesheet volatility and the potential for losses. It is true that there have been cases in which the use of derivatives has led to spectacular losses but this has normally been the result of their mistaken misuse or outright abuse by incompetent or ruthless individuals. Certainly, in the normal course of business life, derivatives are a prudent and, indeed, indispensable tool of price-risk management.

Derivatives are financial contracts that derive their price or value from an underlying price or asset reference. They can be divided into three main types: futures contracts, swaps contracts and options.

- Energy futures contracts are legally binding standardized agreements on a regulated futures exchange to make or take delivery of a specified energy product (oil, gas, power), at a fixed date in the future, and at a price agreed when the deal is executed.

- Energy swaps represent an obligation between two parties to exchange — or swap — cash flows, one of which is a fixed price normally agreed at execution; the other is based on the average of a floating price index during the contract period. No physical delivery of the underlying energy takes place; there is only money settlement.

- Options are agreements between two parties that give the buyer of the option the right, but not the obligation, to buy or sell at a specified price on or before a specific future date. They can apply to a specific futures contract (a futures option) or a specific cash flow (if an OTC Option) or they can be used to buy or sell a specific swap contract (if an OTC swaption). When the option is exercised, the seller of the option (also known as the writer) must deliver or take delivery of the underlying asset or contract at the specified price (unlike a swap in which there is no obligation). The specified price is known as the “strike price”, which is the price level at which the option becomes profitable independent of the seller or buyer.

Derivatives are often referred to as “off-balance-sheet” items. This term is used because, in the past, there was no need for derivatives to appear on a company’s balance sheet (now this is only the case when hedging using derivatives). Derivatives weren’t required to appear on the balance sheet because a derivatives contract requires no transfer of the principal value of the contract; in other words, there is no commitment to lend money or take money. For example, when a US$1 million swap is traded, the principal value is not exchanged. Instead, an exchange is made of the cash flow of the difference between the agreed fixed price on the derivative instrument and the forward floating-price reference that the derivative is priced out against.

ON-EXCHANGE AND OVER-THE-COUNTER

In the energy industry, derivatives can be bought and sold in two main ways: on-exchange and over-the-counter (OTC). On-exchange refers to the futures markets which are found on regulated financial exchanges such as the New York Mercantile Exchange (NYMEX) and London’s International Petroleum Exchange (ICE). The OTC market is specific to the non-standard swaps and OTC options. These are usually traded directly between two companies (principals, players) in the energy markets.

Although the futures markets are important to the energy industry, they rely much more heavily on OTC derivatives. This is because OTC derivatives are customized transactions, whereas their on-exchange counterpart, the “futures” contr...