![]()

1

Fundamentals of Commodity Spot and Futures Markets: Instruments, Exchanges and Strategies

1.1 THE IMPORTANCE OF COMMODITY SPOT TRADING

Commodity price risk is an important element of the world physionomy at this date, as it has an impact on the economy of both developed and developing countries: in a rough approximation, one can state that the latter include most commodity producing countries, the former being originators, marketers and manufacturers. All parties are still involved in activities of spot trading with physical delivery while the formidable development of liquid derivative markets - forward, Futures contracts and options - has paved the way for risk management and optimal design of supply and demand contracts.

Every commodity is traded on a spot market. In the old days, buyers and sellers used to meet on the marketplace where transactions led to immediate delivery. In the 18th and 19th centuries, potato growers in the state of Maine started selling their crops at the time of planting in order to finance the production process. In a parallel manner, numerous forward transactions were taking place in Chicago for cereals and agricultural products and in London for metals. A need for standardization in terms of quantity, quality, delivery date emerged and led to the establishment of the New York Cotton Exchange (NYCE) in 1842 and the Chicago Board Of Trade (CBOT) in 1848. The clearing house, unique counterparty for buyers and sellers of Futures contracts was the effective signal that the Exchange was operating. As of today, some of these clearing houses are owned by independent shareholders, others are primarily owned by market participants as in the case of the London Metal Exchange (LME) and the International Petroleum Exchange (IPE). Different qualities of the same commodity may be traded on different exchanges. The most famous examples include: coffee which in its “arabica” variety is traded on the New York Coffee, Sugar and Cocoa Exchange (CSCE), while the “robusta” type is traded on the London International Financial Futures Exchange (LIFFE); and oil which is traded on the New York Mercantile Exchange (NYMEX) as Western Texas Intermediate (WTI) and on the IPE in its Brent variety.

Let us observe that the fact that any transaction on commodities may be physical (delivery of the commodity) or financial (a cash flow from one party to the other at maturity and no exchange of the underlying good) is in sharp contrast to bonds and stock markets where all trades are financial. However, physical and financial commodity markets are, as expected, strongly related. Price and volatility observed in “paper” transactions are correlated to the analogous quantities in the physical market, both because of the physical delivery that may take place at maturity of a Futures contract and the existence of spot forward relationships that will be discussed throughout the book.

Lastly, let us note that the last two decades have experienced dramatic changes in world commodity markets. Political upheavals in some countries, economic mutation, new environmental regulation, a huge rise in the consumption of commodities in countries such as China and other structural changes have contributed to increase the volatility of supply and prices. This has made hedging activities (through forwards, Futures and options) indispensable for many sectors of the economy, the airline industry in particular being an important example.

As mantioned before, we call spot trading any transaction where delivery either takes place immediately (which is rarely the case in practice) or if there is a minimum lag, due to technical constraints, between the trade and delivery. Beyond that minimal lag, the trade becomes a forward agreement between the two parties and is properly documented by a written contract which specifies, among other things, who among the buyer and seller is responsible for shipping, unloading the goods and other transportation-related issues.

Consider a standard situation where the seller is a producer (e.g., of copper) and the buyer a manufacturer: in general, they never meet and, even if they did, would rarely agree on prices, timing and so forth. Hence the existence of intermediaries who play the role of go-between, are prepared to take delivery of goods that may not resell immediately and organize the storage and shipping.

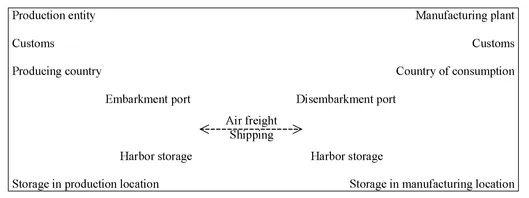

We can represent the different phases of the physical execution of a trade as:

The document that represents the ownership of the good is called a bill of lading. It is issued either by the captain of the transportation ship or by the transporter in charge. That transportation contract may eventually be traded. It can bear the label “shipped” or “to be shipped”; the latter terminology indicates that the merchandise has been embarked, leading to the qualification clean on board.

Responsibility for commercial execution

It may lie in the hands of the seller, or the buyer, or the intermediary (since, in practice, many intermediaries will play a role, in particular because of the lags in the timing of different operations).

The responsibility will take different forms:

• For the exporter, sale Free On Board (FOB).

• For the commercial intermediary, purchase FOB out of the dock or in warehouse.

• For the importer, purchase on the dock or in warehouse.

Note that the commercial responsibility may be fragmented in the course of contract execution. For instance, a manufacturer who buys metals under a FOB specification is responsible for organizing the shipping but the armator is in charge of managing the shipping and holds the corresponding risk.

Major risks in commodity spot transaction

Four major types of risk may be identified in commodity spot markets:

• Price risk, which will be discussed throughout the book and for which the first examples of hedging strategies are presented in Section 1.2.

• Transportation risk, which is described below.

• Delivery risk, which concerns the quality of the commodity that is delivered and for which there is no financial hedge that may be put in place. The only coverage is provided by a very customized contract or by a solid long-term relationship with the originator.

• Credit risk, which is present all along until the final completion of the trade.

Risk attached to the transportation of commodities

1. The first category of risks concerns the deterioration, partial or total, of goods during transportation. Two types of risks are usually recognized in this category:

e “ordinary” risks;

e “extraordinary” risks such as wars, riots and strikes.

The expeditor of the goods or the FOB buyer directly holds the transportation risk, unless they purchase an insurance contract to be covered. Different companies specialized in freight insurance (such as the famous Lloyds of London) propose various types of contracts. We need to keep in mind that transportation risk is an important one as it includes the entire community - the tanker that sank in Alaska being a sad example. If no specific insurance coverage has been purchased, the company that bears the liability must put in place some kind of self-insurance process as do some major oil companies today.

2. Cost of transportation risk: All Futures exchanges around the world quote FOB prices. Consequently, if a trade (e.g., on sugar) is settled for delivery 12 months later with the CIF price as a reference, the seller needs to hedge his position not only against a decline in sugar prices by, say, selling Futures on the New York Coffee, Cocoa and Sugar Exchange, but also against changes in the shipping cost. The latter risk will be hedged by entering into a Forward Freight Agreement (described in Section 1.5). Consequently, the two components of the CIF price will get hedged in totally different exchanges.

1.2 FORWARD AND FUTURES CONTRACTS

A forward contract may be generically described as an agreement struck at date 0 between two parties to exchange at some fixed future date a given quantity of a commodity for an amount of dollars defined at date 0. A Futures contract has the same general features as a forward contract but is transacted through a Futures exchange. The clearing house standing behind that exchange essentially takes away any credit risk from the positions of the two participants engaged in the transaction. This default risk is almost reduced to zero through margin deposits or initial margins that need to be made before entering into any contract, as well as the daily margin calls required to keep a contract alive if its market value has declined from the previous day.

Futures contracts serve many purposes. Their first role has been to facilitate the trading of various commodities as financial instruments. But they have from the start been providing a hedging vehicle against price risk: a farmer selling his crops in January through a Futures contract maturing at time T of the harvest (say, September) for a price FT(0) defined on 1 January has secured at the beginning of the year this amount of revenue. Hence, he may allocate the proceeds to be received to the acquisition of new machinery or storage facilities and, more generally, design his investment plans for the year independently of any news of corn oversupply possibly occurring over the 9-month period.

It is noticeable in many markets, ranging from agricultural commodities to electricity, that Futures contracts are used as a substitute for the spot market by hedge funds, Commodity Trading Advisors (CTAs) or any class of investors wishing to take a position in commodities, both because it takes away the physical constraints of spot trading and provides the flexibility of short and long positions, hence the choice of positive or negative exposure to a rise in prices. This will be discussed in detail in Chapter 14.

What follows describes in detail the mechanisms of forward and Futures contracts with their various characteristics as well as the way exchanges operate. The different classes of participants, the mechanism of price discovery and the crucial relationships, if they exist, between spot prices and Futures prices under some form of equilibrium assumptions are described in detail.

Forward contracts

A forward contract is an agreement signed between two parties A and B at time 0, according to which party A has the obligation of delivering at a fixed future date T an underlying asset and party B the obligation of paying at that date an amount fixed at date 0, denoted FT(0) and called the forward price for date T for the asset. Note that this price is not a price in the sense of the price of a stock, but rather a reference value in the contractual transaction. If the underlying asset is traded in a liquid market, the no-arbitrage condition between spot and forward markets at maturity implies that:

If the value at date T of the Futures contract maturing at that date was different from the spot price, an arbitrage opportunity would be realized by buying in one market and selling immediately in the other.

Keeping in mind that the buyer of the forward contract may immediately sell at maturity in the spot market at the price

ST the commodity which was delivered to him against the payment of

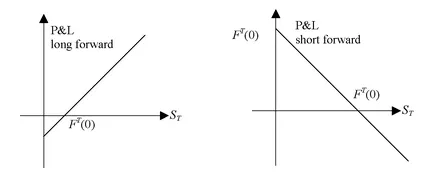

FT (0) dollars, the respective Profit and Loss (P&L) of party A (called long forward) and party B (called short forward) are depicted by the following graphs:

Obviously, the contract is a zero-sum game between the buyer and the seller. Note also that, by definition, both P&Ls are expressed in dollars at date T.

For practical purposes, party A represents an economic agent who wants to hedge against a possible rise in the price of the underlying ass...