![]()

PART ONE

Systems Building and Behavioral Finance

![]()

CHAPTER 1

Systems Building for the Three Skills of Top Trading

Early in my trading career I was a student of the Edson Gould philosophy depicted in his Findings and Forecasts of the early 1970s. Then later, in the late 1970s through the early 1980s, as a full-time trader for my own account and an avid student of technical analysis, I became an enthusiastic follower of Joseph Granville and his Granville method of technical analysis. Joe Granville’s system comprised a “tree of indicators” so that all the weight of decision making did not depend on any one branch. In Granville’s hands, this weight-of-the-evidence and tree-of-indicators approach worked like magic during the widely swinging trading ranges of the 1970s and early 1980s.

I was impressed by Granville’s capacity to call intermediate trend reversals in U.S. equity markets, but I was disturbed by his subjective approach to technical analysis. My PhD education and professional research training led me to seek out a model from the behavioral sciences for a framework that would give structure and discipline to Granville’s tree-of-indicators approach. The results of this research were tested both in my own trading and by the experiences of my students and my technical-trading colleagues in San Francisco. Ultimately, my research crystallized into a decision support system called the Life Cycle Model of Crowd Behavior. (See Figure 1.7 later in this chapter).

The Life Cycle Model of Crowd Behavior rests on a solid foundation of behavioral science theory. Hence, the trader-analyst can have confidence that her decision support system is logical and dependable. This system covers the main dimensions of price, volume, sentiment, and time; it shows how these elements fit together in a mutually reinforcing scheme or system. Because price, volume, sentiment, and time are dimensions of market behavior that are independent of each other, the trader-analyst has the scientific reason she needs to compile the indicator readings of these four elements of technical analysis to obtain a more comprehensive and accurate reading of a market’s present position and probable future trend.

One beauty of a decision support system is its flexibility. The market itself is dynamic, which means that from one market juncture to the next, a different mix of market indicators may become dominant. Hence, you, the trader-analyst, will lean most heavily on price indicators and downplay sentiment at one juncture, while later, sentiment will become the focus of your attention. With a decision support system you are free to judge the relative weightings of indicators at different market junctures and respond accordingly.

You can make the choice to push this decision support system more toward the nondiscretionary pole and use it as a semi-mechanical trading system. Conversely, you can rely on behavioral finance simply as a setup for market timing decisions. In my judgment, this degree of flexibility fits the dynamic nature of the market, but you risk filtering away the advantage of flexibility with decision systems that are too mechanical or too rigid in their rules for decision making.

After several years of full-time trading, tracking technical analysis systems, and being involved in the technical-trading community, I graduated to a higher level of trading. I elevated my attention more and more to pattern recognition and discretionary trading. I had always backed up my indicator analysis with chart patterns, which I found helpful. However, I was also aware that my interpretations of chart patterns succeeded on a hit-or-miss basis.

One of my colleagues in the technical analysis and trading community in San Francisco used a pattern recognition and discretionary trading approach that he swore by and that he encouraged me to learn. It was the Wyckoff method of technical analysis and art of speculation. My friend had been an engineer working in Lebanon for Middle East Airlines before one of the many wars in that part of the world forced him and his family to flee. However, while he was living in Lebanon, he had good success applying the Wyckoff method to U.S. stocks. He, too, had progressed from indicator analysis to pattern recognition. As an engineer specializing in reliability testing, he carefully classified the Wyckoff method as a sound and reliable system of market analysis and a total trading philosophy, including money management.

Around 1980 I enrolled in the Wyckoff correspondence course offered by the Stock Market Institute. Soon thereafter it became my principal method for triggering trades. Over the years, the Wyckoff method grew to become a dominant part of my trading and professional life. I created and began teaching a university graduate-level course in Wyckoff and subsequently tested the Wyckoff method extensively in my own trading. These experiences stimulated me to refine some basic Wyckoff principles and to create new tools to add power to the trader who adopts the Wyckoff method.

Also in the 1980s I became friendly with Mr. Robert Prechter and adopted the Elliott Wave Principle as another way to validate my Wyckoff interpretations. During the 1970s and 1980s, I expanded my acquaintances among the older traders and technicians in the New York area, including Mr. Anthony (Tony) Tabell, grand-nephew of Richard D. Wyckoff, from whom we shall soon learn a vital lesson that links the style of the old-time traders to the style that will lead to success for the trader in the twenty-first century.

Another two big steps forward in my process of systems building took place around 1990. First, I created the Action Sequence method for the active learning of Wyckoff’s approach. The Action Sequence is a simulation and a sequential case study with chart analysis and feedback. Second, I collaborated with Dr. Van K. Tharp, trader psychologist, to develop a mental state control system that evolved into “The Ten Tasks of Top Trading.”

The Ten Tasks of Top Trading is a system that helps the trader follow through on her trades. Essentially, it is a behavioral/psychological system for proper mental state management. The ten tasks of top trading are at the heart of the third part of The Three Skills of Top Trading: Mental State Management.

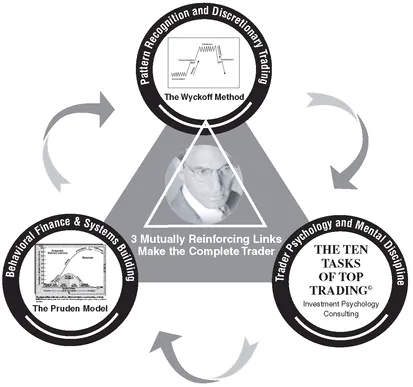

In sum, I have enjoyed a happy combination of formal education, trading experience, and collaboration with professional colleagues, and have profited from the appearance of new concepts for systems building that led to the discovery and creation of the Three Skills of Top Trading and the design of the three-in-one trader model. (See Figure 1.1.)

SYSTEMS BUILDING

The complete trader for the twenty-first century will most likely look a lot like the old-time stock operator who lived and worked on Wall Street a century ago. Hence, in The Three Skills of Top Trading, the systems building tools are designed both to capture the essence of the old-time trader and to introduce you to the skills and new thinking needed to meet the challenges you face as a trader-analyst in the twenty-first century.

FIGURE 1.1 Three Mutually Reinforcing Links Make the Complete Trader

We begin with a human connection between the old-time traders and the trader of the future: third-generation technician and veteran of Wall Street, Mr. Anthony Tabell, who explains how the behavior of the old-time technicians and traders lines up with the latest thinking and theories of behavioral finance for trader-technicians of the twenty-first century.

This link between classic and modern eras leads us into the second section of this chapter: the story of Mr. Addison Cammack, a legend in his own time who operated on the New York Stock Exchange in the early 1900s. Cammack provides a model of a classic trader who captured all three of the skills of top trading, the type of old-time pioneer trader who is relevant to the new thinking about markets for this century.

The third section of this chapter introduces Daniel H. Pink’s new and provocative book, A Whole New Mind: Why Right-Brainers Will Rule the Future, outlining its relevance to today’s trader. I explore the power of capturing the essence of the technical-trader pioneers coupled with Pink’s whole-mind approach in building your competitive edge in the twenty-first century, and I demonstrate the correspondence between Pink’s “six senses” and the “new edge” tools for traders.

The fourth section of the chapter explores systems-building choices available to the trader. The systems-building approaches selected for you in this book are illustrated with the assistance of a series of schematic diagrams. You will discover a spectrum of systems building, from nondiscretionary to discretionary trading, with the Life Cycle Model of Crowd Behavior and the Wyckoff method of technical analysis and speculation spotlighted for further development.

This spectrum highlights the trader’s need for self-discipline and mental state management. To gain the competitive edge in the twenty-first century, you will need to cultivate self-discipline and mental state management with the aid of conceptual frameworks like the Ten Tasks of Top Trading. This chapter also introduces the trader to conceptual schemes for decision support systems with the Life Cycle Model of Crowd Behavior, and a pattern-recognition and discretionary trading system with the Wyckoff method.

Appendix A offers the trader a trustworthy mechanical system, A Primary Trend Projector. Also included in this chapter is a more esoteric coverage of market facts and market research that argues in favor of methods that stress skill building and judgment. This rationale appears in Appendix B, where I recap survey, laboratory experiment, and case study research of market behavior and trading methods.

THE LEGENDARY TECHNICAL TRADER OF YESTERDAY FORESHADOWED THE TECHNICAL TRADER OF THE TWENTY-FIRST CENTURY

In an address to the Society for the Investigation of Recurring Events in 1992, Anthony W. Tabell, a third-generation technician and veteran of Wall Street, linked the behavior of the old-time technicians and traders to the latest thinking and theories of behavioral finance for trader-technicians of the twenty-first century. A dedicated lifelong student of the market, Tabell follows in the footsteps of his father as well as his great uncle on his mother’s side, the legendary Richard D. Wyckoff.

For Tabell, the beauty of behavioral finance is its compatibility with the worldview of the old-time technicians and traders. Tabell anticipates that as the field of behavioral finance (for example, chaos theory) develops further, it will ultimately result in a view of the market similar to the way technicians and traders saw things back in the early days of the twentieth century. According to Tabell, the early technicians and first experimenters in the art of analytical speculation in the early twentieth century could be described as intuitive, deterministic, contrary, and apocalyptic.

Just how did those traders and technicians see things during the first quarter of that century? Tabell explained that the old-time technician had a hard-boiled world view that led him to buy and sell on the only thing he could trust, his intuition. Certain that there were larger forces at work in the market (for example, what Richard Wyckoff termed the “Composite Man,” the sum of the interests that have an effect on the market) and that, though he could not control them, he could detect them, he was deterministic . A product of the era of the trading pool when the fix was always in, he was contrarian—the crowd, which was subject to the forces of the market, ultimately had to be wrong. Lastly, he had an apocalyptic worldview—no surprise, given the economic climate that eventually gave way to the crash of 1929.

Buying and selling on intuition resulted from skill and experience. It was a judgmental approach the trader and technician applied to his tape reading and to his chart analysis. Like having a sixth sense, the intuitive approach was a prized possession. Indeed, an archetype of the old-time trader was James Keene, a New York Stock Exchange floor trader who claimed to have no “rules” for trading but to buy and sell by intuition. Keene’s skill at detecting market manipulation and, indeed, leading a pool operation of a stock made him sought after as an “operator.” Keene and operators like him were also sought out by Richard Wyckoff, who observed and codified their best practices, which eventually became an integral part of his method of technical analysis and the art of speculation.

With respect to the old-timer’s intuitive, deterministic, and contrarian attributes, Tabell reported that they were largely spawned by the pools of the pre-1929 era. These pools consisted of investors who would find an operator (for instance, Keene). Then they would enlist the help of customers’ men, willing brokers who would put the word on the street that a stock was on the decline, going south fast. Then, when the value of the stock depreciated, the pool would scoop it up, running the stock price up again. They would then turn to their brokers (or the press) with doomsday news that would depress the stock anew, and the pool would purchase at bottom again.

“Then you could start a rumor that the company was going to cut it...