![]()

PART ONE

CASH MANAGEMENT

![]()

1

Treasury Department

The treasury department is responsible for a company’s liquidity. The treasurer must monitor current and projected cash flows and special funding needs, and use this information to correctly invest excess funds, as well as be prepared for additional borrowings or capital raises. The department must also safeguard existing assets, which calls for the prudent investment of funds, while guarding against excessive losses on interest rates and foreign exchange positions. The treasurer needs to monitor the internal processes and decisions that cause changes in working capital and profitability, while also maintaining key relationships with investors and lenders. This chapter explores these and other responsibilities of the treasury department, as well as such key issues as treasury centralization, bank relations, outsourcing, and performance metrics.

ROLE OF THE TREASURY DEPARTMENT

Ultimately, the treasury department ensures that a company has sufficient cash available at all times to meet the needs of its primary business operations. However, its responsibilities range well beyond that single goal. It also has significant responsibilities in the following areas:

• Cash forecasting. The accounting staff generally handles the receipt and disbursement of cash, but the treasury staff needs to compile this information from all subsidiaries into short-range and longrange cash forecasts. These forecasts are needed for investment purposes, so the treasury staff can plan to use investment vehicles that are of the correct duration to match scheduled cash outflows. The staff also uses the forecasts to determine when more cash is needed, so that it can plan to acquire funds either through the use of debt or equity. Cash forecasting is also needed at the individual currency level, which the treasury staff uses to plan its hedging operations. This topic is covered in Chapter 3, Cash Forecasting.

• Working capital management. A key component of cash forecasting and cash availability is working capital, which involves changes in the levels of current assets and current liabilities in response to a company’s general level of sales and various internal policies. The treasurer should be aware of working capital levels and trends, and advise management on the impact of proposed policy changes on working capital levels. This topic is addressed in Chapter 5, Working Capital Management.

• Cash management. The treasury staff uses the information it obtained from its cash forecasting and working capital management activities to ensure that sufficient cash is available for operational needs. The efficiency of this area is significantly improved by the use of cash pooling systems. This topic is addressed in Chapter 4, Cash Concentration.

• Investment management. The treasury staff is responsible for the proper investment of excess funds. The maximum return on investment of these funds is rarely the primary goal. Instead, it is much more important to not put funds at risk, and also to match the maturity dates of investments with a company’s projected cash needs. This topic is addressed in Chapter 8, Investment Management.

• Treasury risk management. The interest rates that a company pays on its debt obligations may vary directly with market rates, which present a problem if market rates are rising. A company’s foreign exchange positions could also be at risk if exchange rates suddenly worsen. In both cases, the treasury staff can create risk management strategies and implement hedging tactics to mitigate the company’s risk. This topic is addressed in Chapter 9, Foreign Exchange Risk Management, and in Chapter 10, Interest Risk Management.

• Management advice. The treasury staff monitors market conditions constantly, and therefore is an excellent in-house resource for the management team should they want to know about interest rates that the company is likely to pay on new debt offerings, the availability of debt, and probable terms that equity investors will want in exchange for their investment in the company.

• Credit rating agency relations. When a company issues marketable debt, it is likely that a credit rating agency will review the company’s financial condition and assign a credit rating to the debt. The treasury staff responds to information requests from the credit agency’s review team and provides it with additional information over time. This topic is addressed in Chapter 6, Debt Management.

• Bank relationships. The treasurer meets with the representatives of any bank that the company uses to discuss the company’s financial condition, the bank’s fee structure, any debt granted to the company by the bank, and other services such as foreign exchange transactions, hedges, wire transfers, custodial services, cash pooling, and so forth. A long-term and open relationship can lead to some degree of bank cooperation if a company is having financial difficulties, and may sometimes lead to modest reductions in bank fees. This topic is addressed further in the Bank Relations section of this chapter.

• Fund raising. A key function is for the treasurer to maintain excellent relations with the investment community for fund-raising purposes. This community is composed of the sell side, which are those brokers and investment bankers who sell the company’s debt and equity offerings to the buy side, which are the investors, pension funds, and other sources of cash, who buy the company ’s debt and equity. While all funds ultimately come from the buy side, the sell side is invaluable for its contacts with the buy side, and therefore is frequently worth the cost of its substantial fees associated with fund raising. This topic is addressed in Chapter 6, Debt Management, and Chapter 7, Equity Management.

• Credit granting. The granting of credit to customers can lie within the purview of the treasury department, or may be handed off to the accounting staff. This task is useful for the treasury staff to manage, since it allows the treasurer some control over the amount of working capital locked up in accounts receivable. This topic is addressed in Chapter 5, Working Capital Management.

• Other activities. If a company engages in mergers and acquisitions on a regular basis, then the treasury staff should have expertise in integrating the treasury systems of acquirees into those of the company. For larger organizations, this may require a core team of acquisition integration experts. Another activity is the maintenance of all types of insurance on behalf of the company. This chore may be given to the treasury staff on the grounds that it already handles a considerable amount of risk management through its hedging activities, so this represents a further centralization of risk management activities.

Clearly, the original goal of maintaining cash availability has been expanded by the preceding points to encompass some types of asset management, risk management, working capital management, and the lead role in dealing with banks and credit rating agencies. Thus, the treasury department occupies a central role in the finances of the modern corporation.

TREASURY CONTROLS

Given the large sums of cash involved in many treasury transactions, it is important to have a broad set of controls that help to ensure that transactions are appropriate. The following chapters contain sections on controls related to those chapter topics. At a more general level, it is critical that duties be properly segregated among the treasury staff, so that anyone concluding a deal never controls or accounts for the resulting cash flows. For example, trading activities should be separated from confirmation activities, so that someone fraudulently conducting illicit trades cannot waylay the confirmation arriving from the counterparty. In addition, a senior-level treasury manager should approve all trades, yet another person (possibly in the accounting department, in order to be positioned out of the departmental chain of command) should reconcile and account for all transactions.

It is also useful for someone outside of the trading function to regularly compare brokerage fees or commissions to reported transactions, to see if there are any unauthorized and unrecorded trades for which the company is paying fees.

Treasury is also an excellent place to schedule internal audits, with the intent of matching actual transactions against company policies and procedures. Though these audits locate problems only after they have occurred, an adverse audit report frequently leads to procedural changes that keep similar problems from arising in the future.

In addition to segregation controls and internal auditing, the treasurer should impose limit controls on a variety of transactions. These limits can prohibit or severely restrict the treasury staff from investing in certain types of financial instruments (such as some types of financial derivatives) that present an unduly high risk of capital loss. Another limitation is on the amount of business a company chooses to do with a specific counterparty, which is designed to reduce company losses in the event of a counterparty failure. Limitations can also apply to certain currencies if there appears to be some risk that a country’s leaders may impose currency controls in the near future. Finally, there should be monetary caps on the transaction totals to which anyone in the treasury department can commit the company. Even the treasurer should have such a limitation, with some major transactions requiring the approval of the company president or board of directors.

The controls noted here are only general concepts. For more detailed itemizations of specific controls, please refer to the Controls sections of each of the following chapters.

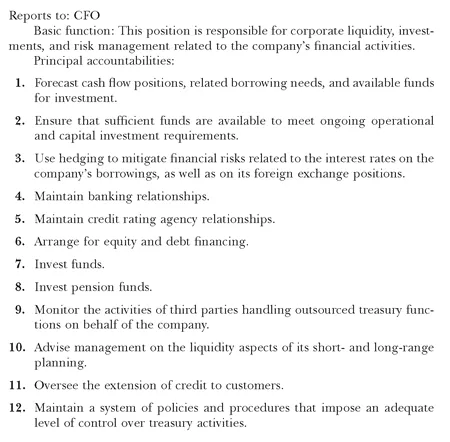

Exhibit 1.1 Treasurer Job Description

TREASURER JOB DESCRIPTION

Within the organizational hierarchy, the treasurer usually reports to the chief financial officer (CFO). The treasurer’s job description, as noted in Exhibit 1.1, essentially establishes responsibility for the tasks noted in the preceding sections.

POSITION OF TREASURY WITHIN THE CORPORATE STRUCTURE

In a small company, there is no treasury department at all, nor is there a treasurer. Instead, treasury responsibilities are handled by the accounting department and are under the supervision of the controller. This is an adequate situation if there are just a few bank accounts, foreign exchange exposures are minor, and there is not an excessive need for investment or borrowing expertise. However, as a company grows, the need for a specialized treasury staff increases. This typically begins with a treasurer, who personally handles all of the responsibilities of the department, and gradually includes specialized staff to handle more complex transactions, such as cash pooling and hedging. Personnel are added either as transaction volume increases or when management decides to centralize more activities under the treasurer, as described in the next section.

Once the treasurer position is created, the treasurer usually reports directly to the CFO, and may also be asked to deliver occasional reports to the board of directors or its various committees.

TREASURY CENTRALIZATION

The treasury department deals with a number of highly regimented processes, which are noted in the Procedures sections of each of the following chapters. Given the very large amounts of funds that the treasury incorporates into its transactions, it is critical that all procedures be performed precisely as planned and incorporating all controls. Procedural oversight is much easier when the treasury function is highly centralized and progressively more difficult when it is distributed over a large number of locations. Centralization is easier, because transactions are handled in higher volumes by a smaller number of highly skilled staff. There is generally better management oversight, and the internal audit staff can review operations in a single location more easily than in a distributed environment. Further, treasury activities frequently involve complicated terminology that is incomprehensible to nontreasury specialists, so it makes sense to centralize operations into a small, well-trained group.

Another reason for using treasury centralization is the presence of an enterprise resources planning (ERP) system that has been implemented throughout a company. An ERP system processes all of the transactions used to run all key operations of a company, so all of the information needed to derive cash forecasts and foreign exchange positions can be...