- English

- ePUB (mobile friendly)

- Available on iOS & Android

About this book

Praise for Computer-Aided Fraud

Prevention and Detection: A Step-by-Step Guide

"A wonderful desktop reference for anyone trying to move from traditional auditing to integrated auditing. The numerous case studies make it easy to understand and provide a how-to for those?seeking to implement automated tools including continuous assurance. Whether you are just starting down the path or well on your way, it is a valuable resource."

-Kate M. Head, CPA, CFE, CISA

Associate Director, Audit and Compliance

University of South Florida

"I have been fortunate enough to learn from Dave's work over the last fifteen years, and this publication is no exception. Using his twenty-plus years of experience, Dave walks through every aspect of detecting fraud with a computer from the genesis of the act to the mining of data for its traces and its ultimate detection. A complete text that first explains how one prevents and detects fraud regardless of technology and then shows how by automating such procedures, the examiners' powers become superhuman."

-Richard B. Lanza, President, Cash Recovery Partners, LLC

"Computer-Aided Fraud Prevention and Detection: A Step-by-Step Guide helps management and auditors answer T. S. Eliot's timeless question, 'Where is the knowledge lost in information?' Data analysis provides a means to mine the knowledge hidden in our information. Dave Coderre has long been a leader in educating auditors and others about Computer Assisted Audit Techniques. The book combines practical approaches with unique data analysis case examples that compel the readers to try the techniques themselves."

-Courtenay Thompson Jr.

Consultant, Courtenay Thompson & Associates

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

CHAPTER 1

What Is Fraud?

Fraud: A Definition

Fraud consists of an illegal act (the intentional wrongdoing), the concealment of this act (often only hidden via simple means), and the deriving of a benefit (converting the gains to cash or other valuable commodity).

- Improper transfer pricing of goods exchanged between related entities by purposely structuring pricing to intentionally improve the operating results of an organization involved in the transaction to the detriment of the other organization

- Improper payments, such as bribes, kickbacks, and illegal political contributions or payoffs, to government officials, customers, or suppliers

- Intentional, improper related-party transactions in which one party receives some benefit not obtainable in an arm’s-length transaction

- Assignment of fictitious or misrepresented assets or sales

- Deliberate misrepresentation or valuation of transactions, assets, liabilities, or income

- Conducting business activities that violate government statutes, rules, regulations, or contracts

- Presenting an improved financial picture of the organization to outside parties by intentionally failing to record or disclose significant information

- Tax fraud

- Misappropriation of money, property, or falsification of financial records to cover up the act, thus making detection difficult

- Intentional misrepresentation or concealment of events or data

- Submission of claims for services or goods not actually provided to the organization

- Acceptance of bribes or kickbacks

- Diversion of a potentially profitable transaction that would normally generate profits for the organization to an employee or outsider.

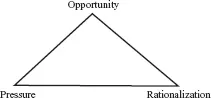

Why Fraud Happens

Table of contents

- Cover

- Contents

- Titlepage Text

- Copyright

- Dedication

- Case Studies

- Preface

- CHAPTER 1: What Is Fraud?

- CHAPTER 2: Fraud Prevention and Detection

- CHAPTER 3: Why Use Data Analysis to Detect Fraud?

- CHAPTER 4: Solving the Data Problem

- CHAPTER 5: Understanding the Data

- CHAPTER 6: Overview of the Data

- CHAPTER 7: Working with the Data

- CHAPTER 8: Analyzing Trends in the Data

- CHAPTER 9: Known Symptoms of Fraud

- CHAPTER 10: Unknown Symptoms of Fraud (Using Digital Analysis)

- CHAPTER 11: Automating the Detection Process

- CHAPTER 12: Verifying the Results

- APPENDIX A: Fraud Investigation Plans

- APPENDIX B: Application of CAATTs by Functional Area

- APPENDIX C: ACL Installation Process

- Epilogue

- References

- Index

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app