eBook - ePub

Create Your Own ETF Hedge Fund

A Do-It-Yourself ETF Strategy for Private Wealth Management

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

Many investors are intrigued by the profit potential of today's hedge funds, but most feel like they're on the outside looking in, due to the high investment requirements and complexity of these vehicles. Create Your Own ETF Hedge Fund allows you to break down these barriers and effectively operate within this environment. By focusing on the essential approaches of global macro long/short and aggressive growth, this book will help you create a fund that can take advantage of both bullish and bearish conditions across the globe.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Create Your Own ETF Hedge Fund by David Fry in PDF and/or ePUB format, as well as other popular books in Business & Investments & Securities. We have over one million books available in our catalogue for you to explore.

Information

PART One

Contemporary Investment Conditions

CHAPTER 1

Hobson’s Choice

For the Model T, you may have any color as long as it’s black.

—Henry Ford

“Hobson’s choice” originated from English liveryman Thomas Hobson, who kept at least 40 horses for hire but never let a customer choose his own horse in the stable. He offered only the horse nearest the door or no horse at all.

No choice at all has been the theme for many retail investors when securing investment choices from most FAs [financial advisors, consultants, and brokers]. In 2004 a distressed friend told me of a difficult situation she was experiencing with her FA, also a family friend of hers, making solutions even more awkward. She is a well-educated, intelligent, professional person and has maintained a long-term relationship with her FA who was associated with a well-known national firm. She had a variety of small accounts, which the advisor loaded up with high fee mutual funds that pay a share of the recurring annual fees back to the firm and advisor.

She had become increasingly dissatisfied with the low returns, so she asked the FA if she could consolidate her accounts and invest in exchange-traded funds [ETFs] or index funds instead since she had read and heard so many positive things about them. Rather than accommodate her, the advisor just told her no, that it wouldn’t be appropriate for her and to stick with what she had. Further she was told that what positive attributes she had heard about ETFs and index funds was nonsense, that if she went down that road, the commissions to make these changes would be too high both in redemption penalties and transaction commissions. Frustrated and very reluctantly, she did as she was told but her relationship with her family friend and FA was forever changed.

So, you might ask, how did she allow her FA to set up the accounts in this manner? Didn’t she know about the penalties for early redemption? The facts are straightforward but this type of situation occurs more often than most expect and with the same unpleasant results. A typical problem might start with a client calling their FA saying, “I have some funds to invest. What do you recommend?” The FA will give what they consider a good recommendation and then most busy clients accept the advice and give the go-ahead. Both are too impatient. The FA wants the client to buy their recommendation and if avoidable not be bothered explaining alternative choices. The client isn’t interested in listening to lengthy and complex alternatives, either. The clients don’t ask a lot of questions since they’re busy and just want to get this task scratched from the “to do” list and get on with their work. It’s just human nature, but down the road problems often surface. Whose fault? Both are to blame.

CURRENT SITUATION: THE CAPTIVE CLIENT

Most firms have set up their investment plans like Las Vegas would design a typical casino—easy to find your way in but almost impossible to find your way out. If you get dissatisfied with what you own, or you didn’t ask all the right questions up front, you will find just impractical or costly surprises to make needed or desirable changes. And in the end, like my friend, you will just find frustration and feelings of helplessness.

Many individual investors have their financial savings locked up in retirement accounts that offer them only one choice: to keep adding money every year to the the plan some sponsor, employer, advisor, or broker has set up for them. And, unfortunately from the market top of 2000 through 2006, most conventional mutual fund averages have underperformed both conventional index funds and ETFs. As outlined in Chapter 2 some mutual funds have barely broken even over that period. I can’t tell you how many times some acquaintances have said, “Well, my account is finally back to the previous high after five years.”

As noted in Financial Services Review, Summer 2006 edition by John Haslem, H. Kent Baker, and David M. Smith, “The bulk of the evidence, however, suggests that actively managed funds, on average, underperform benchmark portfolios with equivalent risk by a statistically and economically significant margin [Jensen, 1968; Malkiel, 1995; Gruber, 1996; Carhart, 1997]. That is, after accounting for expenses and transactions costs, active managers typically destroy value.” A sobering thought.

HOW THE INVESTMENT BUSINESS CHANGED

How did the lack of investment choice get this way? In May 1975 the U.S. Congress ended the NYSE’s fixed-commission schedule that Wall Street firms charged and the era of discount commissions was introduced. Most retail brokers didn’t think much of the change since it primarily affected institutional business, at least initially. So brokers continued to charge relatively high retail commissions until Charles Schwab & Co., which entered the markets around the same time, really started to gain traction with retail investors in the early 1980s. Schwab was joined by others and by the mid- to late 1980s there were several well-established discount firms dealing with both institutional and retail investors.

Most brokers scoffed at the upstart discounters. In fact, many major Wall Street firms told their landlords that if they rented to one of those firms, they would terminate their lease for cause. I did my share of scoffing, too; I was living off those high commissions myself. As a matter of fact, I prided myself on being ahead of industry trends then since I was one of the first brokers in the firm to make a living by gathering client assets for outside money managers. Managers paid me commissions from the accounts at the full retail rate, thank you very much, and both the client and I were seemingly content.

Then sometime in 1987, the firm I was then associated with, Shearson Lehman Bros., presented a tape from Fidelity Investments that its high-end brokers were asked to watch. Both firms had exchanged tapes regarding their respective vision of the financial services future. [We didn’t get to see our firm’s tape, which with hindsight would’ve been as, or more, interesting.] At that time Fidelity was the leading sponsor of mutual funds and had started a complementary discount brokerage firm. The CEO of Fidelity made a convincing case that the discount commission and mutual fund business were going to continue to grow due to expanding retirement accounts and favorable Baby Boomer demographics challenging the conventional Wall Street models—including mine!

After initially dismissing these themes out of pride, I started to notice a short time later that the money managers hired for my clients were starting to agitate for lower commission rates. Excuse me? Every broker in this position would naturally resist at first. But the money manager stated it was his fiduciary duty to seek the best transaction prices and his peers were doing the same. You certainly can’t go to your clients and complain that you want to make more of their money when better executions were available. So, you went along. Commissions started to drop in short order from an average of 1 percent per transaction to just pennies.

What to do? Since most FAs were paying nearly 60 percent of what was left of the commission revenue to their firm, perhaps it would be better to alter that relationship by starting my own firm. I rented some cheap office space, went through the expensive and exhausting registration and licensing requirements, and after all was done changed the split, increasing our take before expenses to 85 percent. We also registered with the Securities and Exchange Commission [SEC] as investment advisors so that we could share some of the managers fee income the money manager was charging. This was an awkward period since the money manager also wasn’t interested in sharing but eventually saw my worth as a member of the team. Now we were on the same side working in the client’s best interests.

But our commission revenues suffered as customers who didn’t qualify for privately managed accounts, or who wanted to do their own thing, including some of our best trading oriented clients, started to take a portion of their business to places like Schwab. A good client who might usually buy 1,000 shares of stock from us was suddenly just buying a few hundred shares and taking the balance to the discount firm. And that’s if we were lucky!

It got worse. Our in-house research analyst wrote a report recommending a stock. I mailed the report to a client who called to chat about it subsequently. He placed no order. Then about a year later the analyst put out a sell recommendation on the stock. The stock dropped and I received a call from the client who seemed interested as to what happened to the stock. The client was upset that the stock had dropped and became even more furious when told that we had put a sell recommendation on it previously. Believing that the client hadn’t bought the stock, or so we thought, he hadn’t received the sell recommendation. No, he obviously had purchased it from a discount firm. So he was taking our research that we were paying a high cost analyst to research and prepare a report only to take his business to a discount firm. This is something that happens every day now, and is a big part of the reason that investment banks have cut back on their research efforts.

Needless to say, we had to find a way to compete and raise a lot more money. One way was to hire more brokers and grow the company. So we proceeded to grow following that path over the next 10 years. But in a highly regulated environment where the largest firms dominate and have more influence over the rules, they can make things rough for the smaller firms. After all, they have the economies of scale to deal with all the regulatory requirements including filings, audits, examinations, additional registrations, reporting requirements, and endless red tape. You start a small broker/dealer and investment advisory firm to manage your clients’ investments, and end up spending more time on regulatory matters, benefiting the big firms by driving smaller competitors out of business. Anyway, I did something about it and sold the company.

Now I’m back to doing what I value most, studying the markets and writing about it them our newsletter, but that’s another story.

THE AGE OF THE DIY INVESTOR

Many retail investors don’t realize they can pursue other alternatives on their own without complicating their lives too much. If you have a computer, an Internet connection, and enough money—and it doesn’t have to be a huge amount, although more is always better—you can do everything yourself.

The success of the discount brokerage firms has made investing online a low cost and convenient way to deal with investments for those willing to take the time to do so.

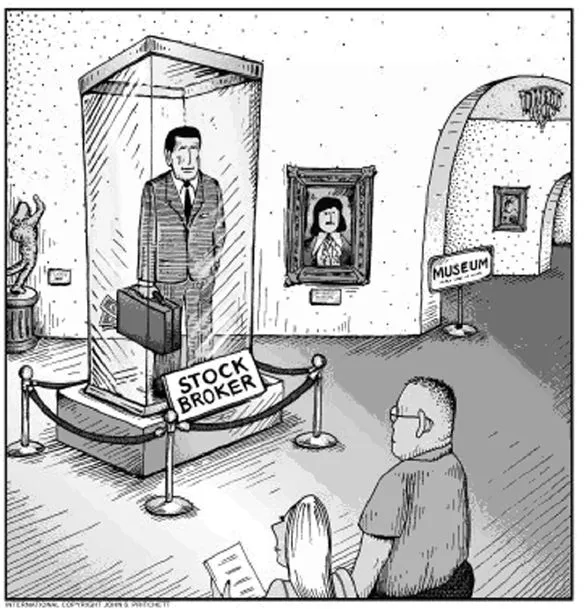

“Online Tradinz Makes Broker Obsolete.”

Source: Courtesy Pritchett Cartoons.

During the 1990s when the bull market was roaring day trading became a popular activity even for the most unsophisticated investor. Armed with high-speed computers and handheld quote devices, individuals were having a great time. Some quit their jobs and started trading full-time for a living. Small unlicensed shops sprang up sponsored obliquely by newbie online firms where individuals could open accounts and learn rudimentary trading skills. It all worked well until the bear market arrived in 2000. By the time it was all over in early 2003, most of these boutiques were closed and the full-time traders were back looking for conventional employment.

As we learn in Chapter 2 online investing reached a peak in 2000, fell substantially with the bear market, but is now back to the heights of 2000. Many online brokers consolidated during the bear market as day traders and others left the scene for greener pastures or more stable forms of investing. After all, the quick money crowd who were day trading later found flipping real estate a new and more lucrative activity at least until that, too, ended in late 2005.

As firms consolidated, their services expanded to include more online investing help while at the same time a commission price war ensued. Of course all this accrued to the benefit of customers. Commissions for transactions have been reduced to single digits for most online firms. In late 2006, Zecco.com, a new online brokerage firm, introduced the “zero commission” structure. That’s right “zero.” That action was quickly matched by Bank of America Securities for accounts with $25,000 minimum balances. And in February 2007, Wells Fargo also introduced a zero commission structure for 100 transactions per year for accounts also with $25,000 minimum balances. The services aren’t as free as they look, though. These accounts pay very low interest rates, and some have questioned execution quality. No doubt, however, this commission model will pressure the traditional online brokers, much as the online brokers in their day pressured traditional brokers’ revenues.

New services offered by online firms allow you to more easily monitor your portfolio checking on performance, asset allocation, dividends, and taxes with an open architecture to make further customization constrained only by your own imagination. Low cost and even free IRA accounts are standard fare as are many other services online investors would expect only from conventional wire-house firms.

The big wire-houses have fought with the “wrap” account concept that offered free trading, with some limits [200 trades a year at Merrill Lynch], all-inclusive fee for high net worth clients. The fee charges are on a sliding scale with lower fees maybe less than 1 percent per annum for balances greater than $1 million. The initiative goes some way toward meeting the challenge, but has run into regulatory problems as some firms moved large, but largely inactive accounts, into this structure, essentially charging customers huge sums for what are basically custodial services. Customers with other managed assets, such as hedge funds and privatized partnerships, can be “stuck” if they don’t want to deal with the complexity of different accounts at different institutions, but the writing is on the wall for this business. After all 1 percent on $1 million is $10,000. That’s a foolish amount for investors to pay and eventually they’ll get hip to it.

Younger investors who are starting to earn and save funds in their retirement accounts are more likely to want to do their own thing online in the most contemporary manner but they’ll want more help and tools. Further they will gravitate toward ETFs since they are easy to use with many different issues and sectors to choose from.

DIY investors will find many resources to help them structure and employ various strategies including guidance with some handholding from online inves...

Table of contents

- Praise

- Title Page

- Copyright Page

- Dedication

- Acknowledgments

- About the Author

- Introduction

- PART One - Contemporary Investment Conditions

- PART Two - Strategies

- PART Three - Hedge Funds for the Rest of Us

- Index