![]()

Stratagem 1

Fool the Emperor to Cross the Sea

See Through All Guises for Calculated Returns

Origin of the Stratagem

Emperor Tang Taizong, the second emperor of the Tang Dynasty, who ruled from 626 AD to 649 AD, was said to have once led 300,000 soldiers from Changan to Liaodong. When the troops arrived at a beach, Emperor Tang Taizong looked troubled as he scanned the cold and choppy waters. Sensing his anxiety, General Xue Rengui invited the emperor to join him and his soldiers in a tent for some food and wine.

Music filled the air. All the merrymaking soon made the emperor relax and forget his worries. However, the respite was cut short by the sound of abrupt and thunderous waves. Worried, the emperor took a cautious peek out of the tent. To his surprise, his war vessels had set off without his knowledge, and were almost reaching the opposite shore of the sea. This tactic employed by General Xue Rengui is still used by the military today, as they carry out stealth missions.

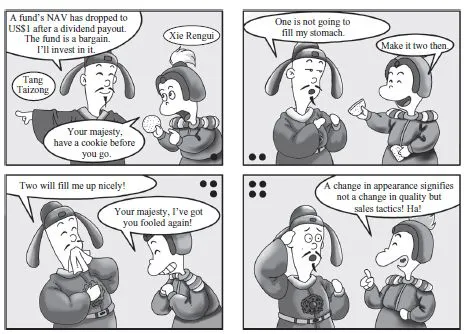

New Spin on Funds

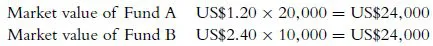

|

US$1 funds and the truth about net asset value

|

|

Performance indicators

|

|

Do your math

|

US$1 funds and the truth about net asset value

Investors love “US$1 funds,” as the very claim of US$1 net asset value (NAV) seems such a bargain, compared with a US$2 net asset value. In fact, the net asset value alone does not tell us anything. It is also a fallacy to judge a fund’s performance based on its net asset value. More critically, we should take into consideration the history of the fund, the potential dividend payouts, how the fund compares with the performance of similar funds in the market, and so on. Someone may say: “This fund has a net asset value of just US$1 right now. You should buy it!” That should raise the red flag. Do not be fooled.

Truth be told, a “US$1 fund” does not enjoy any advantage over other funds in terms of its growth potential, except for the fact that a US$1 fund makes returns easy to calculate and follow. Even a spinoff will not affect the asset size of a “US$1 fund.” The only change in the event of a spinoff is an increase in its holdings, which offers a fair amount of flexibility if you decide to buy back or swap your shares.

Performance indicators

A bias toward “low net-asset-value funds” is not encouraged. If you are not convinced, the following arguments may well change your mind. Smart fund investors always do their homework with regard to how fund investment returns are calculated, the fund’s net asset value per share, as well as the correlation between accumulative net asset value and dividends.

Net asset value per share, accumulative net asset value, and dividends are direct indices of a fund’s investment returns. Net asset value per share refers to the actual value of a single unit at a certain point in time. It is a key index to measure how well or how badly a fund is managed. It is also an indication of the bidding and buyback (trading) price of a unit of fund. The prices do not factor in dividends which reflect the profitability of a fund. It shows the fund’s actual earning power.

Accumulative net asset value is the total sum of the latest net asset value and accumulated dividends, which reflects the accumulated net income of the fund since its inception. Accumulative net value also tells us about a fund’s dividend performance. Hence, accumulative net asset value is more important than the latest net asset value or dividend as an indicator for an investor to measure investment returns. Accumulative net asset value captures more directly and broadly the performance of the fund in operation. Higher accumulative net asset value generally means the fund is faring better than before.

Dividends refer to cash payouts or dividend reinvestment awarded to fund shareholders for profit made.

Do your math

Always bear in mind two considerations in calculating the rate of return from a fund. An investment period promising no dividend clearly means that the overall rate of return is the same as the growth rate of net asset value per share within a certain period (without taking into account fees and charges). For example, an open-end fund valued at US$1 at the end of last year and US$1.06 at the end of this year will yield an overall rate of return of 6 percent this year. The method used to calculate this is: (US$1.06 – 1) ÷ 1 = 6 percent. Multiply your total investment sum by 6 percent, and you will find out your returns for the entire period.

What if there is a dividend payout? You will see net asset value per share taking a dip after the payout. Let’s say net asset value per share stands at $1.06 before the payout, and dividend per share comes up to $0.05. Net asset value per share after the payout will drop to $1.01. In this case, you have to factor in the impact of the dividend on net asset value when calculating the overall return on investment. If you have difficulty tallying up the numbers yourself, simply go to MorningStar Fund QuickRank to check out the indices called “Total Return Percentage.” Having said that, investors should bear in mind that MorningStar’s method of calculation for the rate of return is based on the assumption that dividends are reinvested. Hence, if you opt for cash payouts, and invest the dividends or spend the money elsewhere, your actual income will be somewhat different from the calculated rate of return.

An investor should note that net asset value per share affects only the size of your holdings, not your future returns on investment. Let’s say there are two funds, called Fund A and Fund B, with a net asset value of $1 and $2 respectively. You invest $20,000 in each fund, which gives you 20,000 shares in Fund A and 10,000 shares in Fund B. Assuming the net asset values of both funds surge 20 percent after three months (with no dividend payout during this period), the net asset value of Fund A and Fund B will now stand at US$1.20 and US$2.40 respectively. Can you tell what the current market value of the fund is? Check out the answer below.

You will discover that the returns from both funds are the same. The net asset value at the time of purchase makes no difference at all.

Therefore, there is no such thing as a cheaper or more expensive fund. Whether or not a fund is worth investing in depends on its future earning power. When we talk about a fund having high accumulative net asset value, we are referring to the caliber and capability of its managers, and the fund’s resilience in weathering different market conditions in the past. That earns the fund greater trust with investors. The level at which the net asset value is at has no direct impact on the future value of the fund either.

A share price gets its boost from a listed company’s prospective ability to create greater profit. Once the company’s profitability lags behind the rate at which the share price is rising, the share price inevitably falters. A share price is prone to adjust downward once it scales to a certain height. A fund invests in myriad stocks that are considered a basket of good “eggs.” Periodically, the fund manager will remove “rotten eggs” from the lot, and replace them with “good ones.” Therefore, a fund has to adopt a sound strategy in picking stocks, and make appropriate adjustments in the investment portfolio to propel its net asset value higher.

![]()

Stratagem 2

Besiege Wei to Rescue Zhao

Take Advantage of Fund Switching

Origin of the Stratagem

In 354 BC, when King Weihui sent General Pang Juan to attack the Zhao State’s capital of Handan, the king of Zhao immediately sought help from King Qi Weiwang of the Qi State. Tasked with the defense mission, military advisor Sun Bin offered his strategy to General Tian Ji who was commanding the Qi troops: “Do not get into a mindless fistfight. Resolve the problem without getting into a struggle. Find out their weaknesses to gain the upper hand without having to resort to violence. The Wei troops are out in full force. If we attack them head-on, Pang Juan is bound to beat a retreat. He will lose his stranglehold on Handan. We shall ambush him midway and defeat his troops.”

Tian Ji carried out the mission as planned. True to Sun Bin’s predictions, the Wei troops left Handan and were ambushed by the Qi army at Guiling. Exhausted after a long march and fight, the Wei army surrendered. The Qi State emerged on top by coming to the rescue of the Zhao State.

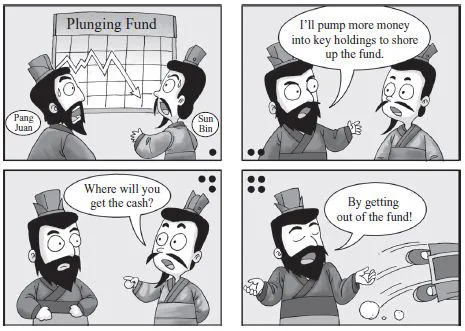

New Spin on Funds

Fund swap as a way out

- The less costly route

- Swap medium- and high-risk funds for low-risk funds

- Change tack according to market conditions

- The difference in risk endurance

|

Fund swap as a way out

Stock markets are volatile and unpredictable. Fund investors will inevitably get caught when the markets trend downward. Whether or not to redeem funds becomes a burning issue. Pulling out of one may spell losses, while staying put means having to bear with the pain of a downward spiral in net asset value.

Learning to adopt the stratagem as illustrated in the classic story “besiege Wei to save Zhao” may well save you the angst. Shift your attention away from the glare of the “bears” that are out in full force by making good and flexible use of fund companies’ swap services. Convert a share-based fund into a currency fund belonging to the same company at an appropriate time to protect future earnings, and prevent losses. Reconvert it into a share-based fund only when the stock markets are back in favor. By turning a share-based into a currency fund, or by buying a currency fund, you are making good use of your investment in a share-based fund. It is a tactic worth borrowing from the war strategy used by the Qi army to save Zhao.

The less costly route. Swapping funds is a key transaction method used in overseas markets. In China, several fund companies have started to do the same. A fund swap refers to an investor’s request for a fund manager to diversify all or part of his or her holdings in a fund into another or other funds. A fund swap produces the same result as the redemption or re-subscription of a fund, but the inner workings of the two are as different as chalk and cheese. A fund swap costs less transaction time and money than redemption and re-subscription. The transaction of a fund swap takes three to five working days, while redemption and re-subscription requires five to seven working days. The monetary costs of a fund swap are divided into three components, namely the redemption fee for the exiting fund, the differential in subscription fees between the exiting fund and replacement fund, and the fund swap fee which is usually set at zero. The total rate charges of these fees are generally lower than the redemption rate and re-subscription rate.

A fund swap has to take place at the right place and the right time to produce the desired investment effect, just as Tian Ji timed his move to besiege the strongholds of the Wei State to trap Pang Juan into submission.

Swap medium- and high-risk funds for low-risk funds. Swapping a low-risk currency fund with a high-risk share-based fund is an example of the most effective fund swap. Swapping funds with similar risk returns is only recommended if there is a huge gap in performance between the fund you wish to exit from and the one you wish to get into. Oftentimes, such a gap is inherent in the management of the fund.

Change tack according to market conditions. You can discern signs of whether a stock market is doing well or poorly by making a meticulous study of macro trends. If the market is mired by bears, convert share-based funds into bond or currency funds to avoid losses from shrinking net asset value. When the stock market is flying high, trade bond and currency funds for share-based funds to enjoy more lucrative long-term investment returns.

The difference in risk endurance. Age may make an impact on a person’s income. Older folks are likely to face more health issues, which will affect their work ability. That may lead to a drop in income level. Any investor in such a dilemma should trade share-based funds for bonds or currency bonds to raise the safety net of an investment portfolio. At the other end of the spectrum are the individuals enjoying job promotions, incremental increases in their salaries, and other improved conditions. As these people are able to endure risk better, they should, as investors, convert bonds or currency bonds into share-based funds to beef up their investment portfolio returns.

Practical tips

How best to convert funds?

1. T + 0 for greater profit

Convert a currency fund into a share-based fund on T day, according to the net asset value of the currency fund quoted that day. T day refers to the trade date. This enables the investor to lock in profits from the currency fund at the same time.

2. Make use of the time difference and overlap in time

In general, banks take five to seven working days to complete the transaction for the redemption of a share-based fund, a bond fund, or a composite fund. However, you can convert any type of fund into currency funds in just two days, and complete the redemption and transaction process in one to three working days. Hence, learn to capitalize on the gaps between the maturity dates of different types of funds, and the mechanism for fund conversion provided by fund management companies. Convert all types of funds to currency funds before redemption. This speeds up transactions, and allows you to reap several more days of returns from currency funds.

![]()

Stratagem 3

Kill with a Borrowed Sword

Gain Full Market Exposure in One Go

Origin of the Stratagem

Before his attack on the Wei State during the Spring-Autumn Period from 800 BC to 300 BC, Zheng Huangong got a hold of the names of Wei’s ministers and generals. He then announced that after he had defeated Wei, he would make them lords and dukes, and let them share the Wei territory. Zheng Huangong put the names in an urn at an altar that he had set up in the country, and swore to deliver on his promise.

The king of Wei was furious when he got wind of the news, and gave orders for all his great ministers and generals to be sent to the guillotine. In one fell swoop, the Zheng State had destroyed the Wei State.

New Spin on Funds

Leverage through a third party - Amass huge capital gains through funds

- Explore unfamiliar territories

|

Financial management is a buzzword these days. With a constant stream of new products coming into the marketplace every day, the average investor can’t help but feel bombarded and perplexed. Worst of all, individual investors often do not qualify for some of these products, or find many of the products too difficult to comprehend. So, how should one invest? You may want to consider taking a leaf out of the “killing with a borrowed sword” stratagem. Fear not, there is no blood and gore involved. It simply means riding on the strength of a third party to realize one’s financial goals. In other words, use the power of funds as a leveraging tool to boost your profit.

Leverage through a third party

The Chinese are fond of government bonds, but few know of the more lucrative, similar products out there that they may qualify for. For example, individual investors cannot invest in the banking bond market and corporate bonds due to restricted retail sales, insufficient individual investor demand, and so forth. However, purchases of bonds such as central bank treasury bills and corporate bonds can be made indirectly through the acquisition of bond funds.

Some individual investors also bemoan lost opportunities in the stock markets. In general, listed companies have to suspend stock trading for a period before announcing any shareholding changes or other major events, and their share prices tend to soar when they resume trading. With the market rife with talk about shareholding chang...