![]()

CHAPTER 1

Profit from the Mistakes of Others

Thinking about buying a home? Good for you. You’re about to make one of the best personal and financial decisions of your life—if you do it right. And that’s just what this book will help you do.

As you read through the eye-opening stories—sometimes funny, sometimes sad—you will see how to steer clear of potential pitfalls. Even better, you will learn to profit from the opportunities that you discover (or create) along the way. You will gain not only from the knowledge I’ve accumulated from dozens of my own property transactions, but also from the experiences of hundreds of homebuyers, real estate agents, mortgage loan officers, and home inspectors.

Here are some of the fears, mistakes, and pitfalls you’ll learn how to handle:

1. Getting turned down for a mortgage

2. Paying too much for mortgage interest, fees, and costs

3. Overpaying for your house

4. Discovering that a house or neighborhood comes with hidden and unwelcome surprises

5. Being taken advantage of by a real estate agent, loan officer, or lawyer

6. Buying too little, too much, or the wrong kind of insurance

7. Suffering discrimination

8. Buying a house whose value doesn’t appreciate much

9. Running into problems at (or on the way to) closing

10. Buying a house that doesn’t meet your needs, wants, or budget

Unlike other books on homebuying, the discussions here don’t merely present general principles, simplistic questions, or a “homebuying process.” Instead, 106 Mistakes illustrates what you need to know through dozens of real-life examples. Through these examples, you’ll see how to conquer your confusion, become more confident, and make the right homebuying decision.

The Origin of This Book

Throughout the past 20 years I’ve taught graduate and undergraduate college courses in real estate; professional education programs for Realtors®, home builders, and mortgage loan officers; and STOP RENTING NOW!™ seminars that are directed especially toward first-time homebuyers. In these courses, one of the most favored classroom topics has been “How to prevent mistakes in homebuying.”

Although just about everyone knows that real estate, particularly home ownership, stands out as one of the best ways to build personal wealth, a growing number of people also realize that successful homebuying doesn’t occur easily. It requires education. Shopping for a home, negotiating, arranging financing, and qualifying to buy have become much more complex. There are many ways to get bamboozled. Naturally, then, learning about the mistakes of others has proved to be a good prescription for a happy and profitable homebuying experience.

When I first began to discuss mistakes in homebuying with my classes, I relied on many of my own experiences (and mistakes). Over time, though, students were eager to broaden their knowledge and learn firsthand about the mishaps, misfortunes, and mistakes suffered by others. As a result, I incorporated “interview papers” into class assignments. To carry out these assignments, students interviewed Realtors, home builders, loan officers, recent homebuyers, and other people involved in homebuying and financing.

The students asked their interviewees to describe in concrete detail the homebuying mistakes that the interviewees had made themselves or had seen others make. Next, the students wrote up their conversations and we scheduled a class session or two to discuss what they had learned.

These classroom discussions became quite popular. As a result, many students suggested that they would like to see the most common (and costly) mistakes I’ve collected brought together in a book. Fortunately, John Wiley & Sons, Inc., and senior editor Michael Hamilton agreed. In this book we’ve aimed to help you benefit from the experiences of hundreds of people who have been involved in homebuying. Read through these stories and apply the lessons to your own situation. You’ll enjoy a more profitable and more satisfying homebuying adventure.

1To protect the privacy of individuals, in many instances I’ve changed names and specific identifying facts. But all told, these experiences are real.

![]()

CHAPTER 2

Explore Possibilities, Set Priorities

As you search for a home, you’ll run up against many choices, confusions, and contradictions. You may face discouragement. In fact, some potential homebuyers give up on the challenges they encounter. They then make the biggest mistake of all: They needlessly continue to rent.

As you go through this chapter you will see that, regardless of your present situation, the power of knowledge, motivation, and goals can move you into the home you want.

You also will see why you can profit when you explore various neighborhoods, price ranges, types of homes, and home features. Even if you think you can describe (and afford) the perfect home, the mistakes in this chapter show you why you should still broaden your knowledge of the market. Greater knowledge will encourage you to rethink your priorities and discover better alternatives for you at this stage of your life.

MISTAKE # 1

We want to own, but we pay less to rent.

LESSON: Over time, you will pay far more to rent than to own. Plus, homeowners gain the wealth-building power of home equity.

Do you believe that you’ll pay more to own than to rent? If so, you’re experiencing the same confusion that troubles many of the renters who attend my STOP RENTING NOW!™ seminars. They want to own, but they hesitate because they think owning costs too much. Undoubtedly, the recent increase in home prices has made this myth even more prevalent.

But here are the facts you need to know: After you weigh in income tax deductions, personal freedom, long-term rent increases, and the accumulation of wealth through growing home equity, you will see why it actually costs much more to rent. In addition, renters stand to lose tens (and often hundreds) of thousands in net worth.

Benefit from Tax Deductions

As a homeowner, you can deduct most of your monthly mortgage payments from your taxable income. As a result, your actual out-of-pocket home costs may fall—depending on your combined federal, state, and local marginal income tax rate (MTR)—to 20 to 40 percent less than the actual check you write each month to your mortgage lender.

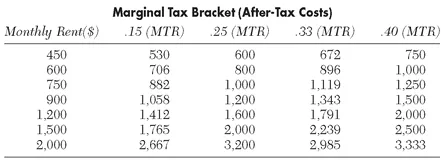

Say your house payment (principal, interest, property taxes, and insurance) will cost $1,000 a month. Chances are, after counting the tax benefits of owning, that $1,000 may cost you only $700. A $2,000-permonth mortgage payment may cost you around $1,400 a month. Or to look at it in terms of rent, if you’re paying your landlord $600 a month, you may be able to afford $750 to $800 a month for your own home. If you’re now paying $1,800 per month in rent, you might be able to go up to $2,500 a month for your mortgage payment. To get a general idea of your potential savings, see Table 2.1.

Your personal rent-versus-own cost figures will differ from those listed. But this point is true: Don’t assume that monthly mortgage payments will cost more than renting. Talk with a loan representative and tax advisor. Run through specific figures. In today’s world of home finance, lenders offer multiple ways to obtain lower monthly payments. Quite likely, you’ll be pleasantly surprised to learn how advantageous it is to own.

Table 2.1 Rent-Equivalent Mortgage Payments after Benefit of Tax Deduction

Escape from Renter’s Jail

After buying her own home, Yolanda Jones told me, “I can’t believe it. Not only am I saving money each month and building equity, but I feel like I’ve escaped from renter’s jail.” When I asked her what she meant by “renter’s jail,” Yolanda explained, “For the first time in my life I feel free. No more landlords to tell me how I can decorate, who I can have over, or whether I can get a dog. This is my home now. I’m free to do with it what I want. Even if it costs me more it’d be worth it.”

Yolanda brings out a point many renters overlook. When you own, you don’t just buy a home, you gain freedom. You escape from renter’s jail. If you’re like Yolanda, the personal benefits of owning will far surpass those of renting. When figuring your rent-versus-own cost comparisons, keep in mind those great feelings of freedom and security that owning will bring you.

Think Long Term: Rents Will Go Up

We’ve all heard dozens of times how America’s corporate management focuses on the short term instead of the long term. Renters commit a similar error. In some high-cost areas of the country even after allowing for tax deductions and owner benefits, your monthly mortgage costs still may look higher than the costs of renting. If that’s your situation, think long term. In fact, no matter where you live, the most important reason to buy a home is not to save money today. It’s to save hundreds of thousands of dollars over the rest of your life.

Say you pay $1,000 a month to rent. Assume that after tax deductions, owning will cost you $1,500 a month out-of-pocket. Renting sure looks cheaper. But wait—don’t fall into this trap. Think: If you’ve got a fixed-rate mortgage, your monthly mortgage payments won’t go up—and if at some later date you can refinance at lower interest rates, your monthly costs of owning actually will go down.

In stark contrast, over the longer term, you can only expect your rent to increase. Even at relatively modest rates of inflation, rent levels will head up to the stratosphere. Table 2.2 provides several examples of how rents will increase at rates of four, six, and eight percent a year.

Some of those future rent figures look absurdly large. But consider the rent levels of the 1940s and 1950s. In most parts of the country, you could rent a nice house for $25 to $75 a month. Average house payments were $40 to $60 a month. Today’s rent and mortgage payments often run 20 to 40 times higher than the amounts of those earlier years. Likewise, you can safely bet that over the next 20 or 30 years, people in the future will be talking about the ridiculously low rents of the early 2000s.

Fortunately, today’s homebuyers will still enjoy mortgage payments at those “ridiculously” low early 2000s prices (and interest rates) decades into the twenty-first century. Those who didn’t buy will be paying (if they can afford them) rents 3 to 10 times higher. And if we get years of double-digit inflation similar to previous years, rents could even shoot past the figures in Table 2.2. Over time, owning costs far less than renting—and the benefits are far greater.

When it comes to buying a home, think long term. Pay no attention to how high home prices are today compared to where they sat 5, 10, or 20 years ago. Instead, think how low today’s prices are...