- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

Are you sick of attending open inspections every weekend in a fruitless search for the right property?

Do you want to know more about the property-investing market and how it can make you money?

I Buy Houses is a comprehensive handbook that will have you buying, managing and selling property like an expert. Paul Do explains how to build a property portfolio using research, rather than legwork, allowing you to invest in the best properties in the most effective way. His tried-and-tested SYSTEM T framework is perfect for beginning and experienced investors alike.

In this insightful book you will discover:

- how to determine the right time to buy

- why buying a property every year is the wrong thing to do

- why some people are better off renting than buying

- why selling should be a last resort

- why other property investing strategies are no longer effective.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access I Buy Houses by Paul Do in PDF and/or ePUB format, as well as other popular books in Business & Real Estate. We have over one million books available in our catalogue for you to explore.

Information

Part I:

Real estate basics

Real estate has created more millionaires than any other form of investment because it provides high returns over the long term and most people have a significant investment in it. Australians have one of the highest rates of home ownership in the world, and as a result many are becoming millionaires as their homes increase in value.

I have included the basics on real estate in this section as this forms the foundation for the rest of the book. Even if you are familiar with some of the material, I recommend that you still go over it for completeness. Here I cover the advantages and disadvantages of investing in real estate, the different characteristics of the real estate market, and the important concept of median prices.

Chapter 1

Advantages and disadvantages of real estate

Over the years, I have found that the easiest way to make money from real estate is to maximise its advantages and avoid the disadvantages (where possible). The main advantage of real estate is that it allows you to borrow a lot of money to fund the purchase due to its high security. Real estate also offers high returns over the long term, and there are many other advantages that we are also going to look at in this chapter. The main disadvantages are high transaction costs, high holding costs, low liquidity and lumpiness, which mean that taking a long-term view with real estate is essential.

The main advantage of real estate is that it allows you to borrow a lot of money to fund the purchase.

Advantages of real estate

The advantages of real estate include high returns combined with high security that allows investors to borrow more. Let’s have a look at these and the other advantages of real estate.

Leverage

You can borrow more to fund real estate than you can any other asset because of its high security. This allows you to have a bigger asset working for you, so you can achieve your financial goals faster.

Returns

Over the long term, real estate has returned around 10 per cent per annum in capital growth and rental yield, before holding costs (see ‘High holding costs’ in the next section). This return is comparable to shares but is more than bonds, cash and inflation. It is important that the long-term returns from real estate are higher than the returns from bonds and cash, because it means that the returns from real estate exceed your borrowing costs over the long term. It is also important that returns from real estate exceed inflation so that you can at least maintain your standard of living.

Security

Unless you overextend yourself, it is very difficult to go bankrupt with real estate because there will always be demand for shelter. It is this security that affords high leverage.

Familiarity

An often-overlooked advantage of real estate is that everyone is familiar with it as an owner, renter or boarder. The more familiar we are with real estate as an asset class, the more likely we are to invest a meaningful amount of money in it for the long term. Most people are less familiar with shares and, therefore, have less money invested in this way.

Forced saving

Another advantage of real estate is that it forces disciplined saving through leverage. People with a large mortgage tend to refrain from splurging on things they do not need until they have reduced or paid off the mortgage. When you start on your investment journey, the amount you save is more important than the returns you make. Over the long term, the returns you make become more important than the amount you save. Through the power of compounding (see below), investors who start early can invest less but still be in a much better position financially than those who start later.

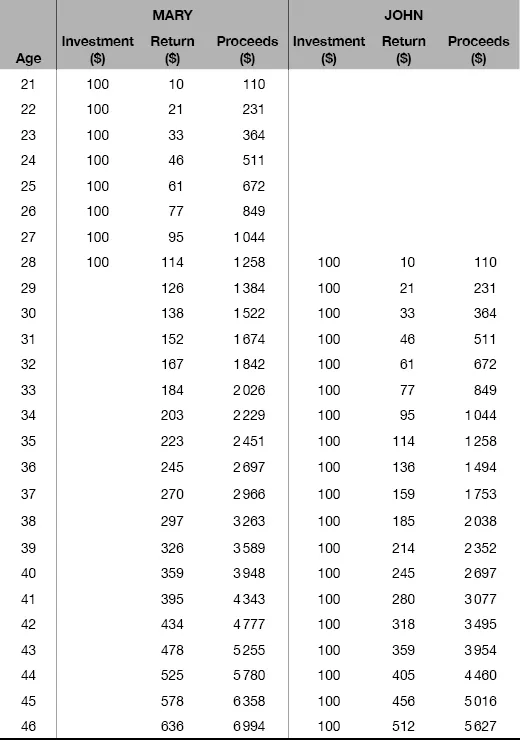

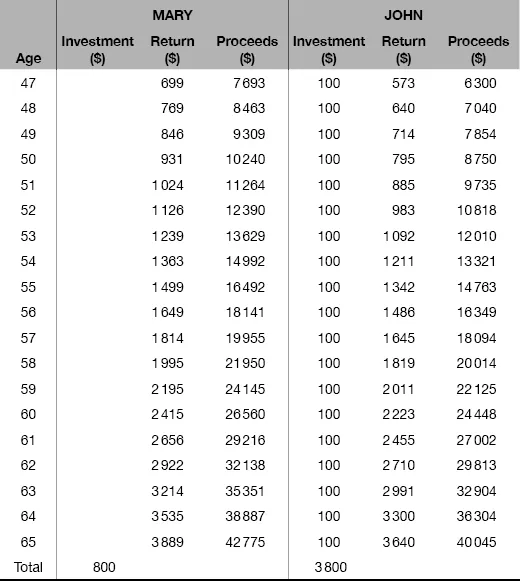

Table 1.1 shows the power of compounding when you start early. Mary invests $100 each year from the age of 21 to 28, a total of $800. John, on the other hand, invests $100 each year from the age of 28 to 65, a total of $3800. Assuming that both Mary and John are able to earn a return of 10 per cent per annum, at retirement Mary will have a portfolio worth $2730 more than John’s ($42 775 versus $40 045), despite investing $3000 less than John. The reason for this is that by age 28 the return from Mary’s investment exceeds the investment and return John makes each year ($114 versus $110, and then $126 versus $121, and so on). So in effect Mary is investing more each year than John is.

Table 1.1: the power of compounding

Value add

Real estate has the added advantage (that shares do not) of allowing you to add value through refurbishment. For the experienced investor, cosmetic renovations as simple as tidying up the yard and repainting can add thousands of dollars to the value of a property. This can be important when you are starting out and have limited funds and the value of your time is lower. However, I have found that this advantage tends to be overrated because people forget to take the opportunity cost of their time into account.

Disadvantages of real estate

Real estate also has some disadvantages, the main ones being high transaction and holding costs and lumpiness.

High transaction costs

The round trip cost of buying and selling a property can be around 10 per cent of the property’s value (see ‘Transaction costs’ in chapter 4). This is significantly more than the cost of buying and selling shares, which — depending on the size of the order — is only around 0.2 per cent for a round trip.

High holding costs

The holding costs of investing in real estate can be around 20 to 30 per cent of the rental income each year (see ‘Holding costs’ in chapter 4). In contrast, the costs of investing in shares are much lower, and are mainly research-based.

Lack of liquidity and lumpiness

The lack of liquidity and lumpiness are significant disadvantages of real estate. It can take weeks or months to buy or sell a property, as opposed to a few seconds for blue-chip shares. In addition, real estate is hindered by its lumpiness — you have to buy or sell the whole property, and not just, say, one bedroom. These disadvantages can be mitigated by planning ahead and taking a long-term approach, such as adopting a buy-and-hold strategy as opposed to a flipping (or trading) strategy.

Inefficient market

The real estate market also has the disadvantage of being inefficient, unlike the stock market. In an efficient market, prices reflect all available information. This does not happen in the real estate market for two reasons. Firstly, information on specific properties is not widely available. Two-tier marketing, where out-of-area investors are charged a much higher price than locals, is an example of this. Secondly, even if the information were available, many buyers (especially owner-occupiers) would still transact with their hearts instead of their heads.

Since the real estate market is inefficient, the buyers that do the most research will achieve the better returns. This is one of my two key investing principles, the other being you should only buy real estate when market values are less than intrinsic values (see ‘Fundamental analysis’ in chapter 6).

Chapter 2

Characteristics of the real estate market

The real estate market can be described in a number of different ways. Each characteristic provides an insight into how the market works and how to participate in it. The most commonly considered characteristic of property is location. The real estate market can also be classified according to land, houses and apartments, type of ownership, property age and architectural style of houses.

Let’s have a look at each.

Location

Unlike the stock market, the real estate market is location-dependent. The state economy drives the property market in each state. For example, while the Sydney real estate market peaked in 2003, then declined and moved sideways until 2008, the Perth market rose strongly off the back of the mining boom during this period. Furthermore, different states have different stamp duty and land tax rates (see chapter 9), and council rates vary from suburb to suburb.

Most of Australia’s population resides in the capital cities in each state. The biggest capital cities are Sydney, Melbourne and Brisbane on the eastern seaboard. Perth, on the western seaboard, is catching up rapidly due to the strength of the mining boom, although this slowed down in 2008. Sydney is the most expensive Australian city measured on a house-price-to-income multiple, as it is a global coastal city that dominates its geographic location, like New York and London.

Within a capital city, properties are divided into concentric rings radiating out from the central business district: the inner, middle and outer rings. Prices typically start to rise in the inner ring, and then this ripples out to the outer rings. Satellite cities are suburbs within a capital city with significant business districts. In Sydney, they include Parramatta to the west, Chatswood to the north, Hurstville to the south and Liverpool to the south west. In Melbourne, they include Dandenong to the south east and Werribee to the south west. Satellite cities provide job opportunities, which is a significant driver of house prices. Outside of the capital cities are the regional areas.

Start with the big picture

One of the first things I did when I started investing in real estate was to get a foldout map of my capital city from the local motoring association and stick it onto the wall to get a bird’s-eye view of the suburbs and their proximity to the central business district, satellite cities, transport, schools and shops. As I diversified my investments interstate, I did the same with the other capital cities.

Capital cities vs regional areas

The majority of Australia’s population lives in the main capital cities:

- Sydney has a population of over four million people, and is the corporate and financial capital of Australia. It contains the headquarters of more than half of Australia’s top companies and the headquarters of many multinational corporations.

- Melbourne has a population of almost four million people and also houses the headquarters of many of Australia’s largest companies and multinational corporations.

- Brisbane’s population is just under two million. It is the headquarters of some medium-sized and smaller Australian companies, although most major companies have offices in Brisbane.

- Perth has a population of around one and a half million people, and is at the heart of ...

Table of contents

- Cover

- Contents

- Title

- Copyright

- Dedication

- Acknowledgments

- Introduction

- Part I: Real estate basics

- Part II: System T™ 29

- Part III: The buying process

- Part IV: Managing your properties

- Part V: Making money in real estate

- Appendix: Comprehensive buying example

- Glossary

- Resources

- Index