- English

- ePUB (mobile friendly)

- Available on iOS & Android

Stochastic Methods for Pension Funds

About this book

Quantitative finance has become these last years a extraordinary field of research and interest as well from an academic point of view as for practical applications.

At the same time, pension issue is clearly a major economical and financial topic for the next decades in the context of the well-known longevity risk. Surprisingly few books are devoted to application of modern stochastic calculus to pension analysis.

The aim of this book is to fill this gap and to show how recent methods of stochastic finance can be useful for to the risk management of pension funds. Methods of optimal control will be especially developed and applied to fundamental problems such as the optimal asset allocation of the fund or the cost spreading of a pension scheme. In these various problems, financial as well as demographic risks will be addressed and modelled.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

Chapter 1

Introduction: Pensions in Perspective

1.1. Pension issues

1.1.1. The challenge

1.1.2. Some figures

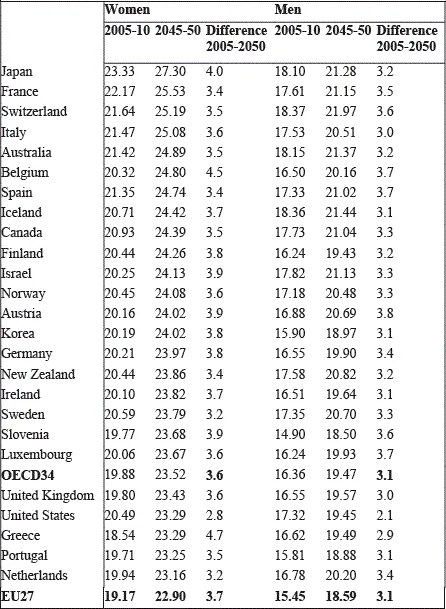

1.1.2.1. Longevity at 65

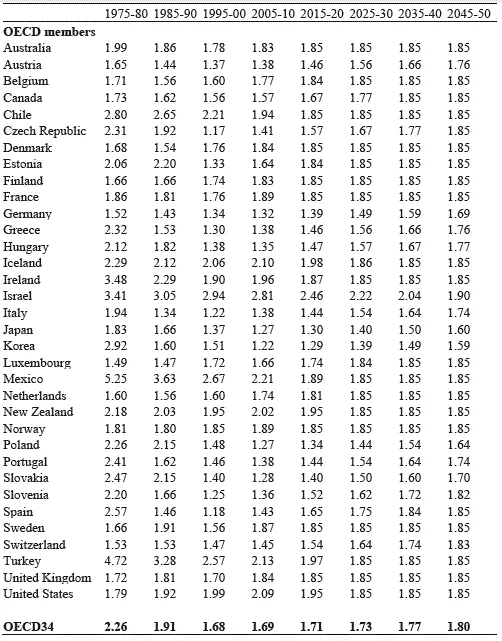

1.1.2.2. Fertility rates

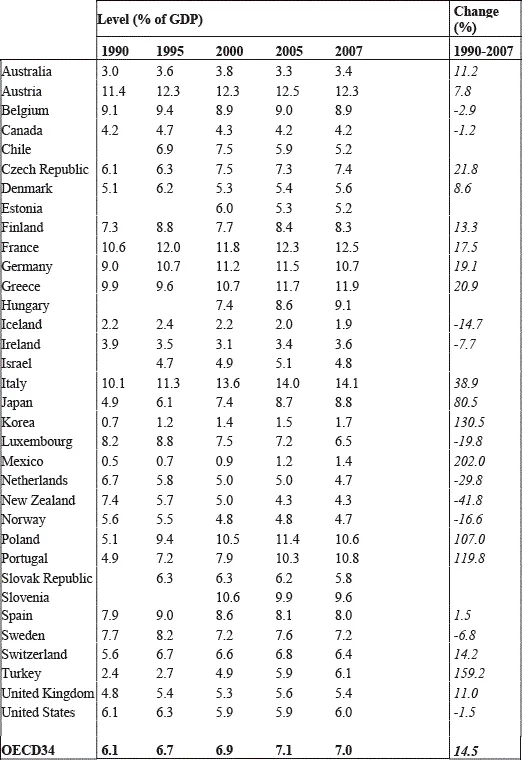

1.1.2.3. Public pension expenditure

1.1.2.4. Assets of pension funds

Table of contents

- Cover

- Title Page

- Copyright

- Preface

- Chapter 1: Introduction: Pensions in Perspective

- Chapter 2: Classical Actuarial Theory of Pension Funding

- Chapter 3: Deterministic and Stochastic Optimal Control

- Chapter 4: Defined Contribution and Defined Benefit Pension Plans

- Chapter 5: Fair and Market Values and Interest Rate Stochastic Models

- Chapter 6: Risk Modeling and Solvency for Pension Funds

- Chapter 7: Optimal Control of a Defined Benefit Pension Scheme

- Chapter 8: Optimal Control of a Defined Contribution Pension Scheme

- Chapter 9: Simulation Models

- Chapter 10: Discrete Time Semi-Markov Processes (SMP) and Reward SMP

- Chapter 11: Generalized Semi-Markov Non-homogeneous Models for Pension Funds and Manpower Management

- Appendices

- Bibliography

- Index

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app