![]()

PART One

Pricing Fundamentals

Part One describes what the price advantage is and explains why this is such a worthwhile and profitable advantage to pursue. This part also introduces an overarching framework for identifying the magnitude and location of pricing opportunities—and for sustainably capturing those opportunities.

![]()

CHAPTER 1

Introduction

What’s your advantage? What capabilities distinguish your company most from its peers, allow your business to perform better than your competitors, provide the foundation for superior returns to your shareholders? Is it a cost advantage—do you purchase better and manufacture more efficiently than your competition? Is it a distribution advantage—are your products sold through the best wholesalers, retailers, and locations in your markets? Is it a technology advantage or an innovation advantage? Or is yours a brand advantage or a capital structure advantage or a service advantage?

For all of the advantages that businesses pursue, there is one powerful advantage that is accessible to virtually every business, but actually pursued by too few—and ultimately achieved by even fewer. That advantage is the price advantage.

Setting prices for goods and services is one of the most fundamental management disciplines. It is, in truth, unavoidable. Every product and service sold since the beginning of time has had a price assigned to it. Setting that price is among the most crucial, most profit-sensitive decisions that companies make. Ironically, very few companies price well. For a host of reasons, few ever develop anything resembling a superior, business-wide, core capability in pricing. In other words, few companies build pricing into the distinctive business advantage that it can be.

In this book, we discuss the details of creating and sustaining the price advantage, where pricing excellence generates superior returns to shareholders and enables a company to invest in sustaining its advantages in other areas. But first, let us look at why getting pricing right is so important, and why so few companies realize this advantage.

THE POWER OF 1 PERCENT

Why is it so vital to get pricing right? Because pricing right is the fastest and most effective way to grow profits. The right price will boost profits faster than increasing volume; the wrong price can shrink profit just as quickly. The exhibit above illustrates this dramatically. In Exhibit 1-1, the average income statement of the Global 1200 (an aggregation of 1,200 large, publically held companies from around the world), shows just how quickly the right price can create profit. We use a five-year average to reduce sensitivity to yearly economic variations.

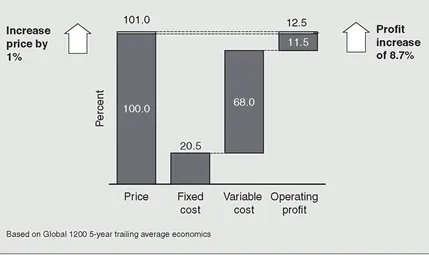

Exhibit 1-1 Average Economics—Global 1200

Starting with price indexed to 100, we see that fixed costs (items like overhead, property, and depreciation that do not vary when volume changes) amount to an indexed average of 20.5 percent of price. Variable costs (expenses like labor and materials that shift in tandem with volume) account for 68.0 percent. This leaves an average return on sales (ROS) of 11.5 percent.

Now, given these Global 1200 economics, what happens if you improve your price by 1 percent? Price will rise from 100 to 101. Assuming volume remains constant, then variable costs will remain constant as well—as will fixed costs. Operating profit, however, rises from 11.5 percent to 12.5 percent, a relative increase of 8.7 percent.

The clear message is that very small improvements in price translate into huge increases in operating profit. When you talk about creating a pricing advantage, you may have to recalibrate your thinking about how large a price increase needs to be to have a meaningful impact. Pricing initiatives that increase average prices by only a quarter or a half percent are important because they bring disproportionate increases in operating profit. A 1 or 2 percent price improvement is a major victory with significant profit implications. Find 3 percent—and many companies can, once they start looking—and operating profit can jump by more than 25 percent, if your cost structure is similar to the Global 1200 average.

Exhibit 1-2 Comparison of Profit Levers

Not only that, but pricing is far and away the most powerful profit lever that a company can influence. Continuing with average Global 1200 economics, Exhibit 1-2 illustrates the impact on operating profit when individual levers improve by 1 percent while other factors stay constant. Pricing has by far the strongest impact, raising profit by 8.7 percent.

Variable cost is the second most significant one, increasing operating profit by 5.9 percent for every 1 percent decrease in costs. However, most companies have already wrung a lot out of variable costs in recent years through purchasing and supply management initiatives, labor productivity improvements, and other measures. As a result, continued improvement in variable cost structure has become increasingly difficult.

Fixed cost decreases have an even smaller effect on operating profit. A 1 percent improvement generates only a 1.8 percent operating profit increase. While making other cost-cutting efforts, companies over the past decade were also busy trimming fixed costs; as with variable costs, further improvements have become elusive.

The low impact of volume increases on operating profit can be a real surprise to many managers. A 1 percent increase in unit sales volume only increases operating profit by 2.8 percent, if per unit prices and costs remain constant. This is less than a third of the impact of a 1 percent improvement in pricing. But which lever gets the majority of the attention and energy from marketing and sales people? The volume lever, despite its much smaller impact on profit—a fraction of what pricing delivers.

Unfortunately, the pricing lever is a double-edged sword. No lever can increase profits more quickly than raising price a percentage point or two, but at the same time nothing will drop profits through the floor faster than letting price slip down a percentage point or two. If your average price drops just a single percentage point, then, assuming your economics are similar to the Global 1200 average, your operating profits decrease by that same 8.7 percent.

THE PRICE/VOLUME TRADEOFF

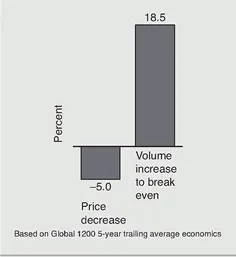

This inevitably leads us to the age-old question of the price/volume/profit tradeoff: If I lower my price, can I increase volume enough to generate more operating profit? Exhibit 1-3 explores how that tradeoff works—or, more accurately, does not work. If a business takes steps that effectively reduce average prices by 5 percent, how much of a volume increase would be necessary to break even on an operating profit basis?

Exhibit 1-3 Breakeven Price/Volume Tradeoff

With economics similar to the Global 1200 average, a 5 percent price decrease would require an 18.5 percent volume increase, just to break even, much less increase operating profits. Such an increase is highly unlikely. For a 5 percent drop in price to generate a 18.5 percent volume rise would require a price elasticity of -3.7 (price elasticity is equal to the percentage change in volume that occurs with a percentage point change in price; in this case 18.5 divided by -5). In other words, every percentage point price drop would have to drive up volume by 3.7 percent. Our experience shows price elasticities commonly reach a maximum of -1.7 or -1.8. On rare occasions, usually for consumer items purchased on impulse, it might be as high as -2.5. In the real world, -3.7 price elasticity is extremely rare.

As this example shows, the basic arithmetic of decreasing price and increasing volume to increase profits just does not add up. You should do this calculation using the economics of your own business to confirm how the tradeoff works for you.1

But the point to remember is that profits are extremely sensitive to even minute changes in prices. Each percentage point of price represents a precious nugget of profit that should be held tight to the chest and never given up without a hard fight. Unfortunately, sales reps (and often even general managers), propelled by their incentive systems, routinely negotiate away five percentage points at a time through discounts, special offers, and other inducements to close deals. Companies with a superior pricing capability—with the price advantage—consistently let fewer of those nuggets slip away.

MARKET FORCES ADD PRESSURE

The second reason managing pricing is so important is because even if nothing changes internally, most companies, whether selling to consumers or to businesses, face unprecedented downward pressure on prices. If nothing is done, these external forces will depress prices and erode profits quickly.

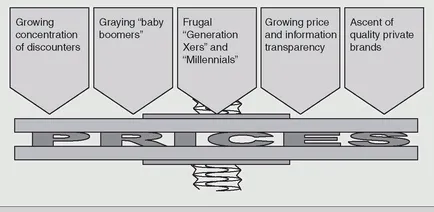

Exhibit 1-4 Consumer Price Squeeze

A combination of fundamental business and demographic changes are squeezing prices in consumer markets as illustrated in Exhibit 1-4. Discount retailers such as Walmart, Home Depot, and Costco are growing larger and accounting for ever-increasing shares of volume in their markets. These giants use their market power to extract lower prices from consumer goods suppliers. The growth of the Internet, as well as the increased use of price advertising by such discounters, makes it easier for shoppers to find and compare prices of consumer products. Meanwhile, private-label packaged goods, often sold under a retailer’s brand name, have witnessed quality improvements that put added pressure on traditional brands in many product categories.

Generational shifts are leaving their mark on the consumer market as well. The baby boomers who fueled much of the rampant consumer spending over the past few decades are throttling back purchases now that they are helping children through college, supporting aging parents, preparing for their own retirement, and carrying other financial burdens. The generations behind the baby boomers are notably more price sensitive, having grown up surrounded by discount retailers of every stripe.

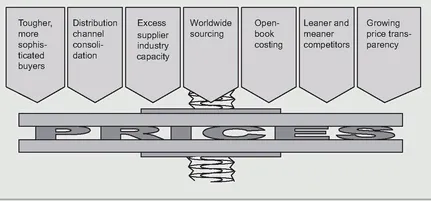

Business-to-business (B2B) companies are also feeling price pressure from changes in the market environment, as shown in Exhibit 1-5. Buyers are tougher and more skilled than ever in extracting every last penny of price from suppliers. Efficiency programs in recent years have unleashed newfound excess capacity into many markets. Open-book costing, in which powerful buyers insist on knowing the details of a supplier’s costs for each component of a product, including individual component materials costs, direct labor, and overhead, has become more common. This greater visibility provides buyers with significantly more leverage when negotiating prices. Prices in some instances have become even more transparent, with individual customer price quotes being highly visible to not only other customers but to competitors as well—particularly if the quoted price is extremely low. We refer to this higher visibility of lower prices as “asymmetrical price transparency”—a condition that actually exerts even more downward force on prices that may already be low.

Exhibit 1-5 B2B Price Squeeze

Furthermore, many industrial suppliers have already cut their own costs—have themselves become leaner and meaner—and thus generally feel more confident competing more aggressively on price to secure business. Global companies increasingly shop the world for the best prices, and then insist on those unified low prices for all their buying locations. Just as in consumer distribution, B2B distribution channels are becoming more concentrated and more powerful relative to suppliers.

The forces that are putting pressure on companies that serve consumers and businesses alike are gathering strength and are not likely to subside in the foreseeable future; indeed, they have shown no signs of subsiding since we wrote the first edition of The Pricing Advantage in 2004. A company that neglects pricing, that does not actively develop an enhanced pricing capability and a price advantage to combat this onslaught, will inevitably see its prices crumble away under the weight of these prevailing forces.

THE NOBILITY OF PRICING EXCELLENCE

The last reason building the price advantage in your business is so important goes beyond profit economics or market forces to the spirit, heart, and pride of your organization. There is genuine nobility to pricing done well. Individuals responsible for setting prices hold a sacred trust. They assure that a business gets fairly rewarded in the marketplace for products and services superior to its competitors—that there is a real payoff for being better.

The price advantage is not about gouging customers or employing tricks to gain undeserved revenues. Quite to the contrary, the real price...