![]()

Part One

ETF Overview and Selection

![]()

CHAPTER 1

Why Use Technical Analysis with ETFs?

Unlike most books on exchange-traded funds (ETFs), this one offers you strategies based on technical analysis, not fundamental analysis. When I began trading professionally in 1999, before ETFs took the market by storm, people tried to persuade me of the merits of studying fundamental factors, such as price-to-earnings (P/E) ratios, balance sheets, earnings growth, and news events. I’ve always believed that a deep knowledge of these items is theoretically important, but fundamentals seem to have a direct impact only on the long-term direction of a stock. In the short to intermediate term, the correlation between the actual price action of an ETF and its fundamentals is rarely significant. Technical analysis, however, tells me everything I need to know about the odds of a trade continuing in the current direction or reversing.

Because an ETF consists of a diverse plethora of individual stocks, using fundamental analysis of the underlying stocks to predict the price movement of the actual ETF brings less than satisfactory results. The only way to have a greater than fifty-fifty chance of predicting the short- and intermediate-term trends of ETFs is through sound technical analysis. This is why Morpheus Capital LP is one of the few professional hedge funds that primarily bases its investment and trading decisions on the technical analysis strategies I share with you in this book. Although the techniques presented here are designed to work ideally with ETFs, individual-stock traders can successfully apply the same techniques.

To understand the problems with a fundamentals-based system of analysis, consider the effect news events such as earnings reports often have on stocks and ETFs. How many times has a company reported what is perceived as a strong earnings report, only to see the stock price go down several points the next day? A positive price reaction to a poor earnings report is equally common. The increase or decrease in the price of the stock that can occur in anticipation of a positive or negative earnings report is one of the reasons these inverse price reactions occur. With technical analysis, however, news events are irrelevant to your analysis. The price and volume of the stock or ETF already tells you everything you need to know. If the equity has been trending higher for quite some time, odds are high that it will continue to do so. Likewise, a stock or ETF stuck in a protracted downtrend will remain that way until the chart pattern proves otherwise.

I have designed this book to provide a logical, step-by-step process that enables you to easily master ETF trading using technical analysis. Whether you’re a professional full-time investor or someone who wishes to learn new techniques for actively managing his personal portfolio, you will benefit from the strategies.

In Part One, the first chapter provides you with a brief history of the growth of ETFs, which has made my strategies possible, as well as my thoughts on some of the advantages of investing and trading in ETFs instead of individual stocks. Chapter 2 describes the numerous fund families from which you can choose ETF products, as well as the unique types of ETFs that began coming to market around 2005. In addition to the popular ETFs that are simply composed of a group of individual stocks, ETF offerings on the market as of 2007 now include currency, commodity, fixed-income, and even inversely correlated products.

In Part Two, I dive into the “meat and potatoes” of the strategy by showing you specifically how technical analysis is used to trade ETFs. Chapter 3 details my “top-down” strategy of ETF trading that always favors your odds of success by identifying the overall trend of the broad market, determining which sector indexes are showing the most relative strength compared to the overall stock market, and then selecting the specific ETF family with the most relative strength compared to the corresponding sector index. Chapter 4 details the method of finding the sector indexes with the most relative strength. Chapter 5 drills down to the specific ETF families with the most relative strength, while Chapter 6 provides supplemental technical indicators and chart patterns.

After learning how to select the best ETFs for trading and investing, the next step is figuring out the proper timing for entries and exits into those positions. This is covered extensively in Part Three. Chapter 7 provides strategies for determining ideal entry points, while Chapter 8 shows you when to exit your positions. Chapters 9 and 10 “put it all together” by graphically walking you through actual trades I have made using the strategies offered in the first eight chapters. The actual outcome of the trades, using real capital, is also presented. Chapter 9 discusses ten actual ETFs I bought long. Chapter 10 discusses ten ETFs I sold short. Many nuances of the entire technical analysis strategy can be gleaned from these two chapters, as they are real-life situations, not merely the theory behind the strategy.

In the final part of the book, I provide you with a host of pointers to help fine-tune your strategy after you put it into action. Topics such as position sizing, getting efficient ETF executions, and identifying relative strength intraday are all covered in Chapter 11. Chapter 12 provides you with some final thoughts and pointers to “take along with you.”

I encourage you to take your time reading the material, unlike a novel you might breeze through, so that you can fully digest the concepts presented. You may realize the greatest benefit through first reading the book cover to cover, and then going back and reviewing the more detailed sections to ensure you have a thorough understanding of the key points.

History and Growth of ETFs

Although you probably already have a basic understanding of ETFs, it’s important to understand just how many options you have when selecting potential ETF trades. The astonishing growth both in the quantity and types of different ETFs may surprise you.

An ETF is a basket of stocks that trades on an exchange with the same simplicity and liquidity of an individual stock. Traders and investors can buy or sell shares in the collective performance of an entire stock, bond, commodity, or even currency portfolio by buying or selling a single security. ETFs add the flexibility, ease, volatility, and liquidity of stock trading to the benefits of traditional index-fund investing. The American Stock Exchange (Amex) launched the first U.S.-based ETF in 1993 as a simple way for more aggressive retail investors to buy the entire realm of stocks that made up the Standard & Poor’s 500 Index. Trading under the ticker symbol SPY, the Standard and Poor’s Depositary Receipt (SPDR) was born. The Amex devised the ETF because it wanted to create a way to attract the business of stock market investors who had become more interested in trading and investing in individual stocks than mutual funds. Although many investors enjoyed the high rates of return that individual stocks provided throughout the 1990s, many people still preferred the perceived “safety” that traditional mutual funds offered. Hence, the ETF was introduced as a way for investors to combine the potentially high returns of individual stock trading with the benefits of diversification that mutual funds provided.

In February 1994, one year after its official launch, SPY was trading an average daily volume of only 250,000 shares. Its popularity quickly spread, and the average daily volume of SPY increased more than twelve times to over 3 million shares per day by the beginning of 1998, five years after its launch. Although such a large initial increase in volume may seem impressive, it was only the beginning for the popularity of SPY. The absolute lows of the recent equity bear market, which were set in October 2002, marked the largest percentage increase in the average daily volume of SPY. In October 2002, the 50-day average daily volume of SPY was 48 million shares per day. By mid-2007, SPY clocked in at more than 200 million shares trading hands on an average day. That represents an astronomical increase in daily trading activity of approximately 80,000 percent in thirteen years.

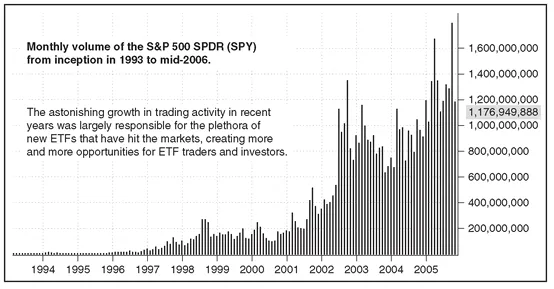

The bear market of 2000 to 2002 was partially responsible for generating interest in SPY and other ETFs as investors grew tired of attempting to pick individual winning stocks during such adverse conditions and instead found it easier to simply choose an ETF that suited their goals. SPY and other major ETFs have seen a remarkable increase in turnover, which began accelerating parabolically in the years 2000 through 2007. To grasp the astonishing growth of the first domestic ETF, look at the volume bars on the monthly chart of SPY in Figure 1.1.

FIGURE 1.1

S&P 500 SPDR (SPY) Monthly Volume Chart from 1993 to 2006

Source: TradeStation

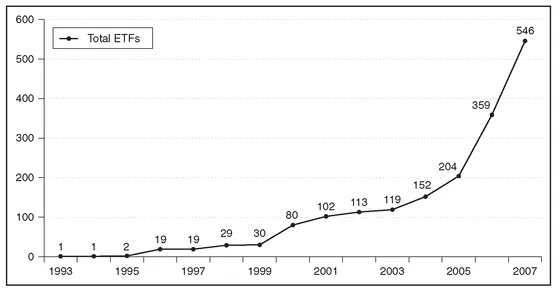

FIGURE 1.2

Annual Growth in Number of ETFs Since 1993

Data: Investment Company Institute (ici.org)

Thanks to SPY, the concept of having transparent exposure to an entire broad-based index through the simplicity of buying an individual stock caught on quickly. This popularity rapidly spurred demand for the launch of more diverse ETF offerings. A second domestic ETF was launched in 1995, and the rest is history. By 2003, just ten years after the introduction of SPY, the total number of domestic ETF offerings had grown to 119. As of August 2007, an incredible 546 different ETFs were traded on the U.S. exchanges. New ETFs are launched practically every month. Figure 1.2 shows how rapidly the total number of ETFs has multiplied since SPY was launched in 1993.

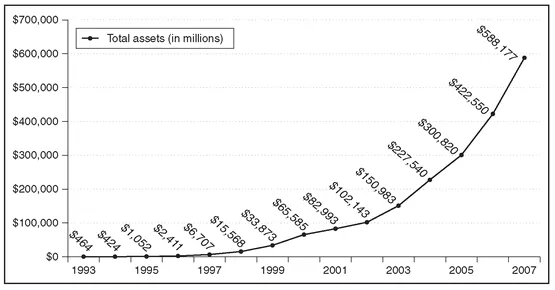

But it’s not only the number of ETFs that has increased dramatically: The total asset growth of ETFs has been equally impressive. Figure 1.3 illustrates the total combined asset growth of ETFs since 1993.

From 1994 to 2000, total assets in ETFs doubled every year. Since 2000, the growth has obviously slowed a bit, but combined assets are still swelling at approximately 50 percent per year.

Considering that the birth of these innovative instruments began with a single ETF just fourteen years ago, the growth is astounding. With no signs of waning interest, the asset growth shown in the preceding figure indicates that there is enough sustainable demand to continue meeting the constantly expanding number of ETF offerings.

FIGURE 1.3

Total Combined Asset Growth of ETFs Since 1993

Data: Investment Company Institute (ici.org)

The diverse mix of ETFs brought to market provides technical traders with more opportunities than ever. While you are probably familiar with the commonplace ETFs that track major indexes such as the S&P 500, the Dow, or the Nasdaq, it’s important to understand the full range of instruments in your ETF trading arsenal. The next chapter takes a look at each of the major types of ETFs, as well as the popular ETF families that constitute each type.

Trading ETFs Versus Individual Stocks

Although I invest in and trade both individual stocks and exchange-traded funds, ETFs have some unique benefits over stocks. The following are the reasons I initially became attracted to trading ETFs as a great alternative to trading individual stocks:

Safety through diversification. Do you ever wonder if you are going to wake up in the morning and find out your stock dropped 50 percent because the CEO was caught with his hands in the cookie jar? This is never an issue with ETFs because they automatically diversify equities and usually have minimal exposure to any one individual stock.

Consider, for example, the PowerShares Dynamic Semiconductors Fund (PSI), the composition of which is shown in Figure 1.4. As of September 2007, a total of thirty different stocks represented the underlying portfolio of PSI. Of those, the largest percentage weighting of any individual stock was only 5 percent. Even if that company (NVIDIA Corp.) had bad news that caused its stock to plummet overnight, the net effect on the price of the ETF would be minimal. By trading ETFs, you are automatically reducing your risk of damaging losses from overnight gaps (sessions in which the opening price of an ETF significantly varies from the previous day’s closing price). (See Chapter 7 for a full discussion of overnight gaps.)

Access to more markets. Through exchange-traded funds, retail investors and traders now have access to markets that were previously difficult and expensive to participate in. Government Treasury bonds, international markets, commodities, and even currency ETFs can all be traded with the same ease and low commission of an individual stock. With new ETFs constantly being created, the realm of trading opportunities is boundless.

Liquidity is never an issue. Unlike individual stocks, in which liquidity can greatly affect how a stock trades, all ETFs are synthetic instruments. As such, the average daily volume that an ETF trades is largely irrelevant. Even if a low-volume ETF had no buyers or sellers for several hours, the bid and ask prices would continue to move in correlation with the fair market value that is derived fr...