![]()

Chapter 1

Overview of Business Valuation Discounts and Premiums and the Bases to Which They Are Applied

This chapter calls attention to the high degree of significance of the topic of discounts and premiums in business valuation. In fact, the existence and/or amount of discount or premium is often the largest money issue in disputed business valuations. This chapter provides an overview of various discounts and premiums and the bases of value to which they may be applied.

In general, we will refer to stock when talking about any type of equity interest unless talking specifically about partnerships or some other specific ownership form. However, the same concepts as applied to stock are usually applicable to partnership interests as well as other forms of ownership.

The purpose of a discount or premium is to make an adjustment from some base value. The adjustment should reflect the differences between the characteristics of the subject interest (the interest being valued) and those of the base group on which indications of value are based.

After all discounts and premiums have been applied, it is often a very good idea as a reasonableness or sanity check to compute the implied expected rate of return on the final concluded value to see if it appears reasonable.

Discounts and premiums generally fall into one of two categories. Entity level discounts are those that affect all shareholders; in other words, entity level discounts are those that affect the value of the entity as a whole, such as environmental issues or dependence on a key person. Shareholder level discounts are those that affect one or a specified group of shareholders, such as minority interests or lack of voting rights.

Entity level discounts or premiums should be applied before shareholder level discounts or premiums.

Most often, discounts and/or premiums are applied individually toward the end of the analysis. They usually are specified as a percentage of the otherwise estimated value, but sometimes are specified as a dollar amount.

On the other hand, since most discounts or premiums reflect risk factors, they are sometimes reflected as an adjustment to the discount rate, capitalization rate, or multiple that otherwise would be used. If this procedure is used, it is generally part of the “specific company risk factor adjustment,” accounting for characteristics of the company or interest that differ from the characteristics of the companies or interests used to derive the base values.

DISCOUNTS AND PREMIUMS ARE BIG-MONEY ISSUES

Often there is more money at stake in determining what discounts or premiums are applicable to some business valuations than there is in arriving at the base value (prediscount valuation) itself. A thorough understanding of (1) the types of discounts and premiums, (2) situations in which each may or may not be applicable, and (3) how to quantify them is a major and indispensable part of the tool kit of any business appraiser or reviewer of business appraisals.

In the dissenting stockholder action of Swope v. Siegel-Robert, Inc., for example, one appraiser testified to a value of $98.40 per share and another testified to a value of $30.90 per share, a difference of well over three to one between the two appraisers’ values. However, their base level values were $72.90 and $46.20 per share, respectively, both on a marketable minority basis. The rest of the difference came from the fact that the first appraiser applied a 35 percent control premium, which the second did not, and the second appraiser applied a 35 percent discount for lack of marketability, which the first did not.1

There have been many cases in which the parties reached agreement on base values, and the only disputes remaining involved premiums and/or discounts.

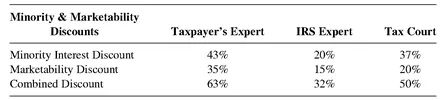

In Estate of Weinberg v. Commissioner,2 the parties agreed that the fair market value of an apartment building, the sole asset of a limited partnership, was $10,050,000. The points of disagreement centered on the magnitudes of lack of control and marketability discounts for a 25.32 percent limited partnership interest. The differences in the experts’ positions on the discounts and the court’s conclusion are shown in Exhibit 1.1. If the court had accepted the taxpayer’s expert’s discounts, the concluded value would have been $971,838. If the court had accepted the Internal Revenue Service (IRS) expert’s discounts, the concluded value would have been $1,770,103. This magnitude of difference based on combined discounts for lack of control and lack of marketability is not uncommon.

The most famous case dealing solely with the issue of discounts is Mandelbaum v. Commissioner.3 The parties stipulated to freely traded minority interest values, so the only issue was the discount for lack of marketability. After hearing testimony from experts for both the IRS and the taxpayer, the court concluded a discount of 30 percent for lack of marketability. Some of the court’s criteria for reaching its decision are still controversial in the financial community. This case is discussed more fully in Chapter 14.

Exhibit 1.1 Estate of Weinberg v. Commissioner: Experts’ and Court’s Discounts from Net Asset Value

Source: Robert M. Siwicki of Fleet M&A Advisors. “Tax Court Rejects QMDM and Use of Single Comparable,” Shannon Pratt’s Business Valuation Update (April 2000): 10.

“ENTITY LEVEL” VERSUS “SHAREHOLDER LEVEL” DISCOUNTS AND PREMIUMS

Some categories of discounts apply to the entity as a whole, such as a key person or environmental liability discount; others reflect the characteristics of ownership, such as control versus minority and lack of marketability. These are often distinguished as “entity level discounts” or “company level discounts,” because they apply to the company as a whole, as opposed to “shareholder level discounts,” which apply to a specific block of stock.

ENTITY LEVEL DISCOUNTS

Certain discounts apply to the entity as a whole or to all shareholders, individually or as a group, regardless of any individual shareholder’s characteristics or attributes. These include, for example:

• Discount for trapped-in capital gains

• Key person discount

• Discount for known or potential environmental liability

• Discount for pending litigation

• “Portfolio,” “conglomerate,” or “nonhomogeneous assets” discount (for an unattractive assemblage of assets)

• Concentration of customer or supplier base (risk of loss/nonrenewal of significant customers or vendors normally is factored into the multiples in the market approach or the discount rates in the income approach)

These entity discounts usually are applied before shareholder discounts, that is, discounts affecting the entity as a whole as opposed to those characteristics affecting the particular share ownership. These entity level discounts normally are applied to a control level value. However, in some cases, such as the guideline public company method and sometimes in an income approach, the analysis may lead directly to a minority level value without ever estimating a control value. In these cases, the entity level discounts can be applied to those minority values before any shareholder level adjustments. (The percentage would be the same since entity level adjustments apply equally to all shareholders.)

Also, in some instances, these “discounts” can be factored into discount or capitalization rates in the income approach or valuation multiples in the market approach to reflect the additional risk that they imply. If this procedure is used, the adjustments to the discount or capitalization rates or market multiples should be clearly explained.

Estate of Mitchell v. Commissioner4 is a good example of an entity level discount. The Tax Court first applied a 10 percent key person discount (for the death of Paul Mitchell) to the $150,000,000 control value for the entity that the court had determined. The court then took the percentage owned by the estate times the remaining $135,000,000 value and applied discounts for lack of control and lack of marketability.

These entity level discounts usually are applied as a percentage to some measure of value, as in the previous example. In some cases, for example, the application of a trapped-in capital gains adjustment, the discount may be quantified as a dollar amount rather than a percentage.

DISCOUNTS AND PREMIUMS REFLECTING SHAREHOLDER CHARACTERISTICS OF OWNERSHIP

The starting point for any discount or premium has to be a well-defined base to which it is applied. This is especially true of shareholder level discounts or premiums.

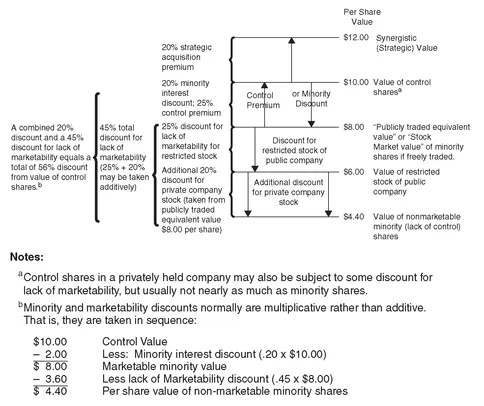

The starting point for discounts relating to characteristics of ownership could be one of the levels defined on the traditional levels-of-value chart (see

Exhibit 1.2), such as:

1. Control value

2. Minority marketable value (also sometimes called “publicly traded equivalent value” or “stock market value”)

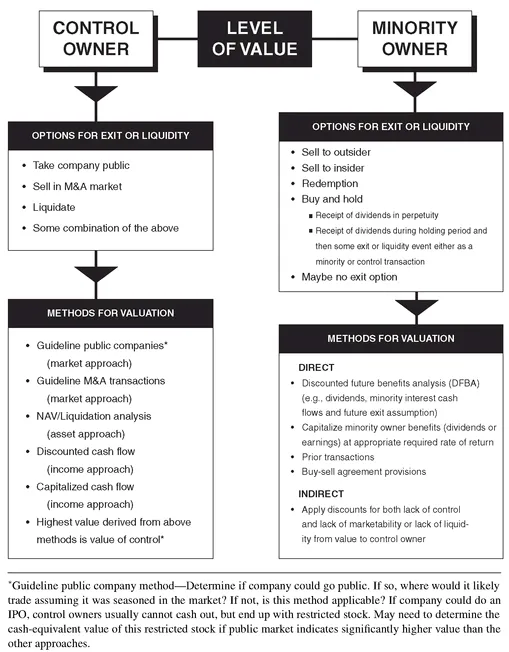

If, on the other hand, the analyst believes that publicly traded equivalent value is equal to control value, in accordance with the alternative levels-of-value chart shown in Exhibit 1.3, discounts for both lack of control and for the relative degree of lack of marketability between a control position and a private minority position may be appropriate to derive a private minority value. Further explanation of the concepts embodied in Exhibits 1.2 and 1.3 is included in Chapter 2.

Other premiums or discounts at the shareholder level may include voting versus nonvoting stock (see Chapter 16) and blockage (an amount so large that it would depress the price if put on the market all at once, normally applied to publicly traded stocks).

Exhibit 1.2 “Levels of Value” in Terms of Characteristics of Ownership

Source: Jay E. Fishman, Shannon P. Pratt, and J. Clifford Griffith, PPC’s Guide to Business Valuations, 18th ed. (New York: Practitioner Pub Co., 2008), Exhibit 8-8.

The most often encountered premiums or discounts reflecting characteristics of ownership fall broadly into two major categories:

1. Degree of control or lack of control. The issue of voting versus nonvoting stock may be regarded as a subcategory of control or as a separate issue.

2. Degree of lack of marketability

Each of the above has economic bases that must be analyzed in each individual situation.

In a valuation analysis, the degree of control usually is considered before the degree of marketability. This is because, although control and marketability are separate issues, the degree of control or lack of it has a bearing on both the size of the discount for lack of marketability and the procedures that are appropriate to quantify the discount for lack of marketability.

It generally is not practical to use the minority nonmarketable level of value as a starting point because there is no database of arm’s length transactions of minority nonmarketable interests and no other empirical data to lead directly to that level of value.

Exhibit 1.3 “Levels of Value” in Private Companies Based on Owners’ Options for Exit or Liquidity

Source: Chart designed by Eric W. Nath.

Note that the issue of marketability is usually distinguished from nonmarketability at the minority interest level but not at the controlling interest level. On the minority interest level, the term “marketable,” or “liquid,” reflects a stock with an active public trading market that can be sold instantly, with cash proceeds received within three days.5 Controlling interests are far less liquid than an actively traded security, although in most cases they are more liquid than a private minority position. Therefore, at this point we have no benchmark against which to classify a controlling interest as marketable or nonmarketable. Also, this concept does not apply to other types of property, such as real property, where no such liquid market for fracti...