- English

- ePUB (mobile friendly)

- Available on iOS & Android

Option Pricing Models and Volatility Using Excel-VBA

About this book

This comprehensive guide offers traders, quants, and students the tools and techniques for using advanced models for pricing options. The accompanying website includes data files, such as options prices, stock prices, or index prices, as well as all of the codes needed to use the option and volatility models described in the book.

Praise for Option Pricing Models & Volatility Using Excel-VBA

"Excel is already a great pedagogical tool for teaching option valuation and risk management. But the VBA routines in this book elevate Excel to an industrial-strength financial engineering toolbox. I have no doubt that it will become hugely successful as a reference for option traders and risk managers."

— Peter Christoffersen, Associate Professor of Finance, Desautels Faculty of Management, McGill University

"This book is filled with methodology and techniques on how to implement option pricing and volatility models in VBA. The book takes an in-depth look into how to implement the Heston and Heston and Nandi models and includes an entire chapter on parameter estimation, but this is just the tip of the iceberg. Everyone interested in derivatives should have this book in their personal library."

— Espen Gaarder Haug, option trader, philosopher, and author of Derivatives Models on Models

"I am impressed. This is an important book because it is the first book to cover the modern generation of option models, including stochastic volatility and GARCH."

— Steven L. Heston, Assistant Professor of Finance, R.H. Smith School of Business, University of Maryland

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

Chapter 1

Mathematical Preliminaries

INTRODUCTION

COMPLEX NUMBERS

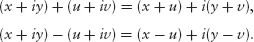

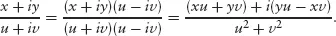

Operations on Complex Numbers

Table of contents

- Cover

- Contents

- Title

- Copyright

- Dedication

- Preface

- Chapter 1: Mathematical Preliminaries

- Chapter 2: Numerical Integration

- Chapter 3: Tree-Based Methods

- Chapter 4: The Black-Scholes, Practitioner Black-Scholes, and Gram-Charlier Models

- Chapter 5: The Heston (1993) Stochastic Volatility Model

- Chapter 6: The Heston and Nandi (2000) GARCH Model

- Chapter 7: The Greeks

- Chapter 8: Exotic Options

- Chapter 9: Parameter Estimation

- Chapter 10: Implied Volatility

- Chapter 11: Model-Free Implied Volatility

- Chapter 12: Model-Free Higher Moments

- Chapter 13: Volatility Returns

- Appendix A: A VBA Primer

- References

- About the CD-ROM

- About the Authors

- Index

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app