![]()

Chapter 1

THE MOST IMPORTANT TOOL FOR ANY OPTIONS TRADER

This book focuses on options, explaining how volatility affects the valuation and pricing of options, and how you can use this information to refine your option trading strategies and improve your trading results.

Depending on your situation, this book is a bit unusual for me because I’m used to dealing almost solely with professional traders—traders for market-making firms, financial institutions, floor traders, computer traders, and so forth. I know that you may not be a professional trader. However, lest that concern you, I’d like to assure you of one thing:

The principles of option evaluation are essentially the same for everyone.

Second, by way of disclaimer, I want to clarify something immediately: I am not going to tell you how to trade.

Everyone has a different background. Everyone has a different goal in the market . . . different reasons for making specific trades. What I hope you’ll at least be able to do—from the limited amount of information I’m going to provide—is learn how to make better trading decisions.

However, you’re the one who must decide what decisions you’re going to make.

See Sheldon as he introduces the world of options to you. Log in at

www.traderslibrary.com/TLEcorner to gain exclusive access to his online video.

Your Goal Is Not to Cut off Your Hand

Learning about options is like learning how to use tools—and everyone applies tools in different ways. For example, if somebody teaches you how to use a saw, your first question becomes, “What can I do with this saw?”

Well, depending on how well you’ve learned your lesson, either you can make a beautiful piece of furniture—or you can cut off your hand.

Obviously, those are the two extremes: there are many other uses in between. My point here is that I’m trying to help you avoid cutting off your hand. You may not learn enough to become a professional trader, but you will learn enough to avoid disaster, and greatly improve your trading skills.

Maybe that’s not the best analogy, but I think you get the idea.

People often ask me about the types of strategies I use and which are my favorites. I think most professionals would agree with me: I’ll do anything if the price is right.

The same standard defines my “favorite” strategy, because my favorite is any strategy that works—and, if the price is right, a strategy usually works.

So, how do I determine whether the price is right?

I determine if the price is right the way almost everybody does: I use some type of theoretical pricing model—some type of mathematical model that helps me determine what I think the price ought to be.

Then, whatever strategy I choose to use depends on whether the actual prices available in the market deviate from what I think they ought to be, or whether they’re consistent with what I think they ought to be.

So, the primary tool for any professional option trader is a theoretical pricing model—and, if you’re going to succeed with your own trades, such a model will become your primary tool as well. With that in mind, let’s talk about a typical theoretical pricing model.

Black-Scholes: The Grandfather of Pricing Models

By far, the most common option-pricing tool used today is the Black-Scholes model (See Appendix B for details). Of course, there are other models that are also widely used, but the Black-Scholes model is most famous because it was the first really widely used pricing model. It was also a theoretical innovation—so much so that Myron Scholes and Robert Merton, who helped develop the model, received the Nobel Prize in Economics for its development.

So, if Merton shared in the prize, why is it called the Black-Scholes model?

Well, as a quick aside, this is a perfect illustration of the fact that life is not fair. The Nobel Prize is given posthumously only if you die within six months of the awarding of the honor. Fischer Black did much of the theoretical work in developing the Black-Scholes model—but because he died roughly eight months before the honors were announced, he missed the Nobel Prize.

Of course, his name lives on in the title of the model—and everyone who knows the story acknowledges that Black really shared the Nobel Prize with Scholes and Merton.

The Fundamental Elements of Any Pricing Model

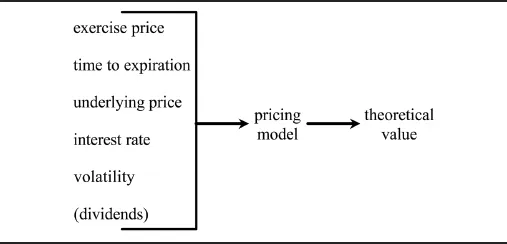

Whether you use Black-Scholes or some other pricing model, there are certain inputs that have to be plugged into the formula. Only after you enter all of these inputs into the model you’re using can you come up with a theoretical value for an option. So, let’s take a look at the required inputs (Figure 1).

Most pricing models, including Black-Scholes, require five—or, in some cases involving stocks, six—inputs. If you’ve done any analytical work with options at all, you’re likely familiar with the first four of these inputs:

- The exercise price

- Time to expiration

- The price of the underlying security

- The current interest rate

That’s because these are things you can generally observe in the marketplace, as is dividend information, which is the added input stock traders are required to factor into the model. You may not know exactly what the correct interest rate is, or exactly what the underlying stock or futures price is, but you can make a pretty good guess. Likewise, if you’re doing stock options, it’s pretty easy to come up with the dividend. Obviously, if you’re trading index options or options on futures, there is no dividend.

The big problem with almost every model, including Black-Scholes, is volatility.

It’s the one input that you can’t directly observe in the marketplace. Of course, there are sources of volatility data that might enable us to guess what the right volatility input is. However, we never really know exactly whether we’re correct—and that’s the big, big headache for all traders who use a theoretical pricing model.

Not only is it extremely difficult to determine the volatility, but traders learn very quickly that, if you raise or lower the volatility just a little, it can have a tremendous impact on the value of the option. What happens?

Either the option’s value explodes, or it collapses.

Obviously, whether you’re a professional trader devising hedging strategies for a mutual fund or an individual investor selecting options for a covered-writing program in your personal account, a lot will ride on your ability to determine a correct volatility input for the theoretical pricing model. You simply can’t afford—in terms of either money or long-term trading success—to be at the mercy of such errors in valuation.

That’s why I focus the bulk of my discussion on just what this volatility input is—what it means, how it’s used, how you interpret it, and so forth.

- - - - - - - - - -

Self-test questions

1. Sheldon Natenberg’s favorite options strategy is the one where the price is right. How do you determine whether the price is right?

a. By buying in the money calls

b. By using the right tools

c. By using a theoretical pricing model

d. By hedging all your trades

2. What is the most common option pricing tool used today?

a. The theoretical pricing model

b. The Black-Scholes Model

c. The Myron-Merton Pricing Model

d. The Binomial Model

3. Which of the following statements about Black-Scholes is incorrect?

a. You should never have to calculate a Black-Scholes option value yourself

b. There are no transaction costs

c. Trading of the asset is continuous

d. It uses an American-style option and can be exercised at any time up to expiration

4. What is the biggest problem, and the one unknown factor, when using pricing models?

a. Exercise price

b. Time to expiration

c. Volatility

d. Interest rate

For answers, go to www.traderslibrary.com/TLEcorner

- - - - - - - - - -

![]()

Chapter 2

PROBAB...