![]()

PART I

INVESTMENT STRATEGY IN AN UNCERTAIN WORLD

![]()

CHAPTER 1

The Uncertainty of Investing

When there’s uncertainty, they always think there’s another shoe to fall. There is no other shoe to fall.

—Kenneth Lay, former CEO of Enron

Investing deals with both risk and uncertainty. In 1921, University of Chicago professor Frank Knight wrote (he is not the publisher) the classic book Risk, Uncertainty, and Profit. An article from the Library of Economics and Liberty described Knight’s definitions of risk and uncertainty as follows: “Risk is present when future events occur with measurable probability. Uncertainty is present when the likelihood of future events is indefinite or incalculable.”

In some cases, we know the odds of an event occurring with certainty. The classic example is that we can calculate the odds of rolling any particular number with a pair of dice. Because of demographic data, we can make a good estimate of the odds that a 65-year-old couple will have at least one spouse live beyond age ninety. We cannot know the odds precisely because there may be future advances in medical science extending life expectancy. Conversely, new diseases may arise shortening it. Other examples of uncertainty: the odds of an oil embargo (1973); the odds of an event such as the attacks of September 11, 2001; or the odds of an accounting scandal the size of Enron. That concept is uncertainty.

It is critical to understand the important difference between these two concepts: risk and uncertainty. Consider the following example.

An insurance company might be willing to take on a certain amount of hurricane risk in Dade and Broward counties in Florida. They would price this risk based on perhaps one hundred years of data, the likelihood of hurricanes occurring, and the damage they did. But only a foolish insurer would place such a large bet that the company would go bankrupt if more or worse hurricanes occurred than in the past. That would be ignoring the uncertainty about the odds of hurricanes occurring: The future might not look like the past. [A number of insurers made this bad bet, losing big-time when Hurricane Andrew swept through Florida in 1991.]

Just as there are foolish insurance companies, there are foolish investors. The mistake many investors make is to view equities as closer to risk where the odds can be precisely calculated. This tendency appears with great regularity when economic conditions are good. Their “ability” to estimate the odds gives investors a false sense of confidence, leading them to decide on an equity allocation exceeding their ability, willingness, and need to take risk.

During crises, the perception about equity investing shifts from one of risk to one of uncertainty. We often hear commentators use expressions like, “There is a lack of clarity or visibility.” Since investors prefer risky bets (where they can calculate the odds) to uncertain bets (where the odds cannot be calculated), when investors see markets as uncertain, the risk premium demanded rises. That causes severe bear markets.

The historical evidence is clear that dramatic falls in prices lead to panicked selling as investors eventually reach their “GMO” point. The stomach screams “Don’t just sit there. Do something: Get me out!” Investors have demonstrated the unfortunate tendency to sell well after market declines have already occurred and to buy well after rallies have long begun. The result is they dramatically underperform the very mutual funds in which they invest. That is why it is so important to understand that investing is always about uncertainty and about never choosing an allocation exceeding your risk tolerance. Avoiding that mistake provides investors the greatest chance of letting their heads, not their stomachs, make investment decisions. Stomachs rarely make good decisions.

Efficient Frontier Models

To assist in the development of investment plans some investors and many advisers use what are called efficient frontier models.

Harry Markowitz first coined the term “efficient frontier” almost forty years ago. He used it to describe a set of portfolios with the highest expected return for each level of risk. Today, many efficient frontier programs are available. They begin with individual investors answering questions about their risk profiles. The program then generates a portfolio consisting of various asset classes delivering the greatest expected return given the individual’s risk tolerance. Sounds like a wonderful idea. The problem is understanding the nature of an efficient frontier model and the assumptions on which it relies. As with a sophisticated racing car, a powerful tool in the wrong hands can be a very dangerous thing.

Efficient frontier models attempt to turn investing into an exact science, which it is not. For example, it is logical to believe that in the future, stocks will outperform fixed income investments. The reason is stocks are riskier than risk-free Treasury bills. Investors will demand an “equity risk premium” to compensate them for this risk. While the past may be a guide to the size of the equity risk premium, the bull market of the 1990s and bear markets of 2000-02 and 2008 demonstrate that it is no guarantee.

The equity risk premium is not constant. From 1927 through 1999, the equity risk premium was 6.8 percent. By the end of 2002, it had fallen to 5.7 percent. By the end of 2007, it was back up to 6.1 percent. And by the end of 2008, it had fallen to 5.4 percent. We shall see that even relatively small changes to the inputs are very important when it comes to efficient frontier models.

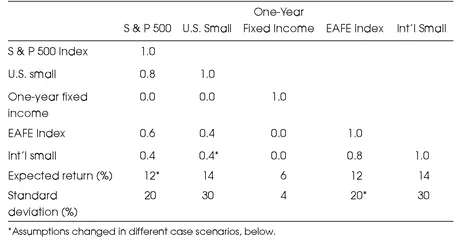

Efficient frontier models rely on inputs of expected returns, correlations, and standard deviations (measure of volatility) for each asset class that could be used in the portfolio. Let’s begin with a simple portfolio that can potentially invest in just five asset classes: S & P 500 (U.S. large-cap); U.S. small-cap; one-year fixed income; Europe, Australasia, and the Far East index (EAFE) (international large-cap); and international small-cap. Table 1.1 shows our assumptions for returns, correlations, and standard deviations. Using standard deviation as the measure of risk, let us also assume we have designated a 12 percent standard deviation as the level of portfolio risk we are willing to accept. An efficient frontier model will generate the optimal asset allocation.

Table 1.1 Capital Market Expectations

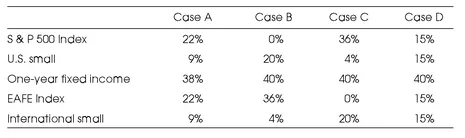

The following is the recommended allocation generated by the efficient frontier model.

| Case A |

|---|

| S&P 500 Index | 22% |

| U.S. Small | 9% |

| One-year fixed income | 38% |

| EAFE Index | 22% |

| International Small | 9% |

We now make a series of minor changes to expected returns, standard deviations, and correlations to see how sensitive the efficient frontier models are to assumptions. Each change, indicated by an asterisk in Table 1.1, will be a minor one from our original base case. In Case B, we reduce the expected return of the S & P 500 from 12 percent to 11. In Case C, we increase the standard deviation of the EAFE index from 20 percent to 22 percent. In Case D, we reduce the correlation between U.S. small-caps and international small-caps from 0.4 to 0.2. In each case, the efficient frontier model generated a dramatically different asset allocation, sometimes entirely eliminating an asset class from the portfolio. This implies a precision nonexistent in the field of financial economics.

We reiterate: Investing is not an exact science. It is foolish to pretend we know in advance exact levels for returns, correlations, and standard deviations. Yet that is the underlying assumption of every efficient frontier model. Experienced practitioners know that to come up with something intelligent, they must generally impose constraints on efficient frontier models. Examples of constraints might be that no asset class can either exceed 30 percent or be less than 10 percent of a portfolio. Another might be that international assets in aggregate cannot exceed 40 percent of the portfolio. The impact of imposing constraints is similar to what we would end up with using a simple common-sense approach (without the need for modeling)—a relatively balanced, globally diversified portfolio with exposure to all the major asset classes. Simply put: Don’t waste your time with efficient frontier models.

![]()

CHAPTER 2

The Investment Policy Statement

Have a plan. Follow the plan, and you’ll be surprised how successful you can be. Most people don’t have a plan. That’s why it’s easy to beat most folks.

—Paul “Bear” Bryant

No rational traveler would ever take a trip to a place he has never been without a road map and directions. Similarly, no rational businessperson would start a business without spending lots of time and energy thoroughly researching that business and then developing a well-thought-out plan. Investing is no different. It is not possible to make a rational decision about any investment without considering how the addition of that investment would impact the risk and return of the entire portfolio, and thus the odds of achieving the plan’s objectives.

There is an old and wise saying that those who fail to plan, plan to fail. Yet, many investors begin their investment journey without a plan, an investment policy statement (IPS) laying out the plan’s objectives and the road map to achieving them. The IPS includes a formal asset allocation identifying both the target allocation for each asset class in the portfolio and the rebalancing targets in the form of minimum and maximum tolerance ranges. A written IPS serves as a guidepost and helps provide the discipline needed to adhere to a strategy over time.

Just as a business plan must be reviewed regularly to adapt to changing market conditions, an IPS must be a living document. If any of the plan’s underlying assumptions change, the IPS should be altered to adapt to the change. Life-altering events (a death in the family, a divorce, a large inheritance, or the loss of a job) can impact the asset allocation decision in dramatic ways. Thus, the IPS and resulting asset allocation decisions should be reviewed whenever a major life event occurs.

Even market movements can lead to a change in the assumptions behind the IPS and portfolio’s asset allocations. For example, a major bull market, like the one we experienced in the 1990s, lowered the need to take risk for those investors who began the decade with a significant accumulation of capital. At the same time, the rise in prices lowered future expected returns, having the opposite effect on those with minimal amounts of capital (who were perhaps just beginning their investment careers). The lowering of expected returns to equities meant that to achieve the same expected return investors would have to allocate more capital to equities than would have been the case had returns been lower in the past. The reverse is true of bear markets. They raise the need to take risk for those with significant capital accumulation, while lowering it for those with little. A good policy is to review the IPS and its assumptions at least annually.

The Foundation of the Investment Plan

Because it outlines and prescribes a prudent and individualized investment strategy, the IPS is the foundation of the investment plan. Meir Statman, a behavioral finance professor at Santa Clara University, notes the importance of psyches in investment behavior, likening the situation to antilock brakes. “When at high speed, the car in front of us stops quickly, we instinctively hit the brake pedal hard and lock ’em up. It doesn’t matter that all the studies show that when the brakes lock, we lose control.” Statman suggests investors need antilock brakes for their investment portfolios as well....