- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Introduction to Option-Adjusted Spread Analysis

About this book

Top traders, investors, and analysts agree that one method, option-adjusted spread (OAS) analysis, is the most useful way to compare and value securities with options. Nearly every day the bond market figures out a new way to structure securities, most of which involve options. This book explains OAS analysis in plain English, presenting each step in the method clearly and concisely. Topics covered include:

- Why yield-based analysis breaks down for nonbullet bonds

- How to model put and call provisions as embedded options

- How to distinguish the intrinsic and time components of option value

- How to model interest-rate volatility, future interest rates, and future bond prices

- How to calculate option-free price and yield

- How to estimate the "fair value" of a bond

- How to calculate implied spot and forward rates

Salespeople, traders, and investors will want to read this book and keep it on their desks.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

PART ONE

YIELD ANALYSIS VERSUS OAS ANALYSIS

CHAPTER 1

FATAL FLAWS IN TRADITIONAL YIELD CALCULATIONS

TRADITIONAL YIELD CALCULATIONS compare the yield of a given bond to the yields of others with similar characteristics, including redemption date, credit rating of issuer, industry, and so forth, and also to a benchmark bond—one considered to be risk free. This is a fairly fruitful way to evaluate bonds with predictable redemption dates (bullet bonds). (It could be argued that other, newer methods are better, but that is the subject of another book.) Unfortunately, yield analysis is often applied to bonds with embedded options (nonbullet bonds). The results of this analysis can be quite unreliable because yield analysis does not account for uncertain redemption dates in a useful way.

This chapter explains yield analysis and identifies how and why employing it on nonbullet bonds can lead to errors.

Yield, Risk, and Benchmarks

Evaluating a fixed-income security means assessing its return, or yield, and the risk it carries. Risk and return are correlated. When investors take a high risk, they expect a high return and vice versa.

By comparing the return of a benchmark bond—most often, a U.S. Treasury since the odds that the U.S. government will default are so low—with the return of the bond being analyzed, it is possible to quantify how much risk one takes in exchange for how much return when making the investment.

The difference between a bond’s risk and the risk of its benchmark is called “incremental” risk. The difference in yield between a bond and its benchmark is called incremental return, or yield spread. When the yield spread increases, so does the incremental risk.

It is important to choose an appropriate benchmark. To do this, consider three variables: coupon (how much interest paid when), duration (a measure of the bond’s sensitivity to price changes), and maturity date (when the principal is paid back to the investor). The benchmark and the bond being analyzed should have similar coupons, durations, and maturity dates.

When coupon, duration, and maturity date are similar, it is possible to accurately compare the bond’s yield with the benchmark’s yield.

Calculating Yield

A bond’s yield is the return provided by its future cash flows when purchased at a given price. Essentially, a yield calculation solves for the discount rate that present-values these cash flows to a given total present value.

Therefore, calculating the yield of a bond requires a well-defined set of cash flows. This means that all coupon and principal payment dates and amounts must be specified before the yield associated with a given price settlement date can be determined. (This is also why the bonds being compared must have similar coupons, durations, and maturities.)

Once the bond’s cash flows are specified, the price-yield calculation shown in EQUATION 1.1 can be used to calculate the bond’s price for a specified yield.

For bullet bonds, the yield calculation is relatively straightforward, because the issue’s only possible redemption date is its maturity. This means that the future cash flows contributing to the overall return of the bond are clearly defined. As such, the cash flows to be present-valued in a yield calculation are also clearly defined.

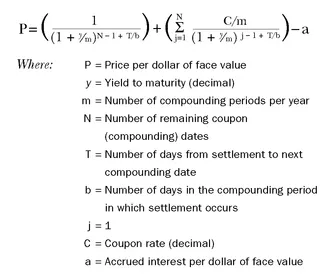

EQUATION 1.1

Price/Yield Equation

EQUATION 1.1 IS A summation of the present values of a bond’s cash flows given a yield rate y. This equation can also be used to solve for a bond’s yield at a given price. However, since equation 1.1 cannot be rearranged to solve for the yield term y explicitly, this quantity must be solved for iteratively. Essentially, an estimate of the yield value is made and an associated price calculated based on the estimated rate. If the calculated price is greater than the given price, then the estimated yield value is too low. Similarly, a calculated price less than the given price indicates that the yield value is too high. The yield estimate is then adjusted until it converges on the value necessary to match the given price. The result of the calculation is the issue’s yield to workout, where the workout is the redemption date specified for the bond in the calculation.

The certainty of these cash flows is the crucial component of the validity of the yield analysis. The yield to maturity of a bullet bond, therefore, offers a relevant, objective measure of the return provided by its remaining cash flows for a given purchase price.

Yield Analysis and Nonbullet Bonds

Nonbullet bonds—including putable, callable, and sinking-fund—are not as easy to evaluate. This is because some aspects of their cash flows—such as the timing or the value of their future payments—are uncertain. To show why such issues present obstacles to meaningful yield analysis, the focus will be on the complications posed by callable bonds in particular. However, it should be understood that similar arguments can be extended to putable and sinking-fund issues.

Since callable bonds have more than one possible redemption date (their call dates and maturity), the collection of future cash flows contributing to their overall return is not clearly defined. The uncertainty surrounding such issues’ cash flows arises from the fact that their actual redemption dates are unknown ahead of time. Yield calculations for such issues are therefore based on assumed redemption dates.

The implications of an uncertain redemption date are significant. In equation 1.1, the second term represents the summation of the present values of the bond’s coupon payments. The number of coupon payments in the summation is directly dependent on the assumed redemption date specified. Yield, which present-values specific cash flows, provides a measure of return based on receiving cash flows through an assumed redemption date. In addition, traditional price-sensitivity measures derived from an issue’s price-yield relationship, such as duration and convexity, are also based on the assumed redemption date.

Furthermore, redemption date assumptions depend on the price used in the analysis: two buyers of the same bond at different prices may expect drastically different redemption dates, thus producing drastically different valuations.

If the actual redemption date of the bond turns out to be different from the assumed redemption date, the collection of cash flows actually received will be different from those included in the analysis. Any return and sensitivity measures based on the assumed redemption date therefore become irrelevant in this situation.

The significance of this shortcoming becomes apparent when it is remembered that an issue’s incremental risks are evaluated relative to its incremental return. When the return measure itself is flawed, the possibility of drawing catastrophically incorrect conclusions about risk and return becomes very real.

Yield-to-Worst Analysis

Despite its undesirable properties, yield analysis is routinely used to assess the incremental return of callable bonds. The most common method of evaluating callable securities is on a yield-to-worst basis.

This method selects as the redemption date of a callable bond that which results in the “worst-case” scenario for an investor. For a given price and settlement date, a yield is calculated for each possible redemption date. The particular redemption date associated with the lowest, or “worst,” yield is then selected as the assumed redemption date of the bond. All traditional return and sensitivity measures are based in turn on this assumed redemption date.

TABLE 1.1 displays a typical yields-to-call analysis, in which the yields to each possible redemption date of a bond are calculated. In this example, the Pacific Bell (AT&T) 6.625 percent bond due 10/15/34 is priced at 100.4500 for settlement on 11/3/06. The lowest yield shown is 6.581 percent and is associated with the 10/15/24 call date. The market therefore assumes, on the basis of the yield-to-worst methodology, that this issue will provide payments until 10/15/24 and will have a duration of 10.395. An investor in this bond would believe he was long a thirteen-year-and-one-month issue and would expect its market value to change by 10.395 percent for a 100-basis-point shift in its yield.

It should be emphasized that the worst redemption date identified by a yield-to-worst analysis is an estimate of the security’s redemption date based on current market conditions. The question of when a callable bond will actually be redeemed is not resolved by such an analysis. In fact, sufficient changes in the issue’s ...

Table of contents

- Praise

- ALSO AVAILABLE FROM

- Title Page

- Copyright Page

- Dedication

- Foreword

- Acknowledgements

- Introduction

- About this Book

- PART ONE - YIELD ANALYSIS VERSUS OAS ANALYSIS

- PART TWO - VALUING OPTIONS

- PART THREE - MODELING INTEREST RATES

- PART FOUR - MEASURING THE SPREAD

- PART FIVE - APPLICATIONS OF OAS ANALYSIS

- CONCLUSION

- GLOSSARY

- REFERENCES & ADDITIONAL READING

- INDEX

- About Bloomberg

- About the Reviser

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access Introduction to Option-Adjusted Spread Analysis by Tom Miller in PDF and/or ePUB format, as well as other popular books in Business & Investments & Securities. We have over one million books available in our catalogue for you to explore.