- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Performance Dashboards and Analysis for Value Creation

About this book

No matter what industry your company competes in, you need to have a firm understanding of how to create a direct link between shareholder value and critical business processes in order to improve performance and achieve long-term value. Performance Dashboards and Analysis for Value Creation contains the information and expertise you need to do just this—and much more.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

CHAPTER 1

The Management Challenge: Integrating Performance, Finance, and Value

One of the primary objectives of corporate managers and directors is to create value for the company’s shareholders. Much has been said and written on this subject over the past 15 years. Yet many managers and most employees still have difficulty in fully understanding the drivers of shareholder value and how their activities relate to these drivers. The objective of this book, and the Value Performance Framework (VPF), is to assist managers and employees in developing a comprehensive understanding of valuation and creating a direct link between shareholder value and critical business processes.

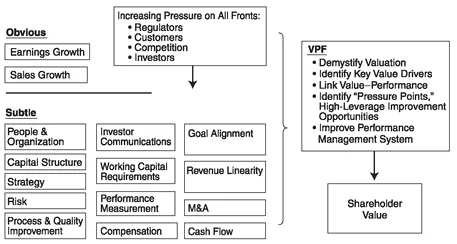

Managers face many challenges in building shareholder value in today’s business environment. They face pressure from all fronts, balancing demands from customers, suppliers, employees, regulators, and investors. In addition, they must integrate a number of available tools to build shareholder value. Many managers focus primarily on sales and earnings growth. However, many other factors will also affect shareholder value; it is a significant challenge to evaluate and incorporate them into a single management framework. Figure 1.1 presents many of these tools and illustrates the objectives of the Value Performance Framework:

• Demystify valuation.

• Identify key value drivers.

• Link value and performance.

• Identify high-leverage improvement opportunities.

• Build a comprehensive performance management system.

• Build long-term shareholder value.

FIGURE 1.1 Managers Face Many Challenges in Managing Factors That Build Long-Term, Sustainable Shareholder Value. The VPF integrates obvious and subtle tools to build value into a single framework.

Note that we are using the verb building shareholder value, rather than creating value. It is important to recognize that building sustainable shareholder value is more akin to constructing a complex building than to a divine or mystical creation. It takes substantial effort, time, process, and a great team to lay the foundation for building long-term sustainable value. “Creating” also conjures up the images of the dot-com bubble and the unsustainable value created by accounting gimmickry. We will focus on those factors that lead to building and sustaining shareholder value.

WHAT IS SHAREHOLDER VALUE?

Shareholder value is defined as the market value of the firm’s stock held by shareholders. It is commonly referred to as the market cap (capitalization) of the firm. It is calculated by multiplying the number of shares outstanding times the price of the stock. For example:

| Stock price | $25.00 | |

| × | Number of shares outstanding | 10 million |

| = | Market value | $250 million |

We will discuss the valuation techniques commonly used by investors to establish the stock price and market value of a firm in Chapter 3. For now, we need to simply understand that the market value of both private and publicly held firms will be determined by the expectations of future performance of the firm, primarily future revenues, earnings, and cash flows.

THE MEASUREMENT CHALLENGE

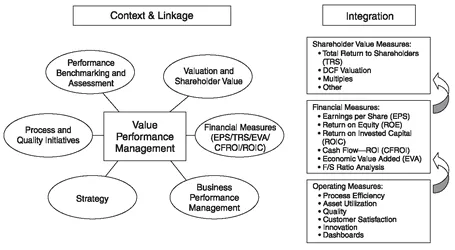

The single greatest challenge in creating an effective measurement system is to ensure that it supports the organization’s objective for creating value by executing a strategic plan. Many attempts at building a performance management framework fail to achieve intended results because the context has not been created and the measures are not integrated with other key management practices and systems. Creating context builds excitement and purpose and takes performance management to a whole new level. In addition, operational, financial, and value measures must be understood, linked, and integrated. (See Figure 1.2.)

FIGURE 1.2 The Measurement Challenge: Creating Context and Effectively Integrating Value, Financial, and Operational Measures

ABOUT THE VALUE PERFORMANCE FRAMEWORK

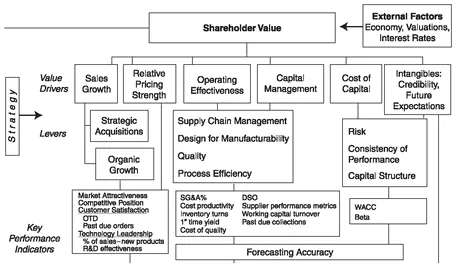

The basic architecture for the Value Performance Framework is illustrated in Figure 1.3. The framework recognizes that there are a number of external factors that will affect shareholder value. These factors, such as the general economy, interest rates, and market valuation factors, will impact the value of all firms. Managers need to recognize these factors and understand the impact each has on their business performance and valuation. In this book, we focus on the value drivers that are largely under management’s control:

• Sales growth.

• Relative pricing strength (competitive advantage).

• Operating effectiveness.

• Capital management.

• Cost of capital.

• The intangibles.

The critical element of the VPF is to link these value drivers to specific processes, activities, and improvement programs that resonate with managers and employees. Many managers and most employees do not under-stand how their activities relate to shareholder value. For example, engineering groups may understand that their activities affect sales growth, but they may not fully understand the impact the activities have on working capital requirements of the firm. In most companies, a significant driver of inventory levels is the extent to which the products are designed for manufacturability (i.e., the design process has a focus on developing products that can be efficiently manufactured) and use common components. If the engineering group is sensitized to the impact of their practices on downstream business processes such as manufacturing, they have a context for more effective design decisions. If the firm establishes an effective set of performance measures—for example, to track the use of common components and product assembly steps—the future impact of design decisions on the supply chain process and inventory requirements can be measured. We cover more on this subject in Chapter 5.

FIGURE 1.3 Building Shareholder Value Requires Performance across All Key Value Drivers

Source: Reprinted by permission of Value Advisory Group, LLC.

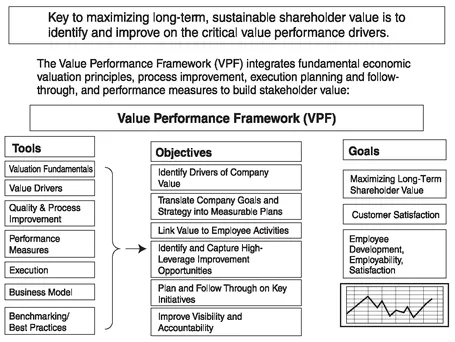

FIGURE 1.4 Value Performance Framework Overview

Linking critical business processes to value drivers and financial performance in this manner can have a profound impact on the firm. Employees are more engaged if they feel connected to the company’s overall performance and shareholder value. It becomes easier to choose between competing initiatives or projects when we can evaluate the potential contribution of each to long-term shareholder value. One of the great aspects of this link between shareholder value and process is the realization that shareholder value is not at odds with satisfying customers or employees. To the contrary, the framework underscores the need to attract, retain, develop, and motivate a competent workforce that exceeds customers’ expectations. This in turn will lead to building long-term sustainable value for shareholders.

The key to implementing sustainable performance improvements and building long-term shareholder value is to integrate valuable business tools including value drivers, benchmarking, quality and process initiatives, and performance management into a cohesive management framework. This integrated framework is illustrated in Figure 1.4. Supported by research covering over 125 companies, the framework emphasizes the importance of linking shareholder value to critical business processes and employee activities. Key elements of the VPF include:

• Understanding key principles of valuation.

• Identification of key value drivers for a company.

• Assessing performance on critical business processes and measures through evaluation and external benchmarking.

• Creating a link between shareholder value and critical business processes and employee activities.

• Aligning employee and corporate goals.

• Identification of key “pressure points” (high-leverage improvement opportunities) and estimating potential impact on value.

• Implementation of a performance management system to improve visibility and accountability in critical activities.

• Development of performance dashboards with high visual impact.

The integrated framework allows managers to ask and answer the following questions:

• What impact will my quality initiatives have on shareholder value?

• How do we compare to best practice companies on key performance measures?

• Given limited financial and human resources, should we pursue a program...

Table of contents

- Praise

- Title Page

- Copyright Page

- Dedication

- List of Dashboards

- Preface

- About the Author

- Acknowledgments

- CHAPTER 1 - The Management Challenge: Integrating Performance, Finance, and Value

- PART One - Creating Context and Covering the Basics

- PART Two - Linking Performance and Value

- PART Three - Driving Performance and Value

- Glossary

- About the CD-ROM

- Index of Performance Measures

- Subject Index

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access Performance Dashboards and Analysis for Value Creation by Jack Alexander in PDF and/or ePUB format, as well as other popular books in Business & Finance. We have over one million books available in our catalogue for you to explore.