eBook - ePub

Option Spread Strategies

Trading Up, Down, and Sideways Markets

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Option Spread Strategies

Trading Up, Down, and Sideways Markets

About this book

Spread trading—trading complex, multi-leg structures--is the new frontier for the individual options trader. This book covers spread strategies, both of the limited-risk and unlimited-risk varieties, and how and when to use them. All eight of the multi-leg strategies are here: the covered-write, verticals, collars and reverse-collars, straddles and strangles, butterflies, calendar spreads, ratio spreads, and backspreads. Vocabulary, exercises and quizzes are included throughout the book to reinforce lessons. Saliba, Corona, and Johnson are the authors of Option Strategies for Directionless Markets.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Option Spread Strategies by Anthony J. Saliba,Joseph C. Corona,Karen E. Johnson in PDF and/or ePUB format, as well as other popular books in Business & Finance. We have over one million books available in our catalogue for you to explore.

Information

1

The Covered-Write

CONCEPT REVIEW

Intrinsic value: The amount by which an option is “in-the-money.”

Extrinsic value: The portion of an option price that cannot be attributed to intrinsic value.

Implied volatility: The volatility component of an option’s theoretical pricing model determined by using current prices along with other known variables. It may be viewed as the market’s forecast of what the average volatility of the underlying instrument might be during the time remaining before its expiration.

Delta: The sensitivity (rate of change) of an option’s theoretical value (assessed value) to a $1 move of the underlying instrument.

Gamma: The sensitivity (rate of change) of an option’s delta with respect to a $1 change in the price of the underlying instrument.

Theta: The sensitivity (rate of change) of theoretical option prices to the passage of small periods of time. Theta measures the rate of decay in the time value of options. Theta may be expressed as the amount of erosion of an option’s theoretical value over one day in time.

Vega: The sensitivity (rate of change) of an option’s theoretical value to a change in implied volatility. Vega may be expressed as the number of points of theoretical value gained or lost from a 1-percent rise or fall in implied volatility.

Synthetic: Two or more trading vehicles (for example, call, put, and underlying) packaged together to emulate another trading vehicle or spread. Some examples:

(long call = long put + long underlying) (short call = short put + short underlying)

(long put = long call + short underlying) (short put = short call + long underlying)

(long underlying = long call + short put) (short underlying = short call + long put)

Conversion: A position that consists of a long underlying, a short call, and a long put with the same strike price, which is considered a market neutral position.

Vertical spread: The simultaneous purchase and sale of options of the same class and with the same expiration times but with different strike prices. Depending on which strike is bought and which strike is sold, vertical spreads can be either bullish or bearish. For example, with XYZ July 100/105 call vertical spread, a bullish trader would buy the 100 call and sell the 105 call, whereas a bearish trader would buy the 105 call and sell the 100 call.

STRATEGY OVERVIEW

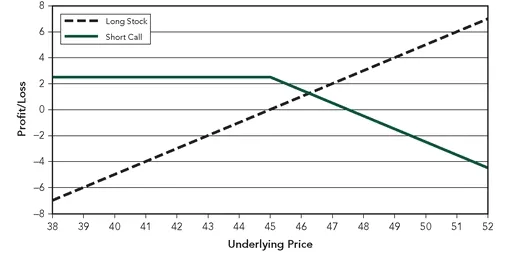

A covered-write is a strategy that combines a long stock position and a short call (Figure 1.1). In options parlance a written option is an option that is sold, in this case a call, and a short call is covered by a long stock position, hence the name covered-write. The calls are sold in equal amounts against the long underlying shares. In the United States, the contract size of a stock option is usually 100 shares; therefore, one call would be sold against 100 shares, five calls against 500 shares, and so on. The strike price and expiration date of the call(s) chosen can vary depending on the investment objective, market view, and risk appetite of the investor, as well as the pricing of the calls themselves.

Figure 1.1 Components of a Covered-Write P&L Diagram

STRATEGY COMPOSITION

| Components: | Sell one 45 call at $2.25 Purchase 100 shares of XYZ stock at $45.00 |

| Maximum Profit: | Limited to the premium received for the sale of the call, plus any increase in value of the underlying up to the strike price of the short call ($2.25) |

| Maximum Loss: | Substantial loss on the downside for the long underlying position (limited by zero), less the premium received for the sale of the call |

| Breakeven: | Price paid for the underlying minus the premium received for the sale of the call ($42.75) |

The writing of a call against a long stock position serves two purposes: It generates potential income and provides some downside protection. However, in return, the investor gives away any upside price appreciation in the stock above the strike price.

• Income Generation

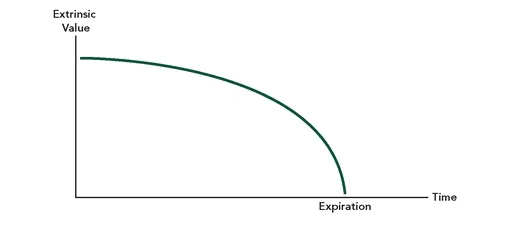

The price of an option has two components, intrinsic value and extrinsic value. Intrinsic value is the amount, if any, that the option is “in the money.” A call option is in-the-money if the stock price is higher than the strike price. Any remaining value is extrinsic value. Extrinsic value is the additional premium carried by an option based on many factors including, but not limited to, interest rate levels, dividend flows, time to expiration, and implied volatility levels. The extrinsic value of an option declines as time passes, and upon expiration it is gone entirely. This phenomenon is known as time decay (see Figure 1.2). Sellers of options benefit from time decay (which is referred to as the Greek “theta”) as the extrinsic value in an option declines over time. This provides income for the investor in a covered-write strategy, as over time the extrinsic value of the written (sold) call will decline.

• Downside Protection

Writing a call also offers some downside protection for the long stock position, as the premium(s) collected from selling the call can partially offset a decline in the stock price. However, this protection is only equal to the amount of the premium collected when the call was written. Once the magnitude of the stock decline exceeds the premium collected, the protection ends.

Figure 1.2 Extrinsic Value Diagram

• Upside Limitations

A covered-write is a neutral to mildly bullish strategy. The reason it is only a mildly bullish strategy is that the profit potential of the position to the upside is limited by the short call. If the stock price rises above the strike price, the short call becomes in-the-money and begins to accumulate intrinsic value as the stock price rises, eventually offsetting any gains in the stock with losses in the short call. Also, if the stock rises above the strike price and the investor takes no action, it is likely for the stock to be “called away” by the owner of the call. This may have unpleasant tax consequences that should be considered.

Modifications

In the event that the underlying stock falls too far, or rises too high, modifications to the position will have to be made to either limit risk, as in the case of the former, or extend the range of profitability, as in the case of the latter. We will discuss modifications later in the chapter. These modifications may increase execution costs, affecting profitability.

RISK MANAGEMENT: THE GREEKS OF THE COVERED-WRITE

The “Greeks” are metrics used to quantify the sensitivity of option prices to changes in underlying market conditions. They can be effective risk management tools and are especially helpful for understanding and managing the risk of positions. They can also be applied to positions that are combinations of options and underlying positions, such as a covered-write. To evaluate the sensitivity of a position to changing market conditions, the Greeks of the various components of the position are simply summed, giving an aggregate exposure for the position. It must be understood, however, that as market conditions change, the Greeks themselves also change, so the Greeks of any position are in a constant state of flux.

Basic pricing models calculate the theoretical price of an option based on six inputs used to describe market conditions:

• Underlying price

• Strike price

• Time to expiration

• Interest rates

• Dividends (if any)

• Implied volatility

Since a covered-write position is part option and part stock, it is the Greeks of the option component of the position that will change; the Greeks of the stock component of the position will remain constant. A brief review of the basic Greeks follows, to help the reader understand how a covered-write position behaves as market conditions change.

THE GREEKS

Delta

Delta describes the sensitivity (rate of change) of an option’s price with respect to changes in the underlying price. Expressed as a percentage, it represents an equivalent amount of the underlying at a given moment in time. Calls are assigned a positive delta (call option prices are positively correlated with the underlying price); puts are assigned a negative delta (put option prices are negatively correlated with the underlying price). The delta of a call option can range between 0.00 (0 percent) and 1.00 (100 percent), while the delta of a put option can range between 0.00 (0 percent) and -1.00 (-100 percent). (See Figures 1.3 and 1.4.) A short position in any of the above call or put options reverses the delta; for example, a short call will have a negative delta and a short put will have a positive delta.

Examples

By what amount can one expect the price of a call with a delta of 0.50 (50 percent) to change if the stock price rises by 1.00?

1.00 × 0.50 = 0.50

Table of contents

- Praise

- Also by

- Title Page

- Copyright Page

- Important Disclosures

- Acknowledgements

- Introduction

- Chapter 1 - The Covered-Write

- Chapter 2 - Verticals

- Chapter 3 - Collars and Reverse-Collars

- Chapter 4 - Straddles and Strangles

- Chapter 5 - Butterflies and Condors

- Chapter 6 - Calendar Spreads

- Chapter 7 - Ratio Spreads

- Chapter 8 - Backspreads

- Appendix

- Index

- About the Authors

- About Bloomberg