![]()

Part I

Banks

![]()

Chapter 1

Introduction

If we were to look at all the trades carried out in the international financial markets we would see that for the majority of them at least one of the counterparties involved in the trade would be a bank. This must say something about the importance of banks in the infrastructure of the markets. The role they play in these trades will differ: sometimes they will be acting as risk-taking principals, buying or selling the financial products for their own purpose, be it funding, investment or trading, and sometimes they will be acting as intermediary on behalf of their customers. When doing this they often take a very time-limited exposure, or even simply execute orders, meaning that whilst their name is on the ticket they never own the risk of the deal. So for these different reasons we will see bank names so prevalent in the market, which begins to explain why the banking crisis of 2007 onwards had such a major impact on all the financial markets.

The financial markets are really about moving money. A market that is working well is one in which those that need funds are matched by those that have funds. This may sound obvious but getting the balance right is not necessarily easy. Not only do the two sides have to find one another but the deal also has to show advantage to both sides to justify entering into it. If a company is looking to borrow money they will naturally want to do this at the best possible rate, but similarly the lender will want to achieve the best return on their funds. So, somehow, the market has to find the rate that achieves these aims for both sides. This is where the market intermediaries come into play. They use their expertise to make this match and to find this balancing rate, either by directing the flow of funds through their own balance sheets or by creating and placing the financial products. At least this is the case at the moment. Maybe as technology and understanding of the markets continue to improve we could ultimately see a market without intermediaries, where all potential buyers or lenders meet all potential sellers or borrowers directly, but the markets of today are not at this stage, at least not across the board. So, for now, we will continue to see the intermediaries fulfilling these functions, facilitating the movement of money. And, of course, the dominant group of intermediaries are the banks.

There are two key models of raising wholesale money that we should take a look at to begin to understand the importance of banks in this world: the first a traditional model of credit banking and the second the disintermediated model.

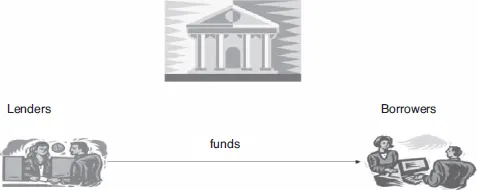

Traditional credit banking is where banks take in funds from their depositors, paying them an interest rate, and then these funds are lent on to borrowers, who in turn pay the bank an interest rate (see Figure 1.1).

The bank’s profit will be the spread between the deposit and the lending rate, but for this profit they must take on the credit risk that exists on both sides of the deal. The risk of a borrower defaulting is clear to see, but there is also a risk that the depositor will want their funds back, a liquidity risk for the bank. This is also a simplistic view of the model, implying that depositor and borrower funds perfectly match one another, when in fact this is very unlikely to happen. Most bank lending is on a leveraged model, whereby they lend out proportionately more than they take in from depositors, and fund shortfalls by borrowing themselves. They will also mismatch maturities, taking in money on, say, an overnight basis, that they will then lend out for longer periods of time, working on the assumption that there will be a steady flow of short-term funds. The failure of this was a major issue for the banks in 2007, and even more so in 2008, when liquidity was so tight that in many cases they simply were not seeing the flow of short-term funds either from their customer base or from their peers in the market. So they found themselves completely caught out in that they could not afford lending they had already made let alone making new loans available. This is one of the reasons the regulators have had to focus so much attention on the reserve balances of the banks as we have seen how vulnerable they can be to changes in liquidity patterns. These reserve balances will provide some sort of protection by essentially buying them time if cash dries up in the marketplace. We will look a little more at how the market provides this liquidity to the banks in the following sections.

The second model, disintermediated financing, shows us an alternative way of funds moving from those that have to those that need. In this model the bank does not stand in the middle of the deal taking on these credit risks, or at least not for the whole period of the loan or investment (see Figure 1.2).

This shows the bank as facilitator in the passing of funds, most commonly by creating the financial products that we outlined in the Introduction to this book. If the party that needed funds were happy to borrow then maybe this would be a bond, a public long-term debt; whilst if they were willing to sell partial ownership of themselves they would issue equity. The bank’s role in this would be to create the product, in the name of the firm needing the funds, which they would then place in the market and try to sell to investors to raise the required cash. This is called the primary market, the market for initially raising funds. During this period the banks may find themselves exposed to some or all of the risk, but their intention would be to spread this as quickly as possible by placing the debt or equity in the market. The bank would then provide a route of liquidity by potentially trading these instruments throughout their lives in what is known as the secondary market. We cannot go too far with this statement because there is nothing in the model that obliges a bank to guarantee liquidity and we cannot always predict if the instruments will have any liquidity years after their initial issue, but more often than not we do tend to see that any liquidity that there is in the products will tend to centre around the firms involved in originally issuing the deal. In terms of cash flow the final net result is the same in both models, the matching of the two end counterparties and movement of funds between the two, but the process is totally different. As we discussed earlier there could come a time when the bank would not need to be in this diagram but all you have to do is to look at any new bond or equity issue coming into the market today to see that we are not at that point. In each case there will be a bank or group of banks bringing their expertise into ensuring this flow of funds works as effectively as possible. And of course in return they will look to be earning income.

Another thing we can see from these two models is how the banking industry has formed itself into reflecting these two ways of doing business. Put broadly, the credit banking model would be the world of commercial banking and the disintermediated model would be the world of investment banking. In the following chapters of this section we will look in more detail at these different types of banking, but a good way to distinguish them is to remember that commercial banking is embedded in core borrowing and lending, whilst investment banking is about raising funds without committing the bank’s balance sheets long-term. In other words, without the bank being the ultimate lender.

In the UK and the US there has been a history of separating these two types of banking business by having different types of institution responsible for each, at least this was so up until the latter part of the 20th century, whilst this has not necessarily been the case in other countries. However over the past few decades the trend has been to integrate rather than to segregate, and so we have seen a series of high profile mergers of commercial and investment banking firms to form the large, dominant universal banks. These are banks that are active in both sides of the industry offering a full range of services to their customers, both wholesale and retail. However having said this we can still see a tendency to internally separate the business, often using different names for the different parts of the firm. A good example of this is JPMorgan Chase & Co. The bank that we see today was formed from a series of mergers beginning back in 1991 with the merger of Manufacturers Hanover Corporation and Chemical Banking Corporation, two of the largest commercial banks in the US. The bank then merged with JPMorgan in 2000, which whilst also a commercial bank, and again one of the largest in the US, was a firm that had spent its recent years, following the beginning of the process to repeal the Glass-Steagall Act, building its strength on the investment banking side. The Glass-Steagall Act was the financial Act that forced legal separation of commercial and investment banking in the US, and we will discuss this further later on. Since this merger, the bank has continued to acquire other banks, notably in 2004 Banc One, and then in 2008 Bear Stearns. All these acquisitions serve to add more strength to the bank’s coverage of the market.

Today the bank divides itself into two business names, JPMorgan and Chase. Under the name of JPMorgan the firm undertakes investment banking business, along with asset management, securities services and private banking, which are all areas involved in financial markets and financial market products. Under the name of Chase they undertake commercial and retail banking. This will include wholesale corporate banking, and the sheer size of their customer base will create for the firm wholesale exposures typical of the credit banking model from numerous smaller size deals. This includes things such as mortgage lending, credit cards as well as the most traditional bank business of borrowing and lending (overdrafts, cheque accounts etc.). So the firm has divided itself to draw some distinction between the two different parts of their business and yet the firm as a whole is JPMorgan Chase, so their customers can benefit from the full range of services. This kind of modelling is mirrored in many firms around the world, often as a result of deregulation that we will examine further in the coming sections.

Following the Financial Crisis there has been a lot of debate over whether the idea of legally separating commercial and investment banks should be reintroduced, with many countries considering this as a sol-ution to the banking crisis and as a preventative measure for the future. Part of this discussion has come about because of the creation of banks such as JPMorgan Chase, which by their sheer size and scope in the market are deemed to be ‘too big to fail’. By this we mean that should these banks find themselves in difficulty, the governments, via the central banks, would really seem to have no choice but to bail them out. Whilst it is to be hoped that these banks should hold enough capital and reserves that they would be able to carry out their business and weather any storms and fluctuations of liquidity, in practice this has not proved to be the case. Instead we have had a situation where widespread inter- vention has been needed to shore up these banks, which has involved using taxpayers’ money, as we have seen in 2008, as it was felt that the impact of their failure would be catastrophic for the global banking infrastructure and thus for the global economic situation. However, despite the many supporters of this change to the segregated model of banking no country has so far decided to introduce this into their banking reforms as at the end of the first decade of the 21st century. In large part this is down to the influence of the banks who would be faced with the task of having to separate these businesses and, potentially, give up lucrative sources of income, and we have often seen over the past few years that losses in one side of the business can to a certain extent be offset by profits in another, helping to support the value of the firm as a whole. It is highly likely, though, that legislation will be introduced in all the major centres focusing on several key issues, amongst which would be ensuring that regulators can efficiently take control of failing banks, limiting the amount of speculative risk taken by banks, particularly those which have received or would be likely to receive taxpayer bailout funds – in particular commercial banks – and providing funding for any bailouts from within the industry so as to reduce the cost to the taxpayer, including looking again at the capital and reserve requirements that should be imposed on the banks by the regulators. In the US 2010 saw finance bills passing through both the Senate and House of Representatives that will need to be merged into a new Finance Act, drawing on parts of both bills, that will incorporate measures to try and address these issues. Similarly in the EU regulators are looking to address the same issues, including the idea of imposing a bank tax to raise bailout contingency funds, but finding pan-European, or indeed international, solutions is never easy. This is particularly so when set against the backdrop at the time of weakness in the credit of key sovereign European borrowers such as Greece, Spain and Portugal, and fears that weakness in these countries could lead to yet more bank failures. So, as of the beginning of the second decade of the 21st century we find ourselves still sitting with a very uncertain picture, despite the return to profitab...