![]()

PART I

ADVANTAGEOUS STRATEGIES

![]()

STRATEGY 1

DECEIVING HEAVEN TO CROSS THE SEA

Explanation

The objective is to create a false impression so the target, or victim, is caught unawares. The plan is carried out under the cover of normal, everyday conditions. The victim is distracted from his concerns.

Origins

There are conflicting origins of this strategy. One concerns a clever trick to deceive the Tang Dynasty Emperor, Tang Tai Zong. The Emperor was known as the Son of Heaven, and in this strategy Heaven is used to represent the Emperor. He did not want to cross the sea so he was deceived into believing he was at a feast when in reality he was under a tent on a boat crossing the sea he feared. He was distracted by food, wine and beautiful dancers.

Another original story concerns the founder of the Sui Dynasty who decided to invade the Chen Kingdom to the south of the Yangtze River. In 589 AD he instructed General He Nuobi to invade the Chen Kingdom. The general camped on the north bank of the river and began to practice military maneuvers. The King of Chen was alarmed and massed his troops on the southern bank of the river. The maneuvers continued, but no attack developed. The King of Chen dismissed the activity as a practice drill and stood his troops down. He Nuobi increased his military activity and instructed his officials to purchase many boats. The Chen forces became accustomed to the on-again, off-again military maneuvers on the northern river bank, and relaxed their vigilance. What was initially frightening had become routine and his forces no longer patrolled day and night. Using his new boats, He Nuobi’s troops launched a night attack and quickly captured the Chen capital, which is present-day Nanjing.

Trader’s translation — using arbitrage returns in rights issues

This strategy affects traders in two different ways. The first is where we apply this strategy to ourselves to enhance our success. The second is where we apply this strategy to the market.

The first application brings success in the market by ‘deceiving’ our inclination to apply previously successful business skills to the task of trading stocks in the financial market. If we are able to deceive Heaven — ourselves — we can cross the sea to the far shores of market opportunity. Although we find ourselves adrift on an uncomfortable sea of uncertainty we must put aside our fears and focus on those elements of everyday events that hold the key to market success while discarding those that hold us back. Uncertainty is defeated by probability, not prediction.

The second application of the strategy is when traders apply this strategy to market trading. We look for concealed advantages lurking under the cover of everyday events. Our objective is to cross the sea — to snatch a profit from the everyday activity of the market that conceals the opportunity from others who are less observant. This is a trading edge and it comes from deceiving Heaven — the rights issuer who wants to raise capital by taking money from us.

In trading terms we find this situation with rights issues. Rights are an expansion of the number of shares available in the company. Rights are issued at a discount to the current share price. For a short time they can be traded separately. Traders add to existing positions or open a new position using a discount entry with a known market price for the converted right. Using these trading methods we deceive Heaven — the way the company intends these rights to be traded — to cross the sea — achieving an additional profit objective.

Traders who own the stock are like consumers ‘hooked’ on a software suite. When the next upgrade comes, they are automatic buyers. Microsoft and other software developers realize that the potential for future sales provides a steady profitable income. When we upgrade to the next generation of Windows we rarely examine the true costs. In the market, when we receive a rights issue we usually do not examine the additional opportunities or the hidden options available in the situation.

The rights issue is really an arbitrage opportunity. These opportunities exist when we can buy a stock in one place and sell it immediately in another place for a better price. A rights issue is the starting point for the strategy. Assume company JiHui issues a 2:1 rights issue. For every two shares you own you are given the right to purchase one share. The company is Heaven in this application of the strategy. Their intention is to raise more capital. Our intention is to cross the sea and make a profit, so we must deceive Heaven. The market gives us the necessary everyday conditions to conceal and implement this strategy.

Rights are generally offered at a discount to the current market price and this provides an arbitrage profit opportunity. The trader dips into his existing shareholding, selling an equivalent number of shares to his rights entitlement. He replaces these sold shares with shares from the rights issue at a lower price. This is an arbitrage short sale and may deliver a 10% to 15% profit.

The strategy is further finetuned to exploit market conditions, boosting returns to 40% or more. This is an almost risk-free return because the strategy is not implemented until we are certain we have captured a profit. We do not sell until the profit is clearly in place. We lock in the profit by taking up the obligation of the company to deliver shares to us at this lower price. We deceive Heaven to cross the sea.

Application 1 — deceiving ourselves

Deceiving Heaven to cross the sea is a beneficial strategy when used to achieve a profitable trading objective. It is a disastrous strategy when it prevents us from achieving our objective. Many people who have successful careers use their entrenched habits and customs when they enter the market. In time, these habits distract them from the dangers lurking in the market. Strategies that bring success in business are likely to bring disaster in the market. The successful businessman often has held on when things were grim only to emerge victorious and profitable because he has controlled the external factors in his segment of the market and outlasted his competitors.

For instance, he may analyze the consumer market to predict a developing shortage of selected services. This analysis gives him the power to control events by opening expanding services to meet the identified demand. To him, it seems that superior analysis means control and this equates with success. Not so in the market, but the idea is difficult to discard because it has given him the wealth to trade in the first place.

Past business success nurtures the unspoken conviction that if he can understand the key market factors or information then he can call the market and make a profit. A small series of successful market predictions helps to reinforce this erroneous idea. Instinctively, we reward ourselves, and others, for being right when they correctly call the market direction.

Eventually, the businessman begins to believe that his understanding of the market means that when he takes a position it must move in his favor. When a position turns against him, he is stunned, and holds on, waiting for the market to reverse and match his previous market call. He rationalizes what he is doing: ‘I have been right before so this will come good,’ or, ‘Perseverance pays, so I will stay where I am.’

The need for control — the need to be right — produces some creative excuses for trading failure: ‘I am surprised the market does not realize the potential of this stock. I will buy more now they have gone lower.’ No matter how foolish these excuses seem in retrospect, the want-to-be trader has to convince himself they are valid because to do otherwise is a larger threat to his self-esteem. Essentially, he struggles to control the market because control of the business environment has brought him success in the past.

The trader makes his profit by controlling the only element he can realistically control — himself. He should apply an analytical framework to improve his understanding of the market so he can make consistent decisions about how he is going to trade the market as it is, rather than the way he would like it to be.

There are many businessmen who successfully make the transition from business to trading. The most successful are those who understand that the rules which allowed them to accumulate business wealth are not the rules that favor trading profits.

In this way, the successful businessman is able to deceive Heaven to cross the sea and reach the further shore to find consistent trading success.

Application 2 — using rights as hidden options

Every now and then the market provides us with an almost risk-free way of collecting a good return. This is a direct result of the mechanics of the market and is not directly related to trends, pattern recognition, or technical analysis. These are arbitrage situations that occur because the current stock price, or stock you hold, has a hidden option.

The objective of the rights issuer is to raise more capital. Our objective is to take a profit from this activity. To achieve this, we must deceive Heaven — the rights issuer — to cross the sea and capture our profit.

We start with the general outline of the strategy, and then put some figures on it. The arbitrage opportunity arises when a company like Highlands Pacific (HIG) issues new shares as a rights issue. These offers allocate shares at a known set price; in this case, at $0.25. This gives existing shareholders the opportunity to add to their shareholdings through a non-renounceable rights or share issue. This means the ‘rights’ to the shares cannot be traded on the open market. It also means, as with any option, you have the opportunity, but not an obligation, to take up this offer. If you reject the offer you are not allocated extra shares so you do not have to pay any money.

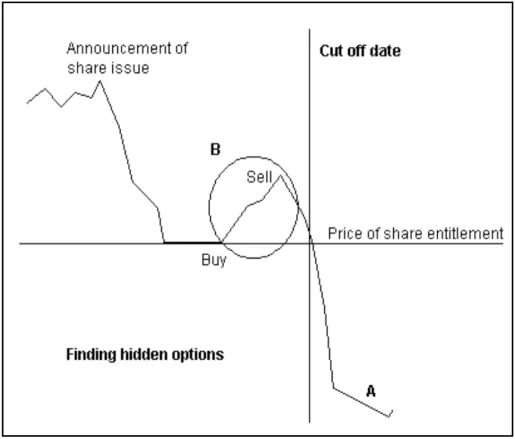

The first step when the offer arrives is to see if the proposed offer price — $0.25 — is less than the current market price. In a bear or nervous market, it is not unusual to find the market has fallen to the value of the rights issue, as shown in figure 1.1. If we accept the offer to buy at $0.25 then the danger is once the closing date for the offer has passed the price will fall, as shown by line A. This result means we have more shares than we started with, and they are worth less than what we paid. This is not a good outcome.

Although ...