Part I: The foundations

What do you want to achieve? Until you know your answer to this question, there’s no point in going forward. Before you start to learn the process of getting to where you want to be you need to work out where that is and what it looks like. You need the destination first; then comes the map to get there. There’s no point taking off on a journey without a map and a destination — you’re gambling on getting where you want to be, assuming that you even know where that is.

Chapter 1: Knowing what you want

It is unfortunate that most people don’t know what they want when looking for a property — especially first-time investors. From the hundreds of thousands of properties on the market in Australia on any given day, investors choose one to purchase. Then they have to organise finance quickly, they waste time looking at many lenders, and they get so confused they end up with a less than perfect financial structure. Then they do their numbers and realise keeping the property will make things a bit tight around the house. So they read a few books on property and decide they could probably do something with the property to make the cash flow better. They ask themselves which strategy they should apply to the property. They then find out that they are restricted because they should have looked at the strategy first, before buying the property. So now they are stuck with what they have and they wonder if they will ever get to their goal.

In fact they should have it the other way around, starting with the destination, that is, their goal. They should decide on a strategy to get them to the goal, and then work out what they can afford. Knowing all this, they should assess the loan product and structure and only then should they start looking at properties.

If you follow this sequence of steps, when it actually comes to looking for a property you will have the search criteria refined so well that you can quickly assess the property.

Obviously, if you know where you’re going everything else has a reference point so you will not be overwhelmed with options each step of the way. In this book we will work our way through these steps. That’s why we won’t even look at how to find a property until part II.

Understanding the asset

Property can be a somewhat volatile asset; perhaps not as jumpy as shares but in any given period — say, two to three years — property prices can be up or down 5 to 10 per cent (yes, down too!). Actually, the 6 per cent price drops experienced in 2011 in Perth and Brisbane were the biggest falls in the property market in more than 30 years (according to a BIS Shrapnel report to QBE, October 2011). What you read about (and I’ll try not to drown you in statistics in this book, even though I love them) in the media — that is, the data they share — is often broad and based on statistical averages, means and standard deviations.

In short, individual properties can actually move up and down in price in opposite directions from the reported trends. I know when everyone was talking about market corrections and falling property prices, my well-placed properties were going up in value. They were in demand, not by chance but because of the research I had done. Over the long term, more than 10 years of property prices in most of our larger cities and towns have achieved long-term capital appreciation. You could buy in a capital city and hope that historical growth would be projected into the future and your property would go up in value. But ‘hope’ is not a strategy. With a well-researched and targeted investment you can do more. You should not be aiming to be average and have average returns; you want the skills to return above-average returns so you can reach your goals sooner.

It’s foolish to expect an unresearched, uninformed property purchase to be a sound investment. It’s possible to purchase a lemon in a lemonade suburb! As a worst-case scenario, you might be forced to sell at a time that is not of your choosing. Having the worst property in the area will not assist you in selling quickly. Your goal should be to have a property that people want to buy (and rent) — one that is always in demand and caters to their needs. No wonder so many people don’t buy investment properties; they have probably heard of all the disasters, many of which were a result of people not prepared to do the work, the reading and the research involved in getting it right.

Regardless of ‘expert’ views that property prices are too high in Australia, we do have a rising income base as well as a shortage of properties and positive population growth. These things contribute to future property price growth.

The great Australian crime

The great Australian crime is happening and no-one knows it. It is the retirement myth and it is a scandal. Here is my ‘40 theory’: we work for 40 hours a week for 40 years to retire on 40 per cent of our income. This is just at the time when we have 40 extra hours a week to do all those things we wanted to do — and you and I know they are going to cost money.

In retirement you need more than what you earn now — well, a whole lot more than the age pension (which is less than $30 000 per year for a couple). I use the word ‘retirement’ in the sense of reaching a stage where you have the financial freedom to do what you want when you want; in other words, a time when you can retire from your 9-to-5 job without financial worries. Obviously, working 40 years to end up with an existence rather than a lifestyle is no-one’s lifelong dream.

I believe people should not trade a life of working hard for a hard life.

So once you decide that the asset class of residential property is for you, you need to determine your goals and how property will enable you to achieve them. Don’t become a victim of the retirement scam.

I want to introduce you to the concept of how just a few well-placed properties can get you $1 million in your bank account (although the reality is that once you start to learn the techniques, the opportunities you discover will lead you to even greater things).

Assuming your exit strategy (we will cover exit strategies in chapter 2) is the easy one of selling your properties and putting the money in the bank, you will need to work out the value of the properties you would need to maintain your lifestyle. If the lifestyle you want to achieve will cost $100 000 per year, multiply that figure by 20 (based on a 5 per cent return) and you will find that you need to have at least $2 million of net assets earning you an income (excluding your home). So that might mean you need $5 million of property to sell with $2 million worth of loans and (after costs) you’ll have to put $2 million in the bank to earn the income you want.

We will look at this later in detail and we’ll also look at costs, and so on. For now, start thinking of the income you want and what you need to get you there. One thing you need to be certain of is when you want this income.

The time frame

Your property investing strategy will be defined by the income goal you set and when you want to achieve it; for example, an income of $50 000 per annum and a time frame of five years. Your property investing strategy is going to be a whole lot riskier than that of a person who wants that same income in 15 years’ time. In this example, to achieve $50 000 per annum in five years, you may be looking at high risk and high reward development type opportunities rather than a buy and hold traditional property investing strategy. Your time frame assists you in identifying the strategy that will get you to your goal.

So, when do you want to have $1 million in the bank?

I am committed to helping Australians believe that they can have $1 million in the bank within a time frame that will actually benefit them and their existing family. I believe that by giving your existing family a better life and better opportunities, you will benefit not just your family now but also pass on your knowledge of the fundamentals of wealth creation to the generations that follow. In addition to helping the individual I believe that educating more people about how to apply low-risk property investing strategies will ensure that future property markets — and your family’s financial future — are built on solid fundamentals. I believe most people buy a property based on a hunch or a tip and wonder why it never performed. This is a strategy of hope, not substance. The strategy you use to choose a property needs to have solid fundamentals so that your portfolio will sustain any economic blips. It should be based on long-term growth and growing rental yields.

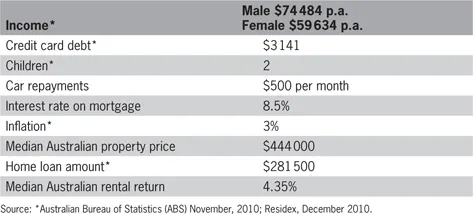

The average family can have $1 million in the bank within 15 years. So what does an average family look like? Take a look at the example in table 1.1.

Table 1.1: statistics on the average family in Australia

I have studied these basic numbers and worked out that with the average long-term capital growth and rental yields, and based on average long-term interest rates, with just two investment properties and one renovation, the average Australian can put $1 million in the bank within 15 years. In fact, if they pay particular attention to my techniques on locating a property to invest in they can do it sooner.

You don’t have to be one of the 14 580 people who — according to the Australian Taxation Office (ATO) — own more than six investment properties. You just have to have two investment properties located in the right areas bought in the next five years with one small renovation to get you to $1 million.

You can achieve a comfortable lifestyle for your family by having two well-bought investment properties that fit your strategies, time frames and goals.

This book not only assists you in setting your goals but takes you by the hand and guides you through the process of doing this for yourself. The key to this is to have solid foundations and to set yourself up correctly first, and then to find the properties with good capital growth and rental yields in the areas where you are considering buying.

The magic rule of 72

There are some considerations you need to learn that will enable you to actualise your goals. Like most things, first of all it comes down to the dollars. In the language of property investing, this is capital growth and rental yield. Rental income enables you to hold your property portfolio during your accumulation phase. Capital growth is the factor that enables you to build your portfolio and cash out to live the lifestyle you want.

There is a nifty little equation that helps you look at the relationship between capital growth and the time to get to your goals — one of those property investing rules of thumb. In this case, unlike most of the figures in property investing, you can’t prove it, you just believe — just as you always know for every pair of socks that go in the washing machine one will never be seen again.

The rule of 72 enables us to calculate how long it will take for a property to double in value. This is important in that it not only relates to the passive income you need because it is directly related to the value of your property portfolio, but it also helps you work out the time fame required for ach...