![]()

Part I

A Practical Guide to the Industry

![]()

CHAPTER 1

Understanding Returns

The purpose of this chapter is to bridge the gap between the world of conventional money management, where return has a natural and well-understood meaning, and the world of futures, where the idea of return by itself makes no sense. The disconnect between the two markets is simply this: Real assets tie up real cash. To buy a portfolio of real stocks, for example, one invests real cash. The stocks then spin off dividends, which constitute part of the return, and the prices of the stocks rise or fall, which constitutes the rest. The resulting gains or losses are converted into a return using a denominator equal to the value of the cash invested in the stocks.

Once you leave the world of fully invested, conventional assets, reckoning returns becomes more of a challenge. What, for example, is the return to a long/short strategy in which the market values of your positions are exactly offsetting? This is, in fact, the case with futures, which behave like fully leveraged or geared positions in the underlying commodity. Their purpose in applied finance is to capture changes in the price of the underlying, which allows them to be used equally well for both hedging and trading. The real usefulness of futures stems from the fact that they are almost always less expensive to trade than are their underlying commodities. And in the hands of CTAs, they are building blocks from which highly diversified portfolios of positions—both long and short—in the world's financial and commodities markets can be built.

To understand how a CTA works and how to interpret a CTA's returns, you need to know a few key things about how futures and the futures industry works. In the sections that follow, we cover most of what you will need to feel comfortable with the industry. The key points include:

- Risk and cash management in futures markets

- Trading levels, funding levels, and the idea of notional funding

- Stability of CTAs’ return volatilities

- Basic futures mechanics (using S&P 500 futures as a worked example)

- Managing cash and collateral

- A typical trend-following CTA's portfolio of futures

- Converting profits and losses into returns and return volatilities

- Different share classes in CTA funds

Risk and Cash Management

Although futures are like forwards in the sense that they both behave like fully leveraged positions in the underlying commodity, the futures industry has must stricter risk and cash management practices than the over-the-counter derivatives market. And the way the futures market approaches risk has important implications for the way CTAs do business and for the way you may choose to invest in this market.

As a stepping-off point, consider these three key points:

1. Futures markets require gains and losses to be settled in cash daily.

2. Futures contracts have no net liquidating value.

3. Futures markets require participants to post collateral to cover potential daily losses.

The first point has important consequences for the way you organize your investment in CTAs. The practice of settling up gains and losses every day in cash produces an ongoing stream of small transactions costs. Minimizing these costs is an important objective for CTAs and their investors. The cash that flows into or out of your account also affects your ultimate return. Cash that flows in can be invested, while the cash that flows out must be financed, either explicitly or out of pocket.

The second point actually follows from the first and is truly fundamental. Because all gains and losses are settled in cash daily, futures contracts never have any net liquidating value except for whatever they accumulate over the course of a single trading day. As a result, there is no natural denominator for reckoning the return on a futures position.

The importance of the third point also becomes apparent when you decide how to structure your investment in CTAs. In Chapter 3 we walk you through a decision process that allows you to compare an investment in CTAs’ funds with an investment in managed accounts, or with a hybrid investment using a CTA investment platform. What you earn on any cash or collateral invested in a fund or posted as collateral in a managed account is part of your return. You also care about the security of your cash investment.

Trading, Funding, and Notional Levels

To cope with these features of the futures market, the CTA industry has adopted three specialized terms that investors must know—trading level, funding level, and notional level.

The three terms can be defined as:

Trading level: Trading level is simply the choice of denominator. It is the dollar number that the CTA uses to translate futures profits and losses into returns. It is also the dollar number that the CTA uses to calculate ongoing management fees.

Funding level: Funding level is the total amount of cash or collateral that you post or invest. The rock-bottom minimum funding level for any futures position or portfolio is the total value of margin collateral required by the various futures exchanges.

Notional level: Exchange margins tend to be small relative to the face values or portfolio equivalent values of the contracts themselves. And in a diversified portfolio of futures contracts, the actual day-to-day risk in the portfolio can be smaller still. As a result, funding levels can be lower than trading levels. If they are, the difference between the trading and the funding levels is known as the notional level or as notional funding.

The Stability of Return Volatilities

One of the important consequences of the way CTAs approach their choice of trading level is that they can control the volatility of their returns. For that matter, unlike real money managers, who must live with the return volatility they are given in their respective stock and bond markets, CTAs appear to actively manage the size and mix of their futures positions so that, given their choices of trading levels, their returns exhibit a high degree of predictability from year to year.

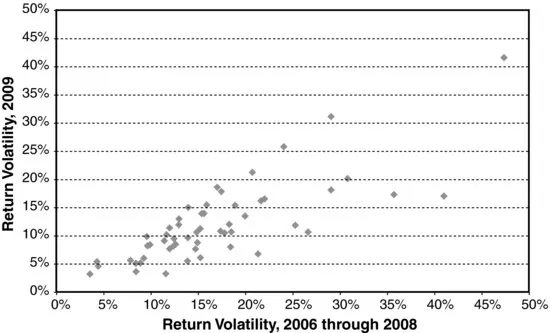

Exhibit 1.1 illustrates this point. For a collection of 54 CTAs (chosen because they all had $100 million or more under management and four years of reported returns), we have calculated the annualized volatilities of reported returns for 2006 through 2008, which are measured on the horizontal axis, and for 2009, which are measured on the vertical axis. We say a lot more about this in Chapter 11, but for now it is enough to know that this kind of relationship is typical. You can choose nearly any look-back and look-forward periods you like, and you will find that a CTA whose returns are low this year (or for the past two or three years) will be likely to have low returns next year (or for the next two or three years).

This kind of predictable return volatility is extremely helpful when constructing portfolios of CTAs.

Basic Futures Mechanics

Most of what you need to know about futures and futures markets can be illustrated using one of the industry's most actively traded contracts—the E-mini S&P 500 contract. It is especially helpful that the underlying is a widely recognized index of stock prices and that the futures contract, when combined with the appropriate amount of cash, can behave like a small diversified portfolio of stocks. In this section, we cover basic contract terms, the S&P 500 futures contract, cash/future price relationships, and combining futures with cash to create a synthetic stock portfolio.

Contract Terms

Strictly speaking, futures are governed by exchange rule books, which lay out in considerable detail just how various members of the exchange are to deal with the exchange and, if they have any, with their non-member clients. Many of the rules are common to all of the futures traded on the exchange, but each futures contract requires a few key contract specifications that govern that particular contract. These basic terms include, at a minimum:

- A definition of the underlying commodity or index

- The dollar (or other currency) value of a 1-point change in the price of the commodity or of the value of the index

- The minimum change in the futures price

- The months in which the contract expires

- Last trading day

- Final settlement terms

- Ticker symbol(s)

- Limit price moves

The exchange, or its clearing house, also determines the amounts of margin collateral that must be maintained by the clearing broker to support any open futures positions.

The S&P 500 Futures Contract

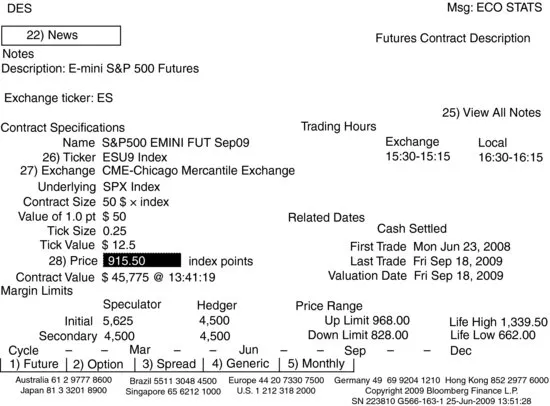

All of the important features of futures can be illustrated with the E-mini S&P 500 futures contract. The relevant contract terms, as they apply to users, are shown in Exhibit 1.2, which is a standard page available on Bloomberg. In this case, we are looking at the September 2009 contract. Its ticker symbol is ESU9, in which the ES stands for the E-mini S&P 500 contract, the U stands for September (don't ask), and the 9 stands for 2009. It is typical to use a 2-letter code for the market, a 1-letter code for the contract's expiration or delivery month, and a single numeral to describe the year.

The underlying is the SPX index, which is simply the S&P 500 stock price index. The contract size is said to be $50 times the value of the index, which means that each index point is worth $50. The tick size is the minimum price change allowed by the exchange and is set at 0.25 price points, which makes the value of a tick $12.50 [= $50 · 0.25]. The value of the contract's price at the time this snapshot was taken on June 25, 2009 was...