![]()

Part 1

The Emergence of Philanthropic Planning

Philanthropy is defined by Webster's as “works or endeavor, as charitable aid or endowments, intended to increase the well-being of humanity.”1 The etymology literally translates to “loving mankind.” Throughout its history, the United States has fostered a sense, or a culture, of philanthropy. Rather than rely upon the government to meet the needs of others, those who could afford to make a gift provided for the common good. This approach contrasts sharply with Europe, where the government has a much more significant role in providing for the poor, funding research, providing social supports, and more.

The basic idea that people should help and support one another is a core tenet of philanthropy in the United States. While that culture has always existed, it has evolved over time from a very basic, simple idea of those with more supporting those with less, to a complex system of laws and charitable giving incentives which allow those who are so inclined to make charitable gifts which meet their own needs while also supporting the charities about which they are passionate.

The first part of the Companion reviews how from the time of Benjamin Franklin to today the fundraising marketplace has evolved. It starts in Chapter 1 with a short history of fundraising and how different donor views, shaped by generational cohorts, impact how Americans view philanthropy. Chapter 2 discusses the living generational cohorts and how the events occurring during their formative years have shaped their world view and their views on philanthropy. It identifies the “New Philanthropists,” those born since 1946, whose giving behavior is proving to be motivated by different factors than the generations which came before them. Building on donor behavior, Chapter 3 outlines how charities should identify the best prospects within these cohorts, using the Philanthropic Planning Pyramid and donor loyalty to create a fundraising matrix which can be used to determine the best prospects to approach and the sequence to approach them. Addressing the role of the Board of Trustees and volunteers, Chapter 4 discusses the critical need to engage leadership in the philanthropic planning process. New Philanthropists will not give to charities unless they have a firm belief in the mission and can readily identify the dedication of the Board for carrying out that mission. The final chapter in Part I outlines the role of professional advisors in the philanthropic planning process. It suggests ways that advisors and fundraisers need to work together in the philanthropic planning process to ensure the personal planning and charitable goals of the prospect are met.

![]()

Chapter 1

The Changing Fundraising Marketplace

There has been significant evolution in the fundraising marketplace over the last 250 years. When Benjamin Franklin, considered by many to be the father of fundraising in the United States, started his first subscriptions (the precursor of the capital campaign), he noted that people give because they want to achieve a goal. He warned against asking just those who the charity believes will give, and reminded charities not to “over-solicit”. He understood that donors made gifts because they wanted to create impact or achieve a long-term outcome.2

The Great Depression brought with it great demands on the charitable sector. With such a range of needs, donors learned to trust charities to put gifts to work where the need was greatest. The Traditionalists (people born pre-1946), made up of the Depression Cohort, the World War II Cohort, and the Post-War Cohort, grew up in this culture and it shaped giving over their lifetimes. In the 1960s, when the Older and Younger Baby Boomers were in their formative years, they developed an inherent distrust for the establishment, including charitable causes. This distrust grew with Generation X and the Millennials who followed them. Chapter 2 will provide detailed information about these generational cohorts and their behaviors.

In the approach to retirement, as the Older Boomers have sought for more meaning in their lives, they have engaged with charities in dramatic ways. This involvement though, has been fundamentally different than that of the Traditionalists. Because the Older Boomers still distrust charities, they demand accountability. They limit their unrestricted giving compared to the Traditionalists and they have returned to Franklin-era values by demanding to see the impact and long-term outcomes of their philanthropy and asking for both accountability and verifiability. They also seek to integrate their philanthropy into their overall tax, estate, and financial planning.

Most fundraising programs today were built during the height of giving from the Traditionalists. Their methodology and systems were built around the needs of the charity rather than focusing on the goals and objectives of the donors. As the Older and Younger Boomer Cohorts have reached their peak earning and giving years with a fundamentally different approach to philanthropy, charities have been slow to adapt their methodology and systems to meet the needs of these generational cohorts, attempting to fit them into a giving model designed for the Traditionalists.

For charities that want to continue to ignore this change in donor motivation, the news only gets worse. Generation X and the Millennials not only want to see the impact and outcomes from their philanthropy, they also want to be meaningfully engaged in shaping the programs they support. Those charities which cannot adapt will find that they have been left behind or passed by charities which meet the needs of their donors using a donor-centered, philanthropic planning approach.

The Evolution from Deferred Giving to Philanthropic Planning

From the advent of the first fundraising programs, donors were asked to include the charity as a will beneficiary. These deferred giving programs were focused heavily on meeting the needs of the charity without a great deal of concern for the donor. As early as the seventeenth century, the Reformed Church offered the first charitable gift annuity as a means for donors to make a gift and receive income back, largely as an enticement to get the gift in the door.

When an income tax was passed in 1917, it permitted individuals to deduct charitable contributions, but this incentive mainly encouraged annual giving. Its purpose was to avoid individuals paying income tax on monies that they were voluntarily giving to charity and for which they would get no benefit themselves.

When Congress passed the Tax Reform Act of 1969, it codified deferred giving options beyond the charitable bequest and charitable gift annuity, such as the charitable remainder trust. The focus of deferredgiving programs moved from the needs of the charity to the selection of the right charitable giving vehicle or tool and the tax benefit of the particular gift form. Robert E. Sharpe, Sr. coined the term planned giving for the industry, highlighting the change in approach from gifts that would mature in the future to gifts which required an element of tax planning. A common definition for planned giving has been the integration of sound personal, financial, and estate planning concepts with the individual donor's plans for lifetime or testamentary giving. As a complimentary fundraising activity, it helped individuals with charitable intent to make the largest gift possible with the right asset, in the most advantageous form, and at the most appropriate time. At least that was the idea.

The 1990s saw the advent of the gift planning program. Gift planning programs put the focus on meeting the needs of the donor in a donor-centered approach, rather than pursuing the needs of the charity first or the gift vehicle involved. The Partnership for Philanthropic Planning (PPP, formerly the National Committee on Planned Giving or NCPG) defined charitable gift planning as the process of cultivating, designing, facilitating, and stewarding gifts to charitable organizations. The PPP definition states that charitable gift planning:

- Uses a variety of financial tools and techniques for giving.

- Requires the assistance of one or more qualified specialists.

- Utilizes tax incentives that encourage charitable giving, when appropriate.

- Covers the full spectrum of generosity by individuals and institutions, and is based on powerful traditions of giving in the United States.3

From Structure to Planning

The charitable gift planning model incorporates the very best of the deferred giving and planned giving programs of the past while meeting the needs of the donor using a donor-centered approach. In May 2007, the NCPG Strategic Directions Task Force issued a report on the needs of the gift planning industry going forward. The task force, led by Chris Yates, then of Stanford University (now at the University of Southern California), found that “Sophisticated planned giving officers have changed their emphasis from structure of the gift to impact, becoming more donor-centered and holistic in their approach. Planned giving is being incorporated in a “cycle” of philanthropy.”4

While a few sophisticated charities today utilize this model, many more traditional non-profits still use the older planned giving and deferred giving models. Regrettably, these three terms are often used interchangeably in the industry, so prospects and professional advisors have no real way to know if the charity involved is focused on the needs of the charity, the tools, or the donor.

To complete the transformation to philanthropic planning, particularly for the top 10 percent of all donors, these models need to take the next step of integrating charitable gift planning with the needs of Older and Younger Boomers, Gen X, and Millennial donors in a more sophisticated way that not only helps them meet their charitable goals, but also integrates their philanthropy into their tax, estate, and financial planning using a comprehensive strategy. Not only does such an approach make it more likely that donors will maximize their philanthropy, it also ensures that they will craft a more meaningful legacy for their families and the charities they support.

It will require charities to develop significant relationships with their donors to understand what impact they want to have today, what outcomes they hope to achieve for tomorrow, and what legacy they desire to create during their lifetimes and beyond.

In order to reach this goal, charities can no longer work directly with donors without involving professional advisors. Professional advisors have access to the important details about their client's tax, estate, and financial planning. Their expertise is critical to the philanthropic planning matrix. Charities, donors, and professional advisors must work collaboratively to coordinate all of the different variables to fully integrate donor wishes into overall planning. When such an approach is implemented, the result is the creation of overall plans that:

- Meet donor personal planning goals.

- Reinforce and pass donor values to future generations.

- Create meaningful legacies for the donor, the donor's family, and the charities the donor supports.

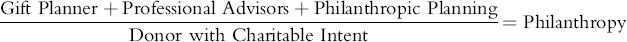

These combined charitable, estate, and financial plans will be tax efficient and values based, ensuring that the donor/client is able to realize a vision of philanthropy. This philanthropic planning model can be illustrated graphically as follows:

The model depicts a planning situation where a donor/client with charitable intent is the common denominator and a gift planner (or fundraiser) working with the donor's professional advisors can complete a philanthropic planning process that leads the donor to b...