![]()

CHAPTER 1

The Search for a Universal Market Law

The Rise of AbleTrend

I don’t know its name. If we must give it a name, let’s call it “Tao.”—Tao by Lao-tzu

The AbleTrend trading system software was first developed in 1994 and was released to the market in 1995. It is now used by tens of thousands of traders in more than 60 countries. Many of these users have been trading market symbols that we in the United States have never even heard of, and yet it still works.

People have asked us “how often” we have to change our formula in order to keep it working properly in today’s fast-changing global markets. Our answer is: not at all. The formula has remained the same as when it was first created. It worked in any market then, and it works now. It is timeless.

As a developer of AbleTrend, I am asked very often how AbleTrend was developed. What are the principles behind it? What is the underlying philosophy? This chapter addresses these most-asked questions.

COMPLETE CHAOS OR HIDDEN ORDER?

These are common questions that I am most often asked by traders:

• Is market behavior random or does it follow certain rules?

• Is the market completely chaotic or is there a hidden order?

• Can markets be quantified or predicted using scientific methods?

Most economists believe that markets are random, chaotic, and cannot be predicted. A very smart man once told me, if you could know just a little bit of the market law, the world would be yours. But most people just don’t believe there is such a thing as market law.

I believe my work has proven them wrong. Because of AbleTrend, the order that underlies market movement can now be easily plotted on charts. Figures 1.1 through 1.5 show the buy/sell signals and support resistance levels provided by AbleTrend in several different times of financial crisis. As you can see, AbleTrend never missed any big moves. Looking at these charts, what do you now think? Is the market completely chaotic, or could it be possible that there is a hidden order?

• During the economic crisis of 2008 to 2009, an AbleTrend sell signal was given on 9/4/2008, before the big market drop, and a buy signal was given on 3/13/2009 before the market soared in 2009 (see Figure 1.1).

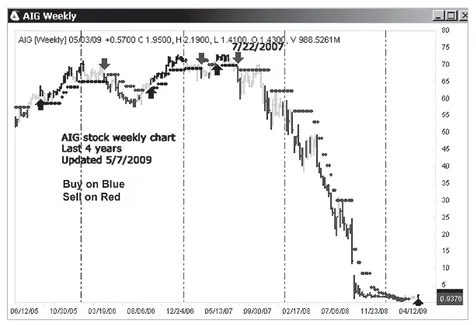

• Figure 1.2 shows the AIG stock chart from 2005 to 2009. A sell signal for AIG stock was given on 7/22/2007, and the stock lost 99 percent of its value from there.

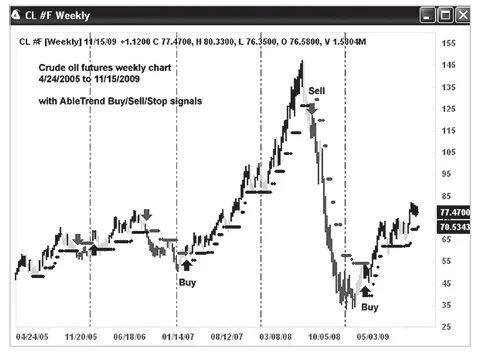

• The crude oil futures weekly chart from 2004 to 2009 is depicted in Figure 1.3. The buy and sell signals of AbleTrend caught the big moves for all major up and down trends.

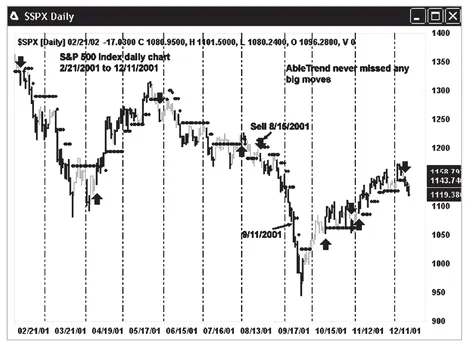

• Figure 1.4 shows the S&P 500 index chart in 2001. The AbleTrend sell signal was one month ahead of “9/11” of 2001 and the big market drop.

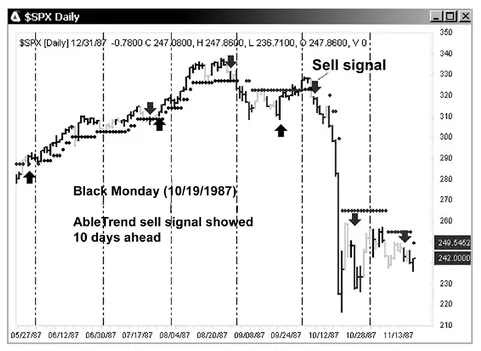

• Figure 1.5 depicts the S&P 500 index chart in 1987. The AbleTrend Sell signal was 10 days ahead of “Black Monday” (10/19/1987), the 1987 stock market crash.

FIGURE 1.1 S&P 500 index chart 2008 to 2009. AbleTrend gave a sell signal on 9/4/2008, before the economic crisis hit.

FIGURE 1.2 AIG stock chart 2005 to 2009. A sell signal for AIG stock was given on 7/22/2007. AIG lost 99 percent of its value after that.

FIGURE 1.3 Crude oil futures weekly chart. Last five years, updated 11/15/2009, showing buy and sell signals given by AbleTrend.

FIGURE 1.4 S&P 500 index chart in 2001. A sell signal was given one month ahead of 9/11/2001.

FIGURE 1.5 S&P 500 index chart in 1987. The AbleTrend sell signal came 10 days ahead of “Black Monday” (10/19/1987), the 1987 stock market crash in the United States.

From these five examples, we can see the signal accuracy of AbleTrend. This indicates that there must be a sound principle, or hidden order, behind the markets—and that AbleTrend is able to tap into it. Chapters 2 and 4 discuss this in more detail.

It’s important to note the advantage of AbleTrend over arbitrary wave analysis, which is a popular method of analyzing charts. Wave analysis draws areas on a chart (1, 2, 3, 4, 5, ...) that change position as market conditions change. For example, one popular wave analysis software initially marks wave “3” as a bottom. However, when the market keeps down in the next 10 bars, it removes the previous mark “3” and reassigns all the previous waves. It changes all marks on the chart to fit the facts, after the fact. How can you rely on that kind of market analysis?

By contrast, AbleTrend signals are dynamic during the formation of the bars. But once the bar closes, the signals generated by AbleTrend do not change. They remain the same as they were when they were first generated because the formula that created them is accurate. This means that AbleTrend signals are valuable and have practical power in real-world trading.

WHEN MY INTEREST IN TRADING BEGAN

To fully appreciate the revolutionary nature of the AbleTrend approach to trading, it would be helpful for you to understand why and how I developed it. AbleTrend did not just appear one day. It naturally evolved when a lifetime of training allowed me to take a unique perspective on a newfound interest in trading the markets.

The fact is, I have been a scientist all my life. I have tried to treat every project with scientific approaches.

I earned a B.S. from the University of Science and Technologies of China, where I studied under some of the finest scientific minds in the country. I then went on to earn my master’s degree in quantum chemistry from Zhongshan University, China. Having been awarded a Regency Fellowship of the University of California (UC), I came to the United States in 1982 and earned a Ph.D. in chemistry from UC Santa Cruz in 1988.

With all my studies, my greatest interest has always been to discover the hidden structure underlying life’s apparently “random” events. So perhaps it was not really an accident that led me to turn my analytical eye to one of the world’s most seemingly chaotic phenomena—the financial markets.

It all started when I was working at a leading gas analyzer company in Silicon Valley, California. It was 1989, and a friend induced me to invest $10,000 in an S&P 500 futures trading pool. My friend told me that it returned 10 percent a month. He had received returns of $3,000 in the last three months and planned to invest even more. At that time, I knew nothing about trading. That’s why a 10 percent return per month didn’t set off any alarm bells within me that it might be too good to be true. Two months later, the Commodity Futures Trading Commission (CFTC) shut down the investment company, which was revealed to be a multimillion-dollar Ponzi scheme. I lost $7,000 of the $10,000.

This incident actually turned out to be a good thing for me. It introduced me to a whole new world—the futures and commodity trading industry. And rather than scaring me off, it triggered my scientific curiosity about trading.

A SCIENTIFIC ANTIDOTE TO ARBITRARY MARKET PREDICTIONS

For all my life I had been steeped in the world of physics. But now, thanks to my friend who had introduced me to the world of investing, my interests broadened to include financial matters. But I was still a scientist, and the more I became interested in trading the markets, the more my scientific sensibilities were offended by the arbitrary statements and predictions of the market gurus.

From TV to radio, from magazines to newspapers, from web sites to books, investment experts talk about “what the market should be doing.” They say things like, “The Dow Jones index should go up 10 percent by the end of this year.” Or “The target price for this stock should be $78 per share in 12 months.” Or “AIG is the blue chip of blue chips; it should come back to $50 per share.” Or “...with such bad news the market should sell down.” The opinions never stop.

One recent example is the market response to the news that the Royal Bank of Scotland (RBS) had announced the largest annual loss in UK corporate history on February 26, 2009, with a total loss in 2008 amounting to 24.1 billion British pounds. According to the report, RBS was planning to put 325 billion pounds worth of toxic assets into a scheme that offers insurance for any future losses. When this terrible news hit, many experts thought RBS prices should plunge as traders would sell their stock. But RBS’s stock price soared 30 percent on that day! Sellers were deeply astonished by the market behavior. In fact, there is no such thing as “should,” or “would,” or “could” in the trading world. What people tell you has no value. If you want to win, there is only one way to go: Act on what the market is telling you. Go in the direction that the market is going now.

Even the most celebrated gurus are not immune to arbitrary predictions. Warren Buffett bought stocks of General Electric (GE), Goldman Sachs (GS), and other stocks in October 2008. He thought it was a good time to buy. However, in March 2009, GE dropped from $22 to $7, and GS from $115 to $75. His Berkshire Hathaway stock price dropped nearly 50 percent from the top within five months. Steve Forbes predicted crude oil would come back to $30 per barrel in February of 2008. At that time oil was priced at $70 per barrel. However, in fact, oil reached $146 per barrel in July 2008. Most airlines experienced huge losses in 2008 by “hedging” (buying) crude oil futures in the second half of that year. They were not expecting what happened next: Oil prices dropped from $146 to about $35 per barrel at the end of 2008. And of course, not knowing where to turn or who to listen to, thousands and thousands of retirement plan investors lost 40 to 50 percent of their account value in 2008 as the stock market plunged.

All these facts made us see the urgency to write this book and introduce the public to a different approach to investment and trading. You see, at every key turning point of the markets, AbleTrend provided clear market directions, buy or sell signals, and specific support and resistance levels. If more and more people knew the concepts of AbleTrend, or perhaps had access to the AbleTrend software, losses like those mentioned here could be avoided. I believe that public awareness of AbleTrend could be of benefit to many people.

FIRST STEPS: BECOMING AN EASYLANGUAGE SYSTEM DEVELOPER

The S&P 500 index futures contract was launched in 1986. Trading futures was still relatively unknown to many people in 1989, the year I first discovered the markets. But by the following year, System Writer (later called TradeStation) EasyLanguage was introduced. It was a computer program that allowed people to develop technical analysis tools such as market indicators and trading systems.

The idea of using computer technology to approach the markets appealed to me, and I decided to look into it further. With my strong background in software programming, I quickly became a certified EasyLanguage expert. At the same time, I studied many of the reputable trading books that were available, and I tested their trading ideas.

In 1990, I began reading many books about trading and took trading workshops from Larry Williams, George Angell, Larry McMillan, et al. Among those master courses, the way Larry Williams used TradeStation’s EasyLanguage to write indicators and trading systems significantly impacted my approach to trading. His introduction to Money Management (MM) piqued my initial interest in this topic and was the reason why I later built MM into AbleTrend.

In 1992, I created the Spyglass trading system, which was sold through George Angell. The system was discussed in his book Inside the Day Trading Game: Putting a Spyglass on Profits (1994). I joined George to give workshops on the “Spyglass trading system” around the country.

During the five years from 1989 to 1994, I tested the validity of over 500 market indicators that purported to describe and predict price activity. I also created over 100 indicators of my own. Among the indicators I developed, one of them—which I now call the “AbleTrend” indicator—was, and continues to be, the most fundamental and robust. The purpose of this book is to explain and demonstrate what AbleTrend is all about.

By the early 1990s, trading the markets had become serious business to me. In 1995, my wife, Grace, and I became commodity trading advisors (CTAs) registered with the Commodities Futures Trading Commission (CFTC).

THE TREND: FOE OR FRIEND?

In the 1990s, a well-known market analyst published an article titled “The Trend Is Your Enemy: Avoiding Trading Trends.” He stated that trading trends may be avoided by means of using the two moving averag...