![]()

Part I

GETTING STARTED IN UTILITIES

![]()

Chapter 1

UTILITIES BASICS

It’s 7:30 a.m., and if your alarm clock was working, it would have woken you for work an hour ago. The cold wakes you instead—it’s only 40 degrees in your bedroom. Near hypothermic, you flip the light switch—nothing. Grumbling and very late, you blindly stumble out of bed, stubbing your toe. You painfully hobble toward the kitchen for a redeeming hot cup of coffee. Sadly, there’s no water coming out of your faucet. Cold, caffeine-less, and cantankerous, you leave for work hoping your job is still waiting for you.

Utilities may not have sexy brand names or occupy skyscrapers on Wall Street, but the sector will get your attention if your electricity, gas, and water are turned off at six in the morning. The Utilities sector plays a critical role in both our personal lives and the global economy, and can serve an equally important purpose in an investor’s portfolio.

It’s likely most people don’t worry about understanding how the Utilities sector operates. But for investors, understanding key aspects of the sector—the tremendous amount of investment required to build utilities infrastructure and the complex regulations involved in pricing the services, for example—is critical in determining how Utilities stocks behave, when to overweight or underweight Utilities, and what types of Utilities stocks are likely best for the prevailing economic conditions, political environment, and market sentiment.

This book’s aim is to help you become a better investor in the Utilities sector by teaching you to think critically in order to form your own investment views. To succeed, you don’t need a set of hard-and-fast investment rules, much less an MBA or a PhD in electrical engineering. Rather, all you need is an understanding of what makes Utilities more likely to perform better or worse than the market overall.

It’s not trivial, but once you understand the sector’s characteristics and most important investment drivers, you can begin forming those opinions for yourself. And to get you to that point, we’ll first cover Utilities 101.

UTILITIES 101

Utilities sell electricity, natural gas, and water—three of the most important commodities on the planet. You probably use all three when you turn on the lights and wash your face, and no matter where you work—or go to school—you’re probably using at least one of them all day. Utilities are, without a doubt, a critical part of the fabric of the modern era: Gas heats our homes, cooks our food, and powers many of our factories; access to clean water is critical to human health and hygiene; and electricity is the lifeblood of the world as we know it—without it, economic productivity would plummet, modern technology would cease to function, and life would become much more difficult.

Although all three commodities are essential to modern society, electricity is by far the most important to the Utilities sector (water distribution, while obviously important, remains largely controlled by municipalities). Most investor-owned utilities are, to some extent, involved in the generation, transmission, or retail distribution of electricity. Because so much of the sector—about 90 percent, depending on how you measure—is involved in the electricity business, we’ll spend most of this book focused on the Electric Utilities industry. (Also, to clarify, you’ll notice when we refer to the Utilities sector or a Utilities industry, like Electric Utilities, that’s capital “U” Utilities. When referring to firms within the Utilities sector, those are lower case “u” utilities.)

However, though the commodities are different, the Gas and Water Utilities industries share many of the same underlying characteristics and business drivers with the Electric Utilities industry—in many cases, utilities operate in multiple industries and sell two or even three of the commodities. So while many examples in this book may come from the Electric Utilities industry, the lessons are very often applicable to all the sector’s industries.

While each industry has its differences and firms have their own unique characteristics, utilities overall share the same general characteristics. Typically, the Utilities sector:

- Has very defensive characteristics

- Produces goods and services with inelastic demand

- Is very capital intensive

- Is heavily regulated

A DEFENSIVE SECTOR

The Utilities sector has traditionally underperformed when the market rallies, but when the market falls, Utilities often remains relatively resilient. For broad stock market investors, this is the sector’s defining characteristic. (Investing professionals sometimes jibe that Utilities is the “widows-and-orphans” sector—best for those with less of a stomach for market volatility.) And as a typically defensive sector, it can be a useful (and at times powerful) risk management tool to help reduce overall portfolio volatility, generate investment income, and help take the teeth out of a bear market.

Best in a Bear

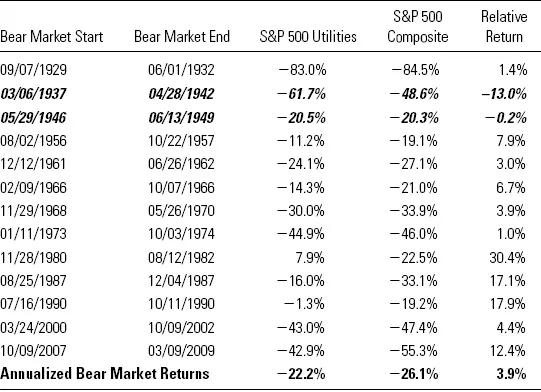

In any given year, one could say the stock market can really only do one of four things: It can go up a lot, it can go up a little, it can go down a little, or it can go down a lot (a bear market). During a bear market, most sectors, if not all, will fall—even those considered defensive (Health Care, Consumer Staples, and Utilities). But in a bear market scenario, though Utilities may also be down on an absolute basis, the sector is also most likely to outperform the market—on a relative basis. Table 1.1 shows the annualized return for the S&P 500 and the S&P 500 Utilities sector during the last 13 bear markets. As you can see, Utilities underperformed only twice. Most times, Utilities outperformed the broader market during a bear.

Table 1.1 S&P 500 Utilities Versus S&P 500 Composite in Bear Markets

Source: Global Financial Data, Inc.; S&P 500 Utilities Total Return Index, S&P 500 Total Return Index, from 08/31/1929 to 03/09/2009.

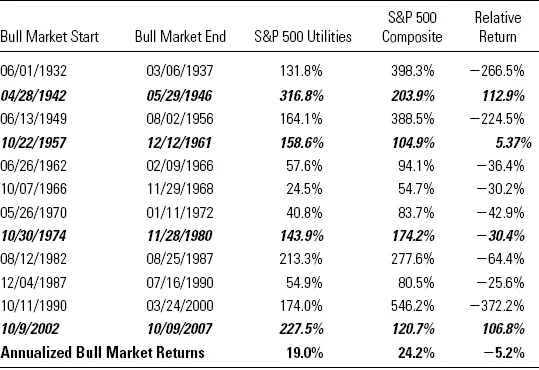

However, during bull markets, Utilities’ limited leverage to a booming economy means Utilities underperformed in 8 out of 12 of the last bull markets (shown in Table 1.2). Again, note that in a bull market Utilities can rise too, just likely not as much as the broad market. And in a bear market, it can be down. What we are focusing on is its performance relative to the broad market.

Table 1.2 S&P 500 Utilities Versus S&P 500 Composite in Bull Markets

Source: Global Financial Data, Inc., S&P 500 Utilities Total Return Index, S&P 500 Total Return Index, from 08/31/1929 to 03/09/2009.

Bear Market Utilities Bets

Utilities has, throughout history, fairly consistently outperformed during bear markets and underperformed during bull markets. Consider this: If you’d invested $1 million into the S&P 500 Composite in 1929, you’d have earned about $1 billion by the end of 2009.1 However, if you’d played defense by putting your entire portfolio in the Utilities sector during every bear market, you’d have nearly twice as much.2

Sounds great! Except such a move is likely foolhardy for most investors. It’s extraordinarily difficult to call the top of a bull market and the bottom of a bear market, and even more difficult to do so with any degree of consistency. And putting your entire portfolio in one sector is a massive bet that, should you be wrong, could seriously harm your relative performance for years to come. (For more information on forecasting bear markets, see Ken Fisher’s The Only Three Questions That Count [John Wiley & Sons, 2006].)

Since bull markets tend to be longer and stronger than bear markets, the Utilities sector has often lagged the market for considerable periods of time. Why would investors want to learn about a sector like that? For its defensive characteristics, of course. But also, there have been some very notable periods where Utilities significantly outperformed, even during a bull market. Understanding the Utilities sector can help investors identify those periods and determine how to optimally position their portfolios. Further, because Utilities has historically had lower volatility relative to the market, it serves a useful purpose in portfolio diversification.

Low Volatility

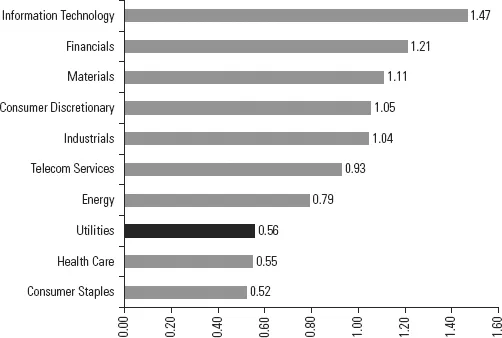

One metric investors use to measure a stock’s historical volatility is beta. Beta describes a given stock’s (or sector’s) historical returns in relation to the returns of the stock market as a whole. A beta of less than 1 means the security tends to be less volatile than the market, while a beta of more than 1 indicates the stock tends to be more volatile than the market.

Figure 1.1 shows the beta of the MSCI World sectors in relation to the MSCI World Index. As you can see, the Utilities sector has a beta of just 0.56—historically it’s been one of the lowest-beta sectors, along with other traditionally defensive sectors like Health Care and Consumer Staples. Theoretically, this means that if the MSCI World moves up (or down) 10 percent, the Utilities sector tends to move up (or down) 5.6 percent.

High Dividend Yields

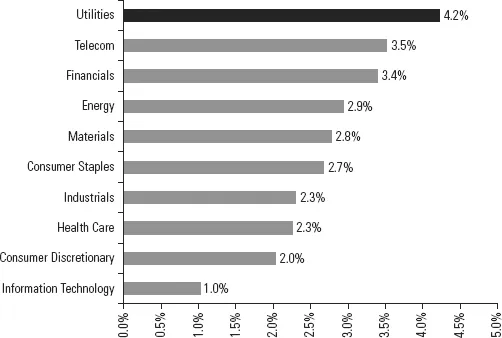

Another defining characteristic of Utilities is it tends to have fairly high, stable dividends, which some investors find attractive. As Figure 1.2 illustrates, over the past decade, Utilities provided the highest dividend yield in the market.

A dividend represents a return of profit to shareholders. While some firms pay dividends, others don’t, preferring to reinvest profits—neither approach necessarily results in better or worse total return over time. Because utilities have limited growth opportunities, they tend to distribute profits through dividends rather than reinvesting profits into the firm. Many investors like the perceived “safety” of higher dividends, which helps contribute to greater demand for Utilities during economic downturns and bear markets.

But keep in mind: Though many investors consider dividends to be “safe,” this is merely a perception (in the near term, however, perceptions can be powerful demand drivers). Dividends are not a guaranteed source of income. Dividends are only as good as a company’s fundamental business prospects, since a company can’t pay a dividend if it is unable to generate sufficient capital to do so. Moreover, while an 8 percent dividend yield may sound attractive if risk-free bonds are only yielding 3 percent, a higher dividend yield is often reflective of a riskier stock—or a perception that the dividend might be cut. And an 8 percent yield is little consolation if shares fall 40 percent—a possibility with any stock in any sector of the market, including Utilities.

What investors should care about at the portfolio level is total return—price appreciation plus dividends accrued.

Dividends and Taxes

One of the most important factors in determining the value of dividends is tax policy. Although different investors have different tax considerations, dividends may be taxed at a different rate than normal income or long-term capital gains. When tax rates change, it could materially affect the value of dividends relative to other forms of income.

WHAT MAKES UTILITIES DEFENSIVE?

The Utilities sector has tended to be a low-risk/low-reward sector. But what is it about utilities that makes their shares so resilient during a downturn, less volatile than the market, and allows them to pay stable dividends? Generally, the key to stable share prices is stable earnings. From year-to-year, utilities are able to generate relatively consistent—albeit relatively low—earnings growth. The major reason for this is the heavily regulated nature of the industry. But before we talk about regulation, we’ll discuss the concepts of inelastic demand and capital intensity, two more key characteristics of the sector and major reasons why it’s so heavily regulated.

Inelastic Demand for...