![]()

CHAPTER 1

An Introduction to Quantitative Equity Investing

Paul Bukowski, CFA

Senior Vice President, Head of Equities, Hartford Investment Management

The goal of this chapter is to provide the reader a basic understanding of quantitative equity investing and to explain the quantitative investing process. We focus on the following three questions:

1. How do quantitative and fundamental equity investors differ?

2. What are the core steps in a quantitative equity investment process?

3. What are the basic building blocks used by quantitative equity investors?

In answering these questions, this chapter explores the quantitative equity investment process. We see how it is similar to many other approaches, all searching for the best stocks. Where it differs is in the creation of a repeatable process that uses several key criteria to find the most attractive companies—its stock selection model. Additionally, some of the most common techniques used by quantitative equity investors are covered.

It is important to understand that this chapter is dedicated to a traditional quantitative equity investing approach. There are many other types of investing that are quantitative in nature such as high-frequency trading, statistical arbitrage, and the like, however, these are not covered.

EQUITY INVESTING

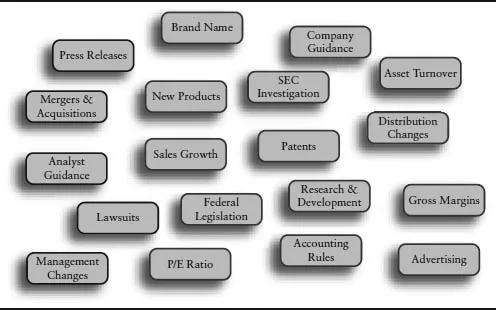

Investing can take many forms, but it starts with an investor assigning a value to a security. Whether this value exceeds or is less than the current market price usually determines whether the investor will buy or sell the security. In the case of equities, the investor often seeks to understand the specific company under consideration, the broader economic environment, and the interplay between the two. This encompasses a wide range of information for the investor to consider as displayed in Exhibit 1.1. How this information is used differentiates the quantitative from the fundamental investor.

FUNDAMENTAL VS. QUANTITATIVE INVESTOR

Let’s start with a basic question. How do portfolio managers select stocks from a broad universe of more than a thousand companies?

Fundamental managers start with a basic company screen. For instance, they may first look for companies that satisfy conditions such as a price-to-earnings (P/E) ratio that is less than 15, earnings growth greater than 10%, and profit margins in excess of 20%. Filtering by those characteristics may result in, say, 200 potential candidates. Next, portfolio managers in consultation with their group of stock analysts spend the majority of their time thoroughly reviewing each of the potential candidates to arrive at the best 50 to 100 stocks for their portfolio. A quantitative manager, in contrast, spends the bulk of their time determining the characteristics for the initial stock screen, their stock selection model. They will look for five or more unique characteristics that are good at identifying the most attractive 200 stocks of the universe. A quantitative manager will then purchase all 200 stocks for their portfolio.

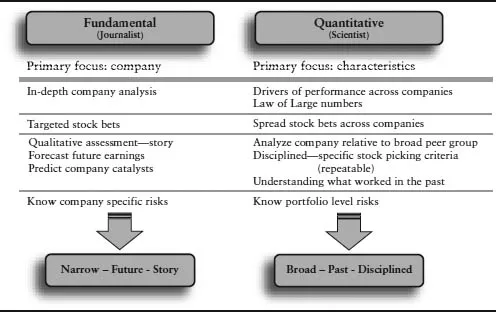

So let’s expand on how these two investors—fundamental and quantitative—differ? Exhibit 1.2 details the main attributes of the following two approaches:

1. Focus: Company vs. characteristic. The fundamental investor’s primary analysis is on a single company at a time, while the quantitative investor’s primary analysis is on a single characteristic at a time. For example, a fundamental investor may analyze a health care company to assess if a company’s sales prospects look strong and whether this stronger sales growth is reflected in the company’s current stock price. A quantitative investor may also invest in a company based on its sales growth, but will start by assessing the sales growth characteristic. The quantitative investor will determine whether stocks within the group, health care companies, with higher sales growth also have higher stock returns. If they do, then the quantitative investor will buy health care stocks with higher sales growth. In the end, both types of investors may buy a stock due to its good sales prospects, but both come at the decision from a different point of view.

2. Narrow vs. broad. Fundamental investors focus their attention narrowly on a small group of stocks. They cover fewer companies since they make more in-depth reviews of each company. Fundamental investors immerse themselves in the company studying everything from financial information, to new products, to meeting management. Ideally, they are searching for exploitable differences between their detailed assessment of the company’s value and the market’s perception of that value. In contrast, quantitative investors focus more broadly. Rather than reviewing one company at a time, they look across a large group of companies. Quantitative investors’ focus on what separates companies from one another; they search for pieces of information (characteristics) that they can use to exploit differences between securities. Since they are dealing with a great deal of data from a large number of companies, they employ quantitative techniques to quickly sift through the information.

3. Position concentration/size of bets. Another difference in the two approaches is the size of the positions within a portfolio; they tend to be larger for a fundamental investor and smaller for a quantitative investor. A fundamental investor performs in-depth company analysis so they will have greater conviction in taking larger positions in their selected stocks. A quantitative investor performs in-depth analysis across a group of companies, so they will tend to spread their bets across this larger group of companies.

4. Risk perspective. The fundamental investor sees risk at the company level while the quantitative investor is more focused at the portfolio level. The fundamental investor will review the risk to both their forecasts and catalysts for the company. They understand how a changing macro picture can impact their valuation of the company. In contrast, the quantitative investor’s broader view relates to understanding the risks across their portfolio. They understand if there are risk characteristics in their portfolio that are different from their chosen stock selection model. For example, a quantitative investor who does not believe growth prospects matter to a company’s stock performance would want to investigate if their model had them buying many very high- or low-growth companies.

5. Past vs. future. Finally, the fundamental investor often places greater emphasis on the future prospects of the company while the quantitative investor studies the company’s past. Fundamental investors tend to paint a picture of the company’s future, they will craft a story around the company and its prospects, and they will look for catalysts generating future growth for a company. They rely on their ability to predict changes in a company. In contrast, the quantitative investor places more emphasis on the past, using what is known or has been reported by a company. Quantitative investors rely on historical accounting data as well as historical strategy simulations, or backtests, to search for the best company characteristics to select stocks. For instance, they will look at whether technology companies with stronger profitability have performed better than those without, or whether retail companies with stronger inventory controls have performed better than those without. Quantitative investors are looking for stock picking criteria, which can be tested and incorporated into a stock selection model.

In the end, we have two types of investors viewing information, often the same information, quite differently. The fundamental investor is a journalist focused on crafting a unique story of a company’s future prospects and predicting the potential for gain in the company’s stock. The quantitative investor is a scientist, broadly focused, relying on historical information to differentiate across all companies, testing large amounts of data and using statistical techniques to create a stock selection model.

These two investors can and often do create different portfolios based on their different approaches as shown in Exhibit 1.3. The fundamental investor is more focused, with higher conviction in their stocks resulting in fewer, larger positions in their portfolios. The quantitative investor, reviewing a large group of companies, generally takes a large number of smaller positions in their portfolio. The fundamental investor is investing in a stock (or sector) and therefore is most concerned with how much each of their stocks (or sectors) is contributing to performance. The quantitative investor is investing in a characteristic and how well it differentiates stocks. They want to know how each of their characteristics is contributing to performance. Finally, the fundamental investor’s detailed view into the company allows them to understand the intrinsic risk of each investment they make—what are potential stumbling blocks for each company. The quantitative investor’s goal is to understand specific characteristics across a broad universe of stocks. They look at risks across their entire portfolio, attempting to diversify away any firm-specific risks ancillary to their strategy.

Now that you understand the basic differences between the two approaches, it might also be clear how using both investment styles can be very appealing. As Exhibit 1.4 shows, the two styles are quite complementary in nature and can provide a robust, well-rounded view of a company or port...