![]()

Chapter 1

Birth of High Frequency Trading

Equity Markets Go Electronic

Electronic trading defines modern day trading in global equities markets. While one can point to many different factors for the eventual proliferation of electronic trading, it is important to acknowledge that without the basic market structure framework for accommodating electronic trading, today's market reality of sub-second trading and hyper-competitive market centers would be unthinkable.

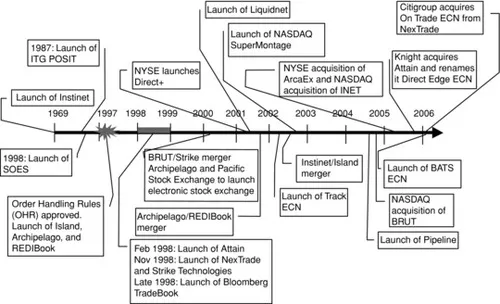

As such, the electronification of the U.S. equity markets can be traced back to launch of Instinet in 1969, which predated the so-called Electronic Communication Networks (ECNs) by close to 30 years. Figure 1.1 shows the historical perspective.

Instinet provided a much needed service for buy-side firms looking for ways to trade listed securities in a private network. It became the largest alternative execution venue by the time the first generation alternative trading systems (ATSs) hit the U.S. equities market in the late 1990s.

Electronic trading occurred on the NASDAQ market first as market makers leveraged electronic communication tools to provide liquidity into the market. The 1987 crash, though, led to the development of SOES (Small Order Execution System), which provided automatic execution capabilities on a price-time priority. However, SOES only handled market or marketable limit orders and only executed up to 1,000 shares. In addition, SOES was only open for agency orders and prohibited any proprietary orders from market makers. While SOES is also often associated with the activities of SOES Bandits that took advantage of the new market reality, it can certainly be viewed as one of the precursors to today's automated trading platforms that dominate the market.

Another set of regulatory change, the Order Handling Rules of 1997, triggered the birth of ECNs and the beginning of the end of the traditional floor-based exchange model characterized by open-outcry. After a decade of numerous regulatory changes, technology and business innovations, the electronification of the U.S. equities market had been completed. This set the foundation for the high frequency trading (HFT) firms.

DEFINING HIGH FREQUENCY TRADING

How can one cut through the misconception of high frequency trading? The subject has been defined in many ways with little satisfaction from the HFT community itself. The investing public has long viewed high frequency traders as market predators who game the market to their advantage. It is however, fair to say that during electronic trading infancy there was a good amount of predatory activity going on. This occurred as institutional investors who were just starting to self execute their own orders by using basic algorithms such as VWAP (volume weighted average price). This type of algorithm is one of many that slice up a large order into smaller orders that in theory will go undetected in the market place. Unfortunately for many institutional investors this theory did not hold up, as detecting a VWAP algorithm is a very simple process—“easy pickings” for any high frequency trader.

For most this would be enough evidence to prove that high frequency traders have not added any value to the markets. This is not the case at all, as the misunderstanding about how a market works has led to all the negative press about the subject. First, let's look at how a transaction is done. Every transaction needs a buyer and a seller to be matched off against each other. The price and size of the transaction need to be the same as well as the time of day. Using equities as an example, you have a buyer of 1000 shares of ABC stock at $10 and you need to have a seller of the same stock at the same price. Who would be a willing seller of ABC stock at $10? The first logical answer would be someone who already owns the stock. In a perfect world there would be someone willing to do such a transaction. But we do not live in a perfect world so in this case more often than not another party, who most likely has a position in the stock that does not exactly match what we are looking for, will need to provide an amount and price for one to transact against. Prior to electronic trading this role was held by a group of traders (market makers/specialists) who provided amount and prices (liquidity). Their role would be as a counterparty to the transaction. This is a relationship that is involved in every transaction in every market. Without a counterparty there would be no transactions of any type. This relationship is often misunderstood. Institutional and retail investors alike always want to be able to transact at any time at any price that is advantageous to them. In their minds the counterparty should be willing to provide liquidity without any change in price at all times of the day. Since we already have discussed that there is a lack of natural sellers (people/companies who already own the stock) the market maker/counterparty fills that need. This role of market maker is not a charitable one. Without an edge a market maker cannot make money and of course a business without profits is a business without participants.

Although we used the equity market as an example, the role of a market maker exists in all major markets. The interest rates (bond), currency, commodity, and option markets all need to have counterparties to complete a transaction. The more competition that exists in this role, the better the price provided will be.

As the financial markets migrated to an electronic marketplace, the role of the human-based market maker was disappearing. The only way to efficiently provide prices for buyers and sellers was to do so by electronic means. The market makers from the floor knew that the only way to do so properly was to have the most stable and fastest technology available. The life span of a slow market maker is too short to measure. Developing a system that had minimal latency was the key to success in the electronic world of market making. Speed is not the only variable to a successful operation, but without a low latency trading infrastructure you will not be able to compete.

Since speed is one of the components of high frequency trading, what are the other variables involved? As frequency is in the description it is logical to assume that the trading style leads to many transactions. This is of course is not a bad thing as an increase in volume leads to revenue increases in many areas of the business. Exchanges, brokers, technology providers, and telecom have all benefited from the increased participation in trading. The amount of volume attributed to HFT varies within each asset class, but it is safe to say without the volume generated from HFT firms the markets would look entirely different. Market making is the most common strategy for HFT, so if you make the assumption that every transaction has a market maker involved, the 50% volume threshold will be a good starting point in the equity markets.

The real issue remains how you silo the marketplace in a way that the press, politicians, regulators, and the public can understand. In today's equity market you can argue that everyone who buys and sells equities is using some sort of HFT type technology. Institutional customers either send their orders to their broker for execution or use an execution system to transact. Retail customers now execute their orders via an online broker. Orders are sent and filled immediately and prices are reported back in seconds.

What then separates the high frequency trading community from the rest of the investing world? It comes down to two subjects: trading strategy and holding time.

There are multiple trading strategies employed by the HFT community. The two main areas are liquidity provision and arbitrage. Both of these strategies require a low latency trading infrastructure with reliance on receiving live market data as trades occur. In a perfect world a market-making strategy would buy the bid and sell the offer all day every day. They would make the small spread and everyone would go home happy. Of course this is the not the case and a market maker will always adjust their prices and size available based on the prevailing price action in the market. It really is all related to supply and demand. As the old trading saying goes, more buyers than sellers will drive the market higher and the opposite is true as well. This may seem simplistic, but this is how the price discovery process works. There always has been and always will be an advantage to those who provide liquidity: If they were not there, there would be no market. So despite the criticism the new market makers of the electronic trading world will continue to make technology investments and fine tune their algorithms to stay ahead of their competition. New entrants are always welcome and as long as they are willing to make the appropriate investment, the playing field is truly level. The investing public has been rewarded with narrowing spreads and lower commission costs. This is a fact that gets thrown out the window when markets are trading lower and the public is losing money, so today's market makers live in a fickle world and understand that this is the price of doing business.

Riskless arbitrage is the action of buying and selling the same security on two different venues at the same time. Although the opportunities in this area have decreased significantly due to increased competition there is still money being made. The equity market remains the market of choice for arbitrageurs. All is not guaranteed in this strategy as there is always a risk of missing out on one part of the trade and being left with a money- losing position.

Statistical arbitrage (stat/arb) is another HFT strategy that is difficult to be executed without a low latency trading infrastructure. An example of an opportunity for stat/arb traders comes from outside investors who are either accumulating or liquidating a position of stock that is a member of an index. Once that price of the individual stock changes, the correlated index price also has to change. Other derivatives such as options or futures of the index also have to update. These opportunities are short lived and competed for by various traders. The competition for such trades is an essential component of how high frequency traders contribute to market efficiencies.

Since the majority of the listed markets are electronic and investors of all types are using technology that can be defined as high frequency, the holding time of each trade or investment is the ultimate differentiator between the professional high frequency trader and others. There is no absolute time that a HFT holds a position, but as a general rule the time is measured in seconds. It could be in milliseconds or microseconds or in the near future nanoseconds, but the reality is the holding time is for very small periods of time. Can a HFT hold position for a longer time period? The answer is yes and there will always be circumstances when holding times vary. However, as long as the market venues continue to improve their technology and the regulators do not require orders to be held for a certain time period, the race to zero will continue. A change to sub-penny pricing in the equity world would be the major catalyst for holding times to be reduced even further.

WHO ARE THE HIGH FREQUENCY TRADERS?

For most Wall Street firms out there, 2008 was a year to forget and move beyond as quickly as possible. For a small group of firms based mostly outside downtown Manhattan in Chicago, Dallas, and Kansas City, however, 2008 was a banner year with record performance.

So-called “high frequency prop shops” thrived during a year characterized by massive economic downturn, job losses, record volume, and volatility, while traditional asset managers, large hedge funds, and all of the bulge bracket firms suffered.

Until recently, high frequency prop shops have been flying under the radar, preferring to take a back seat as bulge bracket firms and high-flying hedge funds soaked up all the glory and publicity. While the Goldmans and Morgans of the world were building up their global empire, firms with names like GETCO and Tradebot were fine-tuning their trading models and low-latency technology infrastructure. Today, the growing market clout of these high frequency trading firms can no longer be ignored. As a collective group, they represent a significant force in trading and market structure, and will play a more public role in the global securities markets for many more years to come, whether they like it or not.

There are many proprietary trading firms, including those that reside within large broker/dealers, which until 2008 were major sources of revenue for the bulge bracket firms like Goldman Sachs, Morgan Stanley, Credit Suisse, and more. Based on the Aite Group's interviews with leading independent proprietary trading firms (i.e., not affiliated with a bulge bracket firm), an elite group of firms numbering no more than 15 currently account for a significant percentage of overall average daily trade volume in U.S. equities. Over the last couple of years, their presence has been clearly felt well beyond equities and into other exchange-traded, liquid markets such as U.S. equity options and global futures as well as highly liquid OTC (over-the-counter) markets, such as FX (foreign exchange). These firms have also moved beyond U.S. borders, especially into the European equities market.

The high frequency, high-volume trading game is being played by many different types of players. In today's competitive trading market, the high frequency trading community consists of market makers that rely on automated trading technology, low-latency agency brokers, statistical arbitrage hedge funds, and high frequency proprietary trading firms:

- Regulated market makers. Leading wholesalers such as Citadel, Knight, and ATD have carved out a nice market for the automated market making business. They are regulated market makers that have employed technology to enhance the overall operations of a traditional market making role.

- Statistical arbitrage hedge funds. Statistical arbitrage hedge funds have also added to the overall trading volume in recent years, using high-powered computer models to identify and execute tiny arbitrage opportunities across hundreds if not thousands of names in milliseconds.

- Low-latency brokers. Less well-known, but highly technology-driven, low-latency agency brokers such as Lime Brokerage drive an incredible amount of volume on behalf of their stat/arb and prop trading clients.

- Clearing. On the clearing side, firms such as Wedbush, Penson, Fortis, and Assent have carved out a nice business catering to the high frequency trading community through aggressive pricing and their ability to handle large volumes.

The burgeoning independent proprietary trading firms scattered across the United States have been leading the charge. These active trading firms have emerged to level the playing field and replace traditional market makers and specialist firms, becoming an indispensable source of liquidity for the U.S. equities market. While small in number (estimated to be 10 to 15 firms at most, with significant trading operations), these firms have energized the overall trading market, pushing for greater technology innovation, testing the limits of speed and, most importantly, providing liquidity to the various execution venues. A set of common high frequency proprietary trading firms’ characteristics includes the following:

- Technology vendor first, trading second. Most of these firms behave and function like a technology firm. Leading proprietary trading firms are filled with Ph.D.s, typically in areas such as mathematics, physics, computer science, and statistics. Every problem these firms face, they look for solutions based on technology, which enables them to keep a streamlined operation with limited number of people. First-tier proprietary trading firms (top 10 to 15 firms) have built their IT infrastructure from scratch, rarely relying on third-party vendors.

- More than just speed. Systematic black box trading requires a lot of speed, and certain high frequency firms are obsessive about maintaining a trading infrastructure that can handle the peaks and valleys of a trading day with minimum levels of latency. In addition to speed, proprietary trading firms believe that the trading infrastructure must be resilient, reliable, and predictable.

- Trading models as a competitive differentiator. In the end, these firms’ bread and butter are their trading models. Development of new and constant enhancements of existing trading models enables high frequency trading firms to stay a step ahead of the competition. Leveraging their Ph.D.s' brainpower and cutting-edge trading technology platforms, proprietary trading firms have created systematic trading models that drive significant volume into the marketplace.

- Keeping a low profile. Historically, since all of these firms are trading with their own money, generating publicity is one of the lowest priorities for a prop shop. However, with today's challenging economic conditions and the threat of wholesale regulatory changes that might threaten their business model, these traditionally publicity-shy proprietary trading firms will have to open up to validate their market importance.

Growth of these prop trading firms has contributed greatly to today's market reality of exploding trade volume, tight spreads, decreased average trade size, and focus on speed and technology. Over the years, traditional market makers have been replaced by regulated market makers that have fully embraced technology (i.e., Citadel, Knight, ATD, etc.). High frequency proprietary trading firms have also stepped into the void, providing much-needed liquidity and tighter spreads while at the same time leveling the playing field, making it possible for anyone with good te...