![]()

PART I

GETTING STARTED IN HEALTH CARE

![]()

CHAPTER 1

HEALTH CARE BASICS

Shane is having dinner with his wife Emily when he notices a strange numbness in his arm keeps him from picking up his fork. He tries to tell Emily, but numbness in his face slurs his speech. Worried, she immediately calls 911, and an ambulance arrives and rushes him to the nearest hospital. Doctors run various tests and determine plaque formation in his carotid artery is preventing adequate blood flow to his brain, causing a stroke. To treat Shane, doctors will perform a procedure called carotid angioplasty and stenting, where a small balloon will open the clogged carotid artery, and a stent (a thin, metal mesh tube) will be inserted to keep the artery open. Shane is moved and placed on a stainless steel table in a sanitized operating room. Doctors wash their hands, put on their scrubs and gloves, and use various tools and equipment to perform the procedure. Shane successfully recovers and heads to the local pharmacy to pick up his newly prescribed medicine. He later receives the bill and works with his insurance company to pay for the services rendered. Shane is thankful Emily recognized the early signs of a stroke.

This is more than a simple anecdote with a happy ending—it’s an illustration of how Health Care products and services impact our lives. Every event, interaction, and item in Shane’s situation used products and services from the Health Care sector. Table 1.1 lists just some of the Health Care products and services he encountered.

Table 1.1 Health Care Sector Impact

| Interaction With | Health Care Sector Involvement |

| Ambulance | Performed by a Health Care Services company |

| Hospital | Run by a Health Care Facilities company |

| Diagnostic machines used to run tests | Made by Life Sciences and Health Care Equipment firms |

| Lab test | Performed by a Health Care Services company |

| Balloon and stent | Manufactured by a Health Care Equipment company |

| Stainless steel table, knives, and gloves | Manufactured by Health Care Equipment and Supplies companies and delivered to hospitals through Health Care Distributors |

| Prescription drugs | Manufactured by a Pharmaceuticals firm |

| Health insurance company | Run by a Managed Care provider |

This book covers investment opportunities in the Health Care sector, as well as how to better incorporate a Health Care allocation into a broader portfolio. Many of the firms making people’s lives healthier are publicly traded and can be an integral part of your portfolio. Of the 10 standard investing sectors, Health Care arguably plays the most critical role—literally—in daily life. Moreover, in recent years, health care—its availability, cost, and how it should be delivered—are among the most hotly debated topics around the world. After all, it was Mahatma Gandhi who said, “It is health that is the real wealth and not pieces of gold and silver.”

This doesn’t suggest Health Care is inherently superior to other sectors (Energy, Materials, Industrials, Consumer Staples, etc.)—it isn’t. But Health Care, like each sector, has unique attributes leading both to outperformance and underperformance depending upon economic, market, and industry-specific conditions. There will be periods when Health Care performs very well relative to the broader market and periods when it lags.

While health care can be a politically touchy subject and can foster great ethical debate, the aim of the book isn’t to support one ideology or another. Rather, the goal is to help you gain a basic understanding of the Health Care sector—its components, drivers, and challenges—and serve as a general guide for better Health Care investing. Wherever possible, we’ll also help you think critically about the sector to generate your own views rather than just dictating rules. Successfully investing in Health Care firms doesn’t require an advanced degree in medicine. Instead, you need a firm grasp of the laws of supply and demand and an understanding of what drives the earnings and stock prices of Health Care firms.

HEALTH CARE BASICS

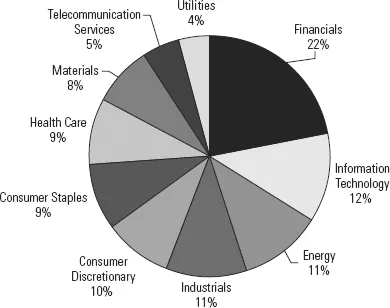

Figure 1.1 shows how the sector composition of the MSCI All Country World Index (ACWI) is broken down. The ACWI index covers the entire globe, including emerging markets, and is currently the broadest representation of global stocks. The index is capitalization weighted, meaning larger firms have more weight. Health Care currently accounts for 9 percent of the index and is one of the smaller sectors by weight. That doesn’t make it unimportant, however. Further, sector weights may differ among various indexes, as you will see in subsequent chapters. And as sectors go in and out of favor, their relative weights can change, sometimes tremendously.

What does the Health Care sector look like from a high level? Not all health-related firms belong in the sector. For example, food, some consumer products, and retail pharmacies belong in the Consumer Staples sector, while some Industrial sector conglomerates, such as General Electric and Siemens, own large Health Care equipment and diagnostic divisions. This isn’t a hard and fast rule, but classification as a Health Care firm largely depends upon how much health-related revenues and profits comprise a firm’s overall sales and earnings.

Because Health Care has many diverse industries, it’s split into two broad groups (as defined by the Global Industry Classification Standard [GICS] classification system):

- Pharmaceuticals, Biotechnology & Life Sciences

- Health Care Equipment & Services

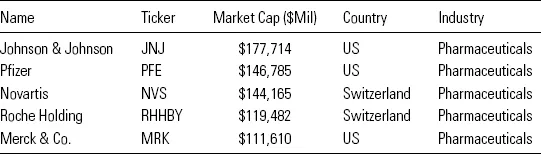

Pharmaceuticals, Biotechnology & Life Sciences, the larger group, includes firms involved in the discovery, development, manufacturing, and distribution of prescription drugs. It also includes firms supporting the drug discovery process, as well as those that serve firms outside the health care business by testing the quality of food, water, air, and metals. There are over 1,600 publicly traded firms globally in this segment.2 Table 1.2 lists the largest firms in this industry group.

Table 1.2 Largest Firms in the Pharmaceuticals, Biotechnology & Life Sciences Group

Source: Thomson Reuters, as of 12/31/2009.

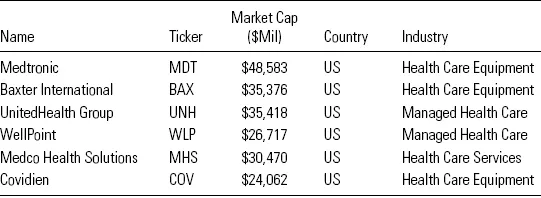

The Health Care Equipment & Services group includes medical equipment makers, health insurance firms (called managed health), pharmacy benefit managers, hospitals, and technology firms. There are over 1,200 globally publicly traded firms in this segment.3 Table 1.3 lists the largest firms in this group.

Table 1.3 Largest Companies in the Health Care Equipment & Services Group

Source: Thomson Reuters, as of 12/31/2009.

HEALTH CARE CHARACTERISTICS

Although Health Care firms span various industries, firms in this sector tend to share some similar characteristics. Generally, the sector as a whole:

- Is less economically sensitive and less volatile than the broad market.

- Deals with heavy government involvement.

- Has a large, global market.

- Is mostly characterized by big cap, growth companies.

- Is dominated by US firms.

Let’s look at each of these characteristics in more detail.

Less Economically Sensitive

As we’ll cover more in depth in Chapter 4, Health Care’s drivers can be somewhat independent of pure economic growth. In other words, demand for Health Care goods and services typically holds up well even when the economy sours. In a down economy, consumers might buy fewer Consumer Discretionary goods and firms might delay upgrading computer systems during recession (which isn’t great for the Tech sector), but folks are likely to keep taking heart medication and visiting the emergency room. In other words, Health Care firms produce goods and services for which there is typically inelastic demand.

Health Care, as a relatively economically insensitive sector, can be a useful part of your portfolio because it can perform relatively well when the economy contracts and broader markets decline. For this reason, the sector is also sometimes described as defensive. This doesn’t necessarily mean Health Care stocks will post positive returns during a market downturn—instead, those stocks may just perform relatively better than stocks as a whole during those periods. Nor does it mean the sector must underperform in good times. For example, Health Care led at some points as broader markets rose during the late 1990s. No sector has a single, defining driver, and there can be myriad reasons Health Care (though generally defensive in nature) might lead during broad market advances and lag during declines.

Elasticity

Elasticity is a measure of one variable’s sensitivity to a change in another variable. The term references changes in demand relative to changes in price or income. The concept of elasticity is core to understanding what makes the Health Care sector tick.

Health Care products are generally inelastic because they are necessities purchased regardless of how an individual’s personal economic situation shifts over time. Discretionary purchases, like vacations, are just the opposite—elastic—because income or price fluctuations do materially impact demand.

For example, if our friend Shane’s income increased, he wouldn’t demand more surgery or prescription drugs. And if the price of surgery or drugs increased, he would still need those things to keep him alive....