![]()

PART I

THE STRATEGIC DRIVERS

![]()

CHAPTER 1

M&A OVERVIEW

CHAPTER SUMMARY

This chapter looks at the different types of M&A and the drivers behind the decision to purchase. It discusses the factors that need to be taken into account in deciding how much to pay and highlights the importance of setting the criteria for success early on.

There is also an overview of the M&A deal process, which sets out the key stages. It is surprising how few people know and understand the overall deal process, but without this understanding they cannot plan or deliver. These sections provide a starting point for the topics, with more detail following in later chapters.

Later in the chapter, we discuss the importance of reflecting the overall business strategy in the integration plan and of ensuring that the learning derived from the process is not lost when the deal is closed.

WHAT TYPES OF M&A ARE THERE?

“First, have a clear organic growth strategy and a clear investment strategy, then buy where we need to augment growth.”

John Peace, Chairman, Experian

Organizations looking for growth can go down one of three paths – organic growth, joint venture (JV, or partnerships) and M&A. All companies should constantly be looking at all three. Organic growth must be the first and main area of priority. Businesses then need to look at the other two and move forward depending on their skill set, cash flow and aims. Many companies do all three. Some decide they don’t want to do M&A now because they don’t have the funds or the skills/capability to move forward. Some decide M&A is the only way forward and that owning part of a company does not provide them with the control they need to move forward fast enough.

There are a number of different entities available to buy. In a mature marketplace one strategy is to consolidate the market by buying competitors. There will be a large overlap in what the two companies do, but this can be removed, reducing the overall cost base. These are what we refer to as the cost synergies.

Some companies are looking for geographic expansion – they are keen to enter into a growth sector or economy, like India, Brazil or Russia, for example. This type of purchase will bring the business new contacts, knowledge and skills and the aim will most probably be to keep everyone and everything. There may be very few cost synergies. The main aim of the merger is to invest, to cross-/up-sell and to reap “revenue synergies” thus creating more profit.

Other reasons for purchasing a business can include the desire to bring a new product or service under the company umbrella. The product may be complementary to the buying company’s range and can easily be sold to existing customers through established sales channels.

The need to continually keep ahead of the game is another common driver for acquisition. R&D is very costly, so an option is to let others in the market create the new technology then buy it at an early stage with a view to developing and exploiting the potential in-house.

The strategic reason for the purchase must be reflected in both the communication and integration process if the M&A is to be a success (Table 1.1).

Table 1.1 M&A strategy

| Market overcapacity | Standardize processes – deliver cost synergies

Understand cultures and move towards one

Restructure |

| Geographic expansion | Roll out key processes and products across new regions |

| Product, service or market extension | Understand new product, service or market

Deliver revenue synergies |

| Buying R&D | Move quickly to retain knowledge and people

Create a new culture |

| Buying competence or technology | Move quickly to retain knowledge and people

Incentivize people to stay

Great communications during integration |

Buying R&D or technological expertise, for example, may contain large amounts of cost and revenue synergies, though the aim is growth. The business is integrating for revenue and profit improvement.

A different reason for purchase calls for a different strategy and also a different way of approaching the integration. The process may be similar, but the activity, action and outcome will be very different in each case.

HOW MUCH SHOULD WE PAY?

“Don’t buy unless you’re clear on why and on the return.”

John Peace, Chairman, Experian

Companies acquire other companies so that they can bring in new technology, new skills, new products and new customers. Acquiring another business helps them consolidate their position in the market, increase revenue and ensure future stability. Getting the price right at the outset is critical if the M&A process is to succeed. Often companies pay a 40% premium for publicly listed companies, sometimes more.

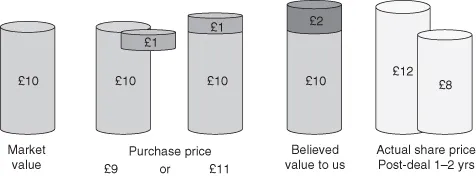

Figure 1.1 shows the company we want to buy, company A. Its share price is £10. We decide to purchase it. Negotiations start and our aim is to buy at £9, but the seller wants a premium for it and tries to sell at £11. Value is often dependent on your view and in due diligence we must always understand why the company is for sale. What does the current owner know that we don’t?

If we owned company A, it may be worth £12, if we follow a strategy of helping it grow faster by injecting cash or knowledge and cutting costs in a way it cannot do by itself. For example, after purchase there will be two head offices. Cutting one will save money, so company A will be worth £12 in two years’ time once it is under our group ownership.

There is a discrepancy between the current £10 valuation and ours of £12. Who is right? This discrepancy causes a negotiation and purchase at £11 where all parties win. An acquisition occurs and integration starts.

Of course the company may not actually be worth £10. We may find we have bought a dud, and it’s only worth £8. This could be because our initial valuation was wrong, because there were some surprises along the way or because the integration did not go well and the value has been destroyed. Whatever the reason, the deal has been a failure.

Integrate well, however, and some companies are able to find an extra £1 and make the company worth £13.

Some deals are wrong from the start. A company pays £20 for a company worth £10 because they have not done enough due diligence (pre-deal investigation). The merger between Quaker and Snapple is the biggest identified loser (bought for $2.4 bn, sold shortly afterwards for $300 m due to an inability to extend an existing distribution system to a new product line), while the Chiron/Cetus merger in health care is the biggest identified winner.

“Be clear on strategic fit, clear on where the value is and clear on the integration plan all before the deal.”

John Peace, Chairman, Experian

MOST MERGERS FAIL

Eighty per cent of mergers fail!

“Success or failure, defined by the academics: The existence of synergy implies that the combined firm will improve its performance, at a faster rate after the merger than when the firms are operating separately.”

The Value of Synergy, Aswath Damodaran, Stern School of Business, October 2005

There is a database with the share price and financial information for companies and deals. The only sensible way to measure success from an outside view is to see if the share price increases because of the purchase.

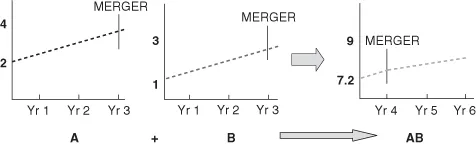

In Figure 1.2 both companies have an upwards share price graph, with improvement at the same rate (similar gradient). If the first buys the second the resulting share price should be the two added together with continuation at the same growth rate or better. This example shows a merger that did not create value and so would be considered a failure.

The premium paid by the acquiring party does not necessarily have to be higher than the costs of internal growth or the costs for establishing increased profitability.

This is viewed externally as a failure.

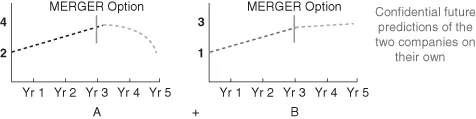

Again, there is an M&A failure in Figure 1.3. A FTSE 100 company has a strong growth rate but can see its demise in the near future (five years). It goes out to buy a company to fill the strategic or profit gap it foresees. The public at large would not be told of this future impending doom and so will see this purchase and subsequent integration as failing to deliver improved or increased value, i.e. no shareholder price improvement.

When asked how to judge success or failure, shareholder view is clearly the only way to go. However, looking internally can provide an improved understanding of the purchase.

“Many mergers fail. Why? I believe it is because:

- There is a lack of knowledge of what fundamentally makes the company valuable and whether this can survive a merger, e.g. an entrepreneurial culture. Due diligence is often legal and financial as opposed to commercial, strategic and cultural.

- The acquisition is defensive in nature, i.e. it is an opportunity to cut costs but is presented to shareholders and investors as a growth deal. Expectations are not met and the deal is considered a failure.

- The integration is not properly planned. People are unclear about what should happen – and can thus destroy the very thing they have bought, e.g. by dismissing the very management that made the business valuable in the first place, in favour of their ‘own’ staff.”

Matthew Lester, CFO, ICAP

Some Are...