eBook - ePub

The Property Professor's Top Australian Suburbs

A Guide for Investors and Home Buyers

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

The Property Professor's Top Australian Suburbs is a handy guide for first time investors and homebuyers. 'Property Professor' Peter Koulizos takes readers through 107 Australian suburbs that offer the best return on investment. The book provides detailed statistical data in the suburb profile including information on demographic, average incomes and what plans local and federal government has for improving the area over the next 20 years.

- Focuses on suburbs that are currently undervalued

- Lists which streets within the suburbs will help investors and buyers reap the largest rewards

- Features the top 20 suburbs from Melbourne, Sydney, Adelaide and Queensland, the top 2 suburbs in Canberra and Darwin and the top 3 suburbs in Hobart

- Easy to use portable format with side tabs

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access The Property Professor's Top Australian Suburbs by Peter Koulizos in PDF and/or ePUB format, as well as other popular books in Business & Real Estate. We have over one million books available in our catalogue for you to explore.

Information

Part I

Investment basics

Chapter 1

Investment—what’s it all about?

In the past decade the popularity of investing has skyrocketed. More and more people have started taking control of their financial future so they do not have to rely on the government’s age pension down the track. Before going any further, let’s be clear about what ‘investing’ actually means. If you purchase a property, put money into a term deposit or buy a rare stamp to sell at a later date, you are investing your money. You are giving up the opportunity to spend the money now on something else because you expect to earn more money from the asset in the future.

In the case of putting your cash into a term deposit, the future benefit is almost certain. For example, if you were to put $10 000 into a term deposit for one year at an interest rate of 8 per cent, at the end of that year you should get back your $10 000 plus interest of $800.

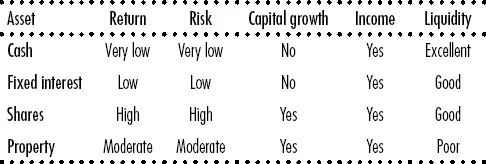

In the previous example, your future benefit is certain. However, this is not the case with all asset classes. When investing in the sharemarket or property market, for example, your future benefit is quite uncertain. Indeed, there is always a certain amount of risk involved with investing. Let’s take a look at the main asset classes — cash, fixed interest, shares and property — and explore how they weigh up in terms of return, risk, capital growth, income and liquidity. Table 1.1 (overleaf) summarises the relationship between the four asset classes.

Table 1.1: the four asset classes

Cash

The most common way for people to invest in cash is to put money into a bank account such as an online high-interest savings account. Compared with the other asset classes, a cash deposit provides a relatively low return (at the time of writing, about 8 per cent per annum), but it is also a very low-risk asset. You can be fairly confident that not only will you get your money back, but you will also earn interest on the amount you invested. The cash deposit won’t grow in value, you will just receive interest income based on how much you invested, how long you invested for and the interest rate. On the plus side, cash is a very liquid asset — that is, you can access your money quickly.

Fixed interest

Similar to cash, a fixed-interest investment (government or corporate bonds) is a low-risk, low-return investment. You will receive a return of, at the time of writing, about 8.5 per cent per annum, but your money is guaranteed by the government or corporation. You can also be confident with this type of asset that you will get back all your money and receive regular interest payments. Again, your initial investment will not grow in value, but you will receive income from the interest earned. You also have reasonably good access to your money as you should be able sell your bond on the market within a day.

Shares

The sharemarket is attractive to many investors because of the relatively high returns it offers. Compared with the other asset classes, shares have the highest capital growth (over 10 per cent per annum) — and the highest risk. Share investors expect that their initial investment will grow in value and that they will earn a dividend (income) while they hold on to the shares. This is not always a certainty, though. Many people have lost money on the sharemarket when the value of their shares has fallen unexpectedly, so share investors need to be prepared to invest for the long term in order to ride out market turbulence. On the plus side, shares are a very liquid asset — they can generally be sold within a day.

Property

Like shares, property is a growth asset. It has a moderate return, which is accompanied by a moderate risk. Historically, the capital growth in property (about 9 per cent per annum) has been slightly lower than for shares, but so is the risk. One of the attractions of property is the security that it offers. Investors can expect to make a profit from a property if it is well located and they are willing to hold on to it for the long term. The value of the property will increase over time and investors will also receive income in the form of rent. Some people do lose money on property, but this tends to be because they have bought the wrong type of property in a poor location and sold during a market downturn. In addition, property is not a liquid asset. You cannot sell it and access the funds quickly, unlike the other three asset classes.

In summary, there is little risk investing in cash and fixed interest, but there is also little reward. By investing in growth assets — shares and property — you are taking on greater risk, but the potential rewards are greater too.

So, what is smart investment all about? It is about maximising your return and minimising the risk. When it comes to property, smart investment means buying the right type of property in the right location. The next chapter takes a closer look at why a growing number of Australians are choosing to invest in property.

Chapter 2

Why invest in property?

The great Australian dream is to own your own home. It is built into our psyche that owning property is something to strive for and be proud of. And today, three out of four properties are bought by owner-occupiers.

Before you start investing in property, however, you need to ask yourself: what is my goal? Do you want to:

- retire richer?

- retire earlier?

- supplement your income?

- give up your day job?

Buying the right type of property in the right location will help you to achieve your goal. It is important to establish what your goal(s) is at the outset because it will determine which strategy — renovate, develop or buy and hold — you apply.

But why choose to invest in property rather than the other growth asset — shares? There are many good reasons, including:

- capital growth

- rental income

- hedge against inflation

- tax benefits

- greater degree of control

- lower volatility

- high demand.

Let’s take a look at each of these in detail.

Capital growth

Putting your money in the bank or investing in fixed interest does not give you any capital growth. If you purchase property, however, you do so expecting that the underlying value of the asset will grow. While this is generally the case, you need to ensure that you buy property in the right location to maximise your capital growth. For example, a new house on the outskirts of Melbourne’s metropolitan area bought for $400 000 may grow at 5 per cent per annum, whereas a well-located property in an up-and-coming suburb, bought at the same price, could grow at 10 per cent per annum. In 10 years’ time, the new property on the outskirts will not have even doubled in value, while the well-located property will be worth more than $1 million. If you had bought the property in the prime location, you could possibly retire in 12 years’ time, based on your increased net wealth; you could not retire on the funds from the poorer performing outer suburban property. Even though properties increase in value over time, it is crucial that you buy in the right location to maximise your returns.

Rental income

One of the benefits of owning investment property is that you start receiving an income almost straightaway. In the current market, you could settle on a property during the week and by the weekend you could have a tenant who will have paid you some rent in advance. With the other asset classes, you often have to wait until the end of your term (in the case of a term deposit) or until your dividends are due, which is usually two to four times per year.

Hedge against inflation

An inevitable part of life is inflation, and the rate of inflation varies according to the strength of the economy. One of the benefits of holding property is that property values increase at a greater rate than inflation. This is great news if you already own property, but not such great news if you are looking to buy property. The important thing to keep in mind is to buy the right property in the right location.

Tax benefits

There are several tax benefits available to property investors, including claiming interest and expenses, and depreciation (both on the building and the fixtures and fittings).

Using property as security to borrow money to purchase other property allows you to leverage (borrow against the security) to a greater extent than if you were using a share portfolio as security. Most lenders generally lend up to 95 per cent of the value of the property being purchased, whereas they generally lend up to 70 per cent if you were purchasing shares. For example, if you wanted to purchase a property worth $400 000, a lender may be willing to lend you $380 000. This means you need to fund only $20 000, plus fees (assuming that you have no other security). If you wanted to purchase $400 000 worth of shares, however, the same lender may only advance $280 000. This means you have to fund the shortfall of $120 000, plus fees. Another advantage is that you can claim a greater tax deduction on the interest charged on the loan.

Any legitimate expense incurred in running your investment property should also be tax deductible. For example, if you travel to the property to collect the rent, you can claim a deduction. Alternatively, money paid to a property manager to manage your property is tax deductible. Even money spent purchasing this book may be tax deductible!

Depreciation of the building may also be claimed as a tax deduction. The age of the building will determine if you can claim any depreciation and at what rate you can depreciate it. Buying a new or relatively new property (built after 17 July 1985) allows for the greatest amount of depreciation. Claiming building depreciation is a smart way to increase your cash flow.

Bear in mind, though, you sho...

Table of contents

- Cover

- Contents

- Title

- Copyright

- About the author

- Preface

- Introduction

- Part I: investment basics

- Part II: the top suburbs: Adelaide

- Brisbane

- Canberra

- Darwin

- Hobart

- Melbourne

- Perth

- Sydney