![]()

Chapter 1

Definition and Structure of a Mutual Fund

The concept underlying a mutual fund has probably existed since securities were created. In its simplest form, it works as follows. A group of individuals, with a similar investment objective or goal, place their investment monies into a common pool. These funds are then used to buy and sell securities. By pooling their money, the participants reap two primary benefits. The first benefit is diversification. The collective buying power of the group’s pooled resources enable it to purchase shares or bonds in a broader range of industries or business sectors than any individual in the pool could do on his or her own. The second benefit is lower transaction costs per participant. Because the commissions and other trading fees are spread over more shares and more investors, the cost per person is usually much lower than it would be if each individual had bought the same shares directly through a brokerage firm.

mutual fund

commonly used name for an open-end management company that establishes a portfolio of securities and then continually issues new shares and redeems already outstanding shares representing ownership in the portfolio.

Originally, one person, usually a contributor to the pool, was designated by power of attorney or other legal means to select which securities to buy and sell. Each person in the pool shared in the gains and losses on the investments. Their percentage of gains and losses was equal to their percentage of the participation in the pool.

investment objective

the strategy by which an investor wishes to increase the value of his or her assets.

bull market

a period during which the overall prices of securities are rising.

These loosely run and unregulated pools were especially popular in the United States during the bull market of the 1920s. In March 1924, Massachusetts Financial Services created the first true mutual fund in the United States. It was called the Massachusetts Investors Trust. Following the market crash of 1929, Congress passed legislation designed to give clearer structure to and better regulate the various type of investment pools (also called investment companies). The Investment Company Act of 1940 was the first U.S. law to define the different types of pools.

investment company

generic name for one of the many companies, like a mutual fund, whose primary business is investing and reinvesting in securities.

One of the types of investment companies defined in the Act is a management company. It is a corporation or trust whose primary business purpose is to invest and re-invest in securities in accordance with a stated investment objective. The securities that a management company’s professional advisor buys and sells are held in an investment portfolio. When an individual buys shares of a management company, he or she is, in reality, buying an undivided interest in the portfolio of securities created by the company.

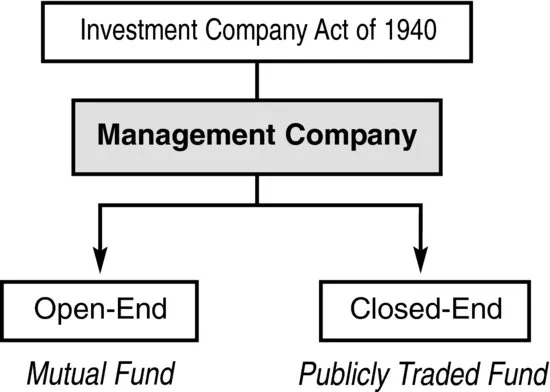

When a management company is formed, it will have either a closed-end structure or an open-end structure. (See Figure 1.1.) The basic difference between the two forms is how frequently new shares are issued to the investing public. A closed-end management company creates an investment portfolio and then issues shares backed by that portfolio to the public only one time. Therefore, the number of shares outstanding, called the company’s capitalization, remains relatively fixed. (This is discussed in more detail at the end of this chapter.)

An open-end management company also creates an investment portfolio and then issues shares to the public backed by that portfolio. In contrast, however, this company, continually issues new shares and buys back already outstanding shares each business day in direct response to investors’ orders to put more of their money into or pull money out of the underlying portfolio. The number of shares outstanding—its capitalization—changes continually. An open-end management company is the legal name for what is widely called a mutual fund.

Open-End Management Company (aka, Mutual Fund)

Each mutual fund is legally registered as a separate management company or trust with the Securities and Exchange Commission (SEC). The financial services company that creates a fund is called the sponsor. It invests its own money to start the fund’s portfolio. (The minimum dollar amount that the sponsor is required to invest is specified in the provisions of the Investment Company Act of 1940.) It also initially selects the fund’s portfolio manager. The sponsor then seeks to bring additional money into the portfolio by marketing it to the public. The more shares it sells, the more money it has to invest in stocks and/or bonds.

Investment Company Act of 1940

the federal legislation that defines the types of organizations that qualify as investment companies and requires them to register with the SEC.

open-end management company

legal name for a mutual fund under the Investment Company Act of 1940.

A mutual fund is called an “open-end” management company because it stands ready to issue new shares and redeem outstanding shares every business day. As individuals buy (i.e., invest more money in) a fund, it issues more shares to the purchasers. The fund’s portfolio manager then uses that money to purchase additional stocks and/or bonds into the portfolio. When investors sell (i.e., redeem or pull money out of) a fund, the total shares outstanding declines. If the number of redemptions is very high, then the fund’s portfolio manager may have to sell some of the stock and/or bonds out of the portfolio in order to pay the investors who have sold (i.e., redeemed) their mutual fund shares. Thus, the number of a mutual fund’s shares outstanding changes daily depending on the number of purchases or redemptions. Even when a mutual fund closes to new investors, those people who already have money invested in the fund can continue to buy and redeem that fund’s shares.

sponsor

the corporation or trust that creates a mutual fund or a family of mutual funds.

stock

a negotiable security representing ownership of a company and entitling its owner to the right to receive dividends.

Mutual fund shares do not trade on stock exchanges or in the over-the-counter market. In fact, the Financial Industry Regulatory Authority (FINRA) expressly prohibits trading these shares in these secondary markets. It is, therefore, inaccurate to describe mutual fund shares as tradable securities. Investors cannot buy and sell shares among themselves. Instead, mutual funds are redeemable securities. An investor can only buy shares from or redeem them with the fund itself or one of the fund’s authorized sales agents. Redeeming mutual fund shares is widely described as selling fund shares.

bond

a long-term debt security or IOU issued by a corporation, municipality, or government that promises to pay interest periodically and to repay the bond’s principal at maturity.

The emergence of mutual fund supermarkets, like those established by Charles Schwab & Co., OneSource, Fidelity Fund Network, E*Trade Mutual Funds Network. and others, has for some unknown reason caused some people to presume that they are actually trading mutual fund shares with other investors who have accounts at these companies. This belief is wrong. The supermarkets are authorized sales agents for many different mutual fund companies, in addition to selling their own. What many investors misconstrue as “trading” in the supermarket is nothing more than a purchase and a redemption, with the firm that runs the supermarket acting as an agent, directing the order to the specific mutual fund company. Again, there is no secondary market trading of mutual funds.

Structure of a Mutual Fund

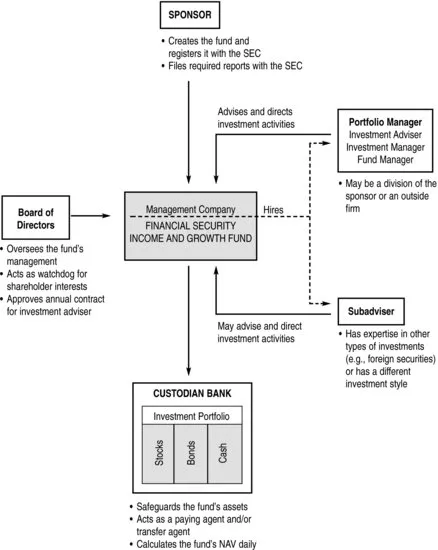

Understanding the organization of a mutual fund and the responsibilities of each of its components makes clear two important features (See Figure 1.2):

1. The safeguards and separation of responsibilities designed to empower certain entities and individuals to act as watch dogs for the shareholders and thus protect their interests.

2. The various costs associated with its day-to-day operation, which are passed along to investors as fees and expenses.

The first feature does not imply that investors’ shares are protected from market price fluctuations. Instead, it means that the fund’s assets are protected from potentially inappropriate and fraudulent activities by the sponsor or portfolio manager. The diagram below illustrates the various participants or entities involved in a mutual fund. Their specific responsibilities and duties are detailed afterward.

redemption

the sale of mutual fund shares back to the fund or its selling agents at the fund’s NAV.

Sponsor

A sponsor is a company—typically a financial services organization such as a brokerage firm, bank, insurance company, or mutual fund company—that creates and makes the first investment in a particular mutual fund or series of mutual funds. For each new fund, the sponsor mus...