- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Handbook of Budgeting

About this book

No other management tool provides the operational direction that a well-planned budget can. Now in a new edition, this book provides updated coverage on issues such as budgeting for exempt organizations and nonprofits in light of the IRS' newly issued Form 990; what manufacturing CFOs' budgeting needs are; current technology solutions; and updated information on value-based budgets. Controllers, budget directors, and CFOs will benefit from this practical "how-to" book's coverage, from the initial planning process to forecasting to specific industry budgets.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Handbook of Budgeting by William R. Lalli in PDF and/or ePUB format, as well as other popular books in Business & Managerial Accounting. We have over one million books available in our catalogue for you to explore.

Information

Part One

Introduction to the Budgeting Process

Chapter 1 Integrating the Balanced Scorecard for Improved Planning and Performance Management

Chapter 2 Strategic Balanced Scorecard–Based Budgeting and Performance Management

Chapter 3 Budgeting and the Strategic Planning Process

Chapter 4 Budgeting and Forecasting: Process or Process Overhaul?

Chapter 5 The Budget: An Integral Element of Internal Control

Chapter 6 The Relationship between Strategic Planning and the Budgeting Process

Chapter 7 The Essentials of Business Valuation

Chapter 8 Moving Beyond Budgeting: Integrating Continuous Planning and Adaptive Control

Chapter 9 Moving Beyond Budgeting: An Update

CHAPTER ONE

Integrating the Balanced Scorecard for Improved Planning and Performance Management

OVERVIEW

The balanced scorecard is a management tool developed by Drs. Robert Kaplan and David Norton in the early 1990s. Since that time, the scorecard has become a standard management practice adopted by large and small organizations throughout the world. The balanced scorecard is based on the simple premise that people and organizations respond and perform based on what is measured. Often this is described as “People respond to what is inspected, not expected.” Measurement becomes a language that communicates clear priorities to the organization.

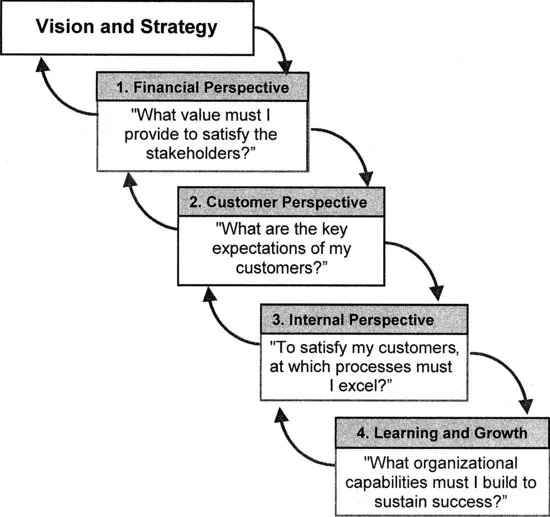

Because the primary goal of any organization (commercial, governmental, or nonprofit) is to create value for its stakeholders and because the strategy is the way the organization intends to create value, the measurement system should be closely linked to the strategy. The balanced scorecard provides a measurement system that translates the strategy into operational terms through a series of causal relationships defined around four key perspectives (see Exhibit 1.1):

Exhibit 1.1 Four Perspectives of the Balanced Scorecard

1. Financial perspective. For commercial organizations, the financial perspective defines the value created for the shareholders. For noncommercial organizations, the expectations of the financial stakeholders are defined.

2. Customer perspective. The targeted customers and the value they receive from the organization are defined in the customer perspective. The value expectations of the customers typically are developed around the standard attributes of cost, quality, service, and time.

3. Internal perspective. The key processes at which the organization must excel are defined in the internal perspective. Often these processes are grouped into a few key themes, such as operation excellence, customer intimacy, and innovation.

4. Learning and growth perspective. The key capabilities of the organization in terms of people, skills, technology, and culture are defined in the learning and growth perspective. These organizational attributes are the foundation for future strategic success.

By specifying and measuring the organization’s key priorities within these four perspectives, a balanced view can be obtained. One element of this balance is the traditional mix of financial and nonfinancial factors, but the other, more innovative balance, is in the timing of strategic impact. In terms of fostering long-term sustainable success, each of the four perspectives has a time-specific impact that contributes to the concept of balanced management. Even though the overall goal may be financial or shareholder value, each of the other perspectives contributes differently to the outlook for that goal.

The financial perspective measures financial performance for a past period (last quarter, last year, etc.). The customer perspective measures the value delivered to and the overall satisfaction of customers which will have a short-term future impact on the financial performance. The internal perspective measures the ability of the organization to execute its processes that will have a short-term future impact on customer value and a medium-term impact on financial performance. The learning and growth perspective measures the development of organizational capabilities that will have a short-term impact on operational execution, a medium-term impact on customer satisfaction, and a long-term impact on financial performance.

By analyzing and measuring the strategy across all four perspectives, organizations achieve balance between the leading and lagging indicators of performance as well as between financial and nonfinancial factors. The combination of these multiple dimensions of balance allows a more holistic understanding of the organization’s strategic execution and ultimate strategic success. Management should be able to use the scorecard results to obtain a snapshot of the current performance and a forecast of future strategic performance for the organization. This snapshot should highlight any key issues and be a valuable tool in steering the business through the allocation of resources and prioritization of strategic initiatives.

ELEMENTS OF A BALANCED SCORECARD

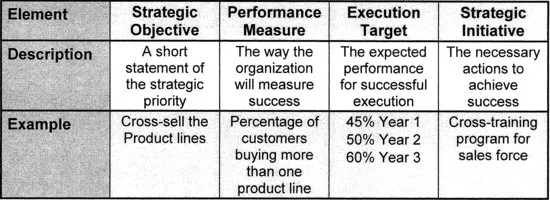

The primary elements of a balanced scorecard are the strategic objectives, performance measures, execution targets, and strategic initiatives (see Exhibit 1.2). These elements must be clearly defined and properly aligned among the four perspectives to create a useful management tool. Once these elements are aligned, their combination should be able to tell the story of the strategy in a clear and common framework. A well-defined framework will become a standard strategic language that can be used throughout the organization to better understand and manage strategy.

Exhibit 1.2 Primary Elements of the Balanced Scorecard

Strategic Objectives

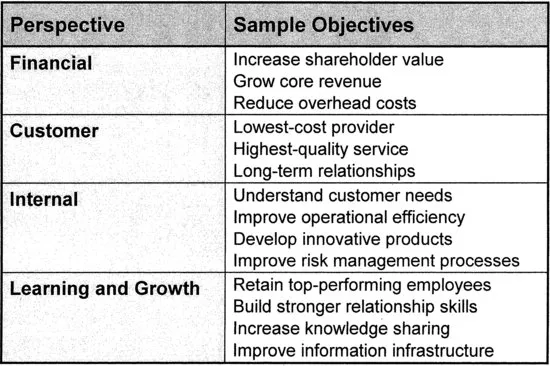

The strategic objectives are short statements of the strategy that are used to highlight the key priorities of the organization. Specifying the objectives is the first and most strategically important step in designing a balanced scorecard. The objectives should be designed to reflect a midterm version of the strategy, typically the priorities over the next five years. The strategic objectives should highlight the most important priorities for the organization to focus on during this time period. These objectives typically are formatted in a verb-adjective-noun format similar to activities (see Exhibit 1.3 for examples). To show the emphasis on the customer’s expectations, objectives for the customer perspective generally are specified in the words of the customer. The formatting of customer objectives is represented as the key attributes of the organization’s products and services that represent value to the customer.

Exhibit 1.3 Sample Strategic Objectives

The definition of the strategic objectives is an area that clearly makes the balanced scorecard a strategic management tool rather than a simple key performance measure framework. The identification of the priorities of the organization across each perspective requires a well-developed strategy that is understood by the organization. Senior management involvement is especially critical during the definition of the objectives. To define strategic objectives, an organization must understand these questions:

- Financial. What is the primary financial outcome for the organization? What are the key financial levers necessary to achieve that outcome?

- Customer. Who are my primary customers or customer groups? What attributes differentiate my products or services to these customers? What is most important to the customer?

- Internal. What areas of my internal processes must excel to satisfy the customers? How do these processes link together to meet specific customer needs? What is the internal focus of my organization: operational excellence, innovation, customer knowledge, and other key goals?

- Learning and growth. What skills and capabilities are necessary to execute the strategy in the future? What type of people and culture will enable the organization’s success? How should we manage technology and information to leverage these assets for tangible results?

Only after the organization has clearly articulated its strategy through the strategic objectives can the subject of performance measures be properly addressed. A large organization can typically expect to define between 20 and 25 strategic objectives for a clearly articulated strategy. More than 25 objectives would indicate a lack of clear priorities for the organization. Fewer objectives can be sufficient if they are defined specifically enough to communicate the strategy effectively.

The definition of the strategic objectives should highlight areas of inconsistency in the strategy. An organization cannot seek to be all things to all customers. The strategic objective process is designed to highlight the most important outcomes that define value for the shareholders and customers as well as the few key processes and organizational attributes that contribute most to that value. The objectives will not cover every activity performed by the organization but should highlight those that will be most critical over the strategic horizon.

Performance Measures

As a measurement framework, the balanced scorecard often is judged by the quality of the performance measures. Performance measures serve to further clarify the priorities of an organization by directly identifying the most important priorities for strategic execution. The performance measures identify how...

Table of contents

- Cover

- Title Page

- Copyright

- Series

- Foreword

- Preface

- Part One: Introduction to the Budgeting Process

- Part Two: Tools And Techniques

- Part Three: Preparation of Specific Budgets

- Part Four: Budgeting Applications

- Part Five: Industry Budgets

- About the Editor

- About the Contributors

- Index

- Wiley End User License Agreement