- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

Filled with insights from leading Australian CEOs, Master CEOs taps into the thoughts of Australia's leading

chief executive officers or managing directors in an effort to understand why they are such outstanding leaders, and why the companies they run have delivered above-average results. Master CEOs is not only about management — it also delivers a very strong message on leadership.

- To be interviewed for the book, the CEO had to be in charge of their company for at least 10 years and delivered shareholders a return greater than the share market in that period.

- CEOs covered include: Gerry Harvey from Harvey Norman, Paul Little from Toll Holdings, Graham Turner from Flight Centre, David Simmons from Hills Industries and many more.

- All new interviews, never before published.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Master CEOs by Matthew Kidman,Alex Feher in PDF and/or ePUB format, as well as other popular books in Business & Leadership. We have over one million books available in our catalogue for you to explore.

Information

Chapter 1

Selecting the Master CEOs

The selection process for the Master CEOs was kept quite simple. There were four key criteria:

- The CEO or managing director must have been in charge of the company for a minimum of ten years. The minimum tenure was based on a desire to, as best as possible, eliminate the benefit or detriment of an economic cycle —that is, we wanted the CEOs to have performed through good and bad times. The average term of CEOs in listed companies is closer to five years.

- The CEO had to be still actively running the company at the time we invited them to participate in the book.

- The company must have been listed on the Australian Securities Exchange for at least the ten years the CEO was in charge. There were many companies whose CEO had been there for many years before listing, but these companies could not be considered because they had been listed for less than ten years.

- The company’s total return to its shareholders must have outperformed the All Ordinaries Accumulation Index over the period the CEO was in charge. The All Ordinaries Accumulation Index measures the overall performance of the Australian sharemarket, including dividends, so we thought it was the best benchmark to work from.

We applied the criteria to the companies in the All Ordinaries Accumulation Index and more than twenty CEOs qualified. Letters were sent to these people and thirteen accepted. This was a tremendous response, given the time constraints and obligations of the people involved. We accept that the list of CEOs is not exhaustive; however, it contains a variety of people from different industries and backgrounds, and all have inspiring stories to tell. Selection processes are often contentious, whether they are for the best teams in sport or the top musicians of an era, and our selection process will not suit everyone.

Three of the CEOs retired after being interviewed — David Simmons of Hills Industries, Pat Grier of Ramsay Health Care and Owen Hegarty of Oxiana. It was decided that all three should stay in the book, given they had a lot to offer and that they had already been involved in the process.

Each of the thirteen CEOs was interviewed directly by the authors. The intention was to have them tell their life story and at the same time explain why they have been such outstanding leaders in corporate life. Most of the interviews begin with the CEO’s childhood and rise to the top, before switching to the subject of leadership and management.

These leaders are from a range of sectors, with health care the dominant industry (providing four of the thirteen people). The remainder are from industries including banking, retail, construction, grocery wholesaling, transport, mining, mining services and diversified industry. Interestingly, they also come from a good cross-section of the country, with six from New South Wales, three from Victoria, two from Queensland, one from South Australia and one from Western Australia. Nine grew up in Australia, two in South Africa, one in Zimbabwe and one in Italy.

Of significance was that only one of the CEOs was brought in from overseas to run a company. That person was Andrew Reitzer, who was placed in the top job at food and liquor wholesaler Metcash after his South African employer made a takeover bid for the company. The rest had learned their management skills in Australia — a fact not wasted on Leighton Holdings CEO Wal King, who had some strong comments about the conduct of Australian boards and the selection of management.

Unfortunately, no female CEOs passed the selection criteria. The one exception was Katie Page, who along with her husband, Gerry Harvey, has run the highly successful Harvey Norman retail group for twenty-five years. We were hopeful that Katie and Gerry could be interviewed together, but she preferred not to be involved, leaving Gerry to do the talking.

There were a number of objectives in writing this book. Firstly, we were keen to look beyond the numbers and investigate how some leaders manage to continually perform highly. All too often analysts and funds managers are only concerned with the end result, rather than with why some managers have the ability to deliver outstanding results over long periods. Sustainable businesses are difficult to find, and when we do come across them it is incumbent on investors, managers and employees to study why they have delivered great outcomes.

Secondly, the subject of leadership has been much researched in other western markets, such as the United States and United Kingdom, and is a much-debated topic in other fields, such as politics and sport. However, leadership in Australian companies has been explored very little.

Finally, as students of business and life we are excited by the subject of success. The thirteen CEOs we interviewed for this book have enjoyed outstanding success in their chosen careers. Tapping into their thoughts was an exercise worth doing even if we had not been writing a book.

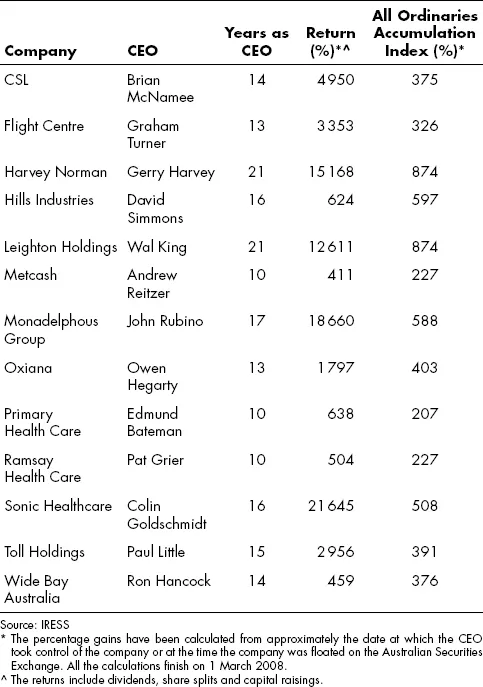

Table 1.1 overleaf sets out the returns the thirteen Master CEOs have presided over at their companies. While the returns vary greatly, we believe each leader has done an outstanding job for their investors, given the time frame and the industry they are in. The returns are based on when the individuals became CEO until we started interviewing them in February 2008.

Table 1.1: company returns

We look forward to writing a sequel to Master CEOs. While it would be difficult to come up with a long list of names today, or even in a year’s time, we are confident there are many new corporate leaders who will qualify in the future. People such as John Grill from WorleyParsons, Mark McInnes from David Jones, Reg Kermode from Cabcharge and Peter Dunai from IRESS will easily qualify in the next few years if they stay where they are and continue to perform. Even at the smaller end of the market, people such as Theo Hnarakis from Melbourne IT and Clive Rabie from Reckon are in line to join the list.

We found that many of the CEOs interviewed shared many similar traits even though they all have very different personalities. While there is no one way to run a business successfully, we found that there are some crucial components that go into making a great leader.

After the AMA saga I thought whatever they do to me, I can survive it. From that point on, I wanted to be my own self and I didn’t want the world to be chasing me and sticking pins in me. If I can put up with that, I can put up with anything people throw at me.

Dr Edmund Bateman

Primary Health Care

Primary Health Care operates the largest medical centre business in Australia, with forty sites around the country. The centres provide access to general practitioners, specialists, pharmacy, pathology, radiology, occupational therapy and paramedical services. Following the takeover of Symbion Health, Primary also operates significant stand-alone pathology and radiology businesses. The company reported a net profit of $57.4 million for the 2007–08 financial year.

Investors have received a return of 638 percent during Dr Edmund Bateman’s time as CEO, between 1998 and 2008, compared with a 207 percent return by the All Ordinaries Accumulation Index.

Chapter 2

Tough medicine

Dr Edmund Bateman is a colossus in the Australian medical industry. In many ways he is to medical business what Kerry Packer was to the media industry in the 1970s and 1980s. Like Packer, Dr Bateman has a hard exterior and a reputation for being tough and uncompromising, yet charming. It takes a game person to go into battle with the doctor. Dr Bateman’s sons describe their father’s leadership style as ‘his way or the highway’, and while their father laughs at this suggestion, there is little confusion about who is in charge at the stunningly successful medical company, Primary Health Care. In many ways Dr Bateman is a visionary. Under his leadership Primary has changed the way medicine is practised in Australia. This change has not come easy, with many of the medical fraternity stinging in their criticism of Dr Bateman and his style. However, the public have voted with their feet, beating a path to Primary’s string of medical centres across the country.

Virtually every GP in Dr Bateman’s home town of Sydney has a story about him and his no-nonsense style of implementing the company’s business plan. The investment community has applauded his direct style and his ability to deliver returns. After watching the doctor give a presentation some years back, one cheeky Sydney funds manager nicknamed him Dr Evil, after the character in the Mike Myers’ Austin Powers films. Dr Bateman is a stern-looking man who, on the face of it, has little time for people who ask impertinent questions and who have the temerity to question his decision making.

Dr Bateman shares a number of other Packer traits. While Packer liked to gamble at casinos around the globe, Dr Bateman has shown a willingness to bet all on his business ventures. Whether it is his farming ventures, revolutionary medical clinics, personal investing or recent successful bid to buy the much larger Symbion Health, Dr Bateman has a propensity to take enormous risks.

In our interview, many of these characteristics were not on show, and it became clear that his reputation as a businessman in a steel suit is more fiction than reality. Dr Bateman comes across as an extremely honest and affable person, and it was a pleasure to be in his company. He reveals his childhood and the lasting impact it has had on him. He also talks at length about his fear of failing and letting his many shareholders, doctors and employees down. There have been many times when Dr Bateman would have been happy to be a farmer in rural New South Wales, but due to fate and his insatiable appetite to take risks, he has pushed on and now believes he will rest only when buried. His flirtations with financial ruin have numbered many over the years, and his willingness to take each threatening situation head on, despite fearing a disastrous outcome, is inspiring.

In short, Dr Bateman has revolutionised the age-old profession of general practice medicine in Australia. He has scoffed at his critics among the medical profession and believes that his way is the only way that can survive in the current environment, and the only way that can sufficiently support the longevity of the GP.

Primary Health Care began its corporate life in the 1980s with the opening of the Warringah Mall Medical Centre on Sydney’s Northern Beaches. While the centre and its support of bulk billing have attracted significant criticism over the years from the medical community, the company has grown to a behemoth with forty centres scattered around the country. In 2007, Primary posted revenue of more than $160 million and earnings of more than $82 million. An immense effort, given most ventures to corporatise general medical practices in Australia have failed. Dr Bateman has become extremely rich on the back of this success, with his personal fortune soaring to over $300 million. Despite this, he reviles flashy lifestyles and works extremely hard to keep a low profile. The Primary Health Care annual report has no pictures of directors, virtually no commentary on the people or the business, and the document only qualifies as an annual report because it includes the financial numbers and corporate governance documents.

We met Dr Bateman in March 2008. He was jovial and warm, and on a high after defeating arch rival Healthscope in the battle to take over the $2.6 billion medical group, Symbion. The attempt to gain control of the pathology and radiology group raged for many months, with Primary winning despite offering a lower bid than Healthscope. It was typical Bateman brinkmanship. He was prepared to roll the dice and put more than twenty years of work at risk to take the company into a new era. All this at sixty-six years of age and having previously held fleeting thoughts of retirement. Dr Bateman remains determined to prove to all and sundry that he can make it work and stick it to the non-believers — something he has been able to achieve most of his life.

Where were you born and where did you go to school?

I was born in Sydney. I went to St Aloysius College.

My father was a doctor and my mother was a barrister. It was a family of seven kids. I spent my whole life in Sydney. My first sixteen years were about school and sport. More sport than school.

Did you enjoy your sport?

At school, football and swimming were my life. Study wasn’t my aim in life at that time. I got through school like I got through most educational things, as something that had to be done, rather t...

Table of contents

- Cover

- Contents

- Title

- Copyright

- Foreword

- About the Authors

- Acknowledgements

- Introduction

- Chapter 1: Selecting the Master CEOs

- Chapter 2: Tough Medicine

- Chapter 3: David to Goliath

- Chapter 4: The Best Mistake I Ever Made

- Chapter 5: Making the World Little

- Chapter 6: The Hills are Alive with the Sound of Music

- Chapter 7: SuperSonic

- Chapter 8: Building a Kingdom

- Chapter 9: Banks, Boats and Bundy

- Chapter 10: Soaring High

- Chapter 11: A Bloody Miracle

- Chapter 12: Out of Africa

- Chapter 13: Mining for Values

- Chapter 14: Go Gerry, Go, Go, Go

- Conclusion

- Index