Global Property Investment

Strategies, Structures, Decisions

- English

- ePUB (mobile friendly)

- Available on iOS & Android

About this book

Developments in the sophistication of global real estate markets mean that global real estate investment is now being executed professionally. Thanks to academic enquiry, professional analysis and entrepreneurial activity, backed by the globalisation of all investment activity, there is now an available body of material which forms the basis of this scholarly but practical summary of the new state of this art.

The measurement, benchmarking, forecasting and quantitative management techniques applied to property investments are now compatible with those used in other asset classes, and advances in property research have at last put the ongoing debate about the role of real estate onto a footing of solid evidence.

The truly global scope and authorship of this book is unique, and both authors here are singularly well qualified to summarise the impact and likely future of global innovations in property research and fund management. Between them, they have experienced three real estate crashes, and have observed at first hand the creation of the real estate debt and equity instruments that led to the global crisis of 2008-9.

Global Property Investment: strategies, structure, decisions offers a unique perspective of the international real estate investment industry with:

- a close focus on solutions to real life investment problems

- no excessive theoretical padding

- a target of both students and professionals

- highly qualified dual-nationality authorship

With many cases, problems and solutions presented throughout the book, and a companion website used for deeper analysis and slides presentations (see below), this is a key text for higher-level real estate students on BSc, MSc, MPhil and MBA courses worldwide as well as for practising property professionals worldwide in fund management, investment and asset management, banking and real estate advisory firms.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

Part One

Real Estate as an Investment: An Introduction

- Chapter 1: Real estate – the global asset

- Chapter 2: Global property markets and real estate cycles

- Chapter 3: Market fundamentals and rent

- Chapter 4: Asset pricing, portfolio theory and real estate

Chapter 1

Real estate – the global asset

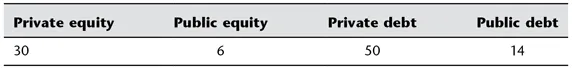

1.1 The Global Property Investment Universe

Table of contents

- Cover

- Dedication

- Title

- Copyright

- Preface

- Acknowledgements

- Part One: Real Estate as an Investment: An Introduction

- Part Two: Making Investment Decisions at the Property Level

- Part Three: Real Estate Investment Structures

- Part Four: Creating a Global Real Estate Strategy

- References

- Glossary

- Index

- End User License Agreement