![]()

CHAPTER 1

THE WEALTH MANAGEMENT PROCESS

The responsibility of advisors revolves around both helping families to keep doing the “right” thing and providing them with as much comfort as possible in doing so.

—Jean Brunel

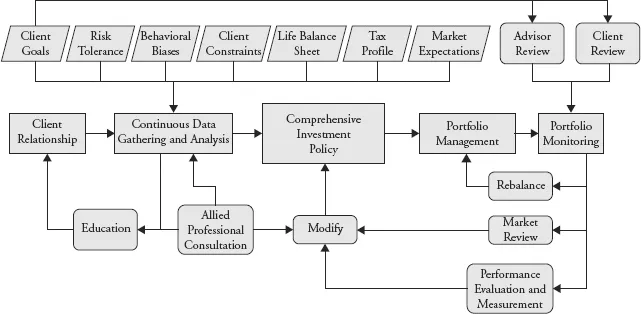

We discussed in the Preface that wealth management geared toward individuals is fundamentally different from money management for institutions. Money managers are focused on the portfolio, whereas wealth managers are focused on the client; therefore, wealth management is a more comprehensive, customized, and complex approach that captures a broad array of issues and interactions that asset managers can often safely ignore. Exhibit 1.1 presents a series of important elements of the wealth management investment process. This chapter provides an overview of that process and is a road map for the rest of this book, which establishes a framework for an effective wealth management practice. We provide a brief introduction of these ideas in this chapter to give an overall perspective, and leave more detailed treatment for the relevant chapters that follow.

EXHIBIT 1.1 The Wealth Management Investment Process

The wealth management investment process can be organized into four general, interrelated categories.

1. Client relationship. The start of any wealth management process is establishing a solid client relationship built on communication, education, and trust. These elements are represented in the bottom-left part of Exhibit 1.1.

2. Client profile. As alluded to earlier, understanding your client in a private wealth management context is complex and based on many factors, some of which are represented by the parallelograms across the top of the chart.

3. Wealth management investment policy. Using the relationship and profile factors as inputs, developing a wealth management investment policy is at the heart of the wealth management process.

4. Portfolio management, monitoring, and market review. Represented by the systems to the right, implementation, monitoring, and review processes are iterative in nature. That is, they are recurring processes that rely on ever-changing information—such as changes in performance, client circumstances, and market conditions. Many behavioral tendencies exhibit themselves in this part of the process, especially in response to volatile market conditions.

It is important to recognize that this process is independent of a client’s wealth level. Although the relevant issues and optimal solutions are often related to net worth (e.g., the use of trusts, the management of estate taxes, philanthropy), the fundamental process remains unchanged.

THE CLIENT RELATIONSHIP

Because everything is client driven, developing a strong relationship with the client is critical to gathering the appropriate data and helping the client understand what the plan is intended to accomplish. Let’s begin on the left side at the bottom-left section of Exhibit 1.1. You may have already noticed from the schematic that the overall wealth management investment process is recursive and ongoing. Developing a client relationship is also iterative, because the wealth manager is continually collecting data from the client and working with other allied professionals, such as attorneys and accountants. The wealth manager uses this information to educate the client about the process in general, possible investment alternatives, and the purpose of chosen investment strategies.

Education is important for developing a strong relationship and ensuring that the advisor and client are speaking the same language. For example, does the client understand what the advisor means when the advisor discusses the concept of risk? Education is performed in cooperation with other investment professionals involved in the client’s financial affairs. Expert professional consultation requires effective and active collaboration among the advisory team members. Typically, the catalyst for this collaboration is the wealth manager, and it requires communication and interpersonal skills. It also involves incorporating accountability into the process, which we discuss more fully later.

The educational process is tailored to the individual, evolves over time, and adapts to a client’s changing levels of familiarity and comfort. For example, as a client becomes more familiar with different asset classes and notions of risks, the wealth manager may introduce and suggest different investment strategies that might have been avoided earlier in the relationship because their complexity might have potentially compromised the rapport between advisor and client. We discuss client education more thoroughly in Chapter 6.

There are as many data-gathering and educational techniques as there are wealth managers. However, successfully building the relationship depends, in part, on understanding the unique characteristics of each individual. Some clients may be reserved, withholding valuable information from their advisors. Other clients, such as successful self-made entrepreneurs, may have little tolerance for exchanging information and want to jump directly to the implementation stage of an investment strategy. Many people (investors and noninvestors alike) exhibit behavioral biases that shape the way they approach decisions and react to investment outcomes. A deft wealth manager identifies these traits and biases and develops tactics to address them. We address these techniques in Chapter 4.

THE CLIENT PROFILE

Determining the client’s profile is a detailed endeavor and is the area in which the differences between private wealth management and institutional investment management are most pronounced. The parallelograms across the top of Exhibit 1.1 list some of the primary elements of a client profile.

Client Goals

An investment strategy starts with identifying an investor’s goals. Asset managers often think of client goals in terms of return requirements, which can come in many forms. They may be expressed as nominal returns or real returns. They may also be expressed in absolute terms or relative to a predetermined benchmark, such as a market index. In any case, goals and objectives must be consistent with an investor’s risk tolerance. That is, an investment objective or agreed-upon investment goal should not require more risk than an investor can reasonably bear. For example, a 10 percent real return investment objective is not congruent with a moderately conservative risk tolerance.

In a wealth management context, a client’s goals can be broader than simply identifying return requirements. They can include planning for wealth transfers; managing risks (e.g., property, longevity); managing family dynamics; and preparing for charitable donations. They do not stand in isolation, but are related to each other, forming part of an integrated whole. Moreover, clients tend to express their goals not in quantitative terms (like percentage return) but in qualitative terms. They often wish to maintain their current standard of living through retirement, pay for a child’s college education, or leave some kind of legacy after their passing. The wealth manager’s job is to help clients quantify these goals with time and dollar specificity and to prioritize them.

Risk Tolerance

Many methods exist for determining a client’s risk tolerance, from the objective to the subjective. Wealth managers often review past investment behavior. Many wealth managers refine their understanding with questionnaires and interviews, while others form opinions based on their holistic experience with the client and an understanding of the client’s lifestyles and habits. In any case, although risk tolerance commonly refers to an investor’s emotional tolerance for volatility or suffering a loss, it is also important to understand a client’s risk capacity (i.e., the financial capacity to withstand market losses).1 They need not be the same. When an investor’s risk tolerance exceeds his or her risk capacity, the lower risk capacity should prevail and the wealth manager needs to educate the client on that client’s financial capacity to withstand losses. If risk capacity exceeds risk tolerance, resolution is also needed. When market losses exceed a client’s risk tolerance level, a nervous client is likely to bail out of the market independent of his or her risk capacity. As a result, the decision should generally be resolved in favor of the more conservative risk tolerance. This discrepancy is illustrated in Exhibit 1.2. We discuss a client’s risk tolerance more fully in Chapters 4 and 5.

EXHIBIT 1.2 Risk Tolerance versus Risk Capacity

Source: Adapted from John L. Maginn, Donald L. Tuttle, Dennis W. McLeavey, and Jerald E. Pinto, “The Portfolio Management Process and the Investment Policy Statement,” and James W. Bronson, Matthew H. Scanlan, and Jan R. Squires, “Managing Individual Investor Portfolios,” both in Managing Investment Portfolios, 3rd edition (Hoboken, NJ: John Wiley & Sons, 2007): 12, 36–38.

| Risk Capacity |

| Risk Tolerance | Below Average | Above Average |

| Below Average | Below-average risk tolerance | R... |