- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

The ultimate guide to the ins and out of mergers and acquisitions

Practitioner's Complete Guide to M&As provides the practical tricks of the trade on M&As: what they need to know, what they have to know, and what they need to do. Numerous examples and forms are included illustrating concepts in discussion.

- Written in a straight-talking style

- A highly, practical application-oriented guide to mergers and acquisitions

- Covers strategy development; deal flow and target identification; due diligence; valuation and offers; tax structuring; negotiation; and integration and value creation"

- Presents information using bullet points rather than lengthy narrative for ease of reading

- Numerous exhibits, forms, and examples are included

This practical guide takes you through every step of the M&A process, providing all the necessary tools that both the first-time M&A player as well as the seasoned practitioner need to complete a smart transaction.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

Topic 1

Strategy Development, Then M&A

Topic 1 presents an overview of the fundamental elements typically addressed in the strategic planning process; explores a number of work activities, approaches, and ideas pertinent to the process of developing strategy; and explores where mergers and acquisitions (M&A) fit in the strategy development and execution process.

The reader is encouraged to take the time to read through the Appendices referenced in the text of this and all remaining Topics in conjunction with the narrative to gain the appropriate level of understanding of the subject matter discussed. Appendices are either presented at the end of this and each remaining Topic or are available for review and download on this book's companion Web site (see the About the Web Site page for login information).

M&A IS ONE OF MANY BUSINESS DEVELOPMENT OPTIONS

- M&A in an operating business is one of a number of means to accomplish a strategic goal and generally results from a strategic planning and strategy development process.

- M&A activity is the strategic activity of investor groups (equity funds, venture capital funds, etc.).

- The work involved in strategy development in manufacturing or service firms is often found to be frustrating and difficult.

- The questions, introspective search, dialog, and answers often are time consuming and unclear, particularly to the operating executives doing this work who are used to dealing with issues and process refinements of running a business and making decisions.

- The operating executives include chief executive officers, chief financial officers, chief operating officers, operations directors, plant managers, manufacturing managers, chief marketing executives, or sales officers.

- The operating executives, however, are the source of the knowledge gained over years in the business that matters most in developing strategy.

- The work agenda must acknowledge early on that strategy development deals with issues and questions that do not have great clarity. The answers to these questions usually surrender not to analysis but to participants’ best thinking and judgment.

- The strategy development team should move along as fast as the pace of capturing and quantifying judgment allows and determine where complementary off-line research and analysis by the team and or team analysts is needed to enhance the judgment.

- Avoid a heavily research-driven process.

STAGES INVOLVED IN THE STRATEGIC PLANNING PROCESS

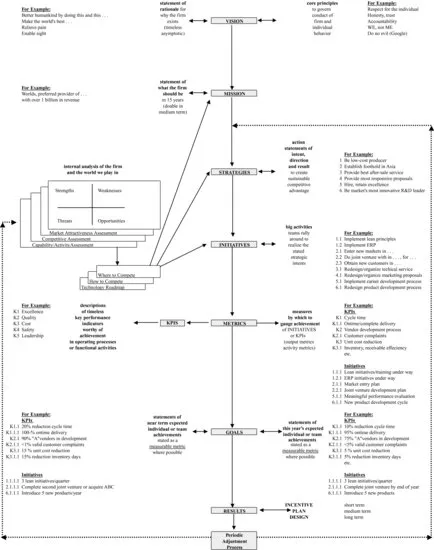

- This section provides a general overview of the key elements of the strategic planning process usually employed in an operating company and indicates where M&A fits in. The information is presented in the Strategy Planning Process Engine in Appendix 1.1. APPENDIX 1.1 Strategic Planning Process Engine: Core Essentials

- Corporate vision embodies a brief, understandable, timeless statement of the rationale for why the firm exists (not what it does or wants to be) and the core principles that govern how the firm and its employees will conduct business and themselves during its existence.

- Corporate mission embodies a brief, understandable, realistic statement of what the firm wants to be (and be seen as) in the medium term, say 15 to 20 years.

- Corporate strategies are brief, understandable, achievable action statements of intent, direction, and desired result that are necessary to achieve and that, if achieved, will move the firm toward its mission (if not achieved, they will prevent achievement of the mission). These strategies are intended to create sustainable competitive advantage in the organization's market space. These strategies emanate from the strategy development process discussed later in this topic.

- Initiatives are big, achievable activities and programs that individuals and teams rally around and participate and take ownership in. Initiatives are necessary to complete and, if completed, will move the firm toward realization of the desired results embodied in each strategy. They are usually multiyear in duration. M&A is potentially one of a number of business development initiatives.

- Key performance indicators (KPIs) are descriptions of relevant, timeless indicators of performance in operating and functional support processes and initiative realization.

- Metrics are relevant, preferably quantitative measures by which to gauge performance toward and achievement of initiatives and of KPIs.

- Goals are brief statements of this year's (perhaps part of a multiyear goal) expected achievements and related metrics of achievement for each initiative or KPI. Goals are owned by individuals and teams and provide a clear measure of personal and team performance.

- Results are measurement based, integrate with incentive plan design and rewards, and provide the basis for measuring goal achievement and making cyclical, periodic adjustments to strategy, initiatives, metric targets, and goals.

STRATEGY DEVELOPMENT—WHERE AND HOW TO CREATE VALUE

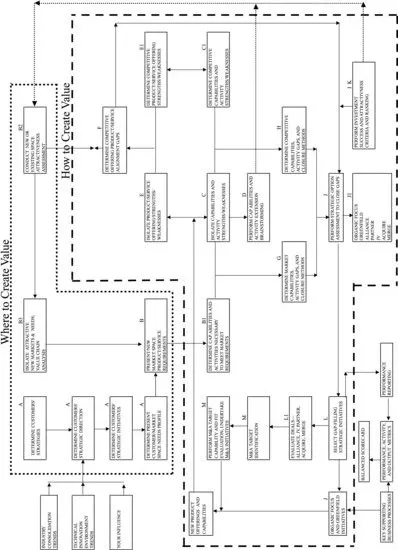

- The essential thrust of strategy development is identifying where to create value (attractive market spaces to enter or maintain and defend) and how to create value in the spaces selected. (What are the enabling capabilities and strategies required to close the capability gaps that exist for the firm to compete in the identified spaces and create enduring stakeholder value?)

- M&A is one of a number of means of closing the capability gaps. Other methods include organic development, in-house start-up, licensing, joint ventures, and other contractual arrangements.

- The process involved in detail strategy development usually includes the two steps noted above, which are shown in the Strategy Development and Gap Closure Engine in Appendix 1.2. APPENDIX 1.2 Key Process Steps to Identify Where and How to Create Value and Close Strategic Gaps

- Many of the process steps presented on Appendix 1.2 may not be carried out explicitly in reaching strategy conclusions in businesses that prefer a more intuitive strategy development approach, but they probably reflect the thought processes and trade-offs made by intuitive strategy developers.

- Do not underestimate what a highly skilled and experienced strategy development consultant can offer to drive the strategy development process. Experienced experts will, at the very least, provide a voice of reason, contrast, and clarity to the process. More often they will provide the results of external research and insights, options, points of focus, and direction, which are all of timeless value to the user.

- There is also great benefit to focus the due diligence process (normally applied to acquisition targets as discussed in Topic 10) internally (the firm's due diligence self-assessment) as part of the firm's strategic planning process. Doing so captures much of the knowledge of the firm's capabilities discussed later in this topic, as well as the business and valuation drivers discussed in Topic 10 and attractive market criteria discussed in Topic 4.

WHERE—IDENTIFY CUSTOMER'S INITIATIVES AND ATTRACTIVE MARKET SPACES

- Identify your customer's (and your customer's customers) strategic initiatives in the market spaces you are now engaged in (See Appendix 1.2). Also identify their current and future product and service needs and requirements that will fulfill their initiatives (B, Appendix 1.2):

- By doing so, you can identify where are they going, what will they need to get there, and what is most important to them to enable them to succeed. You will also identify what capabilities will be necessary for vendors to excel at to meet their customers’ product and service requirements (B1, Appendix 1.2). Consider the following:

- Closely follow industry trends.

- Hold “customer futures” conferences for your industry and its future.

- Talk to your customers: How can you be in their future?

- Attend customer industry conferences and trade shows.

- By doing so, you can identify where are they going, what will they need to get there, and what is most important to them to enable them to succeed. You will also identify what capabilities will be necessary for vendors to excel at to meet their customers’ product and service requirements (B1, Appendix 1.2). Consider the following:

- Identify new attractive market spaces (B2, B3, Appendix 1.2) and the future product and service requirements of those spaces worthy of developing, entering, and defending (B, Appendix 1.2). Identify the capabilities necessary to meet those product and service requirements (B1, Appendix 1.2).

- Use brainstorming techniques to identify adjacent and new market space ideas. Cross-reference them to the results from these idea-generating methods:

- Search Web databases for ideas on where others are placing investments.

- Interview pension advisors and venture capital and equity investors for investment trends and developing sectors.

- Interview “blue sky” thinkers for megatrends and implications on business sectors.

- Perform top-down growt...

Table of contents

- Cover

- Series

- Title Page

- Copyright

- Preface

- Acknowledgments

- Topic 1: Strategy Development, Then M&A

- Topic 2: M&A Process: Front to Back

- Topic 3: Why M&A?

- Topic 4: Deal Criteria

- Topic 5: Deal Sourcing

- Topic 6: Fees for Services

- Topic 7: Financial and Strategic Buyers

- Topic 8: How Long Will It Take to Complete the Deal?

- Topic 9: Confidentiality Agreements

- Topic 10: “Concern Capture” Due Diligence

- Topic 11: Keep Deal Conversations Quiet

- Topic 12: Auctions

- Topic 13: Seller's Prospectus

- Topic 14: Pay for Inherent Capabilities Only

- Topic 15: Platform Value

- Topic 16: Buyer and Seller Value Perspectives

- Topic 17: Integration Initiatives Will Determine Deal Value

- Topic 18: Unlock Hidden Value: The Lean Enterprise

- Topic 19: The Real Deal: Lean

- Topic 20: Valuation: An Introduction

- Topic 21: Discounted Cash Flow: An Introduction

- Topic 22: Free Cash Flow

- Topic 23: Fair Return on a Deal

- Topic 24: Risk-Free Rates

- Topic 25: Equity Risk Premiums

- Topic 26: What Is Business Risk?

- Topic 27: Entropy: Tendency toward Negative Variation

- Topic 28: Equity Investor Risk

- Topic 29: Beta

- Topic 30: Systematic Risk

- Topic 31: Unsystematic Risk

- Topic 32: Beta with or without Debt

- Topic 33: Beta: Levered or Unlevered

- Topic 34: Beta Application in Determination of CU

- Topic 35: Levered Beta Moves as Debt to Equity Moves

- Topic 36: Size Premium

- Topic 37: Weighted Average Cost of Capital

- Topic 38: Terminal Values, Terminal Value Multiples, and Terminal Value DCFs

- Topic 39: Discounted Cash Flow Valuation Illustrated

- Topic 40: Leverage: The Real Deal

- Topic 41: Debt Limits

- Topic 42: Debt Adds Value: The Derivation of Dt

- Topic 43: The Leveraged Buyout; Definition and Valuation

- Topic 44: Valuing the Leveraged Buyout

- Topic 45: Real Option Valuation: An Introduction

- Topic 46: Real Option Valuation: Application and Illustration

- Topic 47: M&A Values Are Not All the Same

- Topic 48: Discounts and Premiums

- Topic 49: Discounted Cash Flow Valuations: Minority or Control

- Topic 50: Inflation in DCF Valuations

- Topic 51: Integration, Alignment, and Synergy Benefits: Plan It Out

- Topic 52: Integration, Alignment, and Valuing Synergy Benefits

- Topic 53: Venture Capital Valuation

- Topic 54: Discount Rates and Valuing Free Cash Flow

- Topic 55: Growth, C*, and Return: The Engine to Increased Valuations and Deferred Tax Advantage

- Topic 56: How Fast Can the Target Grow?

- Topic 57: Cash Flow Multiples, Growth Rates, and Discount Rates

- Topic 58: Comparable Multiples

- Topic 59: Converting FCFM to P/Es and Other Valuation Multiples and Deriving Slot Multiples for Public Companies

- Topic 60: EBITDA Valuation Engine

- Topic 61: Free Cash Flow Equivalent Impacts for Arbitrary Adjustments to Discount Rates

- Topic 62: Transferring Defined Benefit Pension Plan Liability Issues

- Topic 63: Environmental Remediation Expenses

- Topic 64: Environmental Insurance

- Topic 65: Management Warrant Incentive Plans

- Topic 66: Negotiation: Introduction and Overview

- Topic 67: Negotiation: Values, Offers, Prices, and Risk Assumption

- Topic 68: Negotiation: Offer Content

- Topic 69: Negotiation: Create Space in Your Ideas

- Topic 70: Negotiation: Beware of the Emotions of Private Sellers

- Topic 71: Negotiation: Imprint; Do Not Lecture

- Topic 72: Negotiation: Handling Tight Spots

- Topic 73: Negotiation: Closing the Bid-Ask Negotiating Gap

- Topic 74: Negotiation: Be Aware of Leverage and Deal Momentum Shift

- Topic 75: Negotiation in the Final Stages

- Topic 76: Negotiation: Use Earn-Outs or Noncompete Agreements to Close a Bid-Ask Gap

- Topic 77: Negotiation: After the Deal Is Agreed

- Topic 78: Negotiation: Bluffing and How to Handle It

- Topic 79: Negotiation: When Do You Step Away?

- Topic 80: Negotiation: When Do You Proceed?

- Topic 81: Negotiation: Do a Time Capsule

- Topic 82: Negotiation: Build Trust to Get Closed

- Topic 83: Exits under Duress: Have a Plan if the Deal Does Not Work

- Topic 84: Structuring the Deal: An Overview

- Topic 85: Structuring the Deal: Asset Step-Ups, Noncompete, and Synergy Valuation Engines

- Topic 86: Total Shareholder Return

- Topic 87: Stakeholder Value Creation

- Topic 88: EVAquity: Align Shareholder and Management Interests

- Topic 89: Letter of Intent

- Topic 90: Purchase and Sale Agreement

- Topic 91: Purchase and Sale Agreement: Explanation by Section

- Topic 92: Purchase Price Adjustments for Working Capital

- Topic 93: Indemnification and Survival Provisions

- Topic 94: Escrows

- Topic 95: Joint Venture Transaction: Valuation and Structuring Overview

- Topic 96: Why Deals Go Bad

- Topic 97: After the Deal: Do a Deal Bible

- Topic 98: Do the Audits of the Integration and Deal Value Creation Plan

- About the Web Site

- Index

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access Practitioner's Complete Guide to M&As by David T. Emott in PDF and/or ePUB format, as well as other popular books in Business & Managerial Accounting. We have over one million books available in our catalogue for you to explore.