![]()

Part I

Why Investments Matter

![]()

1

Introduction

1.1 INVESTMENTS: THE FORGOTTEN VALUE LEVER

Much of the current management literature focuses on a limited set of “classical” value levers, such as cost reduction, sales optimization or mergers & acquisitions, thus neglecting another core value lever: capital investments (Capex).

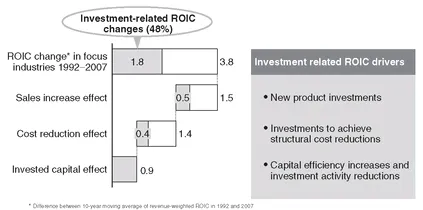

That capital investments receive such limited attention is all the more surprising when one considers just how vitally important they are to the economy as a whole and to business in particular. In 2007, more than $11.8 trillion was spent on capital investments globally - more than the combined GDP of Japan, China, India, South Korea, and Taiwan (or Germany, France, Italy, Spain and the UK). Not only is the sum invested enormous, but its influence on long-term company performance is critical. Since the early 1990s, asset-heavy companies in the S&P 500 have increased their average return on invested capital by 3.8 %. Our analysis indicates that about half of this increase (48 % ) is related to investment activities (Figure 1.1).

Investments are important not only in optimizing the asset structure of a venture but also for enabling the introduction of new products or for introducing structural cost reductions.

Managers know that the value of an investment is not a “given” that results in an inevitable rate of return. A wide range of variables influences the outcome both positively and negatively. Understanding these variables is therefore critical in assessing the likely performance of an investment.

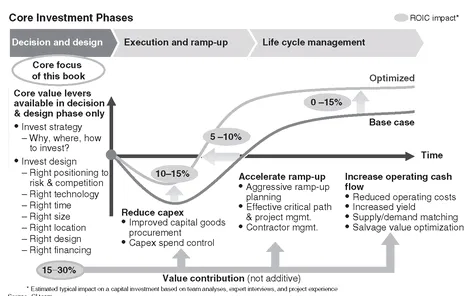

The experiences from a range of capital investment optimization projects show that there is significant value creation potential in optimizing capital investments. Results achieved across a wide range of optimization projects demonstrate this potential to be of the order of 15-40 % of the return on an investment. This value potential arises from three core improvement levers for investments: reductions in the amount of capital invested, acceleration of the production ramp-up, and increases in the operating cash flow during the productive life of an investment (Figure 1.2).

Figure 1.1 Drivers of the increase in ROIC, 1992-2007

Source: MCPAT, McKinsey analysis

Figure 1.2 Core value levers for optimizing capital investments

Source: CI team

1.1.1 The early bird catches the worm

Once a project progresses from the design phase to the execution and ramp-up phase the potential for optimizing the investment narrows, as much of the cash has already been spent or committed. The decision and design phase, therefore, is of critical importance to the performance of any capital investment. This phase provides the largest value creation opportunity for investing companies. The crucial questions managers are faced with in this phase are, of course, “Where, when and how to invest?”, “How do we design the investment so as to ensure an optimum return?” and “What is the best way to finance the investment?”

The decisions made in this phase determine the boundary conditions for the business assets - and a significant part of its ROIC - for many years to come. Despite the importance of these decisions, it is rare to find them managed well from the outset. One of the reasons why companies continue to struggle with the design and execution of large capital investments is that their often discrete nature makes it difficult for companies to build up and maintain investment management competency in-house. A second reason is that, despite the wealth and depth of material on financial investment valuation and assessment, there is currently little or no hands-on, practical advice for capital management and optimization written from a top management perspective. To a large extent, managers are left leaning on their own experience, pulling together the best team they can find within their organization.

This surprising lack of practical management advice has been one of the main reasons prompting us to write this book: decision-makers need the best possible advice to aid them in making decisions on large investments. We intend this book to fill this gap and to provide a strategic manual on large fixed capital investments. It has a holistic approach to the topic, one that is both strategic and practical in its perspective.

In researching this book, we have invested a significant amount of time and effort in collecting and analyzing the information that forms the basis of the ideas that shape it. In the course of this work we have made extensive use of the wealth of knowledge and experience present within McKinsey & Company - based on more than 500 capital investment-related engagements for many of the world’s leading companies. These efforts have contributed to building up the capital investment practice within McKinsey.

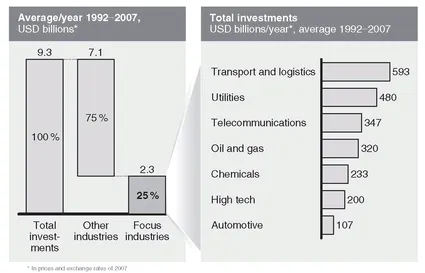

Figure 1.3 Share of investment of the asset-heavy industries under review1

Source: Global Insight, McKinsey

We hope not only that this book will be interesting and readily digestible for the reader but that the ideas within it will serve to sharpen management’s focus on the impact capital investments have on the wellbeing and growth of their companies - whether the companies concerned are already leaders in their field, or aspire to become so.

CAPEX Excellence is addressed in particular to the top management of companies which are based in asset-heavy industries - and especially to managers faced with the challenges of making individual or portfolio capital investment decisions and who are responsible for managing these capital assets over their entire asset lifecycle (this includes CEOs and CFOs, as well as senior managers in the business planning, financial, management accounting and control functions). We hope CAPEX Excellence will also be of interest to graduate management students, as well as to all those who want to gain a deeper understanding of the core strategic choices companies face when making and implementing large capital investment decisions.

Throughout the book we use many industry-specific examples, focusing in particular on seven asset-heavy industries (our “focus industries”): Utilities, Oil & Gas, Telecommunications, Transportation & Logistics, Chemicals, High Tech, and Automotive. Together, these seven industries account for about 25 % of all global annual investments (Figure 1.3). However, this is not to suggest that we think the book’s relevance will be limited to these sectors alone. Other capital intensive industries, such as Steel, Aluminium, or Pulp & Paper, also face very similar challenges, so hopefully the insights here will be relevant to these industries too.

Finally, whatever your particular industry, we hope that, as the reader of this book, you will benefit from our industry and company analyses of what constitutes best practice in capital strategy.

1.2 A BIRD’S-EYE VIEW OF THE BOOK CONTENT

CHAPTER HIGHLIGHTS

This chapter is an executive summary outlining the subject matter of all three parts of this book for readers who want a quick overview of the contents.

• Part I: The introductory section highlights the importance of capital investments and provides an overview of investments across the globe, industries and time.

• Part II: This core section covers the major strategic choices in investment decision, such as where and when to invest and which technology to choose, as well as how to design and finance large capital investments.

• Part III: The closing section places individual investment decisions within the context of the overall capital allocation decisions companies are faced with when shaping their investment portfolio.

Though we hope most people will choose to read this book from cover to cover, all the chapters have been designed to stand alone, enabling the reader to study any individual chapter independently of the others. To aid the reader, wherever appropriate, we have included references to topics which are covered in more detail elsewhere in the book.

1.2.1 Part I: Why investments matter

The importance and structure of capital investments

In this chapter we examine how investments are a prerequisite for growth and what determines their structure and timing. Today about 20 % of the world’s GDP is spent on capital investments. Eight out of the 10 fastest growing economies have investment intensities well above the global average. The correlation between investment and growth is even clearer in the world’s emerging economies, which achieve more than twice the average economic growth with almost twice the capital intensity.

Not only is investment critical at the national level but getting investments right at the company level makes an enormous difference to a company’s value creation. During the last 10 years roughly half the S&P 500’s growth in return on invested capital (ROIC) has been related to investment activity.

Investment patterns vary widely between industries. The most investment-intensive industries are Transport & Logistics, Utilities, Telecommunications, and Oil & Gas, followed by Chemicals, High Tech and Automotive (the industries which are the primary focus of this book).

Investment is also highly cyclical, with a regular pattern of boom followed by bust. We observe that - while unpredictable in specific site and timing - industry cycles are far from random displaying clear cycle frequencies around 5, 10, and 30-40 years.

We conclude Part I with a brief examination of why investment volumes are likely to continue to grow in coming years, despite any short-term economic problems.

1.2.2 Part II: Getting investments right

Part II focuses on the strategic choices that companies and decision makers are faced with when making investment decisions, and provides a number of frameworks and strategies to deal with these challenges.

Chapter 2: Right positioning: Managing an asset’s exposure to economic risk

We examine how the degree to which an investment asset is protected against economic risks largely determines its achievable return on investment. The degree of an asset’s exposure varies: the lowest levels of exposure are conferred by exclusive access to critical resources or a natural monopoly-type situation; the highest levels are derived from leveraging commercial advantages, such as strong brands or a superior distribution network.

The core of this chapter focuses on the use of an “asset exposure scoring metric”. This allows companies to quantify the degree of exposure their investment asset is likely to be subject to. The metric enables the investment to be benchmarked against the expected returns of competitors or other investments.

We close by examining a number of strategies available to companies for manag...