![]()

Part One

Key Structures and Cash Flow Dynamics

![]()

Chapter 1

Mortgage-Backed Securities

Origins of the Market

Mortgage-backed securities have an array of cash-flow profiles and risk profiles. The most basic mortgage-backed security is the pass-through security. As its name indicates, a pass-through simply passes to investors the payments associated with a pool of amortizing mortgages. The pass-through is the basic building block of the mortgage-backed securities (MBS) market. In this chapter we will describe the process of securitization, the output of the process, and the market for the output: mortgage-backed securities. The MBS market in the United States was kick-started and has been sustained by the activities of Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC). The first MBS guaranteed by GNMA was issued in 1970. FNMA securitized its first pool in 1981, and Freddie Mac issued the first collateralized mortgage obligation (CMO), backed by 30-year fixed-rate mortgages, in 1983.1 The pool was refinanced with the issue of three classes of securities that matured sequentially. Over time the number of classes issued to finance a pool of mortgages increased, and the design of the classes became more intricate and more leveraged with respect to various components of risk.

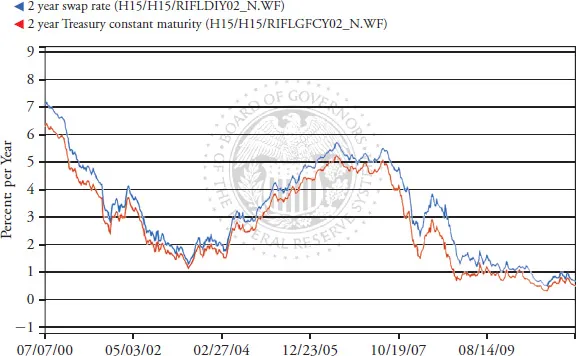

This more extensive refining of risk offered important opportunities to both sides of the financial markets, but also became a destabilizing factor when a significant flow of MBSs/ABSs backed by badly underwritten assets were overvalued. Periods of market turmoil such as the third quarter of 1998 and the years 2007 to 2009 drove investors away from risk and illiquid securities toward safer and more liquid securities. In the case of the nonagency or private label market for MBS market, turmoil would force banks to hold mortgages for longer than expected and would depress the values of leveraged classes—in this case tranches of MBSs—with the most exposure to credit, prepayment, and interest rate risk. When banks must hold mortgages longer than was expected, this uses up capital that would otherwise have been used to extend new credit. When investors cannot sell or adjust their positions due to the illiquidity of the securities they hold, capital is tied up. This was the case on a small scale in 1998 when Russia defaulted on its debt and Long-Term Capital Management (LTCM) subsequently became insolvent as interest rate spreads moved dramatically against the hedge fund’s positions. The flight from risk was profoundly larger and more sustained from 2007 to 2009. Exhibit 1.1 shows this dynamic in the widening spreads.

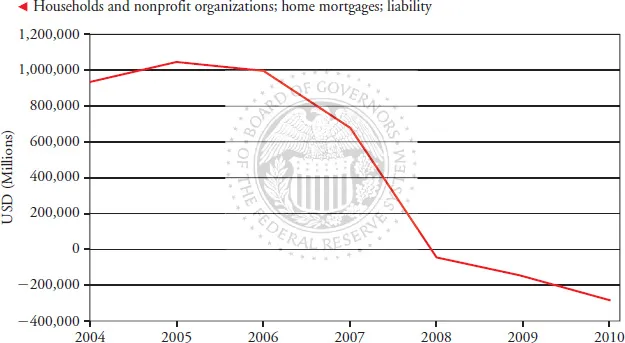

We look at the brief period between Q1 2004 and Q2 2009. Over this period mortgage credit was expanding until Q2 2006 and then actually became negative in Q2 2008. A negative reading means that more mortgage credit was being repaid or defaulting than was being originated. This is evident from Exhibit 1.2.

Over this same period we observe that the mortgage assets on the balance sheets of commercial banks increased relative to those funded by securitization vehicles, “issuers of asset-backed securities, home mortgage asset” in the flow-of-funds accounts.2 The increase in mortgage assets over this period was erratic and it is hard to explain this without deeper analysis. Over this period commercial banks were consolidating structured investment vehicles (SIVs) and asset-backed commercial paper (ABCP) assets onto their balance sheets as banks frequently became the special purpose vehicle’s (SPV’s) primary beneficiary as liquidity and credit lines were called upon. An addition to mortgage assets was also due to the freezing up of the securitization markets. Mortgages slated for securitization were building up on the balance sheets of lenders.

Originating mortgage pools with the intent of liquidating them through whole loan sales or securitizations net of mortgage servicing is characteristic of the U.S. mortgage market. It is a model that has become ingrained in the housing finance system. It is a model that relies on a deep and liquid secondary mortgage market. Finance companies and banks all over the country scrambled to originate mortgages. The market for these mortgages was certain in the sense that there were bid prices and forward markets, so the risk to the originator was very low, especially since the mortgage pipeline could be hedged. The only risk to a well-managed and honest originator was if there were no offers for the mortgage assets in its pipelines and warehouses.

FROM THE PRIMARY TO THE SECONDARY MORTGAGE MARKET

The primary mortgage market encompasses transactions between mortgagors and mortgagees. This market encompasses the actual extension of credit to households and businesses that are mortgaging property. The secondary mortgage market is where mortgages are refinanced and distributed in the capital and money markets in the form of mortgage-backed securities. These transactions result in capital flowing back to originators. Investors value the unique cash flows offered by various tranches of MBSs more than they do portfolios of whole loans.

Multifamily and single-family, fixed- and variable-rate, and level-pay and balloon mortgages are all securitized in the agency and private label markets.

The Agency Market

As we write this, there are discussions about dismantling or at least dramatically reforming the two government sponsored enterprises (GSEs) that funnel a majority of the capital from the secondary mortgage market to the primary mortgage market. FNMA and FHLMC make a market in mortgages so that financial institutions can replenish their capital and continue and make new loans. Knowing that there is a market for the mortgages they originate and knowing the prices for these assets both on the spot market and forward markets enables managers to finance long-term assets such as mortgages as short-term inventory. Managers trade illiquid mortgages with the agencies in return for liquid MBSs. FNMA and FHLMC have lost vast sums of private and public capital. The private capital was as a result of losses on the mortgage assets in their portfolios and on assets they guaranteed. The irony is that while FNMA and FHLMC were both deemed “too big to fail” in the midst of the financial crisis, they have become even bigger since the nonagency segment of the MBS market collapsed. Credit for everyone very nearly turned into credit for no one.

The agencies will not disappear until there is an entity or more likely entities that will fill the role of providing liquidity to the secondary mortgage market across the economic cycles. We will not speculate on the final outcome of the two mortgage GSEs, but we are confident that securitization will continue to play a major role in the financial markets. Without securitization, bank balance sheets will become too heavy in a growing economy and this would dampen the economy.

Mortgage-backed securities issued by FNMA and Freddie Mac or guaranteed by GNMA are at the core of the secondary market for conforming mortgage loans. GNMA is a wholly owned corporate instrument of the United States within the Department of Housing and Urban Development. GNMA guarantees the full and timely payment of principal and interest on MBSs. The quality of the guarantee is that of “the full faith and credit of the United States.”

A mortgage lender qualified to do business with GNMA originates a pool of mortgages and submits the mortgages to GNMA to create guaranteed MBSs. An institution acting as central paying and transfer agent registers the securities secured by a mortgage pool with a clearing agency registered with the Securities and Exchange Commission (the depository), which issues the MBSs through the book entry system. GNMA-guaranteed MBSs are backed by mortgages that are guaranteed by the following U.S....