![]()

Section C

Successful M&A

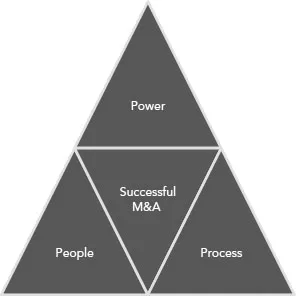

This section looks at what is required to achieve a successful M&A deal. There are three key elements which, when brought to bear on the M&A problem, allow the organisations to mitigate the many risks faced and in turn successfully deliver the deal and realise the potential of that deal. The three elements are:

- Possessing M&A power.

- Managing processes.

- Managing people.

This is illustrated in Figure C.1.

If these elements can be successfully brought to bear on any deal it will be a success both in the short and the long-term. Almost as important, the new entity will bring its abilities to the market more quickly and with more force, impact and results.

![]()

CHAPTER FOUR

M&A power

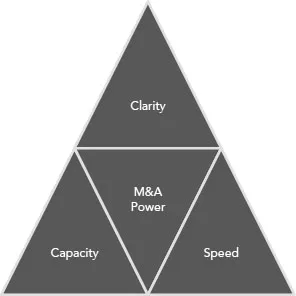

M&A power is an expression of the ability, capacity and will present in the merging or acquiring organisations to successfully complete the M&A transaction, integrate the enterprises and achieve the intended economic and strategic value. It has many components but is best represented by the capacity of the organisation to drive the necessary change and objective, the clarity of purpose and the speed of attainment with which the whole M&A project is pursued. Thus the three main elements are clarity, capacity and speed. Combined, these elements will allow a merger to be clearly directed with due haste. These do not deliver the full project. That is only achieved when the other two key factors of M&A success are also present, those being process and people.

CLARITY

There needs to be an underlying rationale behind every acquisition and merger. Management will have set themselves, and hopefully widely communicated, that rationale and the goals that underpin it. These may be growth, cost reduction, market share, geographic spread or defense for example. Either way, these need to be formed into a vision of the future. It needs to be given to someone to drive it through. Without that clarity, the organisation is heading off on a midnight adventure, without a map, to a place it does not know even exists, and they have their eyes closed! The vision is for the long term.

Most people are aware of the idea of goal congruence: the importance of getting a team or organisation aligned and working towards a single uniform goal. The need to establish clarity is a critical component to achieving organisational M&A power.

This section, ‘Clarity’, describes what is probably the most important single idea contained within this whole book. It gives clear direction and elaborates on the reasoning for engaging in the M&A process.

Successfully arranging an M&A deal, getting it through to completion and then achieving integration, is a series of extraordinarily complex tasks. Many people from varying backgrounds need to come together to bring it to fruition; they come together in very complex ways performing very complex tasks and activities. How does an organisation achieve goal congruence in such a situation, in particular when not all parties are naturally motivated to make it happen? The answer is not a simple one, it involves communications, stakeholder management, planning and control – in fact, it is what this book is all about. However, it starts with the creation of clarity as to what the future state will be. For the organisation to achieve its objectives it needs to be able to state those objectives clearly and consistently from the outset in order to align the organisation behind those objectives.

Having clarity regarding the objective of the M&A activities brings many benefits. The clarity of the goal will aid all of the decision-making process that will follow. All decisions can then be considered in the light of that clearly stated goal. The goal, or more likely goals, can be measured to ensure they are being attained. However, the purpose of clarity is much more fundamental than this. Before a company begins to select its target, it needs to have a goal, a vision of its industry and its place within it.

Before any significant work is undertaken, clarity needs to be established. Many people might call this clarity ‘vision’. I am reluctant to use the term vision, not because it is a bad term, but because it is so over-used that many people mistake things such as business goals for vision.

A company needs to be clear where it stands in its industry and how it believes that industry will transform. It is critical to understand how an acquisition partner will fit the strategy today, but also how it will fit the strategy in the future. M&A has the power to transform a company; therefore it should be focused on transforming the company to not only respond to today’s market, but also to the future market. True clarity has to be able to answer the most fundamental question: what is this transaction for? It is a question that transcends the basic question of ‘fit’. It is answering the longer term question of the transaction. There are many deals where the fit that exists seems perfect, but the deal fails. The type of partner to merge with or acquire might not be the one that provides the best fit but is the one that unleashes the long-term capabilities of the firm.

How does one establish this clarity? That obviously depends on the organisation involved. It is perhaps the ultimate in strategic planning. An organisation needs to take close stock of its capabilities, strengths and weaknesses. This is something that is frequently performed by companies, but they need to move further in their thinking. A firm also needs to be clear how its industry is going (or at least is likely) to develop and how it, the firm, needs to transform in response to that. By answering these questions a clear vision of the future emerges. In doing so the firm can evaluate what, not just in terms of simple financial or market fit, they are looking for in other firms. This might make a firm decide to pursue a number of deals. This process does not mean that a firm will reject market or financial fit entirely. However, where market fit might have suggested a $100m acquisition, they might now elect to make a $60m acquisition for market share and a $40m acquisition that meets their future positioning needs.

This clarity of purpose needs to take into account the financial requirements of the company, the market it operates in, that market’s structure and the way in which that market will transform, due to technological, political, legal and customer change.

Of course this is not easy, this clarity of purpose needs to be a balance between what the organisation would like to be and what the organisation can be. That requires a certain degree of realism which makes it difficult to achieve. Many companies have embarked on visionary M&A strategies with lots of strategic ‘fit’, such as AOL and Time Warner, which ultimately destroyed billions of dollars of shareholder value.

CASE: America On-line (AOL) and Time Warner announced what was seen as the ‘Deal of the decade’ in January 2000. There was great ‘fit’ between Time Warner, which had lots of ‘content’, and AOL, which had a substantial media distribution capability. The deal, which was completed in 2001, soon turned sour. Time Warner eventually accepted write downs totalling US$97bn. To give that number some context, the amount of shareholder value that was destroyed was more than the total output of the State of Israel for a year.

It is not possible to set out a process that should be followed in order to derive the necessary clarity. However, experience shows that there are a number of constraints within which the creation process should take place.

Firstly, the result of the vision must carry the support of senior stakeholders. If the senior management team or significant stockholders are not brought into this vision for the future, then it will fail at the first hurdle. The reaction of key players to the proposed merger between Prudential Life and AIA is a recent example of how the failure to carry senior stakeholders means that the instant there is a problem the whole deal is at risk.

The second requirement is to be creative. Simply put, ‘me too’ strategies tend not to work. As every M&A is unique it is not realistic to expect that one strategy can be copied from one firm to another. In order to steal a march on one’s competitors creativity is required. This is particularly the case when an industry matures. Simply growing through vertical or horizontal integration can only take a firm so far.

The third requirement is to understand the future of the industry. Events such as the opening up of Eastern Europe cannot always be predicted and can have a transformational impact. That said the continuous march of technological improvement can be expected. Based on this and customer needs, it is possible to see what the future of an indus...