![]()

CHAPTER 1

Industry Overview

After reading this chapter, you will be able to:

• Distinguish venture capital from other asset classes.

• Recognize the key functions and processes of venture capital investing.

• Differentiate between general partners and limited partners.

• Estimate typical investment returns for venture funds.

• Understand the seven reasons for the current performance crisis in venture investing.

What Is Venture Capital?

The best definition of venture capital comes from the man who created the industry. General Georges Doriot, a Harvard Business School professor and early venture capitalist, said that his firm would “invest in things nobody has dared try before.”

Venture capitalists, sometimes called “VCs,” look for new technology emerging from a government laboratory, a university research department, a corporate incubator, or an entrepreneur’s garage that disrupts a big market. It may even create entirely new markets. Such disruption presents fertile ground for rapid growth and wealth creation, or wealth redistribution. Venture capitalists professionally invest money in businesses that are neither proven nor safe.

They advise and assist growing companies to achieve extraordinary investment returns. Venture capitalists often say they are “value-added investors” who offer important services to start-ups beyond just writing a check.

The three most common things they do to help start-ups are to give strategic advice, recruit executives, and make introductions to customers. Venture capitalists make their presence known in a company via the corporate board. A venture investor may sit on several boards of directors and can take an active role in company direction, finance, and staffing.

Venture capitalists professionally invest money raised from large institutional investors. They typically buy a minority share of any company they invest in, though a syndicate of venture capital investors might own the majority of a start-up’s stock after several years. It is unusual for venture investors to push debt obligations onto their start-ups. Start-ups seldom have a predictable revenue stream to pay off the debt and few, if any, tangible assets that a lender could foreclose on.

Venture capitalists should be distinguished from “angel investors,” who use their own money to invest in newly formed companies. Angels are typically retired executives who can give advice and between $50,000 and $500,000 of early investment capital. They do similar things as venture capitalists but are not professional investors.

Venture capital is a specific type of private equity investing. Private equity investors bankroll companies that do not have stock traded in public markets, such as the New York Stock Exchange or NASDAQ.

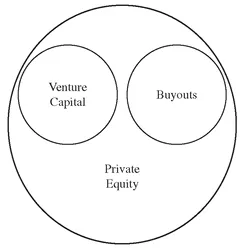

The distinction between venture capital firms and buyout shops, the other group of investors lumped into the private equity category, is the ownership level that they take in the companies they invest in. Buyout shops will buy up enough stock in a target company to be majority owners so that they can make serious changes to a company’s operations. Exhibit 1.1 shows the differences between venture capital, buyouts, and private equity.

EXHIBIT 1.1

Private Equity Family

I think of venture capital as investing money into small, private technology companies expecting rapid growth. But there is no formal definition of what kind of deal a venture investor can or can’t do. They invest in corporate spinouts, leveraged buyouts, public stock, and just about anything else they think they can turn a buck on. A typical year may see anywhere from 2,500 to 3,500 venture capital deals, and no two are identical. Still, there are some norms that prevail and you can get a sense of what type of companies venture investors look for.

IN THE REAL WORLD

Done Deals

What types of investments do venture capitalists make? Here’s a sample of representative deals from top-flight investors.

CANADIAN FUSION STARTUP POWERS UP WITH $22 MILLIONb

A Canadian-based startup that is experimenting with fusion energy technology has quietly raised $22 million in early stage funding from venture capitalists.

Burnaby, British Columbia-based startup General Fusion plans to develop a prototype that will show its fusion technology can produce energy cheaper than coal-fire plants and safer than standard nuclear fission plants.

“What General Fusion is working on is game changing,” says investor Rolf Dekleer, vice president of investments for Canadian venture capital firm GrowthWorks Capital. “If they were working on this 10 years ago, we wouldn’t be talking about global warming today.”

GrowthWorks Capital, Braemar Energy Ventures, Chrysalix Energy Ventures, and The Entrepreneurs Fund combined to provide $9 million for General Fusion. The Sustainable Development Canadian Technology Fund, a government entity charged with financing environmentally friendly technology projects, additionally kicked in more than $13 million, contingent on General Fusion’s ability to meet key milestones.

MOTALLY RAISES $1 MILLION TO MONITOR MOBILE WEB TRAFFICc

Metrics matter. That’s especially true on the Web, where the number of “eyeballs” a site attracts helps to establish what a company charges advertisers.

But as people move from desktop browsing to accessing sites via mobile phones, tracking the exact number of visitors has become more difficult.

San Francisco-based Motally is working to help online publishers determine who is accessing their content and how visitors are interacting with their websites. The startup recently raised $1 million in early-stage venture funding from BlueRun Ventures and angel investor Ron Conway, according to regulatory filings and the company.

BIOTECH STARTUP RAISES $8 MILLION FOR ASTHMA TREATMENTd

Newton, Massachusetts-based NKT Therapeutics is looking for ways to subdue Natural Killers and now has $8 million in fresh funding to do that.

The company recently raised its first round of venture capital funding from SV Life Sciences and Medlmmune Ventures to help it develop treatments for asthma and other diseases.

The company focuses on researching so-called Natural Killer T-Cells, which the company describes as a central component of the human immune system, playing a role in human health and disease. Natural Killers play a very different role in the 20 million asthmatics estimated to be living in the United States, waging war on otherwise normal lung tissue.

“By selectively activating or depleting the function of NKT (Natural Killer T-Cells), NKT Therapeutics’ approach has the potential to treat a wide range of important diseases and provide new avenues for vaccine creation,” says investor Michael Ross, a managing partner at SV Life Sciences.

Companies that raised money from venture capitalists contributed 21 percent of the U.S. gross domestic product (GDP) and employed 11 percent of the workforce in 2008, according to a study financed by a venture capital lobbying group.1 It cites several prominent examples of companies that relied on venture capitalists to get their start: Microsoft, Intel, Oracle, Google, Amazon, Staples, Netscape, AOL, FedEx, eBay, Apple, Cisco, YouTube, and others.

Venture capitalists have come to be associated with technology start-ups and California’s Silicon Valley because the technology industry there has yielded some of the largest growth opportunities in the past three decades. Before that, the epicenter of technology innovation was the greater Boston area.

During the past 20 years, the majority of venture investors were white males in their late thirties to early fifties, educated at either Harvard or Stanford Business School with a background in either operations or entrepreneurship. They typically work in partnerships of 3 to 10 investors with offices within five miles of Sand Hill Road in Menlo Park, California, and make $774,000 a year, according to data from Thomson Reuters. These characterizations are changing as firms diversify and expand beyond their roots. The next 20 years of the venture capital business will see a new generation of investors that reflect the diversity of every other industry.

TIPS AND TECHNIQUES

Venture Capital Spotting

If you spend enough time in Silicon Valley, you’ll learn to spot the venture capitalists in any crowd. Here are a few tips on how to pick them out:

Clothes. Male venture capitalists wear blue button down shirts and khaki pants. Navy blazers are optional, though sometimes you’ll see windowpane-style checkered jackets. I’ve never seen them with herringbone jackets or leather patches on their elbows. Most venture capitalists don’t wear ties. Vinod Khosla has a closet full of mock turtlenecks. There are two notable exceptions: Kleiner Perkins’s John Doerr and Draper Fisher Jurvetson’s Tim Draper. Doerr has one tie he’s worn for at least a decade that has broad black and silver stripes. Draper wears red ties from the Save the Children Foundation.

Early stage and seed investors dress more casually. Marc Andreessen wears flip-flops and shorts. European seed investor Morten Lund wears a blue Adidas hooded sweatshirt and Birkenstock sandals.

Female venture capitalists wear a range of styles. Blouse and slacks combos seem to be the norm, though one periodically sees variation ranging from pantsuits to a black Lacoste polo shirt with jeans.

Communication. Investors love buzzwords and love to look intelligent. Here’s a typical venture capital sentence that one might encounter in casual conversation: “His go-to-market strategy wasn’t going to help him cross the chasm and deliver a scalable, robust solution in real time.”

Eating. Favorite feeding spots tend to persist over time, and Buck’s of Woodside is one which investors consistently favor. It’s not unusual for the waitstaff at this rustic flapjack shop located in the suburbs around Stanford University to automatically bring whatever a venture capitalist typically orders. The place is full of real Silicon Valley history, from boxcar racers hanging from the ceiling to framed semiconductors and a California license plate that says GOOGLE.

Buck’s has become well known to the point where it’s unhip to be seen there. Other venture capitalist favorites in the Silicon Valley area include the laid back Palo Alto Creamery; Redwood City’s upscale Chantilly (down the street from the Ferrari dealership); Menlo Park’s Kaygetsu, a hot sushi spot right off Sand Hill Road; and Menlo Park’s Dutch Goose, which makes killer deviled eggs.

Exercise. Venture capitalists could exercise like normal people, but don’t. Consider Brad Feld, a managing director at The Foundry Group, who is shooting to run a marathon in every state before he turns 50. To balance his strenuous training regimen with work, Feld invented the Treadputer, a computer with three screens mounted to his treadmill. It’s an IBM ThinkCenter with 19-inch flat screen monitors and voice recognition software.

How Venture Capital Works

A venture capitalist’s job is generally broken down into three major functions:

1. Fundraising

2. Findin...