![]()

Part I

Overview

Chapter 1. The History of Financial Engineering from Inception to Today

Chapter 2. Careers in Financial Engineering

Chapter 3. A Profile of Programs and Curricula with a Financial Engineering Component

![]()

Chapter 1

The History of Financial Engineering from Inception to Today*

Tanya Beder

SBCC Group Inc.

WHAT IS FINANCIAL ENGINEERING?

Financial engineering may be broadly defined as the development and creative application of innovative financial technology. Financial technology includes financial theory, quantitative techniques, financial products, and financial processes. At a microeconomic level, the motivation behind financial engineering is to produce profits for the innovators by finding better ways to address society's needs. At a macroeconomic level financial engineering helps improve the allocation of scarce resources. Allocation of resources is the fundamental objective of any economic system. Indeed, financial engineering epitomizes Joseph Schumpeter's view of capitalism as “creative destruction.” New products replace old products, new theory improves on old theory, and new processes supplant old processes.

Financial engineering borrows heavily and liberally from other disciplines, which helps explain why the field has attracted people from across the scientific spectrum. The key to understanding financial engineering is understanding innovation in all of its dimensions and turning this innovation into practical solutions. While, in some sense, financial engineering has been with us since the innovation of money, financial engineering has not, until quite recently, been recognized as a profession. What has changed, more than anything else, is the pace of innovation.

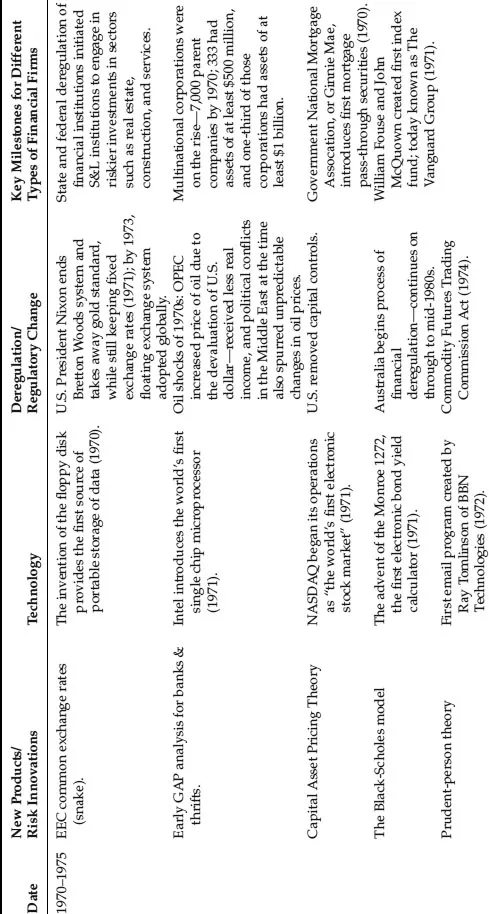

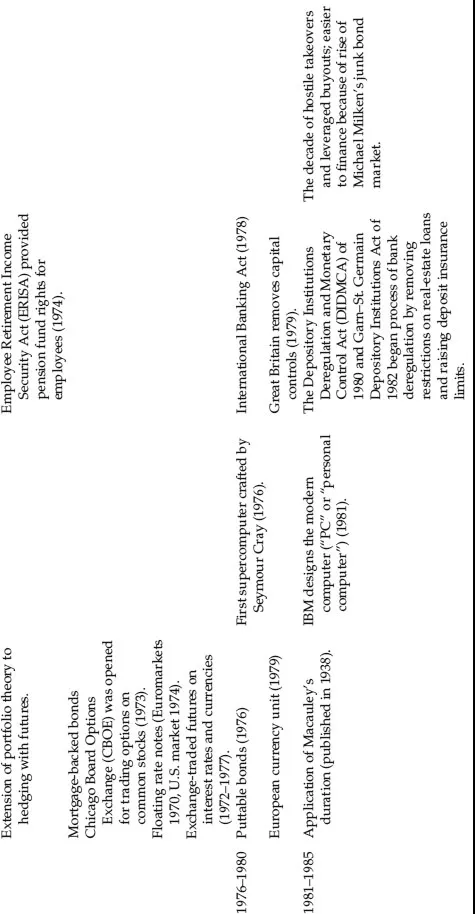

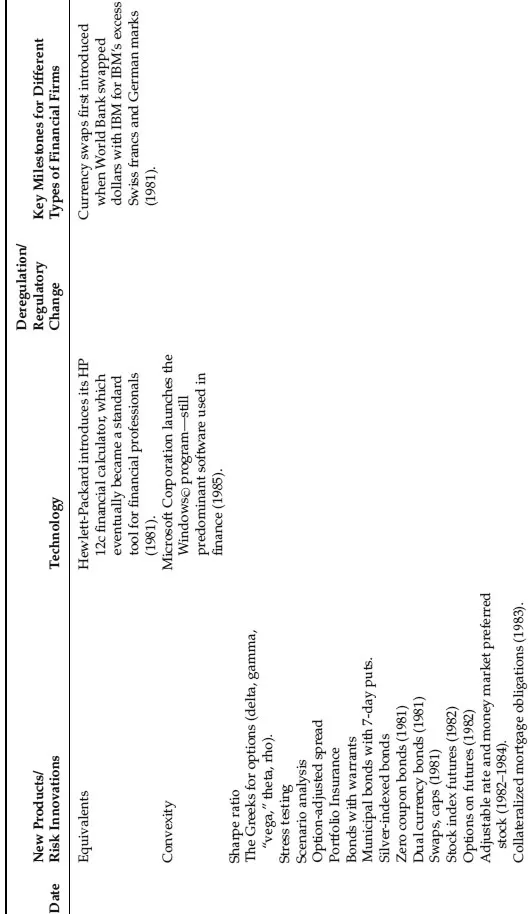

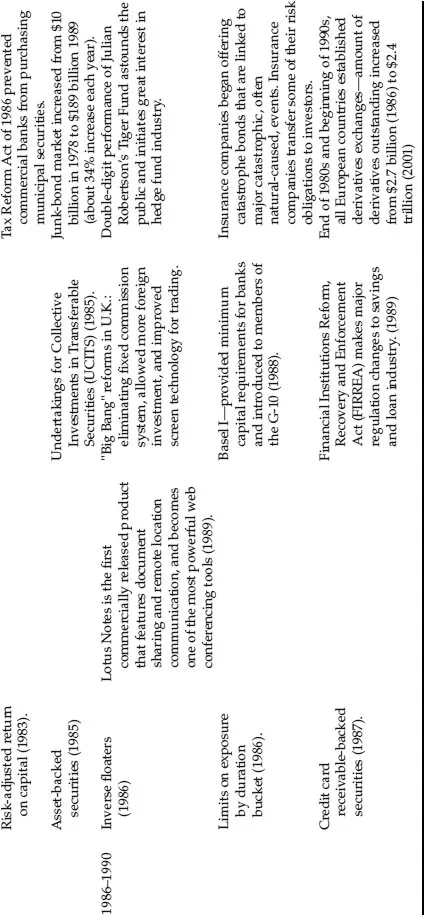

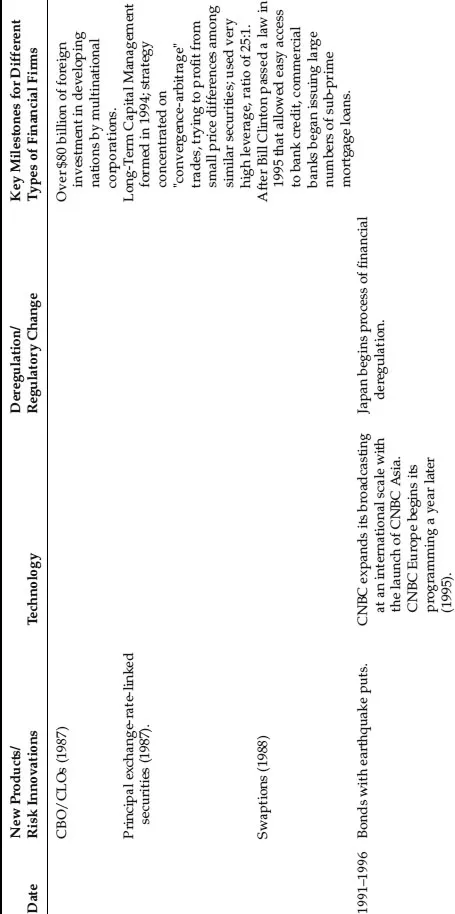

The history of financial engineering is presented in the segments illustrated in Exhibit 1.1.

Exhibit 1.1 Financial Engineering Time Line

Source: SBCC Group Inc.

WHY DIDN'T FINANCIAL ENGINEERING START SOONER?

Markets and some financial functions have been around for thousands of years. There is evidence, for example, that the Romans may have invented checking as early as 352 B.C. By the year 1750 the basic financial firms were established to take deposits; make loans; write insurance; provide investments (savings and pension products); intermediate (checking, crossing trades, brokering); underwrite; distribute; and facilitate trade. From the 1700s until about 1970 (more than 200 years), the development of financial firms was continuous and done at a manageable pace. But the period was also one of frequent violent upheaval, as wars repeatedly ravaged nations and populations. New firms were born and others went out of business, but the basic functions of banks, insurance companies, asset managers, company pension funds, central banks, brokers, and dealers did not change radically. Most firms had monoline business models, and the primary business was the intermediation of capital.

As summarized in Exhibit 1.1, the pace of innovation was slow, but there were notable developments in the four decades leading up to the inception of financial engineering. Harry Markowitz published his seminal work on portfolio theory in the 1950s; the first Eurobonds were issued in the early 1960s, and certificates of deposit were introduced in the late 1960s. There were advancements in technology, but most were not broad-based consumer products: Chester Carlson invented xerography (photocopying) in 1938; the first computer (the ENIAC) was unveiled in the 1940s; Bell Systems revealed the transistor that would revolutionize telecommunications in 1947; the first modem enabling communication between machines was developed in the late 1950s; and the National Aeronautics and Space Administration (NASA) launched the first communications satellite in 1962. As the 1960s ended, Texas Instruments developed the first handheld calculator, which retailed for $2,000.

The decades after World War I right through to the early 1970s were a period of ever-increasing financial market regulation. This period included episodes of currency instability, devastating inflation in some countries, the Great Depression, World War II, and the rebuilding of Europe and Japan in the wake of that global calamity. Substantial regulation was put in place to promote the safety and soundness of individual countries’ financial systems. Most regulations adopted were rule-based by category/type of firm versus by function. In addition, there were important agreements made between countries; for example, fixed exchange rates were established between major countries at the Bretton Woods Conference of 1944. The interest rates paid by savings banks were capped. Commodity prices were kept artificially low by many governments. Hence, there was little price volatility to manage. Also of note is that fewer than 350 companies worldwide had assets in excess of US$500 million, so most financial activities were local (within home countries) rather than global. Losses by financial firms during this era were either credit-based (for example, the failure of the Austrian bank Credit Anstalt that led to substantial overnight foreign exchange losses for counterparties) or operational-based (for example, the United States’ paper crunch during which trading volume outstripped settlement capabilities, leading to the failure of 160 members of the New York Stock Exchange).

Toward the end of the period, glimmers of deregulation and technology advances laid the groundwork for the beginning of financial engineering.

INCEPTION AND THE EARLY STAGES (1970 TO 1997)

During the latter part of the twentieth century, four forces worked together to drive the separation between the past and the present businesses of financial firms:

1. Technology

2. Globalization

3. Deregulation

4. Risk intermediation

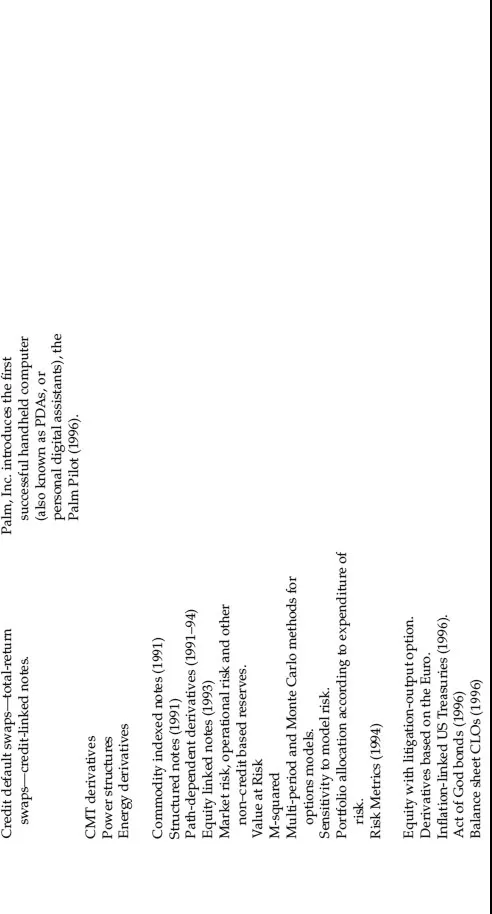

By 1970 the business of financial firms had begun to change radically and irrevocably. Banks, insurance companies, funds, central banks, brokers, dealers, government entities, and others faced difficult new risks and challenges to their profitability. As summarized in Exhibit 1.2, interest rates and currencies were deregulated, and the Organization of Petroleum Exporting Countries (OPEC) was established—all leading to substantial new volatilities to manage. Increasingly, global corporations struggled as well to manage their income statements, balance sheets, and raw material costs.

Exhibit 1.2 Early Stages (1970–1997)

Technology was the first force. Until the advent of personal computers and parallel processing in the 1980s, most technology was too slow to be utilized in the context of the capital markets. Prior to the advances in technology, mathematical techniques long used in the sciences could only be used theoretically in finance due to the inability to wait hours or days for answers. As this period progressed, many techniques whose power was only dreamed about in the early 1900s became employable practically by dealers, end users, regulators, and others. This created not only greater opportunities to see both risk and reward, but also a shortened cycle of innovation.

Dramatic comparisons are evident—a list of all innovations in the early 1970s began to be matched by those in a single quarter. With the exceptions of commodity futures and currency and commodity forwards, derivatives markets that were nonexistent in 1970—for example, interest rate swaps and currency swaps—topped $50 trillion outstanding by the end of 1998.1 Structured notes, collateralized mortgage obligations (CMOs), and asset-backed securities (ABS) were all introduced. Advances in technology changed how firms and individuals participated in the capital markets. Transactions became ever less “hard copy and local” and ever more “electronic and global.” The contrasts make the beginning of this period sound like the Dark Ages: At the beginning of this period, we did not have the personal computer; instead, handwritten spreadsheets and calculators were used to perform calculations, and pools of typists painstakingly produced single documents on wide-carriage typewriters. We did not have desktop publishing; instead, typesetters placed lead type in individual rows, and many an all-nighter was spent proofreading the lines as they were changed. We did not have mortgage calculators to perform interest and principal calculations; instead, bankers looked up monthly payment amounts in b...